Travel insurance is your essential shield against unexpected expenses while travelling abroad. It provides financial protection in case the insured (i.e., the people covered under the plan) suffer a medical emergency or face any issues that might result in financial loss.

Travel insurance is not only helpful but also mandatory in several countries, including in 29 Schengen countries (Italy, Poland, the Netherlands, Spain, Switzerland, and 24+ countries). It is also mandatory in other countries, such as Turkey and Cuba.[11][12][13][14]

Dealing with a health emergency or losing essential items overseas can not only derail your trip but also drain your wallet. Healthcare costs in foreign countries are often sky-high. That’s why choosing the right travel insurance policy is more than a formality; it’s a necessity. [1]

- The right travel insurance policy will cover:

- • Emergency medical expenses abroad

- • Hospitalisation & medical evacuation

- • Dental treatments

- • Personal accident cover

- • Loss of passport or international driving licence

- • Delayed or lost baggage

- • Trip delay and cancellation

- • Delayed or cancelled flights

- • Hijack distress allowance

- • Personal liability cover, and more.

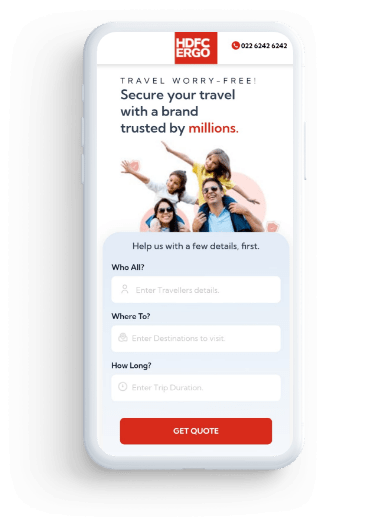

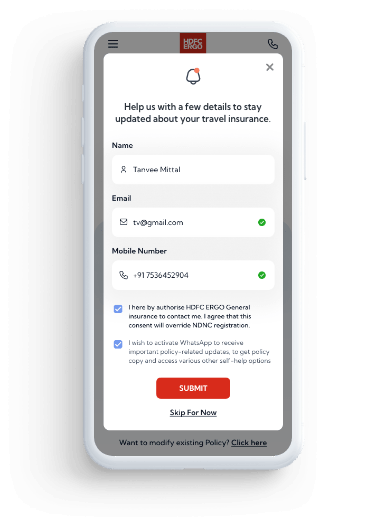

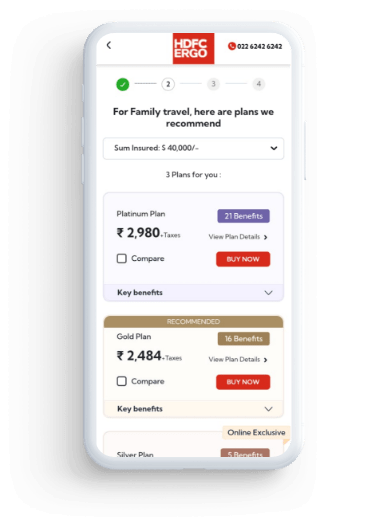

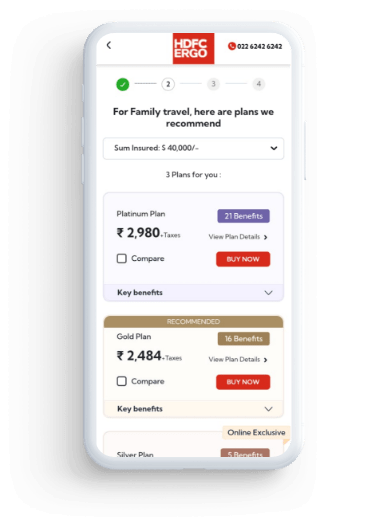

You can buy travel insurance from India and opt for international travel insurance online to ensure peace of mind, no matter where you are.

Plus, with the latest GST reforms effective September 22, 2025, international travel insurance plans in India now come with 0% GST, making this crucial protection more affordable than ever.[2]

So, before you pack your bags for your holiday getaway, secure your trip with HDFC ERGO’s Travel Health Insurance. Get coverage for Coronavirus hospitalization and access to 1 lakh+ cashless hospitals worldwide. Keep your travels safe, seamless, and worry-free.