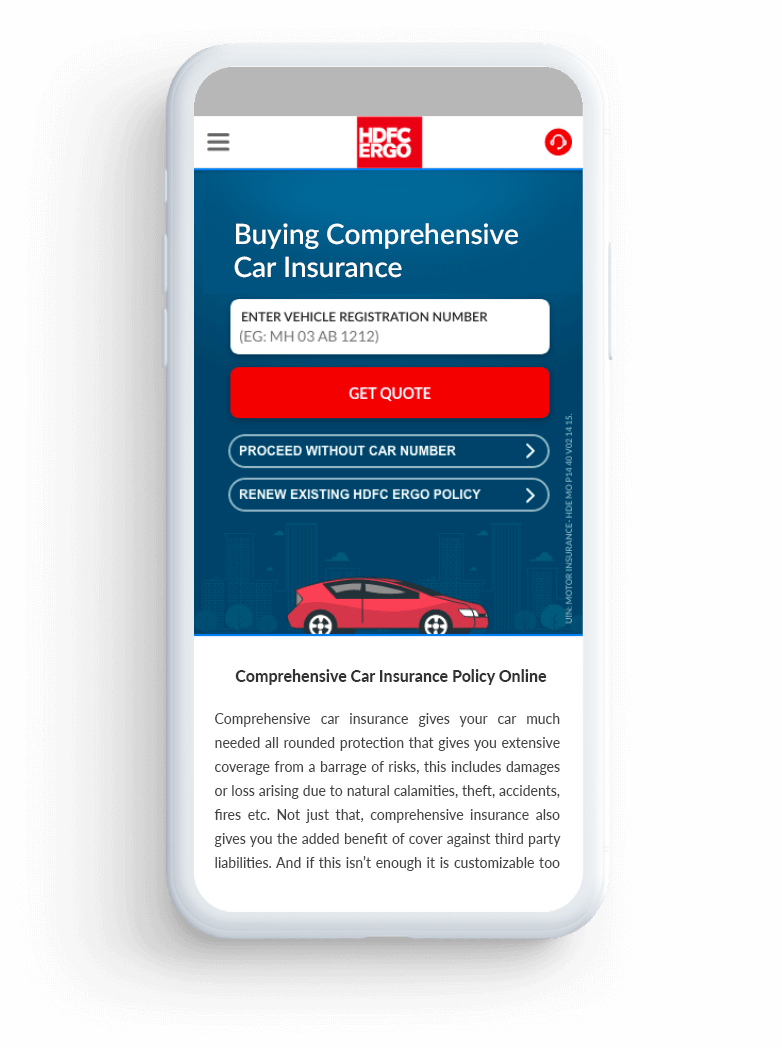

Comprehensive car insurance is a type of motor insurance policy that gives complete protection for your car. It covers damages to your own vehicle due to accidents and natural/man-made disasters. In addition, it also provides coverage for third-party liabilities, which is mandatory as per the law. Simply put, it helps you stay financially protected against most risks your car may face on the road.

What is Comprehensive Car Insurance?

With a comprehensive car insurance plan, if your car suffers any damage, you get financial support equal to the repair amount. The kinds of damage covered differ from plan to plan. A standard comprehensive plan will cover damages due to accidents, theft, fire, natural disasters (earthquakes, landslides, storms, etc.), and more. It will also cover third-party liabilities.

With such wide-ranging coverage, you can enjoy peace of mind every time you hit the road.

Comprehensive insurance also offers a personal accident cover of up to ₹15 lakh~*. This cover provides financial support in case the owner-driver is injured or passes away due to an accident. With HDFC ERGO, you can further customise your policy by choosing helpful add-ons such as Zero Depreciation, EMI Protector Plus, and Return to Invoice, based on your needs.

Health Insurance

Health Insurance  Travel Insurance

Travel Insurance  Car Insurance

Car Insurance  Cyber Insurance

Cyber Insurance  Critical Illness Insurance

Critical Illness Insurance

Pet Insurance

Pet Insurance

Bike/Two Wheeler Insurance

Bike/Two Wheeler Insurance  Home Insurance

Home Insurance  Third Party Vehicle Ins.

Third Party Vehicle Ins.  Tractor Insurance

Tractor Insurance  Goods Carrying Vehicle Ins.

Goods Carrying Vehicle Ins.  Passenger Carrying Vehicle Ins.

Passenger Carrying Vehicle Ins.  Compulsory Personal Accident Insurance

Compulsory Personal Accident Insurance  Travel Insurance

Travel Insurance  Rural

Rural