my:health Koti Suraksha- 1 Crore Health Insurance Policy

To beat ever-increasing medical inflation and offer quality healthcare, here's my:health Koti Suraksha - a health insurance plan that offers a sum insured of up to ₹1 crore. This significant health cover insures you against various medical expenses like hospitalisation costs, critical illness treatments, costs for major surgeries, daycare procedures, and so much more. With my:health Koti Suraksha policy backing you up, stay rest assured that while you take care of your health, we’ll take care of your high healthcare costs. Thus, preparing you to tackle a medical emergency without impacting your life-long savings.

Why buy 1 crore health insurance from HDFC ERGO?

1 cr health insurance is designed keeping in mind the growing medical needs and rising inflation.

Wider pre & post hospitalisation

Unlimited daycare procedures

No room rent capping^*

₹17,750+ Cr claims settled till now`

16,000+ Network Hospitals

#1.6 Crore+ Happy Customers

Understand Coverage Offered by Our 1 Cr Health Insurance

Hospitalization (including COVID-19)

Just like every other health insurance plan, we cover your hospitalization expenses due to illnesses and injuries seamlessly. my:health Koti Suraksha also covers treatment for COVID-19.

Pre & Post Hospitalisation

It means all your pre-hospitalization expenses of 60 days prior to admission and post-discharge expenses up to 180 days get covered, like the costs for medicines, diagnostics, physiotherapy, consultations, etc.

Unlimited Day Care Treatments

Medical advancements help in wrapping up important surgeries and treatments in less than 24 hours, and guess what? We cover you for that as well.

Free Preventive Health Check-Up

Prevention is certainly better than cure and that’s why we offer a free health check-up within 60 days of renewing your my:health Koti Suraksha policy with us.

Road Ambulance

In case of emergency getting to the hospital on time is crucial. Hence, we have got your back here. my:health Koti Suraksha covers the cost of ambulance transport (within the same city).

Home Healthcare*^

If your doctor recommends that you can get yourself treated from the comfort of your home and avail medical facilities, then we cover home hospitalisation expenses too.

Organ Donor Expenses

Receiving an organ is indeed a lifesaver. We cover surgical expenses for harvesting a major organ from the donor’s body where insured is the recipient.

Alternative Treatments

Let your belief in alternative therapies like Ayurveda, Unani, Siddha, and Homeopathy stay intact as we cover hospitalization expenses for AYUSH treatment as well.

Lifelong Renewability

Once you get yourself secured with our health insurance plan there is no looking back. Our health plan continues to secure your medical expenses for your entire lifetime on break free renewals.

Please read the policy wordings, brochure and prospectus to know more about my:health Koti Suraksha.

Adventure Sport Injuries

Adventures can give you an adrenaline rush, but when coupled with accidents, it can be hazardous. Our health insurance plan does not cover accidents encountered while participating in adventure sports.

Self-inflicted Injuries

If you ever end up causing injury to your precious self, then unfortunately our health insurance plan will not cover for self imposed injuries.

War

War can be disastrous and unfortunate. However, our health insurance plan does not cover any claim that is caused due to wars.

Participation in Defence Operations

Our health insurance plan does not cover accidental injury while you are participating in defence (Army/Navy/Air Force) operations.

Congenital external diseases, defects or anomalies,

We do not cover medical expenses incurred for Congenital external diseases, defects or anomalies

Treatment for Alcoholism & Drug Abuse

Treatment for Alcoholism, drug or substance abuse or any addictive condition and consequences thereof remains uncovered.

Not just a simple health cover, also your wellness partner

Health Coach

Get easy access to health coaching services like nutrition, fitness and psychological counselling. You can avail all of these services through our Mobile App via chat service or call back facility. All you need to do is download our App from Google Playstore & enjoy these benefits. Click here to download our App (only android devices).

Wellness Services

Avail discounts on OPD consultations, pharmacy purchases & diagnostic centres. You can sign-up for newsletters, diet & health tips. We also offer specialized programs for stress management & pregnancy care. You are just a click away from exploring a bunch of wellness services. Click here to download the App (only android devices).

Multiple Discount options on 1 Crore health insurance plan

Long Term Discount"

Why settle for short term cover and pay more? Go for a long term plan and save up to 10% with my:health Koti Suraksha.

Family Discount

Avail 10% family discount if 2 or more members buy my:health Koti Suraksha on an individual sum insured basis.

Fitness Discount

We love rewarding you for your constant efforts to stay fit and healthy by offering fitness discount up to 10% at the time of renewal.

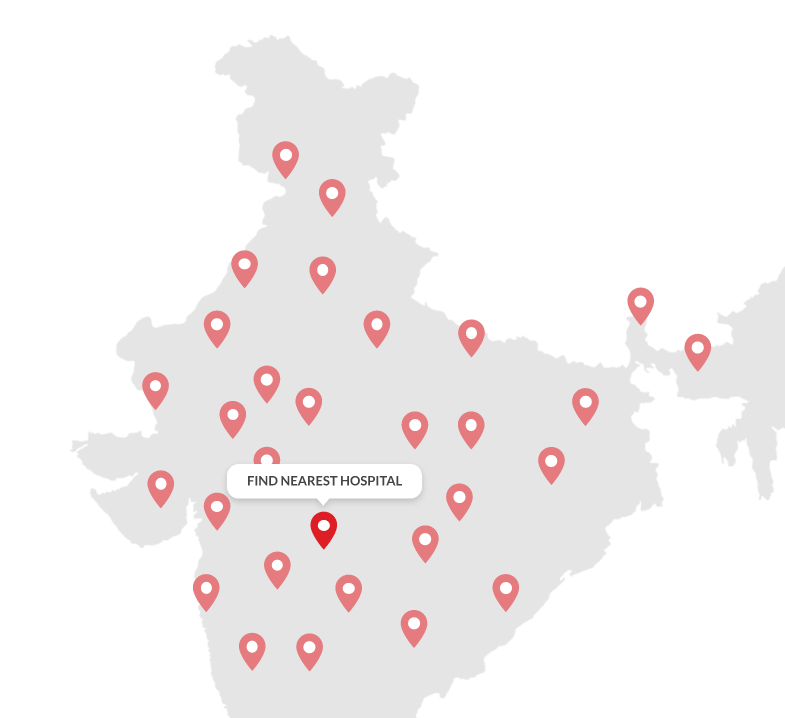

16,000+

Network Hospitals

Across India

Jaslok Medical Centre

Address

C-1/15A Yamuna Vihar, Pincode-110053

Roopali Medical

Centre Private Limited

Address

C-1/15A Yamuna Vihar, Pincode-110053

Jaslok Medical Centre

Address

C-1/15A Yamuna Vihar, Pincode-110053

You should buy 1 crore health insurance if…

Scenario 1

You have a family to take care of

You have a family to take care of

If you are the whole and sole bread earner in the family and have to take all major financial decisions, then it’s imperative to buy a one crore health insurance plan for meeting your family’s future medical expenses. Looking at the current medical inflation, even the smallest medical emergency may drain your savings. Why risk your finances when you have a plan to take care of them?

Scenario 2

You have excessive financial commitments

You have excessive financial commitments

If you are already paying EMIs for your home, car, child’s education etc., then there’s a chance that you may have less disposable income to bank upon during critical times. A single hospitalisation may put a pause to your financial commitments; hence do not think twice before opting for a one crore health insurance plan to meet any medical contingencies. A one crore health insurance plan will boost your confidence and ensure you avail quality healthcare without impacting your ongoing finances.

Scenario 3

Your family has a history of critical illnesses

Your family has a history of critical illnesses

If there is a history of critical illnesses like cancer, heart ailments etc. in your family then there’s no way you should ignore this one crore health insurance plan. Hence, be proactive and safeguard your lifelong savings from paying hospital bills.

Scenario 4

You lead a stressful work life

You lead a stressful work life

While chasing deadlines and targets, you often ignore your health. A sedentary lifestyle may interfere with your wellbeing and not let you follow a healthy regime. If this continues for an extended period, there are chances that you may succumb to various lifestyle diseases and critical illnesses at a young age. To tackle such unexpected medical expenses, it is essential to buy a one crore health insurance plan and invest your hard-earned money in fulfilling your life goals instead of paying medical bills.

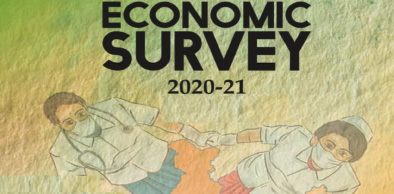

Why opt for a 1 Crore health insurance plan?

Beats steadily rising medical costs

India’s healthcare inflation has been rising steadily and more alarmingly. The average healthcare inflation for India was 7.14% for 2018-19, witnessing a steep rise from 4.39% in previous financial year~. Its time to prepare yourself to tackle these medical expenses arising due to steep medical inflation by opting for a 1 crore health insurance plan.

Enough cover for your family

You do not have to bank upon your savings if you have a 1 crore health insurance plan as it is larger than you think. It will cover you and your dear-ones seamlessly. You won’t have to compromise on the quality of healthcare facilities, if you have a health insurance plan like my:health Koti Suraksha besides you.

High sum insured at Affordable Premiums

Your search for a high sum insured health insurance plan ends here with my: health Koti Suraksha, we offer a health cover up to 1 crore at pocket-friendly prices.

How to Make a Claim for your HDFC ERGO Health Insurance

The sole purpose of buying a health insurance plan is to get financial support at the time of medical emergency. Hence, it is important to read the below steps to know how Health Insurance claims process works differently for cashless claimsand reimbursement claim requests.

Health Insurance Cashless Claims get approved within 38*~ minutes

Intimation

Fill up the pre-auth form at the network hospital for cashless approval

Approval/Rejection

Once hospital intimates us, we send you the status update

Hospitalisation

Hospitalisation can be done on the basis of pre-auth approval

Claim settlement

At the time of discharge, we settle the claim directly with hospital

We settle reimbursement claims within 2.9 days~*

Hospitalisation at non network hospital

You need to pay the bills initially and preserve the original invoices

Register a claim

Post hospital discharge send us all your invoices and treatment documents

Verification

We verify your claim related invoices and treatment documents

"

"Claim Settlement

We send the approved claim amount to your bank account.

Hear from Our happy customers

Frequently Asked Questions on Koti Suraksha Plan

1. Is it useful to buy a health plan with one crore sum insured?

While there are advanced medical treatments to cure most illnesses, such treatments do not come cheap. That is why it has become useful to invest in a health insurance plan with a high sum insured, i.e., an Rs.1 crore health plan.

Moreover, a health insurance plan with a sum insured of Rs.1 crore becomes all the more relevant in the following instances –

● If you have a family to support and you are the sole breadwinner. In such cases, you become responsible to pay for the medical needs of all family members. If you have existing liabilities, you need a high sum insured. This is because when your liabilities are high, you need funds to pay for them.

● If your coverage is low, your savings would be needed to pay for your medical expenses thereby making your liabilities a burden. A one crore health plan can take care of your medical expenses allowing your savings to be used for your liabilities

● If you lead a stressful life, you might suffer from lifestyle illnesses. To cover the financial implications of possible medical complications from such illnesses a high sum insured makes sense

Thus, a one crore sum insured is useful in a health insurance policy as it ensures higher coverage.

2. At what age can you buy my: Health Koti Suraksha policy?

1 crore health insurance plans have an age bracket that specifies the minimum and maximum entry age at which you can buy the policy. Usually, the entry age for family floater policies starts from 91 days. This means that you can cover your 91-day child under the family floater plan. For adults, the minimum entry age is 18 years. The maximum age limit at entry is 65 years for adults and children can be covered as dependents up to 25 years of age.

3. What is the grace period?

A Grace Period of 30 days is available for Renewal of the Policy. However any Illness, disease or condition contracted during Grace Period will not be covered.

4. Does my: Health Koti Suraksha policy offers any value-added services?

Health Coach

The plan provides health coaching facility to help you with disease management, nutrition, activity and fitness, weight management and psychological counselling. You can get access to the coaching facility through the company’s mobile application through chats or by arranging for a call-back.

● Wellness services

As a part of wellness services, you get attractive discounts on OPD expenses, diagnostics, pharmacy, etc. You also get monthly newsletters, diet-related consultations and health tips as a part of our consumer engagement program. Lastly, you get specially-designed programs for stress management, work-life balance management and pregnancy care.

These services help you get an additional benefit with your health insurance plan.

5. Is it possible to buy health insurance with Rs.1 crore health cover online?

Yes, HDFC ERGO allows you to buy its 1 crore health insurance policy online. You can visit https://www.hdfcergo.com/OnlineProducts/KotiSurakshaOnline/HSP-CIP/HSPCalculatePremium.aspx and provide your details to buy the policy online. Here are the steps –

● Choose the type of policy – Individual or family floater

● Mention if the proposer is the same as the insured or not. If not, state the details of the proposer as well as the insured

● Provide the date of birth of all the members being insured

● Provide your name, contact number, email ID, PIN Code, State and city.

● Click on the declaration boxes and hit ‘Calculate Premium’

● Check the premium of the different variants of the plan

● Select the most suitable plan

● Pay the premium online through the available digital payment modes

● HDFC ERGO would underwrite the policy and issue it if your details are verified

Disclaimer: Please read the policy wordings, brochure and prospectus to know more

Health Insurance

Health Insurance  Travel Insurance

Travel Insurance  Car Insurance

Car Insurance  Cyber Insurance

Cyber Insurance  Critical Illness Insurance

Critical Illness Insurance

Pet Insurance

Pet Insurance

Bike/Two Wheeler Insurance

Bike/Two Wheeler Insurance  Home Insurance

Home Insurance  Third Party Vehicle Ins.

Third Party Vehicle Ins.  Tractor Insurance

Tractor Insurance  Goods Carrying Vehicle Ins.

Goods Carrying Vehicle Ins.  Passenger Carrying Vehicle Ins.

Passenger Carrying Vehicle Ins.  Compulsory Personal Accident Insurance

Compulsory Personal Accident Insurance  Travel Insurance

Travel Insurance  Rural

Rural