3.2 Crore+

Happy Customers@

9000+ Cashless

Garagesˇ

Over Night

Vehicle Repairs¯Go the extra mile to protect

your automotive assets with vehicle insurance

Before you head out for your next ride, secure your vehicle with HDFC ERGO and enjoy peace of mind wherever you go.

6 Reasons Why HDFC ERGO’s Vehicle Insurance Should Be Your First Choice

Vehicle Insurance Policy inclusions and exclusions

Accidents

We ensure to cover damages or losses incurred by your vehicle while you regain your calm!

Fire & Explosion

Your vehicle may reduce to ashes in an unexpected fire or explosion, but our policy will ensure your finances remain intact.

Theft

We work round-the-clock to ensure you sleep soundly. Our policy covers losses that you may incur should your vehicle be stolen.

Natural Calamities

We don’t let unannounced natural calamities catch you on the wrong foot. Any damages or losses arising out of such incidents are covered.

Personal Accident

Your safety remains our topmost priority! Thus, we offer a compulsory personal accident cover to cover your treatment charges in case of an accident.

Third Party Liability

Any damage to a third party property or injuries are covered through our third-party insurance feature

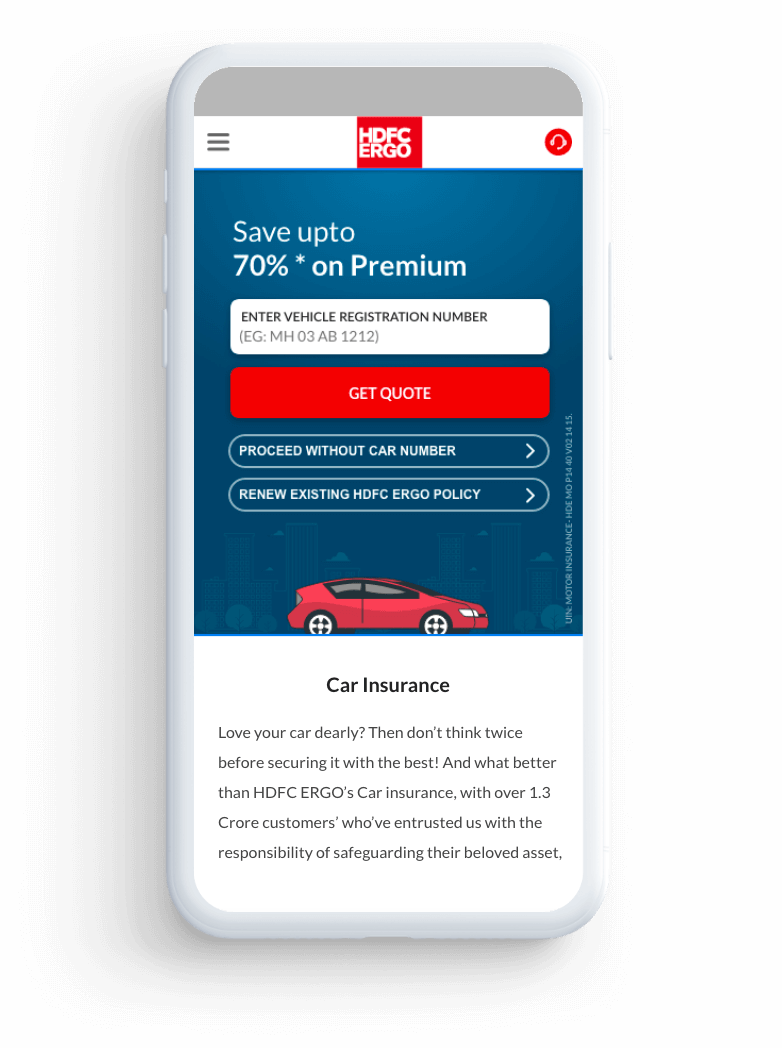

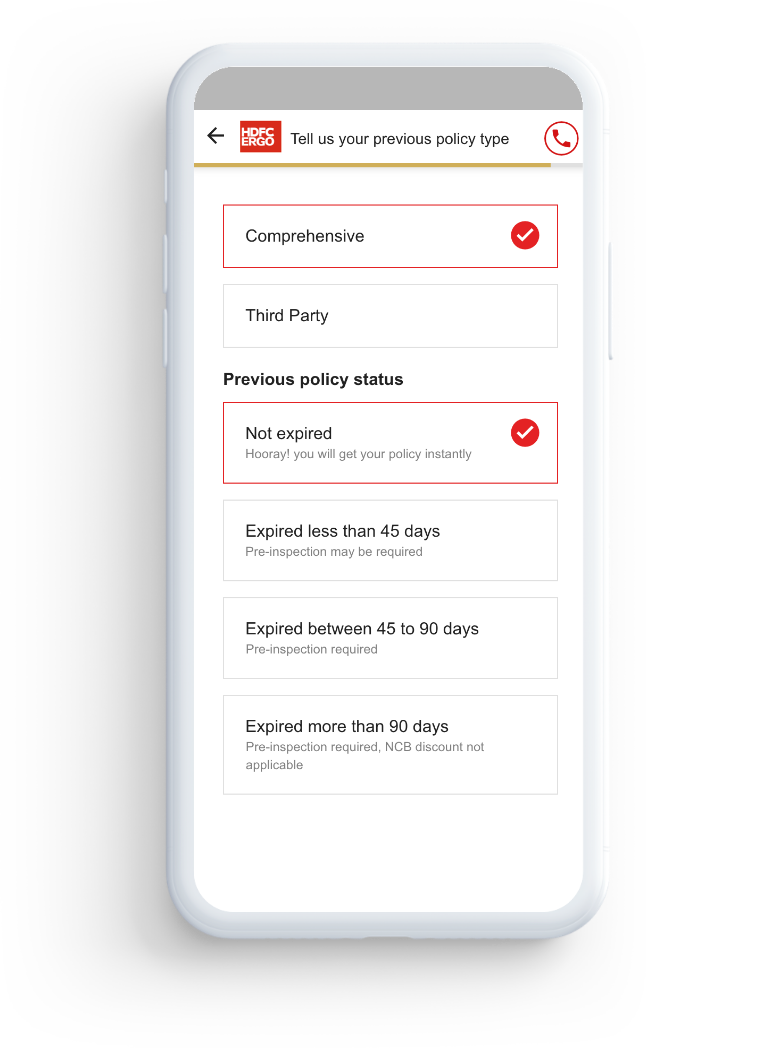

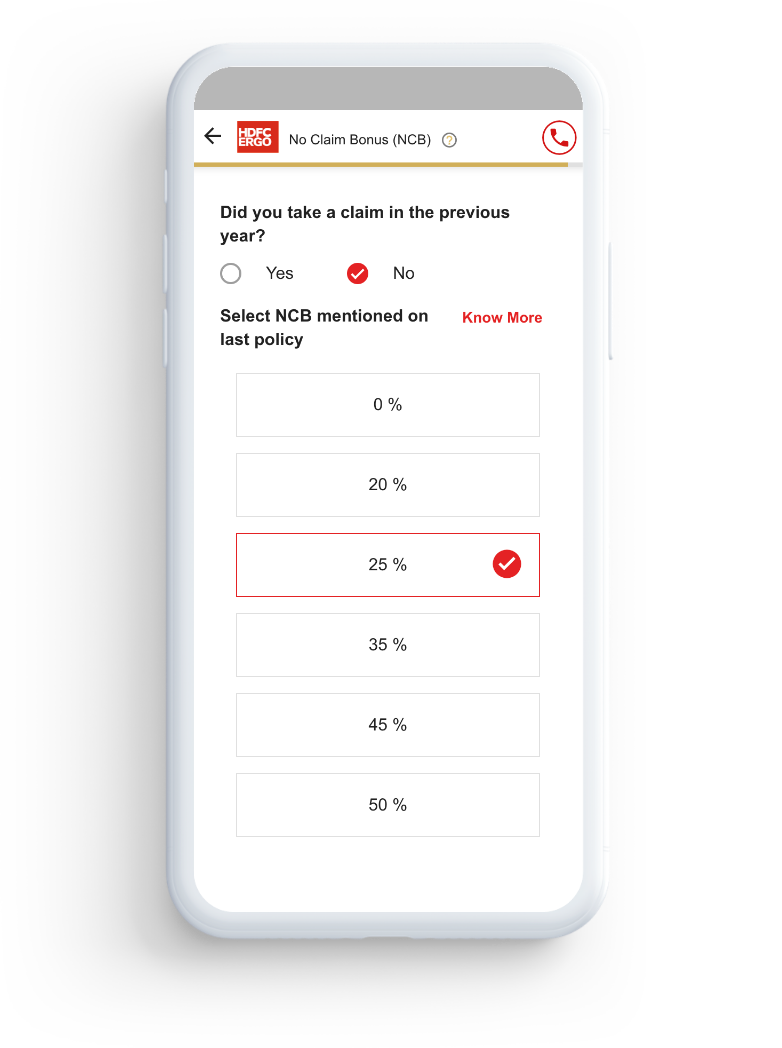

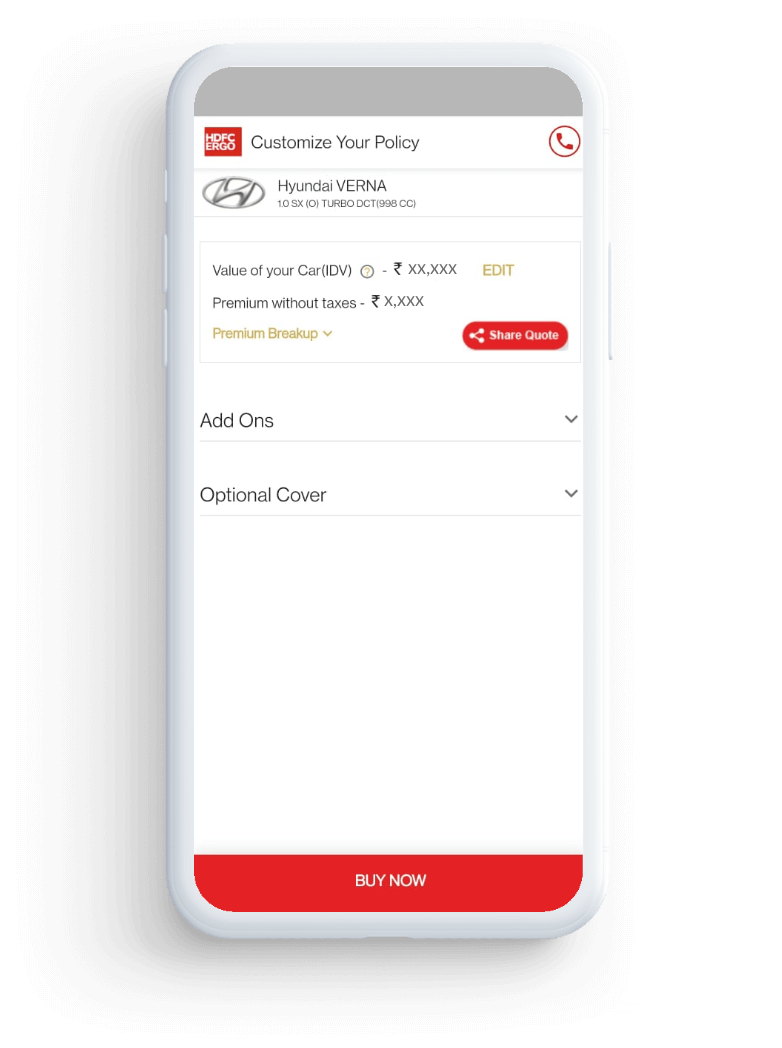

There’s a smarter way of getting a vehicle insurance quote

Now no long waits or hassling with intermediaries, just a few clicks to get your free vehicle insurance policy quote. That’s not all. You can personalize the quote to meet your requirement and pay as you go! Sounds good, doesn’t it?

Simplifying vehicle insurance claims for you

Once you purchase our vehicle insurance policy, leave your claim-related stress to us with these four quick, easy-to-follow steps

- Step #1Ditch piles of paperwork and long queues, and share your documents online to register your claims.

- Step #2Opt for a self-inspection or a digital inspection of your two-wheeler by a surveyor or workshop partner.

- Step #3Track your claim status through our smart AI-enabled claim tracker

- Step #4Relax while your claim is approved and settled with our extensive network garages!

Get added protection with our add-on covers for your vehicle

As your car depreciates due to gradual wear and tear, so does your claim payout! However, with our Zero Depreciation cover, you don't have to worry about losing your money since it protects your finances in such a scenario.

Filing unavoidable claims making you worry about losing the NCB benefits? Well, this is where the No Claim Bonus Protection add-on comes in handy. This cover ensures that the NCB you’ve accumulated over the years remains untouched and is carried on to the next slab.

Your 3-am friend may or may not be there for you, but our Emergency Assistance add-on cover is just the friend you need. The cover offers various 24x7 services, including refuelling, tyre changes, towing assistance, among others

It may sound too good to be true, but our Return to Invoice add-on cover ensures you recover your financial loss in case your vehicle is stolen or damaged beyond repair. This add-on covers the insured declared value (IDV) and the actual invoice value, including road tax and registration fee.

Your vehicle may be a piece of your heart, but you need to go the extra mile to protect its heart too! Secure your car's engine and gearbox with our Engine and Gearbox Protector add-on cover. This cover safeguards you against the financial burden occurring in case of damages to these vital car parts.

Worrying about commute expenses while your vehicle gets repaired in the garage? Fret not! Our Downtime Protection add-on cover offers you the flexibility of alternate transport or pre-decided daily financial assistance to meet your transportation cost.

Factors that affect your vehicle Insurance Premium

The premium you pay is beyond the policy you purchase. There are several factors that are considered before we work out a vehicle insurance quote for you. Let us take you through the top factors that impact your vehicle insurance premium:

How old is your vehicle?

Is your vehicle the latest in the market or an old model that you refuse to part ways with? The age of the vehicle is crucial in deciding the premium amount you pay. Wondering why? Let's say the older your vehicle, the more you need to shell out in terms of insurance premium.

Which vehicle do you drive?

Do you fancy a top-of-the-range luxury vehicle or prefer a mid-range segment ride? Still thinking about how your personal preference determines your premium? Each vehicle, depending upon its make and model, has varying premium costs.

What is your vehicle’s engine capacity and fuel type?

Choosing a vehicle with an engine capacity over 1500cc or low, or looking at petrol or diesel variant – these choices, such as engine capacity and fuel type, are important factors in deciding your vehicle insurance premium amount.

Where do you reside?

Is your residence a gated community with advanced security or a notorious area known for its crime rate? Well, your answer is the key to how much you will end up paying for your vehicle insurance.

Claim related worries? Not anymore!

Owning a vehicle comes with its share of responsibility and worries, one of these is the hassle you may face if you need to make a claim against damage to your car or bike. With HDFC ERGO your claim related worries can take a backseat, we are not just blowing our own trumpet, read on and then agree with us:

Car Insurance for Popular Brands

Across India

Health Insurance

Health Insurance  Travel Insurance

Travel Insurance  Car Insurance

Car Insurance  Cyber Insurance

Cyber Insurance  Critical Illness Insurance

Critical Illness Insurance

Pet Insurance

Pet Insurance

Bike/Two Wheeler Insurance

Bike/Two Wheeler Insurance  Home Insurance

Home Insurance  Third Party Vehicle Ins.

Third Party Vehicle Ins.  Tractor Insurance

Tractor Insurance  Goods Carrying Vehicle Ins.

Goods Carrying Vehicle Ins.  Passenger Carrying Vehicle Ins.

Passenger Carrying Vehicle Ins.  Compulsory Personal Accident Insurance

Compulsory Personal Accident Insurance  Travel Insurance

Travel Insurance  Rural

Rural