Premium starts

at ₹2094*8700+ Cashless

GaragesˇOvernight Vehicle

Repairs-What is Roadside Assistance Cover in Car Insurance?

Emergency assistance add-on cover ensures you’re never stranded during a car breakdown. Whether it’s a flat tyre, dead battery, empty fuel tank, or mechanical failure, this add-on provides 24/7 roadside support. If your car stops working far from the city or a garage, just call HDFC ERGO, and help will be on the way for towing, fuel delivery, or quick repairs, whatever you need.

Emergency Assistance also known as roadside assistance is available with comprehensive insurance or own damage cover. Getting your car insurance policy backed with emergency assistance add on cover will help you drive stress free. You can enhance your policy easily with roadside assistance cover from HDFC ERGO website.

Features of roadside assistance cover

Here are some of the salient features of the emergency assistance-

| Features | Details |

| Optional cover | The emergency assistance cover in car insurance is not a compulsory cover. It is an optional cover that you may purchase as per your preference |

| Claims | You may raise multiple claims in a policy year |

| Available with | The roadside assistance coverage is only available with a comprehensive motor insurance plan and not with third party car insurance |

| When to purchase | You can purchase emergency assistance at the time of purchasing a comprehensive car insurance policy or when you renew your existing insurance plan |

| Premium | You have to pay additional premiums apart from the premium of the comprehensive car insurance plan to purchase a roadside assistance cover |

| Service available | The service of emergency assistance cover is available 24*7. So, at any time of the day, you can raise a claim for a roadside assistance add-on. |

Roadside Assistance Coverage Inclusion & Exclusions

When you buy an insurance policy, it is essential that you understand the policy, its inclusions and exclusions.

If you make a claim for an incident which is covered under the policy, you can make a roadside assistance claim too. The emergency assistance cover in car insurance would provide coverage for the following –

• Towing facility in the case of an accident or breakdown of the vehicle

• On-spot repairs for minor damages

• Replacement of flat tyre

• Key service

• Emergency delivery of fuel

• Arrangement for an alternate mode of travel

• Translator service

• Jumpstart the battery

• Arrangement for accommodation

• Medical evacuation

• Referral of an ambulance

• Continuation or return journey

• Repatriation of the vehicle

• Assistance for legal services

Claim for emergency assistance insurance would not be allowed in the following cases –

• Driving without a license

• Driving outside India

• Participating in adventure sports, hazardous acts or criminal activities

• Consequential losses

• Losses due to depreciation and normal wear and tear

• Claims in a lapsed policy

• Driving under the influence of alcohol or drugs

• Self-inflicted damages or deliberate damages

Is It Necessary To Opt For The Roadside Assistance Cover?

No, it is not necessary to opt for roadside assistance coverage. However, the coverage offers complete support in the case of emergencies and a wide scope of benefits. The premiums for emergency breakdown cover are quite low giving you complete security without hurting your pockets. So, though not mandatory, the breakdown assistance cover is recommended.

How does a Roadside Assistance cover work?

Mishaps can occur at any of your rides, in case you get stuck while en route, you can call up HDFC ERGO if you need any emergency assistance facility. HDFC ERGO will send you assistance for any covered emergency so that you don’t suffer

any inconvenience. Here is how you can proceed with your roadside emergency assistance:

• The policyholder has to inform HDFC ERGO about the incident. One may call the helpline number of HDFC ERGO- 022 6234 6234 / 0120 6234 6234

• You may also raise a claim online and inform your insurer about the incident

• HDFC ERGO will immediately make arrangements for towing or on-spot repairs for your location If required, the vehicle will be towed to a nearby garage (preferably a network garage for cashless repair)

• The admissible expenses of the whole process will be covered by HDFC ERGO.

Remember, you can purchase roadside assistance cover only with comprehensive car insurance or a standalone own-damage policy.

Conditions related to its usage

The roadside assistance cover is a simple cover which is available if you suffer any inconvenience following an accident or a breakdown. The only condition that is applicable is that you should suffer a car insurance claim covered under the policy to utilise the coverage offered by the roadside breakdown cover.

Get simplified claims for the roadside assistance cover in your motor insurance policy only with HDFC ERGO

Benefits of the roadside assistance cover

The emergency assist breakdown cover is quite beneficial in an emergency as it provides you with 24*7 roadside assistance. In the case of any contingency, you simply have to inform HDFC ERGO and we will send help, wherever you are. With

the wide scope of coverage, you can get assistance in most emergencies which would otherwise have proven challenging. Here are various benefits of the roadside

24*7 cover

Roadside assistance cover is available 24*7. So, no matter at what hour you need help, HDFC ERGO will be there for your assistance. All you are required to do is quickly raise a claim.

Affordable premium

The premium charged for the emergency breakdown cover is quite affordable. If you opt for a comprehensive car insurance plan, you can purchase the car breakdown add-on cover.

Comprehensive coverage

The emergency assistance cover in car insurance offers a range of coverage apart from a towing facility. The comprehensive package lets you manage the problem immediately. In case of tyre problems or ones that can be solved on the spot, you can request on-spot assistance or else the vehicle is towed to a nearby garage for repair.

Assistance throughout your journey

The emergency assistance cover is there with you for all your journeys. You can raise multiple claims in a year and drive without any hassle.

Peace of mind

A mishap or car breakdown while on the road, especially where you cannot find nearby help can be very daunting. During this overwhelming situation, having someone ready to assist you even at odd hours instantly is peace of mind. If you are someone who frequently takes out the car, especially on long drives, roadside assistance can be a great choice for you.

Factors to Consider Before Buying A 24x7 Car Breakdown Assistance Cover

Before you purchase roadside emergency assistance, here are a few things that you must keep in mind:

Comprehensive car insurance policy

Your needs

Your budget

No claim bonus

How much does a Roadside Assistance cover cost?

The premium payable for the breakdown cover is quite low. It depends on the base policy, the make and model of the vehicle, the IDV,

the registration location and other factors that determine the motor insurance premium.

You can check the breakdown assistance cover cost using HDFC ERGO’s motor insurance premium calculators.

How to Buy Emergency Assistance Cover Add-on?

Purchasing an emergency assistance cover is easy, and the premium is affordable. Here is how you can quickly purchase it:

• Visit our website and navigate to the car insurance page.

• Enter your vehicle registration number and then proceed.

• Choose the make and model of your vehicle.

• Now select the comprehensive car insurance policy.

• You can customise your comprehensive cover by clicking on add-on covers, and here, you can choose an emergency roadside assistance add-on along with other add-on covers like zero depreciation and no-claim bonus protection.

• You can now view the premium and buy the policy online.

Who should purchase a roadside assistance cover in car insurance?

The roadside assistance cover is suitable for all vehicle owners as it provides an additional layer of security in the case of accidents and breakdowns. Especially when you frequently drive outside city limits, the breakdown cover with car insurance can come in handy.

How to renew roadside assistance cover online?

Renewing the roadside assistance cover online is a matter of a few clicks. Here is how you can do it:

• On the website, login to your account with the login credentials

• Click on the details of your car insurance policy

• Click on the renew option

• Along with your comprehensive car insurance plan, you can quickly renew the roadside assistance coverage as well. This add-on is only available with the comprehensive plans

• Make the payment to complete the process.

How to Claim Roadside Assistance in case of Accident or Breakdown?

You would have to inform HDFC ERGO by calling its claim helpline number or through an online intimation. Once informed, HDFC ERGO would send the required help to deal with the accident or breakdown.

Things to Keep in Mind While Raising a Claim

When you are raising a claim under emergency assistance, remember the following

- Check if the claim does not fall on the list of exclusions. In such cases, the claim would be rejected

- Inform HDFC ERGO immediately about the claim. Do not delay else the claim assistance would also be delayed

- Keep all the proof of the claim handy if required by HDFC ERGO

Things to remember if you get RSA in car insurance

You can purchase roadside assistance coverage either when you are buying a new motor insurance policy or when you are renewing one. Just add the cover to the base policy, pay the additional premium, and the cover will become operational

instantly. Keep the following things in mind when you get the emergency assistance:

1. Adding the emergency assistance cover to your regular plan will increase the premium amount. However, the price should not be the reason that you opt for this coverage, as in an emergency, the roadside assistance service can come to your rescue.

2. The roadside assistance service is typically available if your car has broken down at a place where an active service provider is present in the range of 50 km.

3. Keep in mind that the service is available throughout the country but not in:

a. Jammu & Kashmir

b. 7 North East Indian states.

c. Island territories.

Add the roadside assistance add-on to your comprehensive motor insurance policy in simple steps with HDFC ERGO

Maintenance tips to avoid car breakdown during a long trip

Safe driving is the key to avoiding many risks of accidents and mishaps. When you have a car insurance cover, you undoubtedly have a backup pillar. However, you must try your best to stay safe on the road. Here are some tips to avoid car

breakdowns when you are on a long drive:

Examine your vehicle before the trip

Plan a trip during good weather

Smooth driving is the key

Have basic tools in the car

The RSA policy

Difference Between roadside assistance and Towing service

A roadside assistance service or RSA is an add-on cover and is available with a comprehensive car insurance plan. On the other hand, a towing service is a service that you may request your insurer to provide in case your car suffers a breakdown. Refer to the table below for more details:

| Roadside Assistance (RSA) Services | Towing Services |

| This is an add-on cover that also includes the towing services | This is a service offered by the insurance company and is not an add-on cover |

| RSA offers a range of coverage along with towing | Towing services are standalone service |

| You can only purchase RSA with a comprehensive car insurance plan | Towing services can be availed by anyone, irrespective of the car insurance policy they have |

Other Add-ons in Car Insurance

Add-on covers increase the extent of insurance coverage, thus offering comprehensive benefits. Apart from RSA, there are various other add-ons as well, like:

When you raise a claim, the depreciation cost of the vehicle is deducted from the claim amount. However, when you have the zero depreciation add-on cover, the depreciation value is not calculated and deducted from the claim amount.

As discussed above, when you raise a claim, the accumulated no-claim bonus is lost. In order to protect it from refreshing, you can purchase a no-claim bonus protector. With this add-on, you can enjoy 3 NCB-protected claims in a policy year. This means your NCB remains intact until 3 claims in a policy year.

Cost of consumables items

The expenses of engine oil, nuts and bolts, grease, brake oil, lubricants, washers, ball bearings etc. are covered under this add-on cover.

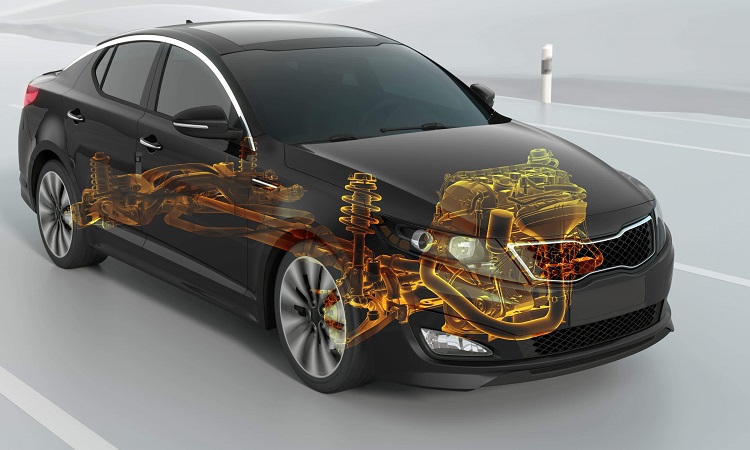

Usually, damages to the engine and gearbox is not covered under the car insurance policy. However, when you have an engine and gearbox protector add-on cover, you need not worry about it. In case water or oil leaks and disrupts the functioning of the engine or the gearbox, the expenses are covered under this add-on cover.

Health Insurance

Health Insurance  Travel Insurance

Travel Insurance  Car Insurance

Car Insurance  Cyber Insurance

Cyber Insurance  Critical Illness Insurance

Critical Illness Insurance

Pet Insurance

Pet Insurance

Bike/Two Wheeler Insurance

Bike/Two Wheeler Insurance  Home Insurance

Home Insurance  Third Party Vehicle Ins.

Third Party Vehicle Ins.  Tractor Insurance

Tractor Insurance  Goods Carrying Vehicle Ins.

Goods Carrying Vehicle Ins.  Passenger Carrying Vehicle Ins.

Passenger Carrying Vehicle Ins.  Compulsory Personal Accident Insurance

Compulsory Personal Accident Insurance  Travel Insurance

Travel Insurance  Rural

Rural