Annual Premium starting

at just ₹538*2000+ Cashless

Network Garages**Emergency Roadside

AssistanceHonda Activa Two Wheeler Insurance

Honda Activa insurance is a two-wheeler policy that protects your Activa scooter from unexpected damages. Launched in 1999, the Activa quickly became one of India’s most popular scooters for daily commuting. Having Honda Activa insurance ensures you don’t end up paying heavy repair bills after accidents or natural disasters.

If you own an Activa, it’s important to keep it well-maintained and protected. You can easily buy Honda Activa insurance online and enjoy peace of mind with add-on covers like Zero Depreciation and No Claim Bonus Protection.

Buying Honda Activa Insurance online from HDFC ERGO involves minimal paperwork. Thereafter, you can renew the plan with just the existing policy number.

Features of Honda Activa Insurance

Some of the features of the Honda Activa two wheeler insurance are listed below:

| Features | Description |

| Third-party damage | The Honda Activa insurance covers the financial liability for property damage and injuries to any third party involved in an accident with the insured vehicle. |

| Own damage cover | The policy pays for damage caused to the insured vehicle by accident, fire, theft, and natural calamities |

| No claim bonus | You can save on your Honda Activa insurance premium by half during renewal by avoiding filing a claim during the policy period. |

| AI-based Claim Assistance | AI-enabled tool IDEAS for processing the claim of your Honda Activa insurance help smoothen up the entire process of cashless claim settlement. |

| Cashless garages | You can access free-of-cost repairs and replacement services at over 2000+ cashless garages with HDFC ERGO two wheeler insurance. |

| Riders | If you purchase Honda Activa insurance via HDFC ERGO, you can expand the coverage scope with 8+ add-ons like zero depreciation, return to invoice, etc. |

Benefits of Honda Activa Insurance

The benefits of having Honda Activa insurance include:

| Benefit | Description |

| Holistic coverage | Honda Activa two wheeler insurance covers almost all the incidents that have the potential to damage your car. |

| Legal charges | The policy covers legal expenditures incurred if someone files a lawsuit against you for an accident involving your vehicle. |

| Adherence to law | You can avoid being penalised because third-party cover in Honda Activa insurance is mandatory by law. |

| Flexible | You can increase the scope of coverage by choosing a suitable rider like no claim bonus protection, engine protection cover, roadside assistance, etc. |

| Cashless Claims | With an extensive network of 2000+ authorised garages of HDFC ERGO, you can get your Honda Activa repaired without having to pay upfront. |

Types of Honda Activa Bike Insurance Plan by HDFC ERGO

A scooter like Honda Activa is great for family use and offers impressive mileage which ensures that you save money on fuel while reaching your destination on time despite the heavy traffic on Indian roads. But simply owning your favourite scooter is not enough, you must also protect it with Honda Activa two wheeler insurance policy. Buying a third party bike insurance policy is mandated by the law, but experts suggest that you buy a comprehensive bike insurance plan as the latter will guarantee a wider coverage against several potential risks. HDFC ERGO offers a variety of plans that will protect your savings in case of an unfortunate event like accident or theft. Here are your options:

If you want all-round protection against damages to your own bike as well as that of third-party person or property, then this is the ideal package for you. You can opt to stay covered for one, two or three years. However, if you want to avoid the renewal hassle every year, we recommend you to secure your Honda Active for three years. Another added benefit of this policy is that you can customise your Honda Active bike insurance with add-ons for enhanced coverage.

.svg)

Accident, theft, fire etc.

Personal accident cover

Natural calamities

Third-party liability

Choice of add-ons

This is a basic type of insurance that provides you financial protection against any liabilities arising due to damage, injury, disablement or loss caused to a third-party person or property. This is a mandatory requirement to drive on Indian roads and if you are caught without a valid Honda Activa third-party insurance, be ready to pay a fine of Rs 2000.

Personal accident cover

Third-party property damage

Injury to a third-party person

Any damage to your own vehicle due to accident, theft or calamities – natural or manmade, will be covered under standalone own damage bike insurance policy. If you already have Honda Active third-party liability insurance, this cover will give you added protection.

.svg)

Accident, theft, fire etc

Natural calamities

Choice of add-ons

If you have purchased a brand-new bike, this cover will offer one year’s protection against loss to your own vehicle and 5 year’s protection against damage to a third-party person or property.

.svg)

Accident, theft, fire etc

Natural calamities

Personal accident

Third-party liability

Choice of add-ons

Inclusions & Exclusions of Honda Activa Insurance

The coverage depends on the policy that you have opted for your Honda Activa bike. If it is third-party liability, then it will provide coverage against any damage only to a third-party person or property. But a comprehensive Honda bike insurance policy will offer protection against the following:

Accidents

Your savings stay intact as we take care of the financial losses arising due to an accident.

Fire & Explosion

Any loss or damage to your bike due to fires and explosion is covered.

Theft

If your Honda Active gets stolen, we will compensate you with the Insured Declared Value of bike.

Natural/Manmade Calamities

We cover any damage caused to your bike due to floods, earthquakes, storms, riots and vandalism.

Personal Accident

You get a personal accident cover of up to Rs 15 lakh to take care of your medical expenses in case of any accident.

Third Party Liability

We provide protection against your financial liabilities in case you cause damage or injury to a third-party person or their property.

You can get two-wheeler insurance for both new and used Honda Activa scooters. Buy Honda Activa Insurance Here!

Honda Activa Two Wheeler Insurance Add-ons

Popular Honda Activa Bike Variants

Honda Activa is India’s highest selling scooter powered by a 109.51cc single cylinder fuel injected engine producing 7.79PS and 8.84Nm. Honda Activa’s latest version is 6G. One of the most significant changes to the Honda Activa 6G from Activa 5G is the presence of the telescopic fork and a larger 12 inch front wheel. The price of Honda Activa 6G in India starts at Rs 76, 234 and goes up to Rs 82,734. Honda Activa 6G comes with 5 variants. Let us see all the variants in the table below.

| Honda Activa 6G | Price (ex-showroom) |

| Honda Activa 6G STD | Rs 76,234 |

| Honda Activa 6G DLX | Rs 78,734 |

| Honda Activa 6G DLX Limited Edition | Rs 80,734 |

| Honda Activa 6G H-Smart | Rs 82,234 |

| Honda Activa 6G Smart Limited Edition | Rs 82,734 |

Honda Activa - Overview & USPs

The Honda Activa 6G is styled after the Activa 125. The LED headlight is only available in the Deluxe variant. The Activa H-Smart Variant gets a smart key that offers a whole range of functions like automatic lock/unlock, engine immobilizer

and keyless start. The H-Smart variant comes with OBD-2 norms compliant. Speaking about latest 6G Activa engine it is 109.51cc single cylinder tuned to produce 7.79PS and 8.84Nm. It also gets an ACG starter (silent starter) and an engine kill

switch. Let us take a look at some of Honda Activa USPs:

Need for Honda Activa Insurance Policy

If you own an Activa or plan to buy one, you must ensure your vehicle has Honda Activa insurance. A bike insurance policy will safeguard your expenses from loss to your vehicle due to an insurable peril like floods, theft, earthquakes, etc. Let us see some reasons to buy Activa insurance

• Legal Requirements – As per the Motor Vehicles Act of 1988, it is compulsory for every vehicle owner to have the third party cover of the motor insurance policy. Therefore, every Activa owner must at least have a third party Activa insurance policy.

• Coverage for Vehicle Damage – If you opt for standalone own damage cover or comprehensive cover, you will get coverage for any damage done to your vehicle due to an insurable peril. In addition to this, you can even opt for add-on covers like no claim bonus protection, zero depreciation, emergency assistance, etc.

• Third Party Liabilities – With the Honda Activa bike insurance policy, you will also get coverage for any damage to the third party person/property involving the insured person's vehicle in that incident.

Why HDFC ERGO's Activa Insurance Should be Your First Choice!

Having two-wheeler insurance is vital. The owner-rider must possess the policy to ride legally in the country. But more importantly, it will keep you financially secure. There are many natural disasters that can cause massive damage to your scooter and repairing it would mean using a good chunk of your savings. Similarly, accidents and thefts can happen without any warning. It can happen to the best of riders and irrespective of how many safety features your bike comes with. A two-wheeler insurance policy from HDFC ERGO will help you avoid these unexpected expenses and give you peace of mind. If you wondering where to get the right kind of insurance, here are the top reasons why you should choose HDFC ERGO for your Honda Activa insurance policy:

24x7 roadside assistance

In case of a breakdown, we are just a call away. Our 24x7 roadside assistance will help you to fix breakdown issues, no matter where you are stranded.

Easy claims

In addition, we offer paperless claims and self-inspection options. Our policyholders can raise claims with ease.

Overnight repair service

With our overnight repair service for minor accidental repairs, you don’t have to wait till the break of dawn to get your bike fixed. You can get your bike repaired overnight without losing sleep and get it back in perfect shape the next morning.

Cashless assistance

Thanks to HDFC ERGO’s 2000+ network garages across India, you will always find a network garage in your vicinity to get your bike repaired.

How to Calculate Activa Insurance Premium?

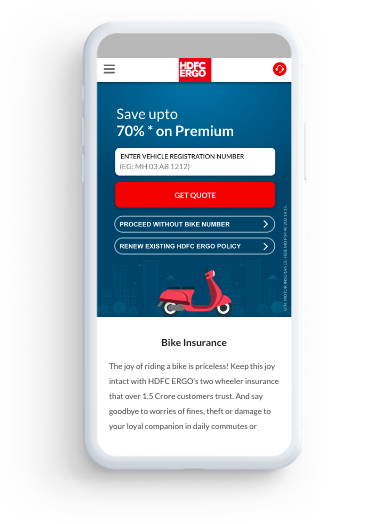

How to Buy/Renew Honda Activa Insurance?

With just few clicks, you can easily buy bike insurance policy for your activa from the comfort of your home. If you already have an active insurance that’s nearing expiry, renew your honda activa insurance on time to enjoy uninterrupted

coverage. Follow the below four-step process and get your bike secured instantly!

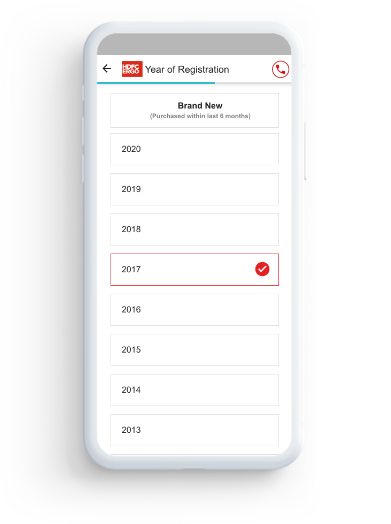

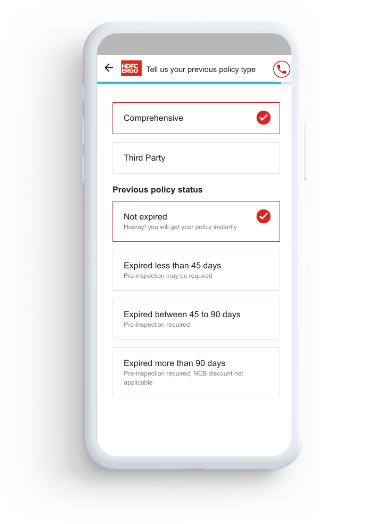

- Step #1Visit HDFC ERGO website and choose to buy or renew your policy

- Step #2Enter your bike details, registration, city, and previous policy details, if any to buy new policy

- Step #3Provide your email ID, and phone number, to receive the quote

- Step #4Make the online payment and get covered instantly!

Benefits of Buying Honda Activa Insurance Online

We live in a digital era where everything can be purchased on your fingertips. When it comes to Honda Activa insurance renewal you can simply buy it online without any worry. Let us take a look at some benefits below

How to File Honda Activa Bike Insurance Claim?

If you want to raise cashless claim against your Honda Activa two wheeler insurance policy, then you will have to go through following steps:

• Inform the HDFC ERGO claim team regarding the incident by calling on our helpline number or sending a message on WhatsApp on 8169500500.

• Take your two-wheeler to HDFC ERGO cashless network garage. Here, your vehicle will be inspected by an individual appointed by the insurer.

• After receiving our approval, the garage will begin to repair your bike.

• Meanwhile, submit the required documents and the duly filled claim form to us. If any specific document is required, we will inform you of the same.

• The HDC ERGO claim team will verify the details of the cashless claim in bike insurance and will either accept or reject the claim.

• Upon successful verification, we will settle a cashless bike insurance claim by paying the repair expenses directly to the garage. Remember that you might have to pay the applicable deductibles, if any, out of your own pocket.

Note: In the case of third-party damage, you can take the details of the other vehicle's owner involved in the accident. However, for significant damage or theft of your vehicle, you have to file an FIR report at the nearest police station before initiating the cashless bike insurance claim process

Documents Required for Activa Two Wheeler Insurance Claim

Here are list of documents required to file Activa Two Wheeler insurance claim

1. Registration Certificate (RC) Book copy of your Honda Activa.

2. Driver's license copy of the individual driving the insured vehicle at the time of the incident.

3. FIR copy filed at the nearby police station of the incident.

4. Repair estimates from the garage

5. Know Your Customer (KYC) documents

Additional Documents Required for Activa Theft Claims

Here are the list of additional documents required for filing Activa Theft Claims

• Original Activa Two wheeler Insurance Policy Documents

• Theft endorsement from the concerned Regional Transport Office

• Service booklets/bike keys and the warranty card

• Previous Two Wheeler Insurance Details like two wheeler insurance policy number, insurance company details and duration of the policy period

• Police FIR/ JMFC report/ Final investigation report

• An approved copy of the letter addressing the concerned RTO regarding the theft and declaring the bike as "NON-USE."

Honda Activa 6G Variants with Insurance Premium Price

Assumptions taken:

1. Registration in Mumbai

2. Recommended IDV taken

3. Personal accident rider not taken

4. A Standalone Own-damage insurance plan is not available for brand-new bikes without a valid 5-year third-party-only insurance plan.

| VARIANT NAME | EX-SHOWROOM PRICE (INR) | COMPREHENSIVE COVER PRICE (INR), excluding GST with 1 year Own-Damage + 5 year Third-party cover | THIRD-PARTY COVER PRICE (INR) with Mandatory 5-year cover |

| Honda Activa 6G Deluxe (110CC) | ₹ 93,155 | 4274 | 3851 |

| Activa 6G Deluxe - Limited Edition (110 CC) | ₹ 94,801 | 4385 | 3851 |

| Activa 6G Standard (110 CC) | ₹ 90,448 | 4310 | 3851 |

| Activa 6G H-Smart - Limited Edition (110 CC) | ₹ 96,984 | 4394 | 3851 |

| Activa 6G Premium ED BSVI (110 CC) | ₹ 86,313 | 4334 | 3851 |

Factors Affecting Activa Insurance Price

Some common factors that affect the Honda Activa insurance price include:

How to Buy or Renew Insurance for Your Second-Hand Honda Activa?

While purchasing a second-hand bike, you have to ensure complete ownership transfer following all the legal norms. Be it a pre-owned vehicle or a new one, you have to maintain a valid vehicle insurance. You need to follow these steps to purchase or renew second-hand Activa insurance:

• Visit the official Ergo website

• Upload the scanned copies of all the relevant documents, including RC (Registration Certificate), your identity proof, etc.

• Once you initiate this procedure, the concerned insurance company will send a representative for inspection.

• Once approved, you can pay the premium digitally and complete the insurance purchase process.

Note that, in the case of renewal, there is no inspection. You can continue using the same insurer by entering the previous policy details.

Maintenance Tips for Your Activa

If you are the owner of Honda Activa, here some of the basic tips to keep your scooter in best condition.

• Avoid overspeeding and ride your vehicle between 40–60 km/hr.

• Don’t overload your vehicle with heavy stuff while riding. Not only it is dangerous, but it also affects the fuel efficiency of the vehicle.

• Always remember to get your Activa serviced after every 1800-2000 km.

• Always maintain correct airpressure in tyres.

• Avoid riding the vehicle in reserve and always keep the petrol tank above half.

• Try to park your Activa in shade and avoid parking in excessive sunlight.

• Keep your Activa clean and get it washed regularly with proper two wheeler cleaning liquid.

Across India

Health Insurance

Health Insurance  Travel Insurance

Travel Insurance  Car Insurance

Car Insurance  Cyber Insurance

Cyber Insurance  Critical Illness Insurance

Critical Illness Insurance

Pet Insurance

Pet Insurance

Bike/Two Wheeler Insurance

Bike/Two Wheeler Insurance  Home Insurance

Home Insurance  Third Party Vehicle Ins.

Third Party Vehicle Ins.  Tractor Insurance

Tractor Insurance  Goods Carrying Vehicle Ins.

Goods Carrying Vehicle Ins.  Passenger Carrying Vehicle Ins.

Passenger Carrying Vehicle Ins.  Compulsory Personal Accident Insurance

Compulsory Personal Accident Insurance  Travel Insurance

Travel Insurance  Rural

Rural