Top 5 Car Insurance Add-Ons to Buy in 2026

Top 5 Car Insurance Add-Ons to Buy in 2026

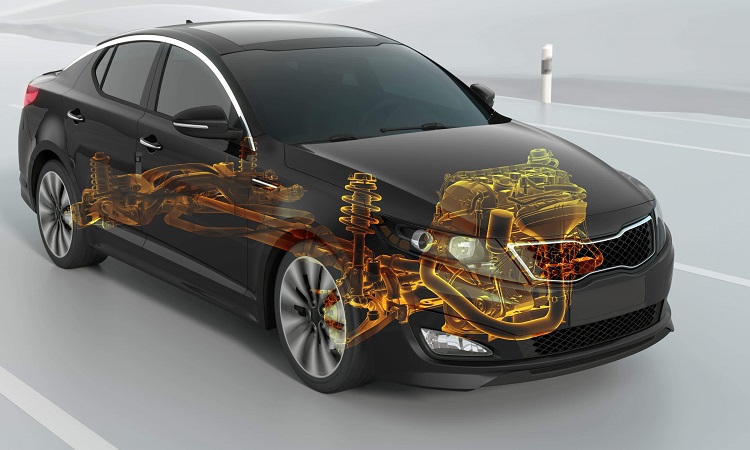

Planning to go on a road trip in 2026? You need to protect your companion, that's going to be your companion- your car. Most people set out on long drives during the holiday season, but there are always risks. From your car breaking down at an unknown location to depreciation, the risks are endless. So, how do you protect yourself? Car insurance add-ons.

Different car insurance add-ons, like zero depreciation cover, return to invoice, and roadside assistance, have been the go-to options. These add-ons offer peace of mind without depreciation deductions and also ensure immediate aid in case of a breakdown. If you want comprehensive and strong coverage for your car, these add-ons can be of great help. Let's explore all the benefits of these add-ons.

Why include car insurance add-ons in 2026?

Adding car insurance add-ons like zero depreciation, return to invoice, roadside assistance and engine protection cover is a practical way to strengthen your policy. These upgrades help address real risks-high repair costs, breakdowns, and depreciation-related losses that standard plans don’t fully cover. Renewal time is ideal for reviewing your current policy and customising it with the add-ons you genuinely need, giving your car more comprehensive protection for the year ahead.

Top 5 car insurance add-ons not to miss in 2026:

There's a wide range of car insurance add-ons to consider to enhance the coverage. You should review all the details and determine which ones best fit your needs.

The top car insurance add-ons to opt for include the following:

1. Zero Depreciation Cover

Over time and with use, your car's value is likely to depreciate. By choosing a zero depreciation car cover, you're protecting your vehicle's value from depreciation. The usual car insurance policies consider depreciation before settling claims. As a result, you don't receive the full amount during settlement.

The zero depreciation car insurance cover becomes a shield for your vehicle. If you have this add-on, the insurance company bears the full expenses of parts replacement and damage. Therefore, you don't get a reduced amount; you get the full amount as settlement.

2. Return to Invoice Cover

The return to invoice option in car insurance is one of the most essential add-ons. Due to depreciation, you will not receive the full invoice amount if the car is lost. The insurance company will only offer coverage as per the current market value. When you invest a significant sum of money in insurance, you wouldn't want to receive only a small chunk of it.

That's where the return to invoice in car insurance comes in. This cover ensures the vehicle owner receives the original value in the event of a complete loss or theft. Insurance companies offer return to invoice cover on car insurance only for specific vehicles. For example, you'll receive the RTI benefits only if your car is less than 5 years old.

3. Engine & Gear Box Protector

Your car's engine is no less than its heart. It is one of the most important and costliest parts of your vehicle. Standard car insurance policies do not cover engine damage due to oil leaks or water emissions. The engine protection cover protects your engine against these damages.

If you're going off-roading on poorly paved roads for your vacation, your engine is likely to be affected. Therefore, it's an ideal time to get this insurance add-on coverage before heading out on a trip. Getting engine protection helps to avoid expensive engine repairs. The insurance company will bear repair costs, helping you save money.

4. Emergency Assistance Cover or Roadside Assistance cover

Roadside assistance in car insurance becomes crucial for all bikers. With long drives and frequent travel being the norm, the risk is really high. Therefore, roadside assistance provides peace of mind in case of a car breakdown. The insurance company will help you with situations like a flat tyre or running out of fuel.

The insurance company will also offer services such as fuel delivery, instant repairs, and towing. There may be situations in which availing these services can be difficult. There's also a higher risk of accidents. Therefore, emergency assistance in such situations is very helpful. It also ensures that you're safe and don't have many difficulties while stranded on the road.

5. No Claim Bonus Cover

The No Claim bonus cover in car insurance protects NCB even after a claim is filed. The policyholder can retain the bonus and receive a discounted premium at renewal. However, this will apply only to a limited number of claims.

The NCB protection will apply only to add-on covers for own-damage premium. With the protection cover, you can file 1-2 claims within the policy year. You can save a significant amount on the premium. It will help you cover minor, unavoidable repairs. If you have a good NCB history, you should get this cover. If you are renewing your policy, make sure to get this as well. If you have to make minor claims for scratches, this cover should help.

To know about more car insurance add-ons, read our blog Add-On Covers For Your Car Insurance Policy.

Conclusion

As you prepare your policy for 2026, prioritise safety and long-term protection for your vehicle. Your car is a major investment, and the right comprehensive insurance plan should reflect that. Review your coverage, strengthen it where needed and consider essential add-ons such as zero depreciation car insurance, roadside assistance and return to invoice to build a more robust, practical policy. These upgrades offer meaningful support in real driving conditions and help you stay protected via your motor insurance throughout the year.

Disclaimer: The above information is for illustrative purposes only. For more details, please refer to the policy wordings and prospectus before concluding the sales.

RELATED ARTICLES

Best car insurance add-ons for expensive cars in India

Choosing the Right Add-On for Your Car Insurance Policy

Promote Discounted Add-ons with Festive Car Purchases

Most Useful Accessories For Car

Key Add-Ons to Consider for Your MG Car Insurance Policy

Health Insurance

Health Insurance  Travel Insurance

Travel Insurance  Car Insurance

Car Insurance  Cyber Insurance

Cyber Insurance  Critical Illness Insurance

Critical Illness Insurance

Pet Insurance

Pet Insurance

Bike/Two Wheeler Insurance

Bike/Two Wheeler Insurance  Home Insurance

Home Insurance  Third Party Vehicle Ins.

Third Party Vehicle Ins.  Tractor Insurance

Tractor Insurance  Goods Carrying Vehicle Ins.

Goods Carrying Vehicle Ins.  Passenger Carrying Vehicle Ins.

Passenger Carrying Vehicle Ins.  Compulsory Personal Accident Insurance

Compulsory Personal Accident Insurance  Travel Insurance

Travel Insurance  Rural

Rural