Premium starting

at Just ₹2094*9000+ Cashless

Network Garages**Overnight Car

Repair Services¯Hyundai Car insurance

Hyundai car insurance is the best way to protect your vehicle from unwanted expenses caused by accidents, theft, fire, floods, or other natural disasters. Whether you own a hatchback, sedan, SUV, or compact SUV from Hyundai’s wide range of models, the right insurance plan ensures peace of mind and financial security.

Hyundai has been a trusted brand in India since 1996, offering popular cars like Santro, Creta, and many more across different segments. With HDFC ERGO, you can buy Hyundai Car Insurance online and enjoy benefits like comprehensive coverage, customizable add-ons, and access to 9000+ cashless garages nationwide.

Types of Hyundai Car insurance Plans

Why limit your car insurance to just a third party cover or a separate plan for covering your damages, when you can get both those sets of benefits under one comprehensive insurance? Yes, you read that right. With the Single Year Comprehensive Cover from HDFC ERGO, you can enjoy all-round protection for 1 year. In addition to this, you can also protect your Hyundai with your choice of add-ons, over and above the basic cover.

Accident

Personal accident cover

Natural calamities

Third-party liability

Choice of add-ons

Theft

The Motor Vehicles Act, 1988, makes the Third-Party Cover mandatory in India. So, even if you only use your Hyundai car sparingly, it’s not just an option, but a necessity to get your vehicle insured with this cover against third party claims. This way, not only are you protected from any potential liabilities you may owe to other people, but you also won’t need to worry about penalties.

Personal accident cover

Third-party property damage

Injury to a third-party person

Extend the benefit of insurance beyond third party claims and secure yourself against financial losses, with the Standalone Own Damage Cover. Your car may be in need of expert assistance and repairs following a harrowing calamity or an unexpected accident. But the costs that come with it aren’t easy on the wallet. This kind of car insurance covers the costs of repairs in case of any damage to your Hyundai. Choose this plan over and above the necessary Third Party Cover and give your Hyundai car an added layer of protection.

Accident

Natural Calamities

Fire

Choice of add-ons

Theft

Along with the joy of driving your brand new Hyundai car home, there are also many responsibilities that go hand-in-hand. You’ll need to protect your new set of wheels and ensure that it remains in top notch condition. But what about insurance? After all, that is the ultimate security against contingencies, both for your car and for your finances. With our Cover for Brand New Cars, you can enjoy a cover against damages to your own car for a period of 1 year as well as protection from liabilities on account of third party claims for a period of 3 years.

Accident

Natural Calamities

Personal accident

Third-party liability

Choice of add-ons

Theft

Inclusion & Exclusions of Hyundai car Insurance

Fire & Explosion

A fire or an explosion may reduce your Hyundai car to ashes, but we’ll ensure that the mishap doesn’t burn a hole in your finances.

Natural Calamities

Natural calamities don’t come knocking at your door. But, not preparing yourself can catch you on the wrong foot. Protect your car with our car insurance plan as we cover damages caused by natural calamities such as floods, earthquakes and much more

Theft

Do not lose sleep over car thefts; rather, protect your finance with our car insurance plan. Should this nightmare ever come to pass, our car insurance coverage will ensure that you aren’t robbed off your finances!

Accidents

The thrill of the road brings along the unpredictability of car accidents, and for such uncertain times, our car insurance policy has your back. Whatever be the intensity of the accident, we are there to cover the damages that your car sustains.

Personal Accident

Your safety is paramount for us! Thus, alongside your car, we take care of you too. In case you suffer from any injuries, our car insurance plan offers you a Personal Accident cover worth 15 lacs to cover charges of your medical treatment.

Third Party Liability

An accident involving your car may also cause damages to a third-party, be it a person or property. In such cases, you need not worry about paying out-of-pocket to meet those liabilities because our car insurance has you covered.

Add-ons For Your Hyundai Car Insurance

Why stop at just a basic cover when you can upgrade the protection for your prized Hyundai with our add-ons? Check out the options here.

Features of Hyundai Car Insurance

If you are planning to buy or renew Hyundai Car Insurance, you must know about its features mentioned in the below table.

| Key Features | Benefits |

| Own Damage Cover | Covers damage to vehicle due to an insurable peril like fire, flood, accident, earthquake, etc. |

| Third Party Damages | Covers third party liabilities involving an insured vehicle in an accident. |

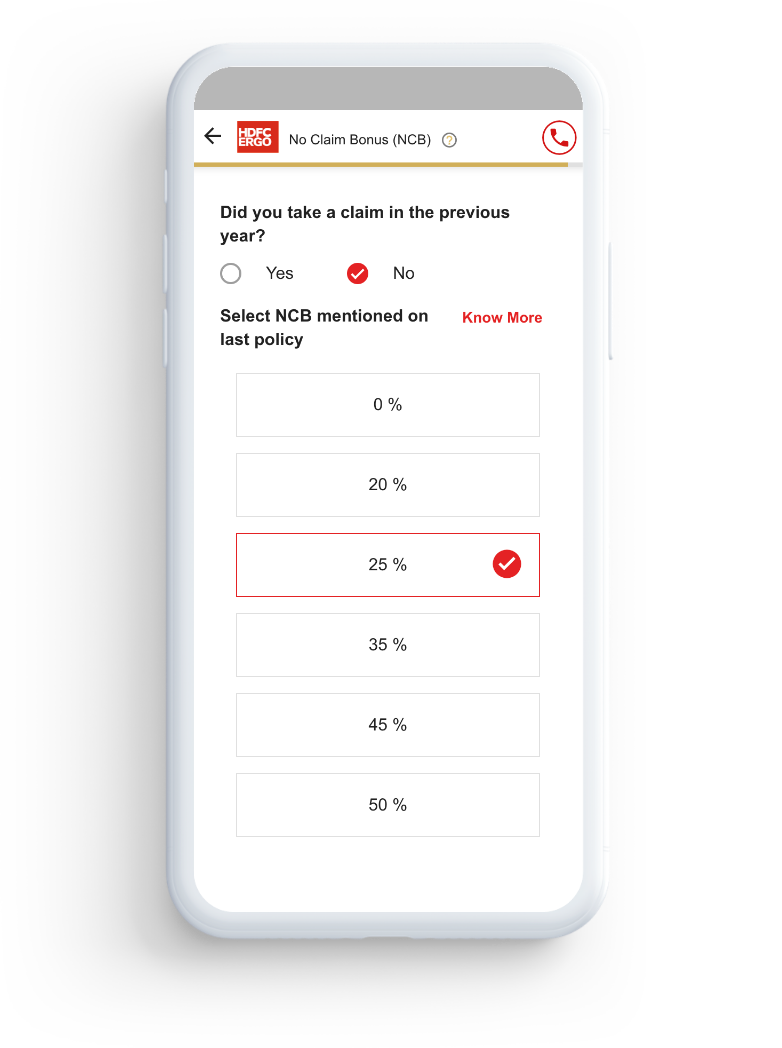

| No Claim Bonus | Up to 50% |

| Personal Accident Cover | Up to ₹15 lakhs~* |

| Cashless Garages | 9000+* all across India |

| Add-on Covers | 8+ Add-on Covers like zero depreciation cover, NCB protection cover, etc. |

Benefits of Buying Hyundai Car Insurance Online

Buying Hyundai insurance online is very easy and simple. All you have to do is just visit our website and click on car insurance. You can view Hyundai car insurance price and buy the policy instantly within few minutes. Let us see below some other benefits of buying car insurance online.

Get instant quotes

Quick issuance

Seamlessness and transparency

Payment reminders

Minimal paperwork

Convenience

Hyundai Cars – Overview

Hyundai offers thirteen car models in India, including five cars in the SUV category, one in the Sedan category, three in the Hatchback category, three in the Compact SUV category, and one in the Compact Sedan category. Hyundai is renowned in India for its reliable, stylish and feature-rich vehicles at competitive prices. The brand's strength lies in offering modern design, innovative features and a wide range of choices to suit diverse customer preferences. Hyundai car price starts at Rs 5.84 lakh for the cheapest model, the Grand i10 Nios and the price of the most expensive model, the Ioniq 5, starts at Rs 45.95 lakh.

Popular Hyundai Car Insurance Models

Other Hyundai Models

Want to take a look at the other popular models from Hyundai? Here’s a quick glimpse.

| Hyundai Models | Car Segment |

| Hyundai i20 | Hatchback |

| Hyundai KONA Electric | SUV |

| Hyundai Verna | Sedan |

| Hyundai Elantra | Sedan |

| Hyundai Tucson | SUV |

Hyundai Car Model Price

You might be planning to buy a new Hyundai car. Before you start your research lets take a look at prices of some popular Hyundai models.

| Hyundai Models | Price Range (on-road Price Mumbai) |

| Hyundai i20 | Rs. 8.38 lakh to Rs. 13.86 lakh. |

| Hyundai KONA Electric | Rs. 25.12 Lakh to Rs. 25.42 Lakh |

| Hyundai Verna | Rs. 13.06 Lakh to Rs. 16.83 Lakh |

| Hyundai Elantra | Rs. 18.83 Lakh to Rs 25.70 Lakh |

| Hyundai Tucson | Rs. 34.73 Lakh to Rs. 43.78 Lakh |

| Hyundai Creta | Rs. 12.89 to Rs 23.02 Lakh |

| Hyundai Grand i10 Nios | Rs. 6.93 - 9.93 Lakh (Petrol) & Rs. 8.73 - 9.36 Lakh (CNG) |

| Hyundai Venue | Rs. 9.28 Lakh to Rs. 16.11 Lakh |

| Hyundai Aura | Rs. 7.61 Lakh to Rs Rs. 10.40 Lakh |

| Hyundai Ioniq5 | Rs 48,72,795 |

Know Your Premium: Third-party Premium vs. Own Damage Premium

Third-Party (TP) plans: A Third-party (TP) plan is not just an option. In India, it is mandatory to protect your car with a third-party cover. So, ensure that you purchase this cover, at the very least, since that allows

you to avoid penalties. A Third-party plan protects you from the financial liabilities that may arise if your Hyundai car causes any kind of damage to a third-party.

The interesting thing about Third-party plans is that they

are very fairly and reasonably priced. That’s because the IRDAI has specified the premium for Third-party plans based on the cubic capacity of each vehicle. So, you can rest assured that your finances are protected against third-party

claims at a reasonable premium.

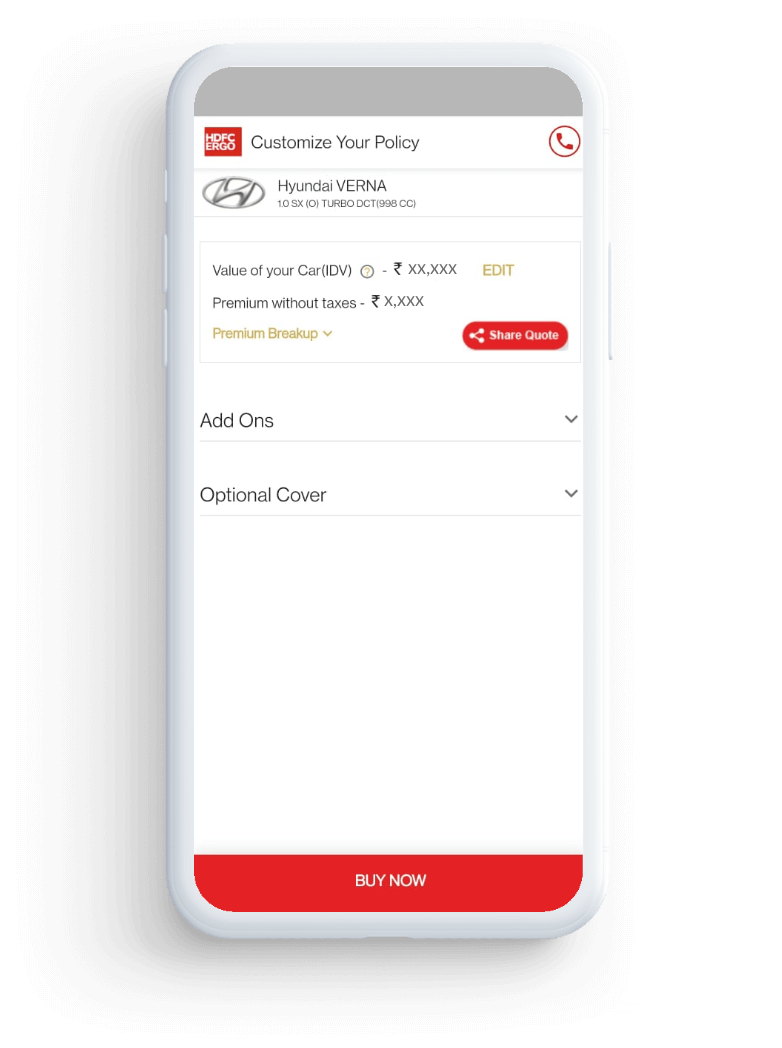

Own Damage (OD) insurance: Own Damage (OD) insurance for your Hyundai car is optional. But trust us, it can benefit you in so many ways. If your Hyundai car is damaged on account of an accident or due to any natural calamities

like earthquakes, fires, or storms, there may be heavy expenses involved in rectifying such damages. Own Damage insurance covers these expenses.

Wondering what the premiums for Own Damage insurance is like? Well, unlike the premium for Third-party plans, the premium for Own Damage insurance for your Hyundai car is not determined only by the cubic capacity of your vehicle. It also depends on Insurance Declared Value (IDV) and the

zone of your vehicle, which is, in turn, based on the city in which your car is registered. The kind of insurance coverage you choose also affects the premium. So, the costs for a bundled cover are different from the premium for standalone

own-damage cover that may or may not be enhanced with add-ons. Furthermore, if you’ve made any modifications to your Hyundai, that will also be reflected in the premium charged.

How To Calculate Your Hyundai Car Insurance Premium

Buying car insurance for your Hyundai car is easy. All it takes is a few simple and quick steps. Take a look at what you need to do.

How to Buy Hyundai Car Insurance Online

While buying or renewing a car insurance policy, it is necessary to know how its premium is calculated. Here’s a step-by-step guide for calculating your car insurance premium

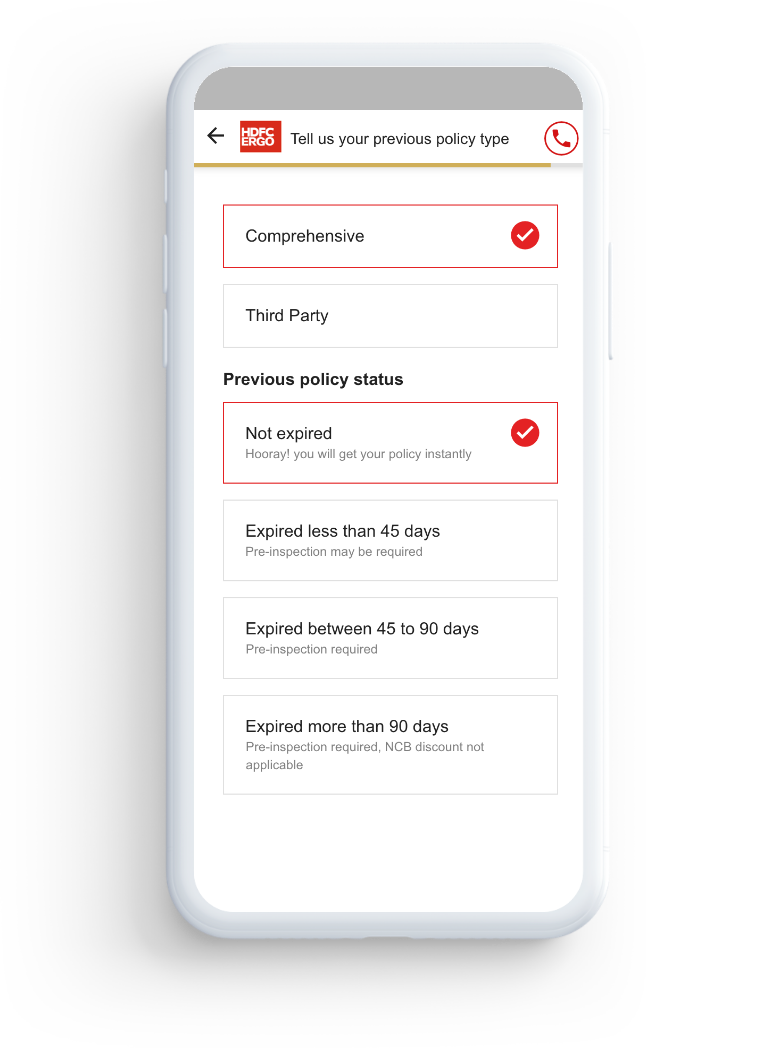

Step 1: Visit HDFC ERGO website and navigate to car insurance page. Enter vehicle’s registration number and fill in the other details that follows.

Step 2: Enter the policy details and mention about no claim bonus, if you have any. In addition, opt for the add-on cover.

Step 3: Complete the process by paying the premium amount via online payment.

A confirmation mail along with the Hyundai car insurance policy will be mailed to you.

How to Buy Car Insurance For A Secondhand Hyundai Car

Step 1- Visit the HDFC ERGO site, log in and enter your Hyundai car details in the check box. Enter all details.

Step 2- The new premium mainly depends on Insured Declared Value.

Step 3- Upload all sales and transfer of insurance

related documents. Choose between comprehensive and third party insurance policy. You can opt for add-on covers with comprehensive plan.

Step 4- Make payment of Hyundai insurance online and save policy documents. You will receive

a soft copy of the insurance policy via email.

How to Renew Hyundai Car Insurance Online

For Hyundai insurance renewal, you must go through following steps

Step 1: Visit HDFC ERGO website and select renew the policy.

Step 2: Enter the details, include/ exclude the add on covers and complete the journey by paying the Hyundai insurance premium online.

Step 3: The renewed policy will be mailed to your registered email id.

Hyundai Car Insurance Cashless Claim Process

If you want to raise cashless claim against your Hyundai car insurance policy, then you will have to go through following steps:

Intimidate claim to HDFC ERGO claim’s team by calling on our helpline number or sending a message on WhatsApp on 8169500500.

Take your Hyundai car to HDFC ERGO cashless network garage. Here, your vehicle will be inspected by an

individual appointed by the insurer.

After receiving our approval, the garage will begin to repair your car

Meanwhile, submit the required documents and the duly filled claim form to us. If any specific document is required,

we will inform you of the same.

The HDC ERGO claim team will verify the details of the cashless claim in car insurance and will either accept or reject the claim.

Upon successful verification, we will settle a cashless Hyundai

car insurance claim by paying the repair expenses directly to the garage. Remember that you might have to pay the applicable deductibles, if any, out of your own pocket.

Documents Required for Filing Hyundai Car Insurance Claim

Here are list of documents required to file Hyundai car insurance claim

Step 1: Registration Certificate (RC) Book copy of your Hyundai car.

Step 2: Driver's license copy of the individual driving the insured vehicle at the time of the incident.

Step 3: FIR copy filed at the nearby police station of the incident.

Step 4: Repair estimates from the garage

Step 5: Know Your Customer (KYC) documents

Why Does Your Hyundai Need Car Insurance?

If you’re a highly cautious driver, you’re perhaps going to wonder why insurance is even necessary for your Hyundai car, isn’t it? Well, you see, insurance for your car isn’t just an option. The Motor Vehicles Act,

1988, makes a minimum third party insurance cover compulsory for all vehicles travelling on Indian roads. So, insuring your Hyundai car is not just an alternative to consider,

but an essential, legally mandated part of the entire experience of owning a car.

And that’s not the only reason to insure your treasured Hyundai. Check out the other ways in which you can benefit from purchasing car insurance.

It takes care of your liabilities

An accident involving your Hyundai may bring in third party liabilities. For example, if you happen to accidentally cause damages to someone else’s property, the owner may claim compensation for those damages from you. This unexpected expense can be steep and draining on your finances. With car insurance in your corner, however, you can rest assured that these liabilities are covered and not due out of pocket.

It takes care of you

Car insurance doesn’t just take care of third party liabilities. It also takes care of you, your Hyundai and your finances. The costs of repairing any damages to your car are also covered. And there’s more. Car insurance also gives you other value-added benefits like personal accident cover, coverage for the cost of alternate means of transport when your car is in for repairs, and even emergency roadside assistance.

It’s the golden ticket to a stress-free driving experience

No matter how few or how many years of experience you may have behind the wheel, taking your Hyundai out on the roads can be stressful if you’re not insured. The possibility of an accident draining your finances is never entirely out of the picture. With car insurance for your Hyundai, you can finally bid goodbye to this worry and have a relaxed and stress-free experience.

6 Reasons Why HDFC ERGO’s Car Insurance Should Be Your First Choice

Find Us Wherever You Go

With your trusted Hyundai car, you're, no doubt, all excited about conquering more roads and discovering unexplored pathways. But, unexpected hiccups may be just around the corner. A breakdown. The need for some towing assistance. An emergency refuel. Or just plain mechanical issues. Finding the cash to pay for such unexpected costs may not be possible if you’re in a remote location. But if you’ve got HDFC ERGO car insurance backing you up, you need not worry about looking for cash to pay for emergency assistance. You can rely on our Cashless Garage facility to ensure that your Hyundai car is always taken care of.

Located all over the country, our wide network of over 9000 cashless garages can be accessed no matter where you are, and no matter what time it is. So, go ahead and conquer all those roads that you’ve been eager to explore. Our car insurance has your back.

Latest News on Hyundai

Hyundai Hikes Price For Multiple Variants of Verna

Due to minor cosmetic revisions, Hyundai has increased prices for multiple variants of Verna. However, the starting price of the Verna EX 1.5 petrol MT variant remains at Rs 11 lakh (ex-showroom). All other variants have witnessed an upward price revision of Rs 6000. This has resulted in the Verna range now topping out a price tag of Rs 17.48 lakh. Customers have 10 colour options in Verna with six variants.

Published on: Nov 14, 2024

MK Stalin Did Virtual Ground Breaking Ceremony of Hyundai Motor India’s Hydrogen Innovation Centre

M.K. Stalin, the Chief Minister of Tamil Nadu, lays the foundation of Hyundai Motor India’s Hydrogen Innovation Centre. Hyundai Motor India Limited (HMIL) will establish a dedicated hydrogen innovation centre in association with IIT Madras. This centre will be fully operational by 2026 and is in line with HMIL’s goal of strengthening Tamil Nadu as a hub of automotive innovation. This will also be an effective measure to reduce carbon footprint in Tamil Nadu.

Published on: Aug 22, 2024

Read the Latest Hyundai Car Insurance Blogs

Top tips for your Hyundai car

• Ensure that the interiors of your car are clean. This will ensure that your car remains free from rodents and other insects.

• Disconnect the battery from the car to prevent it from getting drained unnecessarily.

• Ensure that your spare tyre is in good condition and filled with air.

• Make sure you have all the tools necessary for emergency repairs.

• Check and replace the windshield wipers if necessary.

• Ensure that your tyres are inflated up to the recommended pressure. This will prevent premature wear.

• Ensure that your rear-view mirrors are all aligned and provide maximum visibility.

• Keep an eye on your brakes. Make sure that they work properly before you take your car out for a spin.

Car Insurance for Popular Brands

cashless Garagesˇ Across India

Frequently Asked Questions On Hyundai Car Insurance

• Zero Depreciation Cover: Protects your claim payouts from depreciation cuts

• No Claim Bonus Protection: Ensures that the No Claim Bonus (NCB) you’ve accumulated over the years remains untouched and is carried on to the next slab

• Emergency Assistance Cover: Offers 24x7 emergency assistance services like refuelling, tyre changes, towing assistance, lost key assistance and arranging for a mechanic

• Return to Invoice: Ensures that you get the original invoice value of your car in case of theft or total damage to your Hyundai car

• Engine and Gearbox Protector: Safeguards you against the financial burden occurring in case of damages to the engine and gearbox

• Downtime Protection: Offers you alternative transport or daily financial assistance to meet your transportation costs till your car’s ready to use

a. Third Party Cover

b. Standalone Own Damage Cover

c. Single Year Comprehensive Cover

d. Cover for Brand New Cars

Of these, the Third Party Cover is mandatory, while the others are optional.

Health Insurance

Health Insurance  Travel Insurance

Travel Insurance  Car Insurance

Car Insurance  Cyber Insurance

Cyber Insurance  Critical Illness Insurance

Critical Illness Insurance

Pet Insurance

Pet Insurance

Bike/Two Wheeler Insurance

Bike/Two Wheeler Insurance  Home Insurance

Home Insurance  Third Party Vehicle Ins.

Third Party Vehicle Ins.  Tractor Insurance

Tractor Insurance  Goods Carrying Vehicle Ins.

Goods Carrying Vehicle Ins.  Passenger Carrying Vehicle Ins.

Passenger Carrying Vehicle Ins.  Compulsory Personal Accident Insurance

Compulsory Personal Accident Insurance  Travel Insurance

Travel Insurance  Rural

Rural