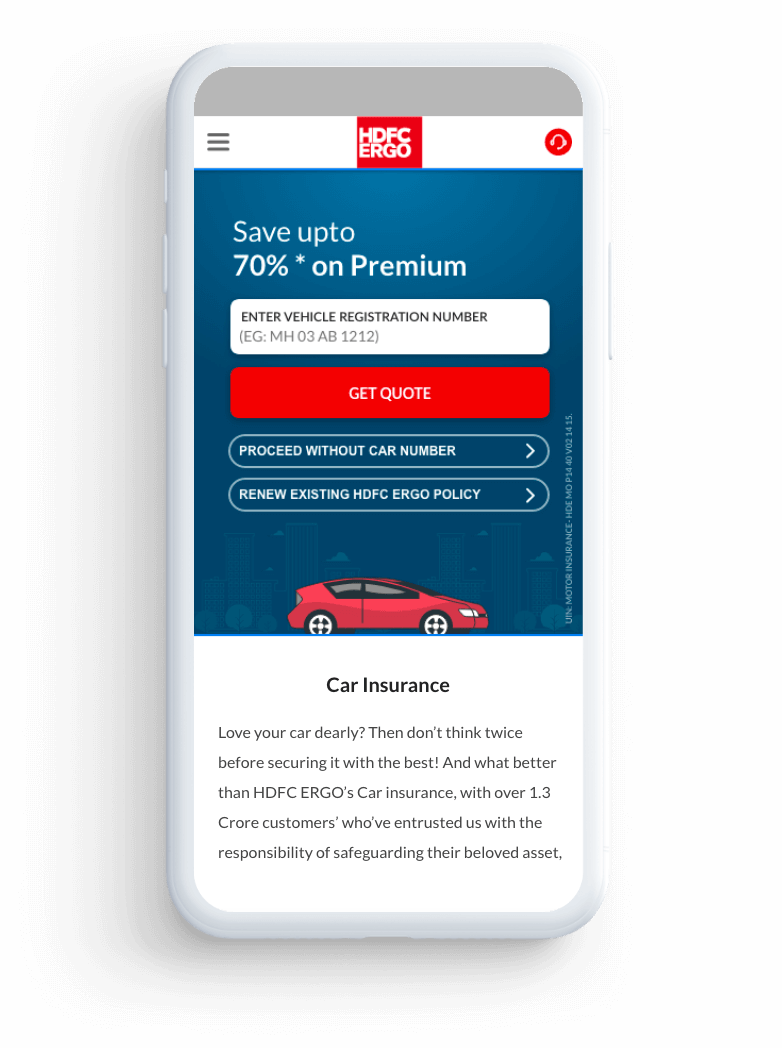

Premium starting

at Just ₹2094*9000+ Cashless

Network Garages**Overnight Car

Repair Services¯Buy/Renew Mahindra Car Insurance

Mahindra car insurance is essential to protect your vehicle from unexpected expenses caused by accidents, theft, natural calamities, or man-made disasters. When you own a Mahindra car—whether it’s a rugged SUV like Scorpio, Thar, XUV700, or a compact model like KUV100—you need the right insurance plan to safeguard your investment and ensure peace of mind.

Mahindra has a strong legacy in India, starting in 1945 and now offering a wide range of SUVs, sedans, and even electric vehicles like the e2o and e-Verito. With HDFC ERGO, you can choose from comprehensive cover, standalone own damage, or third-party liability plans. Plus, customize your policy with add-ons like zero depreciation and return to invoice for complete protection.

Why Do You Need Mahindra Car Insurance?

Why Does Your Mahindra Need Car Insurance?

A car insurance policy protects your vehicle from losses that might occur due to damages from unforeseen events like theft, fire, earthquake, flood, etc. Damages due to

these events can lead to hefty bills, hence car insurance is necessary to get coverage for such losses. It is also a legal requirement for every vehicle owner to have at least a third party cover as per the Motor Vehicles Act of 1988. However,

for complete protection of your vehicle, it is wise to have a comprehensive car insurance policy, especially when you are the owner of Mahindra

car. Let us go through some reasons to buy car insurance for Mahindra.

Covers Cost of Damage

Mahindra car needs to be well maintained and any accident can lead to huge repair bills. Apart from this, your Mahindra car can also get damaged due to floods or any other natural calamity. With comprehensive car insurance policy, your Mahindra car will get overall protection from damages due to unwanted scenarios. You can also avail repair services of Mahindra at HDFC Ergo 9000+ cashless garages.

Diminishes Owner’s Liability

Car insurance policy provides coverage against third party liabilities. While driving your Mahindra car if you accidentally cause damage to third party vehicle or property, you will get coverage for that.

It Gives Peace of Mind

With Mahindra car insurance policy, you can drive stress free. Having a third party insurance policy is mandatory for all vehicles as per the Motor Vehicles Act of 1988. It also protects your expenses from damages due to any unforeseen scenarios. Hence, having Mahindra car insurance policy, will always keep you in peace of mind.

Reasons to buy HDFC ERGO Mahindra Car Insurance

Go Cashless! With 9000+ Cashless Garages

9000+ Network Garages spread all over the country, isn’t that’s a huge number? Not just this, we let you register a claim via IPO app & website.

Why Limit Your Claims? Go Limitless!

HDFC ERGO opens doors to unlimited claims! Though we believe you’ve been driving cautiously, however in case of any claim you wish to register, we do not restrict you.

Overnight Car Repair Services

We repair minor accidental damages from dusk to dawn without any hassle. You can simply get in touch with us; we will get your car picked at night, repair it and deliver it by morning at your door step.

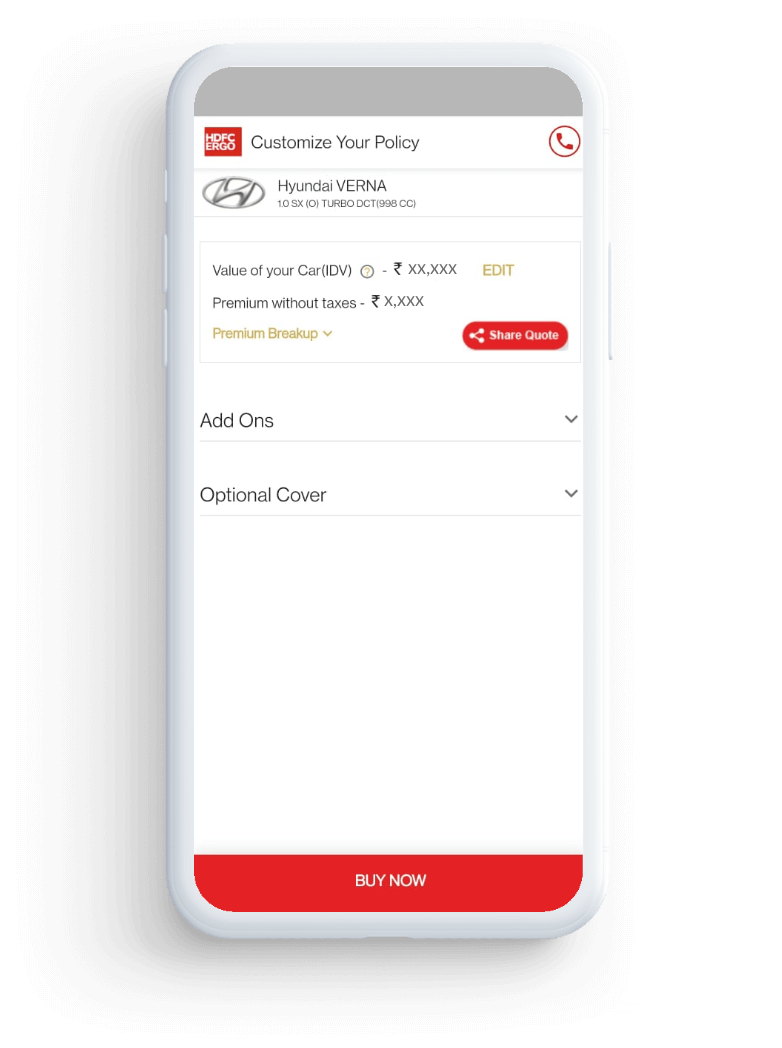

Plans Best Suited for Your Mahindra Car

The Single Year Comprehensive Cover from HDFC ERGO can help you drive your Mahindra car with a peace of mind. The plan includes cover against damages to your car as well as damages to a third party person/property. You can customise your cover further with your choice of add-ons.

Accident

Personal accident cover

Natural calamities

Third-party liability

Choice of add-ons

Theft

It is mandatory to have third-party cover as per the Motor Vehicles Act of 1988. If you don’t use your Mahindra car very frequently, it’s a good idea to get started with this basic cover and save yourself the trouble of having to pay penalties. Under the third party cover, we offer you a personal accident cover coupled with protection against liabilities arising from third-party damage, injury or loss.

Personal accident cover

Third-party property damage

Injury to a third-party person

Standalone Own Damage Car Insurance Cover protects your expenses from damages to your car due to accidents, floods, earthquakes, riots, fires and theft. If you want to enjoy additional protection, you can choose this optional cover, with your choice of add-ons, over and above the mandatory Third Party Cover.

Accident

Natural Calamities

Fire

Choice of add-ons

Theft

If you own a brand new Mahindra car, our cover for new cars is just what you need to secure your new asset. The plan offers a 1-year coverage for own damage. It also gives you a 3-year cover against damages to a third-party person/property.

Accident

Natural Calamities

Personal accident

Third-party liability

Choice of add-ons

Theft

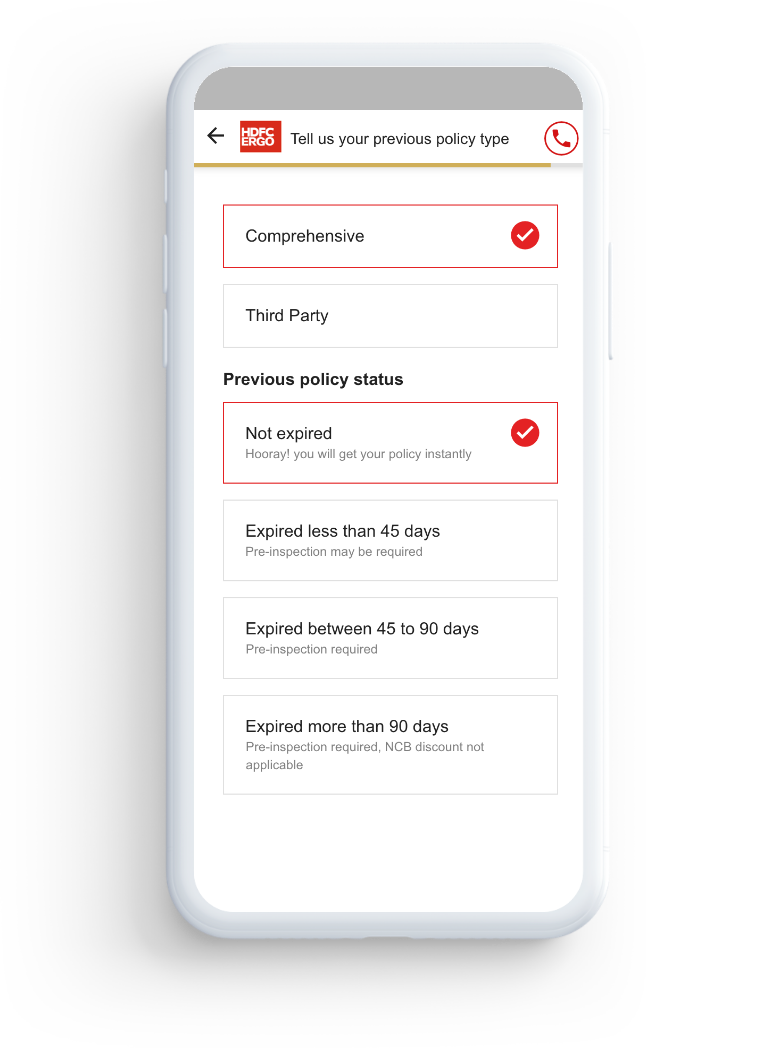

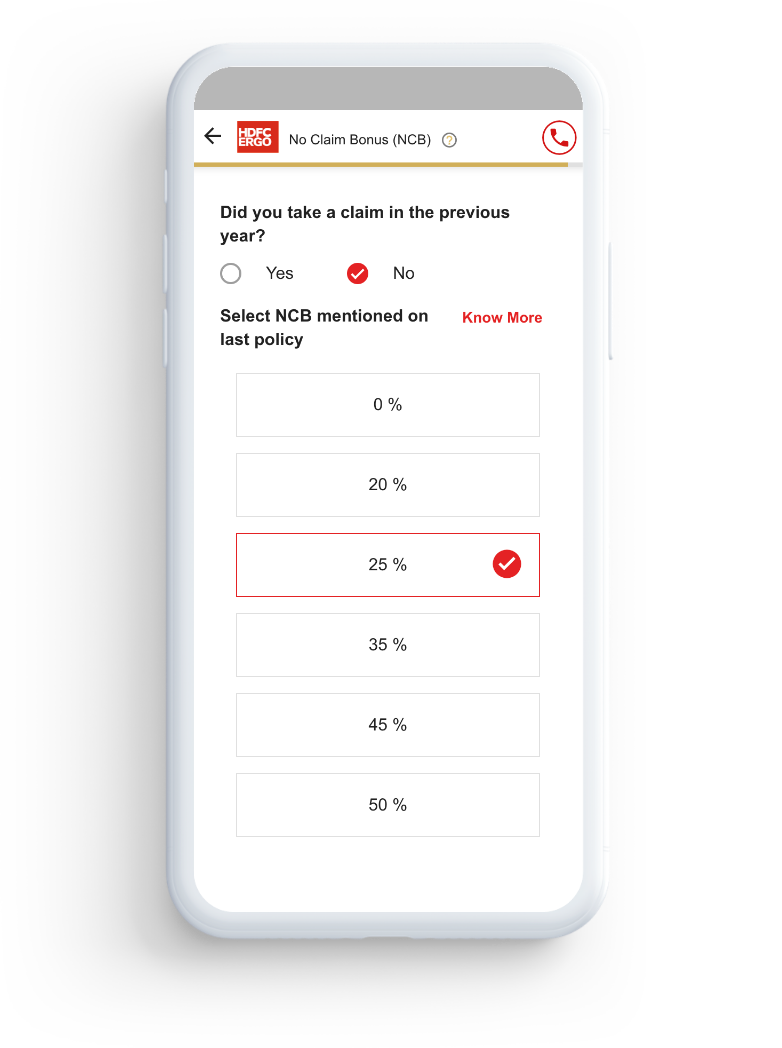

Know Your Premium: Third Party Premium vs. Own Damage Premium

The third party car insurance cover will only provide coverage for third party liabilities. However, own damage cover will provide coverage for

losses to the vehicle by any unwanted events. Let us see the difference below

| Third Party Premium | Own damage Premium |

| It is less expensive as the coverage is limited. | It is expensive compared to third party cover. |

| It provides coverage for only damages done to third party property or person. | It provides coverage for any losses to vehicle due to an insurable peril like floods, earthquakes, fire, theft, etc. |

| The premium is fixed as per IRDAI. | The premium differ depending on the age of the vehicle, add-ons chosen, model of the vehicle, etc. |

Mahindra Car Insurance Policy Inclusions and Exclusions

Accidents

Fire and Explosion

Theft

Calamities

Personal Accident

Third Party Liability

The Perfect Companion to Your Mahindra Car Insurance - Our Add On Covers

Calculate Your Mahindra Car Insurance Premium in a Breeze

Claims Get Easier With Us!

The world has gone digital, and so has our claim settlement process with these four quick, easy-to-follow steps.

- Step #1Do away with paperwork and share your documents online through our website to register your claim.

- Step #2Opt for a self-inspection or a digital inspection of your Mahindra by a surveyor or workshop partner.

- Step #3Track your claim status through our smart AI-enabled claim tracker.

- Step #4Relax while your claim is approved and settled with our extensive network garages!

Find Us Wherever You Go

Our car insurance policy protects your vehicle no matter wherever you travel in India. You need not worry in your journey now as we have a wide network of 8700+ exclusive cashless garages for your Mahindra located across the country. You can rely on our expertise services without taking any stress about paying in cash for repairs.

With the Cashless Garage facility from HDFC ERGO, you can rest assured that your Mahindra car is always near our network garages. Hence, you can drive peacefully without thinking anything about any unfortunate breakdown that your car might face in the middle of your journey.

Car Insurance for Popular Brands

cashless Garagesˇ Across India

Top Tips for Your Mahindra Car

• If you are parking your Mahindra car outside, make sure you to put a cover on the vehicle.

• Remove spark plug, if you are planning to leave your Mahindra car at a stationary position for long time. This will help avoid rust inside the cylinder.

• Fill up the fuel tank when leaving your Mahindra car parked for long time. This will prevent rusting of fuel tank.

• Check your tyre, engine oil of your Mahindra car before setting off for a long journey.

• Keep electrical switch off, when not needed, this will increase your Mahindra car battery life.

• Regularly check tyre pressure of your Mahindra car.

• Keep your Mahindra car engine clean.

• Change lubricant and oil filter regularly.

• Try not to drive your Mahindra car through potholes. Also, drive slowly over speed bumps. Going fast over potholes and speed bumps can damage tyres, suspension shock absorbers.

• Avoid sharp braking at regular intervals. Sudden braking on wet or icy roads can cause you to lose control very quickly if the ABS Brakes (Anti Lock Braking System) lock up.

• Use The Hand Brake While Parking your Mahindra car.

• Avoid overloading your vehicle as it may put load on its components and thereby result in poor fuel mileage of your Mahindra car.

Health Insurance

Health Insurance  Travel Insurance

Travel Insurance  Car Insurance

Car Insurance  Cyber Insurance

Cyber Insurance  Critical Illness Insurance

Critical Illness Insurance

Pet Insurance

Pet Insurance

Bike/Two Wheeler Insurance

Bike/Two Wheeler Insurance  Home Insurance

Home Insurance  Third Party Vehicle Ins.

Third Party Vehicle Ins.  Tractor Insurance

Tractor Insurance  Goods Carrying Vehicle Ins.

Goods Carrying Vehicle Ins.  Passenger Carrying Vehicle Ins.

Passenger Carrying Vehicle Ins.  Compulsory Personal Accident Insurance

Compulsory Personal Accident Insurance  Travel Insurance

Travel Insurance  Rural

Rural