Optima Restore Family Health Insurance Plan

When it comes to safeguarding the health of your family, choosing the right health insurance plan is of utmost importance. With Optima Restore, you not only get the benefit of cashless treatment at our network hospitals, but also get other great features to meet all your healthcare needs.

Reasons to Choose Optima Restore Family Health Plan

100% Restore Benefit

Get 100% of your basic Sum Insured restored instantly after the first claim. Optima restore is a unique health plan that restores your sum insured on partial or complete utilization of your health cover, for your future needs.

2X Multiplier Benefit

A multiplier benefit equal to 50% of the base sum insured from the expiring policy will be provided at renewal, regardless of any claims made during the policy term. This benefit can accumulate up to a maximum of 100% of the base sum insured.

Complimentary Health Check-Up

Regular health check-ups keep track of your well-being and help in early diagnosis of illnesses. Enjoy preventive health check-ups up to₹10,000 with Optima Restore at the time of renewals.

Daily Hospital Cash

Worried about out-of-pocket expenses in case of hospitalisation? Get daily cash of up to ₹1,000 per day and maximum of ₹6,000 per hospitalization on choosing shared accommodation in a network hospital with Optima Restore.

For detailed inclusion and exclusion, please refer the sales brochure / policy wordings

To know more about the terms and conditions, please check the policy wording document

Newly Launched Optional Benefit -Unlimited Restore

This Optional Benefit will provide instant addition of 100% Basic Sum Insured on complete or partial utilization of Restore benefit or Unlimited Restore benefit (as applicable) during the Policy Year. This optional cover will trigger unlimited times and is available for all subsequent claims in a Policy Year.

To know more about the terms and conditions, Please check the policy wording document.

Understand Coverage Offered by Optima Restore Family Policy

Hospitalization expenses

Just what you expect of your health insurance plan- We cover you for hospitalization due to illnesses and injuries seamlessly.

Pre and Post Hospitalisation

Your costs for diagnosis and follow up consultations, are covered too. All your pre-hospital admission expenses up to 60 days, and post-discharge expenses till 180 days are included.

Day-care procedures

Medical advancements help in wrapping up urgent surgeries and treatments in less than 24 hours, and guess what? We cover all your daycare procedures.

Emergency Road Ambulance

If you need to, rush to a hospital in case of an emergency. Your ambulance costs are covered up to ₹2000 per hospitalization.

Organ Donor Expenses

Organ donation is a noble cause. Hence, we cover the medical and surgical expenses of the organ donor when harvesting a major organ transplant.

No sub-limit on room rent

If you have to stay at the hospital, choose a comfortable and convenient room for yourself, without bothering about its bills. We give you complete coverage on room-rent, up to the sum insured.

Tax Savings

Save more with tax benefits on health insurance premiums. Yes, you can save tax up to ₹75,000 with HDFC ERGO Health Insurance plans.

Modern Treatment methods

You deserve the best and the latest medical treatments. So our Optima Restore covers advanced procedures like robotic surgeries, stem cell therapy, and oral chemotherapy.

Lifetime Renewals

Also, enjoy life-long protection as you can continuously renew your health plan, even after you turn 65 years of age.

Family Discounts

There’s more. Get family discount of 10% if 2 or more family members are covered under Optima restore individual sum insured plan

Treatment availed outside India

Any Treatment availed overseas/outside India remains excluded from the scope of this policy

Self-inflicted injuries

Our policy does not cover self-inflicted injuries.

War

War can be disastrous and unfortunate. However,our policy does not cover any claim that are caused due to wars.

Treatment of obesity or cosmetic surgery

Treatment of obesity or cosmetic surgery is not eligible for coverage under this insurance policy.

For detailed inclusion and exclusion please refer the sales brochure/policy wordings

Waiting Periods

First 24 Months From Policy Inception

Few illnesses & treatments are covered after two years of policy issuance.

First 36 Months from Policy Inception

Declared or accepted pre-existing conditions at the time of application will be covered after 36 months of continuous coverage after the date of inception

First 30 Days from Policy Inception

Only accidental hospitalisations shall be admissible in the first 30 days from the date of policy issuance.

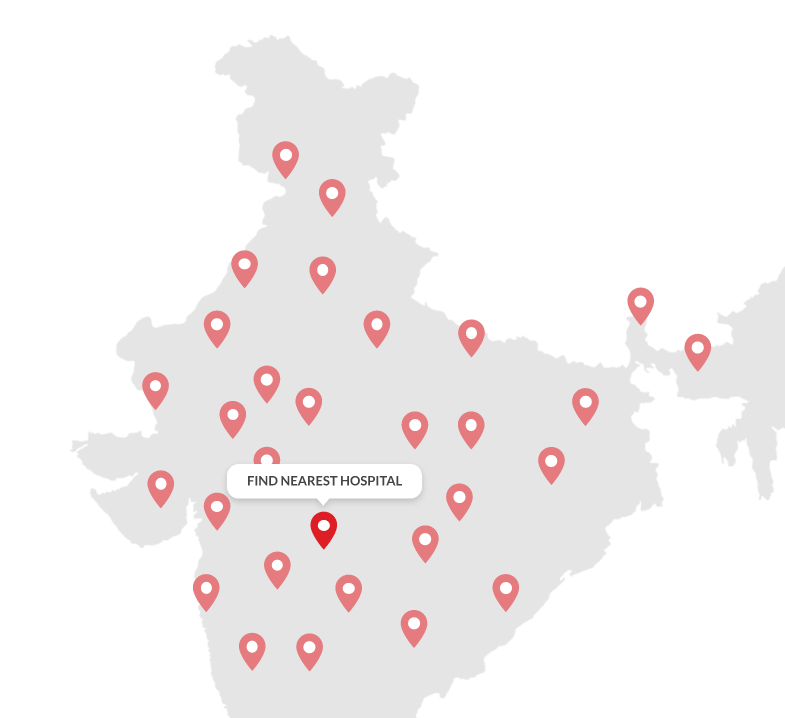

16,000+

Cashless Network

Across India

Jaslok Medical Centre

Address

C-1/15A Yamuna Vihar, Pincode-110053

Roopali Medical

Centre Private Limited

Address

C-1/15A Yamuna Vihar, Pincode-110053

Jaslok Medical Centre

Address

C-1/15A Yamuna Vihar, Pincode-110053

Hear From Our Happy Customers

Read Latest Health Insurance Blogs

Frequently asked questions

1. What are the scenarios under which the Sum Insured would be reinstated under the Restore Benefit?

- Partial Utilization of the Base Cover

- Complete Utilization of the Base Cover

The benefit will restore the amount equal to your base sum insured in both situations for your future claims.

2. What all medical expenses are covered under this policy?

Our bestselling, comprehensive policy covers pre, during, and post hospitalisation expenditure along with allied expenses like ambulance, room rents, and day care procedures as well. For complete details, feel free to download the policy wordings document.

3. What’s the maximum cover given by Optima Restore?

The plan offers insurance cover up to ₹1 Crore.

4. What’s a restore benefit?

Our one-of-a-kind health insurance plan provides 100% restoration of your Basic Sum Insured instantly after the first claim, so that you and your family can step into the future with confidence. Restore Benefit triggers on complete or partial utilization of Basic Sum Insured and Multiplier Benefit (if applicable) and will be available to all insured persons for subsequent claims under in-patient benefit during the policy year.

5. How much premium do I have to pay for the policy annually?

The policy premium depends on the type of plan you choose, whether you’re insuring only yourself or your family, the amount of cover you choose & the city you reside in. If you like more help choosing the right plan and cover for you, feel free to talk to our team!

6. How many times can the Restore Benefit be claimed in a policy year or lifetime?

Restore benefit can be used once in every policy year for a lifetime, provided you keep renewing your policy. Furthermore, if you opt for our newly launched Unlimited Restore (optional benefit), you will get unlimited restorations in a policy year at a nominal cost.

7. Will the insured person have to pay any additional premium when the sum insured is restored?

Not at all. No additional premium shall be levied from customer when his/her Sum Insured is restored.

Health Insurance

Health Insurance  Travel Insurance

Travel Insurance  Car Insurance

Car Insurance  Cyber Insurance

Cyber Insurance  Critical Illness Insurance

Critical Illness Insurance

Pet Insurance

Pet Insurance

Bike/Two Wheeler Insurance

Bike/Two Wheeler Insurance  Home Insurance

Home Insurance  Third Party Vehicle Ins.

Third Party Vehicle Ins.  Tractor Insurance

Tractor Insurance  Goods Carrying Vehicle Ins.

Goods Carrying Vehicle Ins.  Passenger Carrying Vehicle Ins.

Passenger Carrying Vehicle Ins.  Compulsory Personal Accident Insurance

Compulsory Personal Accident Insurance  Travel Insurance

Travel Insurance  Rural

Rural