Individual Health Insurance Plan

An individual health insurance policy is designed to cover a single person, ensuring that the policyholder’s medical needs are fully taken care of. It offers extensive features such as cashless hospitalisation, daycare procedures, road ambulance cover, pre- and post-hospitalisation expenses, alternative treatments, and no-claim bonuses.

HDFC ERGO’s Optima Secure plan stands out with its vast hospital network, fast claim processing, and enhanced 4x health cover benefit, ensuring top-quality care without financial stress. This plan provides flexibility to choose coverage as per personal health needs, offering complete protection and peace of mind for the insured individual.

Protect life’s precious moments with Optima Secure’s 4X cover promise. Pay smart with installments*^

Compare our Best Individual Health Insurance Plans

- No Cost Installment Available*^

Optima Secure

Optima Restore

my:health Suraksha

my:health Medisure Super Top-up

4X Coverage*

Wider Pre & Post Hospitalisation

Free preventive health-check ups

Key Features

- Secure Benefit: Get 2X coverage from Day 1.

- Restore Benefit: 100% restores your base coverage

- No Cost Installment*^ Option: Credit and Debit card holders can now opt for the No Cost Installment*^ Option

- Aggregate Deductible: You can enjoy up to 50% discount every year by choosing to pay a little bit more. You also have the super power to waive your opted deductible at renewal post completion of 5 years under this Policy.@

16,000+ Cashless Network

Cashless Claims Settled in 38 Mins*~

Free preventive health-check ups

Key Features

- 100% Restored Benefit: Get 100% of your cover restored instantly after your first claim.

- 2X Multiplier Benefit: Get up to 100% additional policy cover as no claim bonus.

- Complete coverage 60 days prior & 180 days post your hospitalization. This ensures better planning of your hospitalization needs.

No room rent restriction

Sum insured rebound

Cashless claims approved within 38 minutes*~

Key Features

- No Medical Test Upto 45 Years: It’s better to be safe than sorry! Secure your health when you are young to avoid medical tests.

- Free preventive health-checkups: We offer free health check-ups so that you are healthier and happier always

- Cumulative Bonus: Don’t think that your health insurance plan is of no use if you do not make a claim. It rewards you with additional 10% to 25% sum Insured upto a max of 200% depending on the plan opted at the time of renewal.

Higher cover at low premium

Compliments existing health insurance

No premium hike post 61 years

Key Features

- Works on Aggregate Deductible: This health plan comes in action once your all round total claim amount reaches the aggregate deductible in a year, it’s not necessary for a single claim to meet the deductible unlike other top-up plans.

- No health checkups upto Age 55 : It’s better to be safe than sorry! Secure your health when you are young to avoid medical tests.

- Pay less, Get more: Opt for a long-term policy of 2 years and get a 5% discount.

Why Choose Individual Health Insurance?

Our Individual health insurance plans are designed keeping in mind the growing medical needs and rising inflation.

Cashless Claim Service

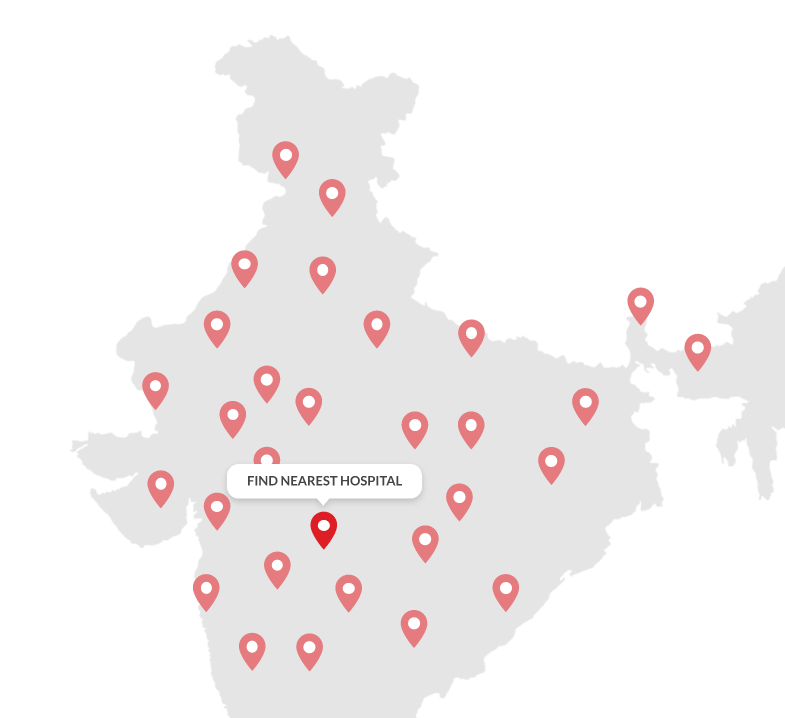

16,000+ Cashless Network**

4.4 Customer Rating

2 Decades of Serving Insurance

#1.4 Crore+ Happy Customers

16,000+

Cashless Network Across India

Jaslok Medical Centre

Address

C-1/15A Yamuna Vihar, Pincode-110053

Roopali Medical

Centre Private Limited

Address

C-1/15A Yamuna Vihar, Pincode-110053

Jaslok Medical Centre

Address

C-1/15A Yamuna Vihar, Pincode-110053

Understand Coverage Offered by Individual Health Insurance Policies

Hospitalisation (including COVID-19)

We cover all your hospitalisation expenses arising from illnesses and injuries seamlessly. Most importantly, the Optima Secure plan includes treatment costs for Covid-19 as well.

Pre and Post Hospitalisation

Instead of 30 & 90 days availed normally, get 60 & 180 days pre and post hospitalisation medical expenses covered.

All Day Care Treatments

Medical advancements help in wrapping up important surgeries and treatments in less than 24 hours, and guess what? We cover you for that as well.

Preventive Health Check-Up at No Cost

Prevention is certainly better than cure and that’s why we offer a free health check-up on renewing your health insurance policy with us.

Emergency Air Ambulance

Optima secure plan is tailored to reimburse the cost of air ambulance transport upto ₹5 lacs too.

Road Ambulance

Optima Secure plan covers road ambulance cost upto the sum insured.

Daily Hospital Cash

Get daily cash of ₹800 per day up to a maximum of ₹4800 on hospitalisation, as out-of-pocket expenses under Optima Secure Plan.

E Opinion for 51 illnesses

Avail e-Opinion for 51 Critical Illnesses through network provider in India under Optima Secure plan.

Home Healthcare

We will pay for the medical expenses incurred by you on home hospitalisation, if advised by the Doctor on cashless basis.

Organ Donor Expenses

We cover medical expenses for harvesting a major organ from the donor’s body where insured is the recipient.

Alternative Treatments

We cover treatment costs upto the sum insured towards in-patient care for alternative therapies like Ayurveda, Unani, Siddha, Homeopathy, Yoga and Naturopathy.

Lifelong Renewability

Optime Secure plan has your back. Our health insurance policy covers your medical expenses for a lifetime on break free renewals.

Please read the policy wordings, brochure and prospectus to know more about my Optima Secure.

Adventure Sport Injuries

Adventures can give you an adrenaline rush, but when coupled with accidents, it can be hazardous. Our health insurance plan does not cover accidents encountered while participating in adventure sports.

Breach of Law

We do not cover expenses for treatment directly arising from or consequent upon any insured person committing or attempting to commit a breach of law with criminal intent.

War

War can be disastrous and unfortunate. However, our health insurance plan does not cover any claim that is caused due to wars.

Excluded Providers

We do not cover expenses incurred towards treatment in any hospital or by any Medical Practitioner or any other provider specifically excluded by the Insurer. (Contact us for list of de empanelled hospital)

Congenital external diseases, defects or anomalies,

We understand that treatment towards congenital external disease is critical however, we do not cover medical expenses incurred for Congenital external diseases defects or anomalies.

(Congenital diseases refer to birth

defects).

Treatment for Alcoholism & Drug Abuse

Treatment for Alcoholism, drug or substance abuse or any addictive condition and consequences thereof remains uncovered.

How Does an Individual Health Insurance Policy Work?

When an individual health insurance is purchased, the policyholder gets into a contract with the insurer. The agreement mentions that the insurer will cover your healthcare costs as per the sum insured, and according to the policy terms. In return, the policyholder has to pay premium regularly.

For example, you have purchased the best health insurance policy with a sum insured of Rs. 10 lakhs. After buying the policy if you are hospitalised, the insurer will be responsible to pay the hospital bills as per the terms and conditions of the policy.

Now, suppose the hospital bill was Rs. 4 lakhs. Your insurer will settle the bill with the hospital, and now your sum insured for the year will be reduced to Rs. 6 lakhs.

All Set to Secure Your Future With Our Health Insurance Plans?

It will just take a few minutes!

How to Make a Claim for your HDFC ERGO Health Insurance

The sole purpose of buying a health insurance plan is to get financial support at the time of medical emergency. Hence, it is important to read the below steps to know how Health Insurance claims process works differently for cashless claims and reimbursement claim requests.

Health Insurance Cashless Claims get approved within 38*~ minutes

Intimation

Fill up the pre-auth form at the network hospital for cashless approval

Approval/Rejection

Once hospital intimates us, we send you the status update

Hospitalisation

Hospitalisation can be done on the basis of pre-auth approval

Claim settlement

At the time of discharge, we settle the claim directly with hospital

We settle reimbursement claims within 2.9 days~*

Hospitalisation at non network hospital

You need to pay the bills initially and preserve the original invoices

Register a claim

Post hospital discharge send us all your invoices and treatment documents

Verification

We verify your claim related invoices and treatment documents

Claim Settlement

We send the approved claim amount to your bank account.

Save Tax with Individual Health Insurance Policy

Tax Benefits on Single Premium Medical Insurance Plans

As per the recent Income tax laws, the health insurance premium paid for a multi-year plan in the lump sum is eligible for a tax deduction under Section 80D. And the tax-deductible amount will be based on the total premium paid for the policy term. This will be subjected to the limits of Rs. 25,000 or Rs. 50,000 as per the case may be.

Deduction on preventive health check-ups

In addition to the hospitalization expenses, tax exemption benefits are also provided on the out-patient department or OPD consultation charges as well as expenses incurred on diagnostic tests. You can avail tax benefits on cash payments also. Unlike other medical expenses that require payments either through debit/credit cards, cheques, or internet banking to avail tax exemption benefits.

Please note that the above-mentioned benefits are as per the current tax laws prevailing in the country. Your tax benefits may change subject to tax laws. It is advisable to reconfirm the same with your tax consultant. This is independent of your health insurance premium value.

Things to Look at When Buying an Individual Health Insurance Plan

Every time you look for a health insurance plan for yourself, you wonder which is the best health insurance plan for you. How to choose the best health plan online? What coverage should it have? To answer all your queries let’s read more to decode the hacks to get the right health insurance plan.

Get yourself adequate sum insured

If you are residing in the metro cities then the cost of treatment is high hence for an individual your sum insured should ideally range between 7 lacs to 10 lacs. If you are looking for a family cover to insure your spouse and kids a sum insured that ranges between 8 lacs to 15 lacs suits best on floater basis. It should be adequate to cover more than one hospitalisation that may happen in a year.

Affordability

If you wish to pay low premiums for health insurance plan then co-pay your hospital bills. You end up sharing the medical expenses with your health insurer hence you do not have to pay a heavy premium. You could also buy my:health Suraksha health insurance that offers instalment payment facility on monthly, half yearly, quarterly and annual basis.

Vast Network of Hospitals

Always check if the insurance company has a wide list of network hospitals. If the nearest hospital or medical facility is listed by the insurance company it will help you avail cashless treatment. At HDFC ERGO, we have a huge network of 16,000+ Cashless Health care centers.

No Sub-limits Help

Usually your medical expenses depend upon your room type and disease. It is recommended to buy a health insurance plan that does not have sub-limits on hospital room rent so that you can choose the hospital room as per your comfort. Most of our policies also don’t imply disease sublimit; this is also an important factor one must keep in mind.

Check Waiting Periods

Your health insurance plan does not come into action while you are waiting period is not completed. Always check health insurance policies with lower waiting periods for pre-existing ailments and maternity benefits before buying a health insurance plan online.

Trusted brand

Always choose a health insurance company that has a good reputation in the market. You must also look at the customer base and claim paying ability to know if the brand will honor the claims that you may make in future.

Let your money fund adventures, not hospitalisations. Choose health cover and live life without financial worry

Am I eligible to buy a Health Insurance Plan?

Often, when we you think of buying a health insurance plan, the first thing that may come to your mind is that whether I am eligible to buy this health insurance plan? Will this particular medical insurance plan require some medical tests? Alternatively, do I have to fulfil age criteria before signing up for health insurance? These questions pop-up quite frequently, however, these days when you try buying a health insurance plan online, in a snap you can check your eligibility before buying a particular health insurance plan in India.

Key factors that decide your eligibility for buying Health Insurance Plans

Previous Medical Conditions / Pre-Existing Illnesses

While buying a mediclaim policy, you have to be honest enough to declare all your pre-existing illnesses. These illnesses need not be your usual fever, flu, or headaches. However, if in past you have ever been diagnosed with any disease, birth defects, undergone surgery, or cancer of any severity it is important to inform your medical insurance company. Because, many ailments are listed under permanentexclusion, few are covered with a waiting period and few others are covered by charging additional premium with a waiting period.

Age

If you are above 18 years of age, you can easily buy a health insurance plan for yourself. We also cover newborn babies but the parent needs to have a mediclaim insurance policy with us. If you are a senior citizen,you can get yourself insured upto the age of 65 years.

Why Buy Individual Health Insurance Online?

Convenience

You can sit on the couch lazing around and browse through the internet and look for plans. You save your time and effort by visiting an insurance company’s office or an agent visiting your place. You can make secured transactions from anywhere and anytime. Also, the policy wordings are available online for you to read the fine print to avoid any last moment surprises.

Secured Payment Modes

You do not have to pay premiums in cash or cheque for your health insurance plan! Go Digital! Simply use your credit/debit card or net banking services to make payments online through multiple secured payment modes.

Instant Quotes & Policy Issuance

You can instantly calculate the premium, add or remove members, customize plans, and check coverage online at your fingertips to buy a health insurance plan online.

What You See is What You Get

You no longer have to wait for the physical health insurance policy documents. Your policy PDF copy comes right into your mailbox as soon as you pay the premium online and you get your policy within a few seconds.

Wellness & value added services at your finger tips

Get access to your policy documents, brochure etc in our my:health services mobile application. Download our wellness application to book online consultations, monitor your calorie intake and keep a track on your BMI as well.

How Much Individual Health Insurance Coverage Should You Have?

.jpg?sfvrsn=7ee92f2a_2)

If you are purchasing health insurance for yourself, then you probably should opt for a coverage amount equivalent to at least half of your annual income. For instance, if your annual income is Rs 6 lakh, then you must opt for a health insurance cover of at least Rs 3 lakh.

But, healthcare costs have increased enormously in the last few years. Hence, opting for a lower health cover, even if it is equivalent to 50% of your salary, may not be sufficient. So, insurance experts advise people to opt for a minimum health insurance cover of Rs 5 lakh to cover their medical expenses comfortably.

Additionally, if you buy insurance in your early 20s, the chances of raising a claim are lower and because of this you will be able to increase your sum insured at no extra cost with the help of a cumulative bonus on every claim-free year.

How to Buy an Individual Health Insurance Policy Online from HDFC ERGO

- Log on to www.hdfcergo.com and navigate to the health insurance section.

- Under the health insurance section, choose between the policies based upon the requirement and the scope of coverage that each policy extend.

- After you have selected the type of policy that you would like to purchase, the next step is to click on the buy online tab which will direct you to a secure webpage. Continue further only if your browser is in a secure mode, as you will be providing critical information.

- The next step will allow you to determine the insurance premium that you will be required to pay for the policy coverage. The health insurance premium calculator will require key details such as types of insurance i.e. individual/family, floater, desired sum insured and date of birth of the applicant in order to arrive at the premium amount.

- The next step entails the filling of personal details such as name, correspondence address, contact details and a history of ailments or diseases.

- This will lead to the secure payment gateway, wherein you make the necessary payment for the mediclaim policy you have chosen.

Health Insurance Reviews & Ratings

Read Latest Health Insurance Blogs

Frequently Asked Questions on Individual Health Insurance

1. Do I need a separate family health insurance if I am covered under my employer’s group plan?

Even if you have an employer health insurance plan for family, you will need a separate health insurance plan. The insurance offered by the employer is valid only till you work in the organisation and generally, group plans provide basic coverage.

2. What are the benefits of health insurance portability?

Health insurance portability ensures that you do not have to go through a fresh waiting period when you change the insurer. With portability, you can easily change your insurer without losing any benefits.

3. What is a pre-existing disease?

A pre-existing disease is an injury or illness that you already have while buying the policy. Typically, insurers offer coverage for pre-existing diseases only after the waiting period.

4. What are pre and post-hospitalisation expenses?

There are many expenses related to hospitalisation. Before you get admitted, you have to consult a doctor and get diagnostic tests done. A similar process is followed after discharge. The expenses preceding and after hospitalisation are known as pre and post-hospitalisation expenses.

5. Do I have to go through a medical examination before buying health insurance?

Yes, a medical examination is required when you buy family health insurance. However, some policies do not require examination if you are below a certain age limit.

6. Can I add my family members to an existing policy?

Yes, you can add family members while buying the policy or at the time of renewal.`

7. At what age can I include my children in the plan?

You can include your children in family health insurance after 90 days of birth and up to 21 years at the time of renewal.

8.What is the benefit of buying family health insurance at a young age?

The younger the applicant, the lower is the premium of health insurance. You also get more benefits when you buy insurance at a young age.

9.Can an individual have more than one insurance policy?

Yes, you can have more than one health insurance policy depending on the needs of your family.

10. What is meant by waiting period?

Waiting period is the time span when the policyholder cannot avail some or all the benefits related to a specific illness.

11. What is ‘free look period’?

The free look period is the time span within which you can cancel your policy without any penalty. Generally, the free look period ranges from 10 days to 15 days depending on the insurer.

12. What is network/non-network hospitalisation?

Insurance companies have several hospitals in their network. You can get cashless treatment only in network hospitals. If you opt for a non-network hospital, you will have to clear the hospital bill and then you can claim reimbursement from the insurer.

13. What is ‘domiciliary hospitalisation’?

If the insured person cannot be taken to the hospital due to his/her medical condition or the treatment is taken at home due to non-availability of hospital bed, it is known as domiciliary hospitalisation.

14. What are the benefits under basic hospitalisation?

Expenses like pre and post hospitalisation, diagnostic tests, medicine and consultation costs are covered under basic hospitalisation.

15. What is the right age to buy a health insurance policy?

The younger you get health insurance, the better. You can get health cover after the age of 18. Below the age of 18, one can get covered under family health insurance.

16. Can a minor buy health insurance?

A minor cannot buy health insurance individually, however, parents can cover a minor under family health insurance.

17. What if I get admitted in a non-network hospital?

if you get in a non-network hospital, have to pay the bills first and then can claim reimbursement from insurer.

Popular Search

- Health Insurance

- Senior Citizen Health Insurance

- Wellness Corner

- Portability Cover

- Optima Secure

- Critical Illness Insurance

- Parents Health Insurance

- Health Insurance Premium Calculator

- Health Insurance Articles

- Bike Insurance

- Bike Insurance Blogs

- Car Insurance

- Car Insurance Blogs

- Travel Insurance

- Travel Insurance Blogs

Health Insurance

Health Insurance  Travel Insurance

Travel Insurance  Car Insurance

Car Insurance  Cyber Insurance

Cyber Insurance  Critical Illness Insurance

Critical Illness Insurance

Pet Insurance

Pet Insurance

Bike/Two Wheeler Insurance

Bike/Two Wheeler Insurance  Home Insurance

Home Insurance  Third Party Vehicle Ins.

Third Party Vehicle Ins.  Tractor Insurance

Tractor Insurance  Goods Carrying Vehicle Ins.

Goods Carrying Vehicle Ins.  Passenger Carrying Vehicle Ins.

Passenger Carrying Vehicle Ins.  Compulsory Personal Accident Insurance

Compulsory Personal Accident Insurance  Travel Insurance

Travel Insurance  Rural

Rural