International Travel Insurance

International travel insurance gives you the security and peace of mind to explore a country worry-free and relaxed. For many top destinations, like all Schengen countries, it is also a mandatory document for your visa application, often requiring a minimum medical coverage.

It provides a necessary layer of protection against unexpected and high-cost crises, ensuring your budget and peace of mind are secured. Foreign medical costs are significantly higher than domestic expenses; therefore, a key benefit of this insurance is covering sudden medical emergencies, dental emergencies, and vital medical evacuation overseas. It also ensures access to a 24/7 worldwide assistance team that can coordinate cashless treatment and emergency support in a foreign environment.

What is International Travel Insurance?

International travel insurance is a policy that financially covers your overseas trip against a variety of unfortunate events. In simple words, it acts as a financial safety net by offering coverage for sudden expenses caused by unexpected events like flight delays, medical emergencies, trip curtailment, loss of checked-in baggage, etc. With international travel insurance, travellers can enjoy peace of mind while on their foreign trip. It lets you easily deal with emergency medical, baggage and journey-related hassles, ensuring your trip stays smooth sailing. It even extends towards offering coverage for personal liability in a foreign country.

As of now, international travel insurance has been made a compulsory requirement to enter certain countries for tourism, while it remains a voluntary choice in the rest. Regardless of its requirement, investing in an international travel insurance for your overseas journey is highly recommended for its extensive coverage benefits.

Why do You Need International Travel Insurance?

While travelling abroad, have a backup plan ready to get the most out of your time if the previously planned itinerary doesn't work out. An overseas travel insurance plan will provide coverage for loss against lost luggage, flight delays, baggage delays or any unforeseen events. HDFC ERGO’s International Travel Insurance provides a network of 1 Lac+ cashless hospitals and 24x7 support to settle claims effortlessly.

Our travel insurance will essentially secure you under following circumstances:

- Luggage Loss

- Baggage Delays

- Medical Expenses

- Flight Delays

- Emergency Dental Expense

- Emergency Financial Assistance

International Travel Insurance Plans by HDFC ERGO

Key Features of HDFC ERGO Overseas Travel Insurance Policy

| Key Features | Benefits |

| Cashless Hospitals | 1,00,000+ cashless hospitals worldwide. |

| Countries Covered | 25 Schengen countries + 18 Other countries. |

| Coverage Amount | $40K to $1000K |

| Health Check-up Requirement | No health check-up is required prior travelling. |

| COVID-19 Coverage | Coverage for COVID-19 hospitalisation. |

Benefits of International Travel Insurance

Here are a few benefits of having International travel insurance -

- Covers for medical expenses: Medical expenses can burn a hole in your pocket during an international trip. But you can get treated in a foreign land with the assurance of International Travel insurance. But International travel insurance ensures that you are covered for such emergencies, saving you a lot of money while ensuring proper treatment and care. HDFC ERGO’s International travel insurance provides cash reimbursements on hospital bills and easy access to 1Lakh+ hospital networks worldwide.

- Promises baggage security: Loss of check-in baggage or delays can derail your holiday plans, but with International travel insurance, you are covered for essentials that can keep you in line with your plans like lost or delayed luggage. Unfortunately, these issues with luggage are quite common on an international trip. With International travel insurance, you are secured against lost or delayed luggage so you can enjoy your holiday seamlessly.

- Covers against uneventful situations: While holidays are all about smiles and joys, life can sometimes be harsh. Flight hijacks, damage to third-party property can dampen your holiday mood. But International travel insurance can ease your stress at such times. International travel insurance secures you from such incidences too.

- Ensures you don’t exceed your travel budget: In case of medical or dental emergencies, your expenses can exceed your budget. Sometimes you might have to extend your stay to complete your medical treatment, which could exceed your expenses. But International travel insurance covers those added hotel expenses too.

- Constant assistance: Robbery, theft or loss of a passport in a foreign land is not unheard of. Having travel insurance can provides peace of mind by protecting you against any financial losses

What Does HDFC ERGO International Travel Insurance Policy Cover?

Emergency Medical Expenses

This benefit covers hospitalization, room rent, OPD treatment, and Road Ambulance costs. It also reimburses expenses incurred on Emergency Medical Evacuation, Medical Repatriation and Repatriation of mortal remains.

Dental Expenses

We believe dental healthcare is just as important as hospitalization due to physical illness or injury; hence, we cover dental expenses which can occur during your travel. Subject to policy terms and conditions.

Personal Accident

We believe in seeing you through thick and thin. In the event of an accident, while traveling abroad, our insurance plan provides a lump sum payment to your family to assist with any financial burdens caused by permanent disablement or accidental death.

Personal Accident : Common Carrier

We believe in being by your side through ups and downs. So, under unfortunate circumstances, we will provide a lump sum payout in case of accidental death or permanent disablement arising out of an Injury whilst on a Common Carrier.

Hospital cash - accident & illness

If a person is hospitalized due to injury or illness, we will pay the per day Sum Insured for each complete day of hospitalization, up to the maximum number of days stated in the Policy Schedule.

Flight Delay & Cancellation

Flight delays or cancellations may be beyond our control, but worry not, our reimbursement feature allows you to meet any essential expenses arising from the setback.

Trip Delay & Cancellation

In case of a trip delay or cancellation, we will refund the non-refundable portion of your pre-booked accommodation and activities. Subject to policy terms and wordings.

Loss of Passport & International driving license

Losing important documents can leave you stranded in a foreign land. So, we will reimburse expenses related to obtaining a new or duplicate passport and/or international driving license.

Trip Curtailment

Don't worry if you have to cut your trip short due to unforeseen circumstances. We'll reimburse you for your non-refundable accommodation and pre-booked activities as per the policy schedule.

Personal Liability

If you ever find yourself liable for third-party damage in a foreign land, our travel insurance helps you compensate for those damages effortlessly. Subject to policy terms and conditions.

Emergency Hotel Accommodation for Insured Person

Medical emergencies may mean you need to extend your hotel booking by a few days more. Worried about the added expense? Let us take care of it while you recover.subject to policy terms and conditions

Missed Flight Connection

Don't worry about unexpected expenses due to missed flight connections; we will reimburse you for the expenses incurred on accommodation and alternate flight booking to reach your destination.

Hijack Distress Allowance

Flight hijacks can be a distressing experience. And while the authorities help sort out the issue, we'll do our bit and compensate you for the distress it causes.

Emergency Cash Assistance Service

When traveling, theft or robbery can lead to a cash crunch. But don't worry; HDFC ERGO can facilitate fund transfers from the insured 's family in India. Subject to policy terms and conditions.

Loss Of Checked-In Baggage

Lost your checked-in baggage? Don't worry; we'll compensate you for the loss, so you don't have to go without your essentials and vacation basics. Subject to policy terms and conditions.

Delay of Checked-In Baggage

Waiting is never fun. If your luggage gets delayed, we'll reimburse you for essentials like clothing, toiletries and medication so you can start your vacation worry-free.

Theft of baggage and its contents

Theft of baggage can derail your trip. So, to ensure your trip stays on track, we'll reimburse you in case of baggage theft. Subject to policy terms and conditions.

The above mentioned coverage may not be available in some of our Travel plans. Please read the policy wordings, brochure and prospectus to know more about our travel insurance plan.

What Does HDFC ERGO’s International Travel Insurance Plan Not Cover?

Breach of Law

Sickness or health issues caused due to war or a breach of the law is not covered by the plan.

Consumption of Intoxicant substances

If you consume any intoxicants or banned substances, the policy shall not entertain any claims.

Pre existing diseases

If you suffer from any illness before the travel you’ve insured and if you undergo any treatment for an illness that already exists, the policy does not cover expenses related to these incidents.

Cosmetic and Obesity Treatment

Should you or any member of your family opt to undergo any cosmetic or obesity treatment during the course of the travel you’ve insured, such expenses remain uncovered.

Self Inflicted Injury

Any hospitalization expenses or medical costs arising from self-inflicted injuries are not covered by the insurance plans we offer.

What Influences Your International Travel Insurance Premium?

The premium of your international travel insurance policy depends on multiple factors, such as:

1. Your travel destination: The travel destination is one of the major factors that influences the premium of your travel insurance. For example, if you are travelling to a safer country, the journey will be deemed low risk and the premium charged will also be on the lower side. In the same way, travel insurance premiums for countries considered high risk will be on the higher side.

2. Total travellers and their age: The total number of travellers also affects the premium of your international travel insurance. For example, the cost of individual travel insurance is less than group travel insurance. Also, the age of the travellers affects the policy premium. For example, travel insurance for the elderly can cost more as they are more prone to getting sick.

3. Pre-existing health conditions: The medical history and existence of present medical illnesses of individuals also affect the international travel insurance premiums. Generally, most insurers don’t cover pre-existing diseases and those who do charge a higher premium due to the higher associated risk.

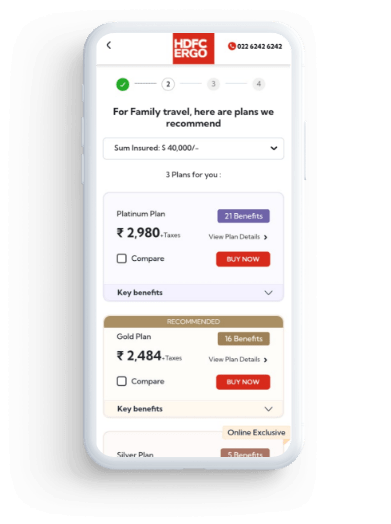

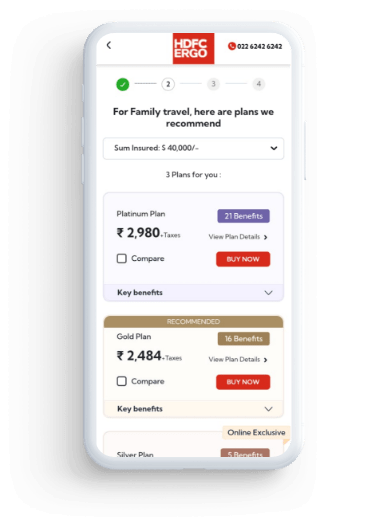

4. Chosen insurance plan: Insurers offer multiple types of international travel insurance plans. You can take your pick depending on the benefits you are looking for. However, do note that you will have to pay a higher premium for the plans that offer more benefits.

5. Trip duration: The total trip duration plays a substantial role in influencing your international travel insurance premium. The more days you are away, the higher the risk of facing an unfortunate event. In simple terms, the longer the trip is, the more the insurer charges for travel insurance.

6. Selected sum insured: With HDFC ERGO, you can choose coverage between $40k and $1000k with your international travel insurance, depending on your requirements. While a higher sum insured means better coverage, it also means a higher travel insurance policy premium charged by the insurer.

Factors that Affect Your International Travel Insurance Premium

The country you’re travelling to

If you’re travelling to a safer or economically more stable country, the insurance premium will likely be lower. Also, the farther the destination is from your home, the higher will be the insurance premium.

The duration of your trip

The longer you are away, the higher the probability of you falling ill or getting injured. Therefore, the longer your travel duration, the higher will be the premium charged.

The age of the traveller(s)

The insured's age plays a vital role in determining the premium. Travel insurance premiums for senior citizens could be slightly higher as their risk of illness and injury increases with age.

The extent of coverage you choose

The type of travel insurance coverage the insured person chooses decides the premium of their policy. A more comprehensive travel insurance plan will naturally cost higher than more primary coverage.

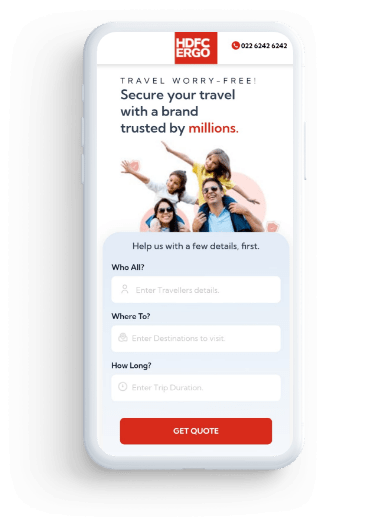

Buy Overseas Travel Insurance Policy Online

Buying international travel insurance is a click away and can be done from the comfort of your home or office at your convenience. Therefore, the online purchase of overseas travel insurance plans has picked up and is growing with each passing day.

• Click here link, or visit the HDFC ERGO travel insurance webpage to BUY our policy.

• Enter traveler details, destination information, and trip start and end dates.

• Choose your preferred plan from our three tailored options.

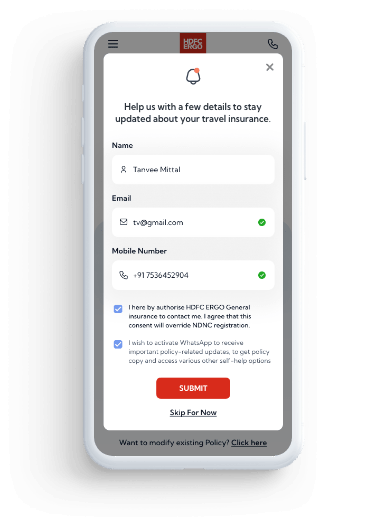

• Provide your personal details.

• Fill in additional details about the travelers and proceed to pay using online payment methods.

• All that's left to do is- download your policy instantly!

Know your International Travel insurance premium In 3 Easy Steps

How to Claim International Travel Insurance?

The claims process of HDFC ERGO travel insurance is straightforward. You can place a claim on your travel insurance online on cashless as well on a reimbursement basis.

Intimation

Intimate claim to travelclaims@hdfcergo.com and get a list of network hospitals from TPA.

Checklist

Medical.services@allianz.com will share documents required for cashless claims.

Intimation

Intimate claim to travelclaims@hdfcergo.com or call on Global Toll-Free No : +800 08250825

Checklist

Travelclaims@hdfcergo.com will share the checklist/documents required for reimbursement

Mail Documents

Claim documents along with claim form to be sent to travelclaims@hdfcergo.com or processing@hdfergo.com

Processing

Claim is registered by HDFC ERGO call centre executive on respective claims system.

Documents Required for Travel Insurance Claims

When filling an international travel insurance claim with HDFC ERGO, you will have to submit a few documents as part of the claim procedure. While the exact documents to be submitted depend on the type of claim filed or the nature of the incident, they generally include:

• The travel insurance policy number

• An initial medical report depicting the nature of the sickness or injury and its extent, and delivering a clear diagnosis

• Proof of ID and age

• All bills and invoices related to prescriptions, hospital costs, reports, etc.

• Official death certificate (in the event of death)

• Proof of legal successor (if applicable)

• Third-party contact details (in the event of third-party damage)

• Additional documentation (as instructed by the claim official).

In case of a covered illness under the travel insurance, you will need to submit these:

• Date when the illness symptoms started

• Date when the doctor was consulted for its treatment

• Contact information of the doctor.

In case of a covered accident under the travel insurance, you will need to submit these:

• Detailed account of the accident and information of the witness(es) (if any)

• Date when a doctor was consulted for the resulting injury/injuries

• Copy of the police report regarding the accident (if any)

• Contact information of the doctor.

A lost passport in a foreign country is stressful, stay protected with a reliable travel policy.

Countries That Require International Travel Insurance

Here are some of the countries that require mandatory overseas travel insurance: This is an indicative list. It is advisable to check each country’s visa requirement independently before travel.

Source: VisaGuide.World

International Travel Insurance for Most Visited Countries

Take your pick from the options below, so you can be better prepared for your trip to a foreign country

Many foreign countries require international travel insurance before you can enter their borders.

Does HDFC ERGO’s International Travel Insurance Cover COVID-19?

While the world is returning to normal and international travel is blooming again, the fear of COVID-19 still looms large over us. Quite recently the emergence of a new variant - Arcturus covid variant – caused much concern among the public and healthcare experts alike. While most countries have relaxed their travel protocols related to COVID-19, precaution and alertness can help us keep another wave at bay. The challenging bit is that any emergence of a new variant is reported to be more transmissible than previous strains. This uncertainty also means that we cannot put anything to chance yet and must follow the basic precautions to prohibit transmission. Masks, sanitisers and compulsive cleaning should still be our mainstay.

Whenever a new variant makes its presence felt, Covid cases in India and abroad increase rapidly highlighting the importance of vaccinations and booster doses. If you aren’t vaccinated yet, it’s high time you get the jab. Remember to take your booster doses on time too. International visits can be interrupted if you have not taken the requisite doses, as it is one of the mandates for overseas travel. Watch out for symptoms such as - cough, fever, fatigue, loss of smell or taste, and difficulty breathing, which could be a matter of concern and get checked at the earliest, especially if you are planning international travel or are at a foreign destination. Medical expenses in a foreign land can be expensive, so having the backing of international travel insurance can be of much help. HDFC ERGO’s international travel insurance policy ensures that you are protected if you catch COVID-19.

Here’s what is covered under the travel medical insurance for COVID-19 -

• Hospitalisation expenses

• Cashless treatment at network hospitals

• Daily cash allowance during hospitalisation

• Medical evacuation

• Extended hotel stay for treatment

• Medical and body repatriation

Things to Remember While Travelling Abroad

When going on a foreign trip, make sure to consider the following things:

1. Be wary of local laws and regulations

Prior to going on an overseas trip, it is advised to research the destination thoroughly. This way, you can learn about the local rules and regulations and make sure to follow them during your visit. This will help you avoid unnecessary trouble while on your international vacation.

2. Carry all travel documents

When packing your luggage for the international vacation, make sure that you are carrying all your necessary travel documents. This includes a valid photo ID proof, passport, visa papers, travel insurance, booking slips, and so on. Carrying such important documents in physical and/or digital copies is highly recommended.

3. Plan in advance

While an abrupt vacation may sound adventurous, planning and booking everything in advance is the right way to approach an international trip. Like investing in international travel insurance, knowing your accommodations, flights, activities, etc., are booked in advance gives you the much-needed peace of mind.

4. Invest in travel insurance

Note that international travel insurance is a mandatory requirement for entry in many countries, such as Russia, Schengen nations, Cuba, the UAE, etc. Even in countries where it is not a mandatory requirement, such as the USA, investing in travel insurance is highly recommended due to its coverage benefits. It financially safeguards your trip from unanticipated events.

5. Safety tips

When in a foreign country, make sure to follow the general safety measures, such as only exchanging currency from authorised dealers, not withdrawing money from ATMs at secluded locations, not carrying valuables outside of your hotel room, packing according to the location and season, etc.

6. Keep a note of local emergency numbers

Make sure to keep the contact details of local emergency & important numbers handy, which include the numbers for the Indian embassy in that foreign nation and the local fire department, police department, ambulance service, etc.

Affordable Foreign Countries to Visit from India

A foreign trip from India doesn’t have to take a heavy toll on your bank account. Here are some of the most popular and affordable foreign countries to visit from India:

| Country name | Visa details for Indians | Average round-trip flight cost | Daily budget | Top attractions | Travel insurance tips |

|---|---|---|---|---|---|

| Nepal | Visa-free entry; valid photo ID required | INR 12,000 - 15,000 | INR 1,200 - 4,000 | Pashupatinath Temple, Swayambhunath Temple, Pokhara, Lumbini, Sagarmatha National Park, Mustang, etc. | Not mandatory, but highly recommended. |

| Sri Lanka | Pre-approved tourist visa required | INR 22,000 - 30,000 | INR 2,000 - 4,000 | Kandy, Colombo, Ella, Sigiriya, Bentota, Nuwara Eliya, etc. | Not mandatory, but highly recommended. |

| Bhutan | Visa-free with an entry permit issued on arrival | INR 20,000 - 35,000 | INR 2,500 - 5,000 | Thimphu, Paro, Paro Taktsang, Punakha, Buddha Dordenma, etc. | No longer mandatory, but still highly advised. |

| Thailand | Visa-free entry (for tourism for up to 60 days) | INR 18,000 - 40,000 | INR 2,000 - 5,000 | Pattaya, Phuket, Bangkok, Phi Phi Islands, Krabi, Ayutthaya, Koh Samui, etc. | Not compulsory, but highly recommended. |

| Vietnam | e-Visa | INR 20,000 - 25,000 | INR 2,500 - INR 6,000 | Hoi An, Halong Bay, Ho Chi Minh City, Hanoi, Da Nang, Phong Nha-Ke Bang National Park, etc. | Not compulsory but highly recommended. |

Top International Destination To Visit in 2025

Here are some of the most trending holiday destinations to visit in 2025:

| Rank | Destination name | Why visit | Best time to go |

|---|---|---|---|

| 1 | Baku, Azerbaijan | Visit Baku to take a deep insight into Azerbaijan's rich historical and cultural heritage. Explore its key tourist attractions and the blooming wildflowers. | Between April & June |

| 2 | Tokyo, Japan | Visit the neon metropolis of Tokyo to relive all your Japanese pop culture references. Explore its iconic locations, delicious street food and more. | Between March & May and October & November |

| 3 | Tromso, Norway | Visit the beautiful city of Tromso in Norway to witness the majestic fjords and northern lights. | Between October & April |

| 4 | Al-Ula, Saudi Arabia | Step back in time by visiting Al-Ula in KSA. Explore the region's ancient cultural and historical heritage, participate in fun adventures, enjoy the natural desert beauty, and so on. | Between November & February |

| 5 | Krabi, Thailand | Visit Krabi to experience the quintessential tropical holidays in Thailand and for its breathtaking scenery, availability of watersports and luxury waterfront resorts. | Between November & March |

Hear from Our happy customers

Read Latest Travel Insurance Blogs

Frequently Asked Questions on Overseas Travel Insurance

1. Which overseas travel insurance is best?

A unique feature of HDFC ERGOs Overseas Travel Insurance is its 24x7 in-house claim settlement services, complemented by a vast network of 1 Lac+ cashless hospitals

2. How much does it cost for international travel insurance?

The premium on your travel insurance depends upon your destination and the duration of your stay. The age of the insured person and the different types of plans chosen play a vital role in deciding the cost of the international travel insurance policy.

3. Can I buy travel insurance while abroad?

Your policy cover starts from the immigration counter of your home country and ends once you return after your vacation and complete your immigration formalities. This is why you cannot buy travel insurance while you are abroad. Therefore, travel insurance purchased after the commencement of the journey is not considered valid.

4. Can I extend my travel insurance while abroad?

Once abroad, you can extend your travel insurance policy if it is still valid. However, remember you can only extend your existing policy. You cannot buy one while you are away.

5. Can you buy travel insurance the day you leave?

Yes, you can buy the travel insurance policy even at the last minute. So even if it's your departure day and you're not insured, you can buy a travel insurance cover.

6. Can I see a doctor with travel insurance?

Yes, you can seek doctor help when you are abroad, as international travel insurance policies cover medical expenses.

7. Do I need international travel insurance to get a visa?

If you are travelling to Schengen countries, buying travel insurance is a must to get a visa. Apart from this, many countries have mandatory travel insurance for getting a visa. Therefore, it is advisable to check the visa requirement of every nation before travelling.

8. I had to cancel my trip for personal reasons, but I already bought travel insurance. Can I get a refund?

Yes, you can get a refund for trip cancellation if you cancel the journey before the departure date due to unforeseen conditions like an emergency at home, the sudden death of a family member, political turmoil or a terrorist attack. A complete refund of your premium is possible in such situations after the cancellation of the policy.

9. What is the Maximum Trip Duration Covered under an Overseas Travel Insurance Policy?

Total policy period, including extensions, shall not exceed 360 days.

10. Should I buy international travel insurance before booking a flight abroad?

Yes, it is advisable to secure your jour with a travel insurance policy before booking a flight abroad. You can do so by going with a multi trip insurance plan that will save you from the hassle of purchasing travel insurance each time you make a trip and it also proves to be cost-effective.

11. Can You Buy Overseas Travel Insurance After Booking a Flight?

Yes, you can buy overseas travel insurance after booking a flight, even on the day of your departure. However, it is advisable to buy the travel insurance cover within 14 days of booking your holiday.

12. Will Extending the Policy Affect My International Travel Insurance Cost?

You can reschedule your policy free of cost; however, the extension of the policy will affect the cost. The increase in cost will depend upon the number of days you extend.

13. If I Return to India Earlier Than Scheduled, Will I Get a Partial Refund for My Overseas Travel Insurance Policy?

No, you will not get a partial refund if you return to India earlier than the scheduled date.

14. If I Buy International Travel Insurance Online, Will It Cover the Cost of Dental Treatment?

Yes, it covers the cost of dental treatment. In addition, international travel insurance covers the costs of emergency dental work up to $500* arising out of an accidental injury.

15. Will an Overseas Travel Plan Cover Me if I Get Injured While Traveling on a Ship or Train Overseas?

Yes, it will provide coverage for injury caused while travelling on a ship or train overseas.

16. If I Get Injured on the Last Day of the Trip, Will My International Travel Insurance Policy Get Extended?

Suppose you extend your stay on the last day of your trip due to a medical emergency, accident, or injury. In that case, you can extend your travel insurance policy for 7 to 15 days without paying any premium.

17. Can I File an International Travel Insurance Claim After Getting Back to India?

Yes, it is possible to file a claim after travelling back to India. However, remember you need to file the claim within 90 days of any unfortunate event like a medical emergency or loss of documents, except if otherwise stated by your insurer.

18. What is the document provided as proof of travel insurance?

The insurer's soft copy mailed to you is enough to work as proof for your travel insurance. However, it is advisable to jot down your policy number and, more importantly, have our 24-hour assistance telephone number with you, so you can contact us if you need our help while you're away.

19. I bought international travel insurance online through the HDFC ERGO website. How do I contact customer care from a foreign country

in case of a claim?

Call our emergency travel assistance partner on the 24-hour alarm centre for travel, medical advice, and assistance during your trip.

• E-mail: travelclaims@hdfcergo.com

• Toll free number (globally): +80008250825

• Landline (chargeable):+91-120-4507250

Note: Please add the country code while dialing the contact number.

20. When does my international travel insurance policy coverage start?

Travel insurance coverage starts at the immigration counter of the home country and continues until the immigration is completed after returning to the home country.

21. Does HDFC ERGO cover trip cancellations due to COVID-19 infection?

Yes, HDFC ERGO does cover trip cancellations in the event you are affected by COVID-19 and have been advised to be in quarantine by medical professionals.

22. What are the age limits for buying HDFC ERGO international travel insurance?

HDFC ERGO offers single-trip travel insurance plans for individuals between the ages of 6 months and 70 years and annual multi-trip travel insurance plans for individuals between the ages of 18 years and 70 years.

23. Can I buy travel insurance for a business trip abroad?

Yes. Alongside holidays (leisure), HDFC ERGO also offers international travel insurance for individuals planning an overseas trip for employment and business/official purposes.

24. Do I need separate policies for multiple countries in a single trip?

If you are planning to cover multiple countries in a single trip, you don’t have to buy separate policies for them. When buying overseas travel insurance from HDFC ERGO, you will get the option to select all the countries you are planning to visit on your trip. By selecting all of them, you can get a single policy that covers your entire journey on that trip.

25. Is HDFC ERGO international travel insurance cashless?

Yes. The international travel insurance from HDFC ERGO offers both cashless and reimbursement claims.

26. Is travel insurance mandatory for all foreign trips?

No. Travel insurance is not mandatory for all foreign trips. However, quite a lot of countries have made it a mandatory requirement for tourists applying for an entry visa. For example, the 29 countries part of the Schengen Area have made travel insurance mandatory to apply for its tourist visa.

27. Can senior citizens buy HDFC ERGO international travel insurance?

Yes. Senior citizens can buy international travel insurance from HDFC ERGO. We offer travel insurance plans especially designed to cover overseas travel of the elderly. Find more details about it here.

28. Do I need to submit a medical fitness proof before buying travel insurance?

Usually, when buying international travel insurance, you don’t have to submit any medical fitness proof. HDFC ERGO also doesn’t require a mandatory health check-up prior to travelling. However, at the time of buying the policy, you should disclose any pre-existing disease or health conditions.

29. What is single-trip travel insurance?

A single-trip travel insurance policy is a plan that covers a specific journey. Its coverage is limited to that one trip and expires when the mentioned trip duration is over.

30. What is evacuation and repatriation coverage?

They are part of the medical emergency-related coverage under international travel insurance. For example, in case of a medical emergency, if you are in need of medical evacuation, the policy will pay for the costs incurred in transporting you to the nearest hospital. It can also pay the costs incurred in transporting you back to India in case you are not able to continue your trip following hospitalisation.

31. Do HDFC ERGO plans have a free-look period?

Yes. HDFC ERGO does offer a free-look period on selected travel insurance policies. However, do note that it is subject to policy terms and conditions. For more details on this, get in touch with our experts by calling our toll-free number or sending an email to care@hdfcergo.com.

32. Can I buy travel insurance after leaving India?

No. If you want to buy international travel insurance from India, you have to do so before your trip begins, which means prior to leaving India. Buying overseas travel insurance is very easy and fast, and can be done online via HDFC ERGO’s official website or application.

Health Insurance

Health Insurance  Travel Insurance

Travel Insurance  Car Insurance

Car Insurance  Cyber Insurance

Cyber Insurance  Critical Illness Insurance

Critical Illness Insurance

Pet Insurance

Pet Insurance

Bike/Two Wheeler Insurance

Bike/Two Wheeler Insurance  Home Insurance

Home Insurance  Third Party Vehicle Ins.

Third Party Vehicle Ins.

Tractor Insurance

Tractor Insurance

Goods Carrying Vehicle Ins.

Goods Carrying Vehicle Ins.

Passenger Carrying Vehicle Ins.

Passenger Carrying Vehicle Ins.

Compulsory Personal Accident Insurance

Compulsory Personal Accident Insurance

Travel Insurance

Travel Insurance

Rural

Rural