Optima Super Secure Health Insurance

Introducing Optima Super Secure health insurance, which redefines the value you get from health insurance, with SO MUCH benefits that give an incredible 5X coverage at no additional cost. You can now enhance your plan with our new add-ons that offer extra coverage you've always wanted.

It doesn't end here! Now you can avail our No cost installment*^ benefit for buying Optima Super Secure that too at no additional cost. This option is available for all debit and credit card holders.

We also provide you with a host of benefits such as no room rent capping, wider pre and post hospitalisation, unlimited day-care procedures and exciting discount options. We’d say do not settle for less when you can avail one of the best healthcare facilities without breaking your bank.

More Protection by Adding More Benefits

You can choose below options while creating wholesome protection for you and your family with my:Optima Secure plans

No Cost Installment*^ Option

You can purchase HDFC ERGO’s Optima Secure using an easy installment benefit. This benefit is available to all policy tenures. You can choose from installment options: monthly, quarterly half-yearly and yearly (note: Long-term discount will not be applicable on installment options).

Unlimited Restore

This Optional Benefit will provide instant addition of 100% Basic Sum Insured on complete or partial utilization of Restore benefit or Unlimited Restore benefit (as applicable) during the Policy Year. This optional cover will trigger unlimited times and is available for all subsequent claims in a Policy Year.

my:Health Hospital Cash benefit

my:Health Hospital Cash benefit add on meets your day to day needs with fixed daily cash for your personal expenses, food, transportation, loss of pay and much more. So make an estimate of your daily spends and pay a small amount today instead of feeling helpless tomorrow.

So Much Benefits

Protect Benefit

Covers Out-Of-Pocket Expenses°Aggregate Deductible Discount

So Much Savings

Online, long-term & many more discountsSo Much Choices

Cover upto 2 Cr & tenure 3 years

Procedure Charges Covered

Cost of Disposables Covered

Cost of Consumables Covered

Key Features

- Support devices: We cover costs towards the cervical collar, braces, belts etc

- Cost of Disposables: Go cashless with in-built coverage for disposable items like buds, gloves, nebulization kits and other consumables during hospitalisation

- Cost of Kits: We cover cost for delivery kit, orthokit and recovery kit.

- Procedure Charges: We cover costs towards gauze, cotton, crepe bandage, surgical tape etc

Twenty Five Percent Off

Fourty

Percent Off

Fifty

Percent Off

Discount Options

- 50% Discount: Get 50% flat discount on your base premium when you decide to pay ₹1 lac before making a claim in a policy year

- 40% Discount: Get 40% flat discount on your base premium when you decide to pay ₹50,000 before making a claim in a policy year

- 25% Discount: Get 25% flat discount on your base premium when you decide to pay ₹25,000 before making a claim in a policy year

- Note :To know more about aggregate deductible discount for sum insured above ₹20 lacs, please read the sales brochure/policy wordings.

Family Discount

Online Discount

Long term discount

Discounts available

- Online Discount: Get 5% premium discount on the base premium if you buy a health insurance policy online through our website

- Family Discount: Get 10% family discount if 2 or more members are covered in a single Optima Secure policy on an individual sum insured basis

- Long Term Discount: Get long term discount of 10% for 3 years policy tenure. Note: Long-term discount will not be applicable on installment options

- Loyalty Discount:Get 2.5% premium discount on the base premium if you have an active retail insurance policy with us, with a premium above ₹2000

Expanded Coverage

Policy Options

Tenure

Key Features

- Coverage: Choose between wide range of base cover from ₹10 lacs to ₹2 crores

- Policy Options: You can buy individual and family floater options

- Tenure: Available for 3 years only

- No Cost Installment*^ Option: Credit and Debit card holders can now opt for the EMI option

So Much Coverage

Choose your health cover

Select your sum insured

Suiting your budget and requirements, select the coverage you want. For example, let's consider you select a sum insured of ₹10 lacs.

Secure Benefit

3X coverage from day 1

Your base cover gets tripled instantly upon purchase, without having the need to claim it. This benefit will instantly increase your ₹10 lacs base cover to ₹30 lacs at no extra cost.

Plus Benefit

100% increase in coverage

On 1st renewal your base cover increases by 50% after 1 year and 100% after 2 years, making it ₹15 lacs and ₹20 lacs respectively. Your total cover now becomes ₹40 lacs i.e 4X of your base cover.

Restore Benefit

100% restore coverage.

Anytime you make a claim whether partial or total of ₹10 lacs base cover, it gets 100% restored for any subsequent claims in the same year.

So Much Trust

Backed by the trust of #3.2 crore+ happy customers over the past 23 years. At HDFC ERGO, we consistently strive to make insurance affordable, easier and dependable. Here, promises are kept, claims are fulfilled and lives are nurtured with utmost commitment.

16,000+ˇ Cashless Healthcare Networkˇ

₹24000+ crores

Claims settled^*

3 claims processed every minute^*

24x7 support in 10 languages

3.2+ crores

Happy Customers#

Know How Optima Super Secure Benefits Boost Your Health Cover?

Secure Benefit 3X Coverage from Day 1

3X Coverage from Day 1

What if we tell you that your health cover triples up as soon as you buy an Optima Super Secure health insurance plan? Don’t believe us? Well, that’s indeed a fact. Secure Benefit instantly makes his ₹10 lacs base cover to ₹30 lacs, at no extra cost.

How does it work?

Suppose, Mr Sharma has bought Optima Super Secure Health Insurance Plan with a sum insured of ₹10 lacs, then in this case his sum insured will instantly get doubled and offer him a total health cover of ₹30 lacs. This additional amount can be utilised for any number of admissible claims.

Plus Benefit 100% increase in coverage after 2 Years

100% increase in coverage after 2 Years

We love the fact that you are choosing us to be your partner on your health journey. And, hence we would love to reward you for your trust and loyalty by offering a 50% increase in base cover post 2 years and a 100% increase post 2nd-year renewals irrespective of any claims made.

How does it work?

When Mr Sharma renews his Optima Super Secure Health Insurance Plan for 1 year, Plus Benefit increases his base cover of ₹10 lacs by 50% and in 2nd year by 100%, making it ₹15 lacs and ₹20 lacs respectively. Plus benefit and super secure benefit together takes the total coverage to ₹40 lacs.

Automatic Restore Benefit 100% restore coverage

100% restore coverage

Optima Super Secure plan restores up to 100% of your base sum insured for subsequent claims, for any illness or accidental hospitalisation. This benefit comes in handy when you exhaust your existing sum insured due to one or several claims.

How does it work?

Imagine a situation where Mr. Sharma claims partial or total 10 lacs base cover, it gets 100% restored, making it ₹30 + ₹20= ₹50 lacs. So, he does not have to limit his claims to ₹10 lac base cover or ₹30 lacs super secure benefit, he will get an additional ₹10 lacs as a restore benefit to settle claims.

Protect Benefit Zero deductions on non-medical expenses

Zero deductions on non-medical expenses

It is the non-medical expenses that really end up burning a hole in your pocket. Well, we have got your back. Go cashless with our my:Optima Super Secure health plan which has an in-built coverage for listed non-payable items like gloves, masks, food charges and other consumables during hospitalization. Usually, these disposable items are not covered by insurance policies or offered as an optional cover at an additional cost. However, with this plan, all your expenses for 68 listed non-medical items that are commonly used during hospitalisation are covered at no extra premium.

How does it work?

During hospitalisation, his non-medical expenses that add up to 10-20% of the total bill amount also gets covered by Protect Benefit. With Optima Super Secure plan you can rest assured that as many as 68 non-medical expenses will be taken care of. You don’t have to bother shelling extra pennies for these non-medical expenses. Items like disposables, consumables and non-medical expenses such as gloves, food charges, belts, braces etc will all be covered under this plan.

No sub-limits No room rent capping | No disease-based capping | No co-payments

No room rent capping | No disease-based capping | No co-payments

Optima Secure plan is tailored for those who want to settle for nothing less than the most premium healthcare for their family. The plan qualifies you for any room category at any hospital. This feature assist customer in reducing their out-of-pocket expenses and further gives freedom to select the hospitalization room of their choice.

How does it work?

Optime Super Secure does not put a claim restriction in terms of a disease. Say, for instance, if Mr Sharma has to undergo a kidney stone removal procedure, then unlike other conventional insurance plans, Optima Super Secure has no capping of ₹1 lac or so as the claimable amount for the disease. He can claim up to the available sum insured as per the treatment costs. Additionally, there is no capping in terms of room rent per day or ambulance charges.

So Much More Coverage Offered by Optima Super Secure Health Insurance

Hospitalisation (including COVID-19)

We cover all your hospitalisation expenses arising from illnesses and injuries seamlessly. Most importantly, the Optima Super Secure plan includes treatment costs for Covid-19 as well.

Pre and Post Hospitalisation

Instead of 30&90 days availed normally, get 60 & 180 days pre and post hospitalisation medical expenses covered.

All Day Care Treatments

Medical advancements help in wrapping up important surgeries and treatments in less than 24 hours, and guess what? We cover you for that as well.

Preventive Health Check-Up at No Cost

Prevention is certainly better than cure and that’s why we offer a free health check-up on renewing your health insurance policy with us.

Emergency Air Ambulance

Optima super secure plan is tailored to reimburse the cost of air ambulance transport up to ₹5 lacs.

Road Ambulance

Optima Super Secure plan covers road ambulance cost up to the sum insured.

Daily Hospital Cash

Get daily cash of ₹1000 per day up to a maximum of ₹6000 on hospitalisation, as out-of-pocket expenses under Optima Super Secure Plan.

E Opinion for 51 illnesses

Avail e-Opinion for 51 critical illnesses through network providers all over the world under Optima Super Secure plan.

Home Healthcare

We will pay for the medical expenses incurred by you on home hospitalisation if advised by the doctor. This facility is available on cashless basis.

Organ Donor Expenses

We cover medical expenses for harvesting a major organ from the donor’s body where the insured is the recipient.

Alternative Treatments

We cover treatment costs up to the sum insured towards in-patient care for alternative therapies like Ayurveda, Unani, Siddha, Homeopathy, Yoga and Naturopathy.

Lifelong Renewability

Optime Super Secure plan has your back. Our health insurance policy covers your medical expenses for a lifetime on break free renewals.

Please read the policy wordings, brochure and prospectus to know more about my Optima Super Secure.

Adventure Sport Injuries

Adventures can give you an adrenaline rush, but when coupled with accidents, it can be hazardous. Our health insurance plan does not cover accidents encountered while participating in adventure sports.

Breach of Law

We do not cover expenses for treatment directly arising from or consequent upon any insured person committing or attempting to commit a breach of law with criminal intent.

War

War can be disastrous and unfortunate. However, our health insurance plan does not cover any claim that is caused due to wars.

Excluded Providers

We do not cover expenses incurred towards treatment in any hospital or by any Medical Practitioner or any other provider specifically excluded by the Insurer. Contact us to get the list of de-empanelled hospitals.

Congenital external diseases, defects or anomalies,

We understand that treatment towards congenital external disease is critical however, we do not cover medical expenses incurred for Congenital external diseases defects or anomalies.

(Congenital diseases refer to birth

defects).

Treatment for Alcoholism & Drug Abuse

Treatment for Alcoholism, drug or substance abuse or any addictive condition and consequences thereof remains uncovered.

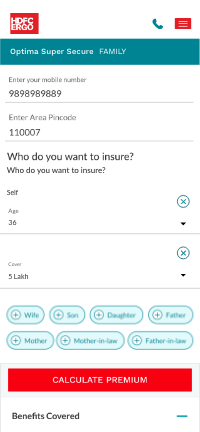

Calculating Premium Is So Easy

How to Make a Claim for your HDFC ERGO Health Insurance

The sole purpose of buying a health insurance plan is to get financial support at the time of medical emergency. Hence, it is important to read the below steps to know how Health Insurance claims process works differently for cashless claims and reimbursement claim requests.

3 claims processed every minute^^

Intimation

Fill up the pre-auth form at the network hospital for cashless approval

Approval/Rejection

Once hospital intimates us, we send you the status update

Hospitalisation

Hospitalisation can be done on the basis of pre-auth approval

Claim settlement

At the time of discharge, we settle the claim directly with hospital

3 claims processed every minute^^

Hospitalisation

You need to pay the bills initially and preserve the original invoices

Register a claim

Post hospital discharge send us all your invoices and treatment documents

Verification

We verify your claim related invoices and treatment documents

Claim Settlement

We send the approved claim amount to your bank account.

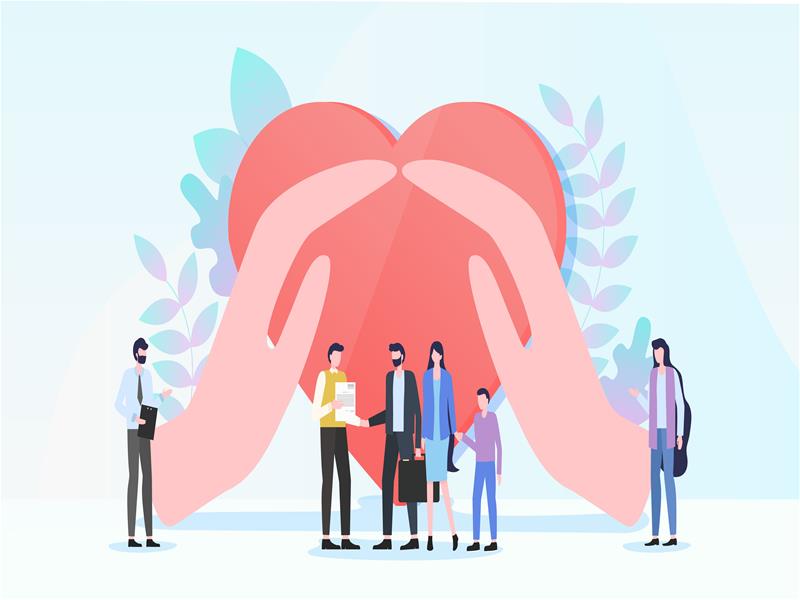

16,000+

Cashless Network

Across India

Jaslok Medical Centre

Address

C-1/15A Yamuna Vihar, Pincode-110053

Roopali Medical

Centre Private Limited

Address

C-1/15A Yamuna Vihar, Pincode-110053

Jaslok Medical Centre

Address

C-1/15A Yamuna Vihar, Pincode-110053

Hear From Our Happy Customers

Frequently Asked Questions on Optima Super Secure Plan

1. How many benefits does Optima Super Secure provide?

Optima Super Secure individual plan policy offers a range of coverage benefits forOptima Super Secure is a comprehensive health insurance plan that provides a range of benefits for policyholders. These benefits include the following –

● Hospitalization expenses

● Road and Air ambulance costs

● Daycare treatments

● Home Healthcare

● Domiciliary Hospitalization

● AYUSH treatments

● Pre and post-hospitalization expenses for 60 days and 180 days respectively

● Organ donor expenses

Furthermore, you get the following unique features too –

● Secure Benefit – that triples the insurance cover you buy, instantly and automatically. This means that you get a 3X coverage from day 1,

● Protect benefit- Zero deduction on listed non medical expenses

● Get e-opinion on 51 critical illnesses through network provider globally.

● Allowance for daily cash if you choose a share accommodation in a network hospital

● Preventive medical check-ups subject to specified limits irrespective of claim status

● Plus Benefit - the base cover you choose for yourself automatically increases by 50% after 1

year, and 100% after 2 years, irrespective of any claims made.

● Restore benefit -100% of the base cover gets restored automatically in the event of complete or partial utilization of the Base Sum insured due to any admissible claim.

2. What is the waiting period applicable under Optima Super Secure?

Optima Super Secure has the following waiting periods specified under the plan –

● Pre-existing illnesses are covered after a waiting period of 36 months. The waiting period reduces every year on successful renewals. Even if you port an existing policy to Optima Super Secure, you get a credit for the waiting period already lapsed in the last policy. In the case of enhancement of the sum insured, however, the waiting period of 36 months would apply again to the increased amount.

● Specific illnesses and treatments are covered after a waiting period of 24 months.

● Initial waiting period of 30 days is applicable from the start date of the policy coverage. The plan would not cover illnesses that occurred during this period of 30 days. However, you get coverage for accidental injury from the first day of the plan itself.

3. Is pregnancy covered under the Optima Super Secure policy?

No, pregnancy is not covered under Optima Super Secure.

4. How do I renew my Optima Super Secure plan?

You can renew your Optima Super Secure in multiple ways. These include the following –

● Online through the website of HDFC ERGO

The fastest and the easiest way to renew HDFC ERGO Optima Super Secure plan is online by visiting the website of the insurance company. The process is quite simple and discussed as follows:

● Click on https://www.hdfcergo.com/renew-hdfc-ergo-policy

● Fill in your policy number, registered email ID, and phone number

● Click on the “Renew” option

● The details of your existing policy would be displayed along with the renewal premium

● Pay the renewal premium online and your policy would be issued instantly

● Offline by visiting the branch office of HDFC ERGO

You can visit the nearest branch office of the insurance company to renew your plan. When you visit the branch of HDFC Ergo, you would have to specify the policy number and make payment of the renewal premium through cheque, or other means available at the office. Once the premium is paid, your policy would be renewed. Please note: - Customer can also pay by PG payment link (received from Inbound or Outbound call center).

● Through an intermediary

You can renew your HDFC ERGO Optima Super Secure Individual plan through an intermediary of HDFC ERGO. You can get in touch with a broker or an agent and apply for renewing your policy. All you have to do is pay the renewal premium to the agent who would deposit it to the insurance company and your plan would be renewed.

Optima Super Secure offers lifelong renewability. The plan can be renewed every year throughout your life without any ceasing date. To enjoy uninterrupted coverage benefits, you should remember to renew your policy within the due date or within the grace period offered under the plan.

You can also opt for enhancement of the sum insured at renewal subject to underwriting guidelines.

5. Does HDFC ERGO offer a portability option?

Yes, HDFC ERGO offers a portability option. You can port into the Optima Super Secure or port out of it. To port, you would have to request with the insurance company at least 45 days before the policy renewal date. However, the porting request should not be submitted earlier than 60 days from the renewal date.

After you request porting, the insurance company would assess your request, verify it and allow you to switch your coverage to another plan or another insurer.

6. What are additional treatments & conditions covered under this plan?

HDFC ERGO Optima Super Secure offers two optional add-ons that you can avail of to enhance the coverage. These add-ons are as follows –

● my: Health Critical illness ( add-on)

Get comprehensive coverage for 51 critical illnesses.with sum insured options of INR 100,000 to INR 200,00,000 and in multiples of INR 100,000.

● my :Health Hospital Cash Benefit ( add-on )

Get a daily cash allowance in case of Hospitalization for 24 hours or more up to maximum of 30 days. There are various sum insured options from Rs. 500, to Rs. 10,000. You can choose one or both of these add-ons and avail of a wider scope of coverage.

Disclaimer: Please read the policy wordings, brochure and prospectus to know more