Parenthood Add-on in Health Insurance

Pregnancy is a beautiful journey that brings a couple closer than ever. Every ultrasound, every tiny kick, and every heartbeat heard fills the heart with excitement and love. However, on the flip side, the costs associated with frequent visits to the obstetrician-gynaecologist, c-section, and pre-and post-natal care can drain your finances if you are not prepared beforehand. To support you financially in this new chapter of your life, we have designed the 'Parenthood Add-on' that you can purchase with your base health coverage.

Key Features of Parenthood Add-on in Health Insurance

The main attributes of the parenthood add-on are:

Eligibility

This Add-on is available only when purchased alongside the base policy and requires at least one female insured person aged 18 or above. Once activated, all insured persons aged 18 or above are covered under this add-on.

Applicability

The coverage is available at the policy level regardless of whether the base plan is individual, multi-individual, or family floater.

Independent Cover

All insured persons share a common sum insured under this add-on, which is independent of the base policy. Any claims paid under this rider do not reduce the base policy’s sum insured.

Geographical Scope

Whether you want to avail the benefit of covered conditions in India or abroad, the policy allows for both.

SI Options

You can choose the parenthood rider with a sum insured of ₹50,000, ₹1 lakh, ₹1.5 lakh, or ₹2 lakh.

Benefits of Parenthood Add-on in Health Insurance

The advantages of the parenthood rider are:

Maternity Coverage

Get coverage for hospitalisation expenses related to childbirth, whether it is a normal or C-section delivery. In the event of life-threatening situations, the policy covers lawful termination of pregnancy.

Prenatal Expenses

Don't worry about prenatal medical expenses. Get reimbursement for antenatal check-ups, gynaecological consultations, sonograms, prescribed medications, and vaccines for up to 180 days before childbirth.

Post-Natal Expenses

Medical expenses incurred within 180 days after childbirth, including gynaecological consultations, postpartum complications, physiotherapy, and essential medications, are covered.

-support.svg)

In-Vitro Fertilisation (IVF) Support

If you are undergoing IVF treatment, this cover helps manage expenses for ovarian stimulation, egg retrieval, embryo transfer, and necessary diagnostic tests. It covers up to two IVF cycles in a lifetime.

Embryo Freezing Expenses

Rest assured, knowing that the cost of storing embryos through freezing is covered.

How Does Parenthood Cover Work in Health Insurance?

Suppose you are planning to start a family and are concerned about the medical expenses. You purchase this add-on along with your health insurance policy. Later, when you welcome your baby, the add-on covers maternity-related expenses like delivery and pre- and post-natal care costs. For example, let’s say your total hospital bill comes to ₹1,50,000 for delivery and post-natal care. With the parenthood add-on, HDFC ERGO reimburses these expenses, allowing you to focus on your family rather than financial worries.

Who Should Consider the Parenthood Add-on?

Complementing your base cover with parenthood rider is ideal in the following scenarios:

• If you are considering delayed parenthood or fertility preservation.

• If you and your spouse are planning for parenthood in the near future.

• If you are planning to undergo IVF treatment.

How to Buy the Parenthood Add-on?

Getting the parenthood add-on is a breeze—just complete these steps!

Step 1: Visit the HDFC Ergo official website.

Step 2: Go to the Health Insurance section and choose the base plan that fits your needs.

Step 3: Provide your basic and health-related details.

Step 4: Select the ‘Parenthood Add-on’ and any other rider you wish to purchase.

Step 5: Pay the premium. We will send the soft copy of your application immediately to your registered email address.

Note: You can purchase planned parenthood health insurance only at the time of base plan purchase or during renewal.

Conclusion

So, what are you waiting for? Purchase health insurance online and supplement it with a parenthood add-on for peace of mind. From maternity coverage to prenatal and post-natal expenses, the rider ensures you are well-prepared for the costs associated with starting a family. Whether you choose a sum insured of ₹50,000 or up to ₹2 lakh, this add-on extends your health coverage seamlessly, both locally and internationally.

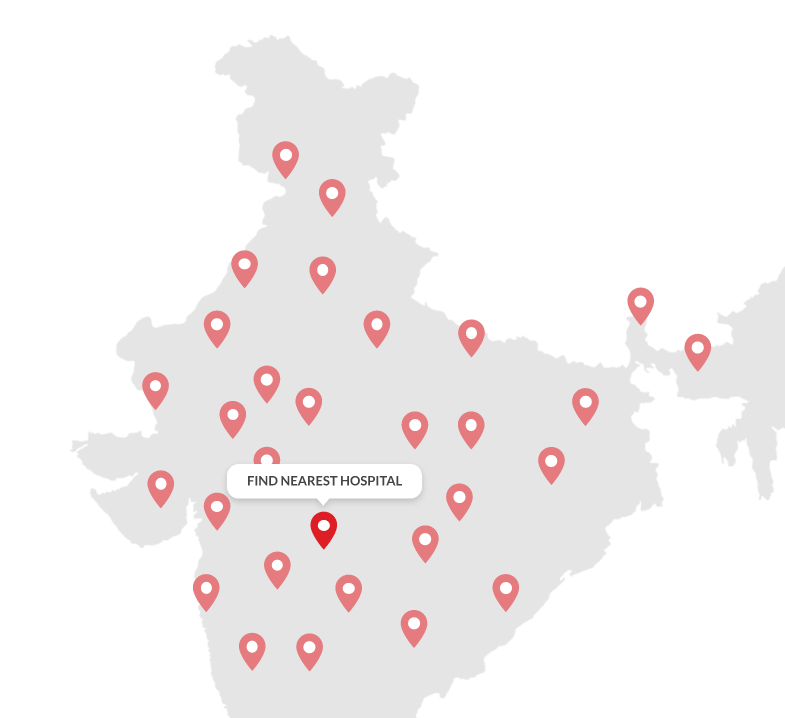

15,000+

Cashless Network Across Indiaˇ

Jaslok Medical Centre

Address

C-1/15A Yamuna Vihar, Pincode-110053

Roopali Medical

Centre Private Limited

Address

C-1/15A Yamuna Vihar, Pincode-110053

Jaslok Medical Centre

Address

C-1/15A Yamuna Vihar, Pincode-110053

Health Insurance Reviews & Ratings

Read Latest Health Insurance Blogs

Frequently Asked Questions

1. Can the parenthood add-on be opted for at any time?

No, you can only opt for this add-on at the inception or renewal of your base policy. If you opt out, you can only re-enrol at renewal, but fresh waiting periods will apply again. Any increase in the sum insured at renewal will have a waiting period on the increased portion.

2. Does the parenthood add-on cover IVF treatment expenses?

Yes, it covers specific IVF-related medical expenses such as ovarian stimulation, egg retrieval, embryo transfer, and pre-implantation diagnostic tests. However, it only applies to the first or second IVF cycle in your lifetime. Donor eggs, donor sperm, surrogacy, or IVF without medical recommendations are not covered.

3. What are the pre-natal and post-natal expenses covered?

Pre-natal expenses include antenatal check-ups, gynaecological consultations, sonograms, vaccines, diagnostic tests, and prescribed medications within 180 days before childbirth. Post-natal expenses cover consultations, medications, postpartum complications, and physiotherapy within 180 days after childbirth. However, costs for newborn care and cosmetic procedures are not covered.

4. What documents are required for a claim under the parenthood add-on?

To file a claim, you may need to provide a filled claim form, ID proof, discharge summary, hospital bills, doctor’s prescription, baby’s birth certificate, and medical history reports. If the claim is related to IVF treatment, consent forms may also be required for processing.

5. What is covered under maternity expenses in this add-on?

This add-on covers hospitalisation costs for delivery (normal or C-section) and medically necessary pregnancy termination in life-threatening situations. However, it does not cover ectopic pregnancies and voluntary terminations.

6. Is the third childbirth covered under the parenthood add-on?

No, the third childbirth is not covered under the parenthood add-on. The coverage is limited to either two deliveries, two lawful terminations, or one delivery and one lawful termination.

7. Can both husband and wife claim the parenthood add-on?

Yes, if you have a family floater plan and have complemented it with the parenthood add-on, then either of you can file a claim for covered maternity-related expenses.

8. What happens if a child is born with complications?

No, the parenthood rider does not cover expenses related to your child, including congenital diseases.

9. Can I opt for the add-on if I’m already pregnant?

Yes, you can purchase this plan even during pregnancy, but since this add-on has a 24-month waiting period, you will not be able to avail of the policy benefits for your current pregnancy.

10. Can I claim parenthood benefits from two insurers?

Yes, you can claim parenthood benefits from two different insurers, provided that the covered expenses you are claiming from each are not the same.

11. When should you opt for a parenthood add-on?

You should opt for a parenthood add-on if you are planning to start a family in the near future. Since the policy has a waiting period, purchasing it early allows timely access to benefits when needed.