A family health insurance policy is designed to safeguard the health and well-being of you and all your family members under a single plan. It offers coverage for hospitalization, medical emergencies, diagnostic costs, and preventive care. It ensures that you and your family have access to quality healthcare without worrying about finances.

What is Family Health Insurance?

If you or your loved ones face a medical emergency and have to undergo treatment, the costs for the same can be covered under a family health insurance policy.

With customizable options, family health insurance provides peace of mind and security for every family member. When selecting health insurance plans for your family, it is essential to consider two key factors: the number of members to be covered, and the sum insured.

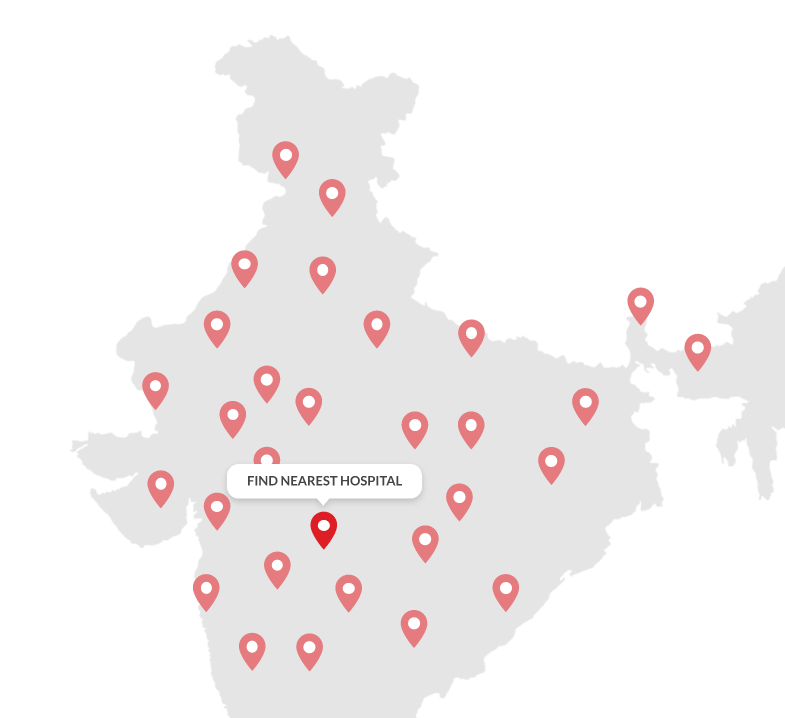

Choose a plan that offers the best coverage for the premium you pay. At HDFC ERGO, we provide comprehensive family health insurance plans that come with numerous benefits, including coverage for hospitalization charges, consultation fees, medications, and more. You can explore our policies online to find one that fulfils your needs and ensures that every family member is well taken care of in case of a medical emergency.