Imagine a scenario when, after hospitalization, you don’t have to worry about the hospital bills! Wonderful, isn’t it? With cashless health insurance, it is possible! Health insurance plans allow cashless claim settlements wherein, after hospitalization, your bills are handled directly by the insurance company. As such, you don’t shoulder the financial strain of hospitalization and can avail yourself of the best treatments.

Cashless health insurance is a mode of claim settlement in a health insurance plan. Under this mode of claim settlement, you get hospitalized in a networked hospital. Thereafter, the insurance company handles the hospital bills directly while you avail the relevant treatments.

Under cashless claims, you don’t have to bear the expensive medical bills of hospitalization, which gives financial relief.

Almost all health insurance plans allow cashless claim settlements. So, you avail of the cashless facility in –

A cashless health insurance policy is important for the following reasons –

The primary benefit of cashless claim settlements is your financial relief. As the health plan takes care of your medical expenses, you don’t have to shoulder the burden of expensive hospitalization costs. As such, you are financially relieved of a medical contingency.

When you have to bear the hospital costs, you might have to liquidate your savings prematurely or use them up for paying the bills. However, with the cashless facility, this dilemma is handled. As the health plan pays for your bills, you don’t have to draw upon your savings or drain them on your treatments. As such, your savings stay protected.

With a cashless plan, you entitle yourself to the best treatment without worrying about the underlying costs and their affordability. Since the plan is handling the expenses, the affordability issue is solved. You can simply get treated, and the insurer will handle your bills.

Cashless claims are a simpler affair. You just need a pre-authorization claim form filled out and submitted to the insurer for cashless approvals. Thereafter, the hospital bills, reports, and records are sent directly by the hospital to the insurance company. You do not have to collect these documents and submit them to the insurer. As such, the claim gets settled easily and also quicker.

The cashless claim facility covers a wide scope of medical bills to give you complete financial relief. Besides hospitalization costs, the cost of treatments, doctor’s fee, nurse’s fee, surgeon’s fee, cost of blood, oxygen, medicines, etc., day care treatments, organ donor treatments, etc. are all covered under the purview of cashless claim settlements.

Some of the important features of cashless health insurance plans are as follows –

The above mentioned coverage may not be available in some of our Health plans. Please read the policy wordings, brochure and prospectus to know more about our health insurance plans.

Cashless health plans do not cover the following types of medical expenses or treatments –

Under a cashless health plan, you would have to take the following steps to initiate the cashless claim:

Once the approval comes, you can get the cashless facility invoked and get the claim settled. Only a small part of the bill, usually the consumables portion, needs to be paid out-of-pocket as that might be excluded from the plan.

.jpg?sfvrsn=7ee92f2a_2)

The documents required for a cashless health claim are as follows –

Besides these, other medical documents are submitted directly by the hospital. So, you don’t have to submit these documents to the insurer to get the cashless settlement of the claim.

The process of availing of cashless hospitalization depends on which type of hospitalization you are undergoing. The process is as follows –

If you are undergoing a planned treatment, like a gall bladder stone removal or a C-Section delivery, you need to avail of the cashless approval beforehand. The process for a planned hospitalization is as follows –

Emergencies are not predictable. As such, you would have to inform the insurer and seek cashless approval after being hospitalized. The process is as follows –

Though health insurance companies have simplified their claim process, in some cases, your cashless claim might get rejected. The top 5 reasons for such a claim rejection are as follows –

Address

C-1/15A Yamuna Vihar, Pincode-110053

Address

C-1/15A Yamuna Vihar, Pincode-110053

Address

C-1/15A Yamuna Vihar, Pincode-110053

No, cashless hospitalization is available only at the network hospital of the insurer.

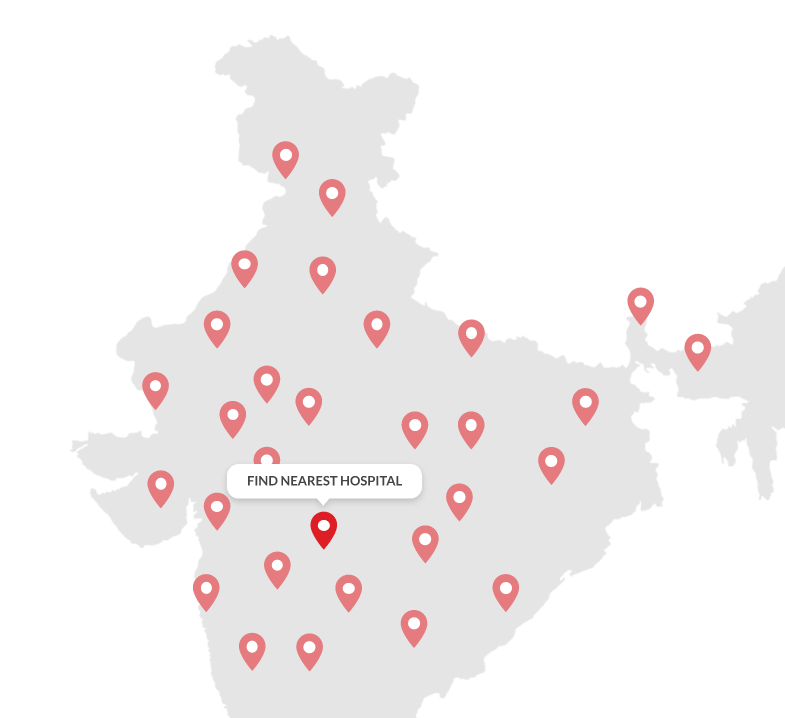

You can check the list of networked hospitals on our website. You can also call up the insurer’s claim helpline number to find the networked hospital in your city and area.

Some health plans allow coverage for OPD treatments on a cashless basis, provided you avail of the treatments at a networked facility. However, in other plans, if OPD treatments are covered, the settlement is usually on a reimbursement basis.

Yes, you need to inform the insurance company of your planned hospitalization. You would have to fill up and submit a pre-authorization claim form at least 3-4 days before hospitalization.

Yes, the premium paid for the cashless health insurance plan qualifies for deductions under Section 80D. You can claim a deduction up to rupees.25,000 if you are below 60. If you are a senior citizen, the deduction limit goes up to Rs.50,000.

Furthermore, if you pay the premiums for your parents’ health insurance coverage, you can have the benefits of an additional deduction of up to Rs.50,000 on the premium paid.

You can check the list of hospitals in Mumbai on the insurance company’s website. Alternatively, you can call up the insurance company and find out about the hospitals in Mumbai wherein the company offers cashless claims.

Some of the possible reasons for denying your request for cashless settlement are:

● The claim is listed in the policy exclusions

● Your policy has run out of sum insured

● Your policy lapses, and you did not renew it on time

● You did not provide required details of the claim in the pre-authorization claim form

● There are errors in the pre-authorization claim form.

If the policy allows the cashless facility for OPD procedures, you can get cashless treatments. Usually, the facility is allowed only at the networked facility of the insurer. So, if the policy allows, check for the networked facility to get a cashless settlement.

If your policy covers maternity, you can request a cashless settlement provided you get the treatment at a networked hospital.

Yes, you can still opt for cashless treatments at networked hospitals. However, do inform the insurer of the loss of the card and provide an alternative identity proof along with your policy copy to get cashless hospitalization.

Cashless health insurance plans have no maximum renewal age. You can renew the policy for as long as you are alive.

The exceptions are the policy exclusions in which the cashless claim is not admissible. Moreover, the cashless facility would not be allowed if you do not follow the claim process or submit the pre-authorization claim form on time.

No, cashless health insurance is not a separate type of plan. It is just a mode of claim settlement in a health insurance plan. An individual health insurance plan or a family floater policy can double up as cashless if you get treated at networked hospitals.

The policy term depends on you. You can opt for an annual plan or a long-term policy of 2 or 3 years. Moreover, if you opt for the Corona Kavach or the Corona Rakshak policy, the coverage tenure can be for 3.5, 6.5, and 9.5 months.