Travel Insurance

Falling sick or facing a dental emergency abroad can derail your trip and drain your wallet, as healthcare costs in foreign countries are often sky high. That’s why International Travel Insurance isn’t just a formality, it’s your essential shield and safety net. From covering medical and dental bills to reimbursing for lost luggage or passports, support is always just a call away. With the latest GST reforms effective September 22, 2025, travel insurance plans in India now come with 0% GST, making this crucial protection more affordable than ever.

Before you pack your bags, secure your journey with HDFC ERGO’s travel insurance, offering coverage for coronavirus hospitalisation and access to 1Lac+ cashless hospitals worldwide. Buy travel insurance online with ease & keep your trip safe, seamless, and worry-free.

Key Benefits of HDFC ERGO's Travel Insurance?

Covers Emergency Medical Assistance

Met with an unexpected medical emergency, in a foreign territory? Travel insurance, with its emergency medical benefits, is just the friend you need during such a toughtime. Our 1,00,000+ cashless hospitals are there to take care of you.

Covers Travel Related Inconveniences

Flight delays. Loss of baggage. Financial emergency. These things can be quite unsettling. But with travel insurance backing you up, you can keep calm and carry on.

Covers Baggage-Related Hassles

Buy #SafetyKaTicket for your travel. Whenever you’re travelling abroad all baggage carries all your essentials, and we cover you against baggage loss and baggage delay for checked-in baggage.

Affordable Travel Security

Secure your international trips without breaking the bank. With affordable premiums for every kind of budget, the benefits of travel insurance far outweigh the costs.

Round-the-clock Assistances

Time zones don’t get in the way of a good travel insurance plan. No matter what time it is in your part of the world, dependable assistance is just a call away. Thanks to our in-house claim settlement & customer support mechanism.

1 Lac+ Cashless Hospitals

There are a million things you can take on your trips; worry shouldn’t be one of them. Our 1 Lac+ cashless hospitals networked worldwide will make sure your medical expenses are covered.

Features of HDFC ERGO Travel Insurance Policy

| Key Features | Benefits |

| Cashless Hospitals | 1,00,000+ cashless hospitals worldwide. |

| Countries Covered | 25 Schengen countries+ 175+Other countries. |

| Coverage Amount | $40K to $1,000K |

| Health Check-up Requirement | No health check-up is required prior travelling. |

| COVID-19 Coverage | Coverage for COVID-19 hospitalisation. |

Start your journey from India with complete peace of mind – Buy travel insurance policy today!

Travel Insurance Plans For All Types Of Travellers

Please refer to the list of Active Products & Withdrawn Products before purchasing any policy.

Compare Travel Insurance Plans Online

| Covers under Travel Insurance | Individuals/Family | Frequent flyers |

|---|---|---|

| Suitable for | ||

| No. of Members in a Policy | ||

| Maximum Stay duration | ||

| Places you can travel | ||

| Coverage amount options |

What Does HDFC ERGO Travel Insurance Policy Cover?

Emergency Medical Expenses

This benefit covers hospitalization, room rent, OPD treatment, and Road Ambulance costs. It also reimburses expenses incurred on Emergency Medical Evacuation, Medical Repatriation and Repatriation of mortal remains.

Dental Expenses

We believe dental healthcare is just as important as hospitalization due to physical illness or injury; hence, we cover dental expenses which can occur during your travel. Subject to policy terms and conditions.

Personal Accident

We believe in seeing you through thick and thin. In the event of an accident, while traveling abroad, our insurance plan provides a lump sum payment to your family to assist with any financial burdens caused by permanent disablement or accidental death.

Personal Accident : Common Carrier

We believe in being by your side through ups and downs. So, under unfortunate circumstances, we will provide alump sum payout in case of accidental death or permanent disablement arising out of an Injury whilst on a Common Carrier.

Hospital cash - accident & illness

If a person is hospitalized due to injury or illness, we will pay the per day Sum Insured for each complete day of hospitalization, up to the maximum number of days stated in the Policy Schedule.

Flight Delay & Cancellation

Flight delays or cancellations may be beyond our control, but worry not, our reimbursement feature allows you to meet any essential expenses arising from the setback.

Trip Delay & Cancellation

In case of a trip delay or cancellation, we will refund the non-refundable portion of your pre-booked accommodation and activities. Subject to policy terms and wordings.

Loss of Passport & International driving license

Losing important documents can leave you stranded in a foreign land. So, we will reimburse expenses related to obtaining a new or duplicate passport and/or international driving license.

Trip Curtailment

Don't worry if you have to cut your trip short due to unforeseen circumstances. We'll reimburse you for your non-refundable accommodation and pre-booked activities as per the policy schedule.

Personal Liability

If you ever find yourself liable for third-party damage in a foreign land, our travel insurance helps you compensate for those damages effortlessly. Subject to policy terms and conditions.

Emergency Hotel Accommodation for Insured Person

Medical emergencies may mean you need to extend your hotel booking by a few days more. Worried about the added expense? Let us take care of it while you recover.subject to policy terms and conditions

Missed Flight Connection

Don't worry about unexpected expenses due to missed flight connections; we will reimburse you for the expenses incurred on accommodation and alternate flight booking to reach your destination.

Hijack Distress Allowance

Flight hijacks can be a distressing experience. And while the authorities help sort out the issue, we'll do our bit and compensate you for the distress it causes.

Emergency Cash Assistance Service

When traveling, theft or robbery can lead to a cash crunch. But don't worry; HDFC ERGO can facilitate fund transfers from the insured 's family in India. Subject to policy terms and conditions.

Loss Of Checked-In Baggage

Lost your checked-in baggage? Don't worry; we'll compensate you for the loss, so you don't have to go without your essentials and vacation basics. Subject to policy terms andconditions.

Delay of Checked-In Baggage

Waiting is never fun. If your luggage gets delayed, we'll reimburse you for essentials like clothing, toiletries and medication so you can start your vacation worry-free.

Theft of baggage and its contents

Theft of baggage can derail your trip. So, to ensure your trip stays on track, we'll reimburse you in case of baggage theft. Subject to policy terms and conditions.

The above mentioned coverage may not be available in some of our Travel plans. Please read the policy wordings, brochure and prospectus to know more about our travel insurance plan.

What Does HDFC ERGO’s Travel Insurance Plan Not Cover?

Breach of Law

Sickness or health issues caused due to war or a breach of the law is not covered by the plan.

Consumption of Intoxicant substances

If you consume any intoxicants or banned substances, the policy shall not entertain any claims.

Cosmetic and Obesity Treatment

Should you or any member of your family opt to undergo any cosmetic or obesity treatment during the course of the travel you’ve insured, such expenses remain uncovered.

Self Inflicted Injury

Any hospitalization expenses or medical costs arising from self-inflicted injuries are not covered by the insurance plans we offer.

Get comprehensive travel insurance cover for medical, trip, and baggage – Apply online today!

Why Do You Need Overseas Travel Insurance Policy?

With HDFC ERGO travel insurance policy, you can go for a trip without worrying about anything. We provide coverage for untimely expenses that might occur during your journey like, loss of luggage, missing out on connecting flight, or the risk of getting infected by COVID-19. Hence to avoid creating a big hole in your pocket due to any unwanted events, buying comprehensive International travel insurance is a must.

Our travel insurance will essentially secure you under following circumstances:

Medical Expenses

Loss of Documents & Baggage

Flight Delays

Delay in baggage arrival

Emergency dental expenses

Emergency financial assistance

International Travel Insurance for Most Visited Countries

Take your pick from the options below, so you can be better prepared for your trip to a foreign country

List Of Countries Where Travel Insurance Is Mandatory

Here are some of the countries that require mandatory overseas travel insurance: This is an indicative list. It is advisable to check each country’s visa requirement independently before travel.

Source: VisaGuide.World

Does HDFC ERGO’s Travel Insurance Cover COVID-19?

The world is returning to normal after being in the clutches of the COVID-19 pandemic for the longest time, but unforeseen disruptions can still arise. While COVID-19 may no longer dominate headlines, our policy continues to offer protection for related medical expenses abroad, including hospitalization. Stay prepared for the unexpected—because a well-planned journey is a worry-free one. HDFC ERGO’s international travel insurance policy ensures that you are protected if you catch COVID-19.

Here’s what is covered under the travel medical insurance for COVID-19 -

● Hospitalisation expenses

● Cashless treatment at network hospitals

● Daily cash allowance during hospitalisation

● Medical evacuation

● Extended hotel stay for treatment

● Medical and body repatriation

Travel anywhere with confidence – Buy international travel insurance policy from India now!

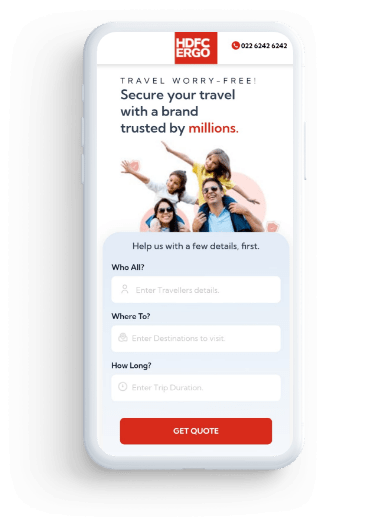

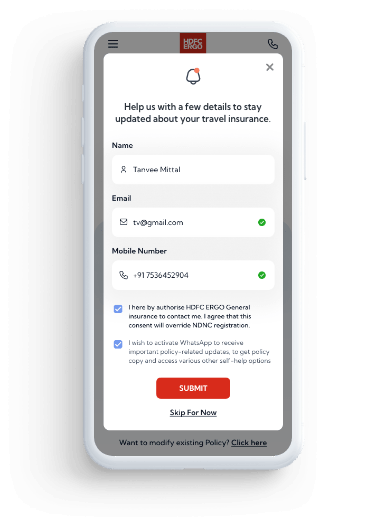

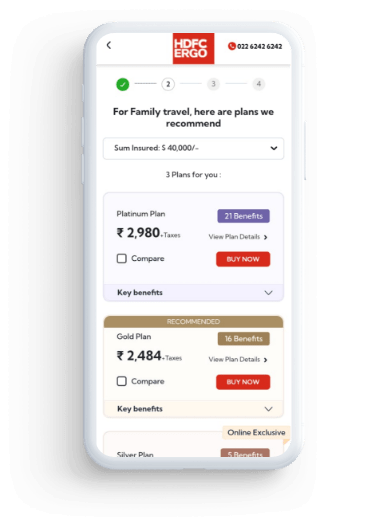

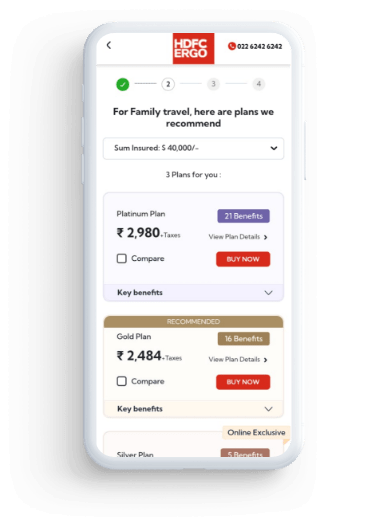

How to Buy Travel Insurance Online?

• Click here link, or visit the HDFC ERGO travel insurance webpage to BUY our policy.

• Enter traveler details, destination information, and trip start and end dates.

• Choose your preferred plan from our three tailored options.

• Provide your personal details.

• Fill in additional details about the travelers and proceed to pay using online payment methods.

• All that's left to do is- download your policy instantly!

Things to Consider Before Buying Travel Insurance

The duration of your trip

The longer your trip, the higher the insurance premium will be, since the risk involved in longer stays abroad is higher.

The destination of your trip

If you’re travelling to a country that is safer or economically more stable, the insurance premium will likely be lower.

The amount of coverage you need

Higher the sum insured higher will be your travel insurance premium.

Your renewal or extension options

You can extend or renew your travel insurance whenever it’s about to expire. Refer policy document for more details.

The age of the traveller(s)

Typically, older travellers may be charged a higher premium. This is because the probability of medical emergencies occurring increases with age.

Common Myths About Travel Insurance

Myth 1 :

"I'm Healthy, so Travel Insurance is Pointless!"

"I'm Healthy, so Travel Insurance is Pointless!"

Myth Buster: Even the healthiest of people can encounter mishaps while travelling. Travel insurance covers unexpected problems like accidents, lost luggage, or trip cancellations. It’s not just about medical issues but provides overall protection during your journey.

Myth 2 :

"Travel Insurance is Only for Frequent Travelers!"

"Travel Insurance is Only for Frequent Travelers!"

Myth Buster: Travel insurance is essential for all travelers, whether you journey frequently or occasionally. It's designed to protect anyone who loves exploring new destinations.

Myth 3 :

“Travel Insurance isn’t available for Senior Citizens!"

“Travel Insurance isn’t available for Senior Citizens!"

Myth Buster: Age is just a number, especially in the world of travel insurance! Senior citizens can travel worry-free knowing there are policies tailored just for them.

Myth 4 :

"It's Just a Quick Getaway – Who Needs Travel Insurance for That?"

"It's Just a Quick Getaway – Who Needs Travel Insurance for That?"

Myth Buster: Accidents can occur at any time and in any place, without prior notice or invitation. Whether it's three days or thirty, travel insurance is your safety net, no matter the time duration.

Myth 5 :

" Travel insurance is mandatory only for Schengen countries. Do I still need travel insurance for other countries?"

" Travel insurance is mandatory only for Schengen countries. Do I still need travel insurance for other countries?"

Myth Buster: Why limit yourself to only Schengen countries? Unforeseen events like medical emergencies, baggage loss, flight delays, etc. can happen in any country. Let travel insurance be your global guardian to travel worry-free.

Myth 6 :

"Travel Insurance is too Expensive!"

"Travel Insurance is too Expensive!"

Myth Buster: While travel insurance may seem like an added cost, it provides peace of mind for potential expenses from flight cancellations, medical emergencies, or trip interruptions. Additionally, you can compare various plans and choose the one that best meets your needs & budget.

Know your Travel insurance premium In 3 Easy Steps

GST on Travel Insurance Premiums

Travel insurance is necessary for Indian travellers heading abroad, covering risks like flight delays, lost luggage, etc. The cost of travel insurance in India is influenced by the Goods and Services Tax (GST). As per GST 2.0 which will come into effect from 22nd September, 2025, GST is exempted from travel insurance premiums.

Effect of Revised GST on Air Travel & Travel Insurance

| Category | Old GST% | Revised GST% (WEF 22nd Sep, 2025) |

|---|---|---|

| Premium air tickets (business/first class) | 12% GST including the Input Tax Credit | 18% GST |

| Economy air tickets | 5% GST | 5% GST (unchanged) |

| Travel Insurance Premium | 18% GST including the Input Tax Credit | Exempt |

GST on Travel Insurance Add-on:

GST on travel insurance add-on like medical evacuation, trip cancellation, etc., will not attract 18% GST and would be exempt from 22nd September, 2025 onwards.

Claim Settlements

Travel Insurance claim settlement has nothing to do with the GST. The insurer will reimburse money as per the limit without considering the GST. Goods and Service Tax only applies on travel insurance premiums.

Factors That Affect Your Travel Insurance Premium

The country you’re travelling to

The duration of your trip¨

The age of the traveller(s)

The extent of coverage you choose

Check your travel insurance premium online instantly – Find the perfect plan for your budget!

How to Claim Travel Insurance?

The claim process of HDFC ERGO travel insurance is an easy 4 step process. You can make a travel insurance claim online on a cashless as well as reimbursement basis.

Intimation

Intimate claim to travelclaims@hdfcergo.com / medical.services@allianz.com and get a list of network hospitals from TPA.

Checklist

travelclaims@hdfcergo.com will share the checklist of documents required for cashless claims.

Mail Documents

Send the cashless claim documents and policy details to our TPA partner- Allianz Global Assistance, at medical.services@allianz.com.

Processing

Our concerned team will contact you within 24 hours for the further cashless claim process as per policy terms & conditions.

Intimation

Intimate claim to travelclaims@hdfcergo.com and get a list of network hospitals from TPA.

Checklist

travelclaims@hdfcergo.com will share the checklist of documents required for reimbursement claims.

Mail Documents

Send all required documents to travelclaims@hdfcergo.com for reimbursement as per the Checklist

Processing

Upon receipt of complete documents, the claim will be registered and processed within 7 days as per policy terms & conditions.

Please refer to the Policy Issuance & Servicing TATs

Cashless Hospital Network in Travel Insurance

Traveling abroad can come with unexpected medical emergencies, and having the right support makes all the difference. Cashless travel insurance ensures that you receive immediate care at top hospitals worldwide without the need for complete upfront payments or navigating elaborate reimbursement processes. With HDFC ERGO, you’re covered under an extensive network of cashless hospitals across major destinations like the USA, UK, Thailand, Singapore, Spain, Japan, Germany, Canada, and more, allowing you to focus on recovery rather than financial worries.

Emergency medical care coverage

Access top hospitals worldwide

Simplified medical expense handling

Over 1 lakh+ cashless hospitals

Hassle-free claims

Travel Insurance Policy Documents

| Brochure | Claim Form | Policy Wordings |

| Get details on the key features and benefits of travel insurance policy. Our travel insurance brochure will help you know in and out about our policy. With the help of our brochure, you will understand the proper terms and conditions of the HDFC ERGO travel insurance policy. | Want to claim your travel policy? Know More to download the travel insurance claim form and fill in the required details for hassle free claim settlement. | Please refer the Travel Insurance policy wordings to know more about the terms and conditions under travel insurance. Get more details on coverages and features offered by HDFC ERGO travel insurance plan. |

Travel Insurance Terms Explained

Confused about all the travel insurance jargon floating around? We’ll make it easier for you by decoding some commonly used travel insurance terms.

Emergency Care

Emergency Care refers to the treatment of an illness or injury that occurs suddenly and unexpectedly. It requires immediate medical attention by a qualified Medical Practitioner to prevent death or serious long-term damage to the insured person’s health.

Day Care Treatment

Day Care Treatment includes medical or surgical procedures that are performed under general or local anesthesia in a hospital or day care center and do not require a stay of more than 24 hours due to technological advancements.

In-Patient Care

In-Patient Care means treatment for which the insured person is required to stay in a hospital for more than 24 hours for a covered medical condition or event.

Cashless settlement

Cashless settlement is a kind of claim settlement process where the insurer directly pays the costs involved in case of any insurable loss on behalf of the policyholder.

OPD Treatment

OPD Treatment refers to situations where the insured visits a clinic, hospital, or consultation facility for diagnosis and treatment based on the advice of a medical practitioner, without being admitted as an in-patient.

AYUSH Treatment

AYUSH Treatment includes medical or hospitalization treatments provided under Ayurveda, Yoga and Naturopathy, Unani, Siddha, and Homeopathy systems of medicine.

Pre-Existing Disease

Refers to any condition, ailment, injury, or disease that:

a) Was diagnosed by a medical practitioner within 36 months before the

policy’s effective date or its reinstatement, or

b) For which medical advice or treatment was recommended or received from a

medical practitioner within the same timeframe.

Policy Schedule

Policy Schedule is the document attached to and forming part of the policy. It contains details of the insured persons, the sum insured, the policy period, and the applicable limits and benefits under the policy. It also includes any annexures or endorsements made to it, with the latest version being considered valid.

Common Carrier

Common Carrier refers to any scheduled public transport carrier, such as road, rail, water, or air services, operating under a valid license issued by the government and responsible for transporting fare-paying passengers. Private taxis, app-based cab services, self-driven vehicles, and chartered aircraft are not included in this definition.

Policyholder

Policyholder means the person who has purchased the policy and in whose name it has been issued.

Insured Person

Insured Person refers to the individuals named in the policy schedule, insured under the policy, and for whom the applicable premium has been paid.

Network Provider

Network Provider includes hospitals or healthcare providers enlisted by the insurer to offer medical services to the insured through a cashless facility.

Travel Insurance Reviews & Ratings

Travel Insurance News

Read Latest Travel Insurance Blogs

Travel-o-guide - Simplifying your Travel Journey

Frequently Asked Questions on Travel Insurance

1. Is a medical checkup necessary before the policy is purchased?

We have good news for you here. A medical checkup is not necessary if you’re planning to buy the HDFC ERGO travel insurance policy. You can bid goodbye to health checkups and purchase travel insurance without any hassle.

2. Can you buy travel insurance after booking your trip?

Yes, you most certainly can buy travel insurance after you’ve made a booking for your trip. In fact, it’s a smart idea to do so, because that way, you will have a better idea of the details of your trip, such as the start date, the end date, the number of people accompanying you and the destination. These details are all essential to determine the cost of your travel insurance cover.

3. In which Schengen countries is travel insurance mandatory?

Travel insurance is mandatory for traveling to all 26 Schengen countries.

4. Can more than one policy be issued for the same trip?

No. HDFC ERGO does not provide multiple insurance plans to the same person for the same trip.

5. Is it mandatory for the customer to be in India for international travel policy issuance?

Policy can be taken only if the insured is in India. Cover is not offered for individuals who have already travelled abroad.

6. How does travel insurance work?

Travel insurance acts as a financial safety net and protects you against the possible financial repercussions of unexpected emergencies on your journey. When you purchase a travel insurance policy, you essentially buy

a cover against certain insurable events. It offers medical, baggage-related and journey-related coverage.

In case any of the insured events, like flight delays, loss of baggage, or medical emergencies occur,

your insurer will either reimburse the additional costs that you incur on account of such incidents, or they shall offer a cashless claim settlement for the same.

7. Is it necessary to get prior approval of the insurance provider before proceeding with medical treatment should the necessary arises?

Emergency medical needs must be treated in time if the need arises. And that is why it is not necessary to get any sort of prior approval from the insurer before you proceed with medical treatment, but it is better to inform the insurance company of the claim. However, the nature of the treatment and the terms of the travel insurance policy will determine if the treatment is covered by the travel insurance.

8. Is travel insurance mandatory?

Well, that depends on where you’re travelling to. To be more specific, there are 34 countries that have made travel insurance mandatory, so you’ll need to purchase a cover before you travel there. These countries include Cuba, The United States of America, The United Arab of Emirates, Ecuador, Antarctica, Qatar, Russia, Turkey and the group of 26 Schengen countries.

9. What are the age criteria for which you issue a travel insurance policy online in India?

single trip-91 days to 70 years. AMT same, family floater – from 91 days to 70 years, insuring upto 20 people.

The exact age criteria vary from one travel insurance policy to another, and also from one insurer

to the next. For the travel insurance policy from HDFC ERGO, the age criteria depend on the kind of cover you opt for.

• For single trip insurance, people aged between 91 days and 70 years can be insured.

• For annual multi trip insurance, people aged between 18 and 70 years can be insured.

• For family floater insurance, which covers the policyholder and up to 18 other immediate family members,

the minimum age of entry is 91 days and can be insured up to 70 years.

10. When should you buy a travel insurance policy?

That depends on the number of trips you’ll be taking during the year. If you’ll likely just take the one trip, you will want to purchase a single trip cover. The ideal time to buy a travel policy for a single trip is within a couple of weeks of booking your flight tickets. On the other hand, if you plan to take multiple trips during the year, it would be a better idea to purchase your travel insurance plan well in advance, before you book your various trips.

11. Are business travellers eligible to purchase a Travel Insurance policy?

Yes, Indian Nationals travelling abroad for business can purchase travel insurance policy.

12. When does the travel insurance cover begin and end?

Travel insurance is usually taken for the duration of travel. The policy will mention the start and end date on its schedule.

13. Where can customers access the list of network hospitals?

You can find your preferred hospital from among HDFC ERGO’s list of partner hospitals https://www.hdfcergo.com/locators/travel-medi-assist-detail or send mail to travelclaims@hdfcergo.com.

14. Can I buy travel insurance after leaving the country?

Unfortunately, you cannot buy travel insurance after leaving the country. The traveller needs to ensure availing of the travel insurance policy before travelling abroad.

15. What are the sublimits of this product?

No sub-limit has been specifically imposed for customers visiting Schengen countries.

For insured individuals below 61 years of age, there are no sub-limits applicable under travel medical insurance.

Sub-limits

are applicable to insured individuals aged 61 years and older for various expenses, including hospital room and boarding, physician fees, ICU and ITU charges, anaesthetic services, surgical treatment, diagnostic

testing expenses, and ambulance services. These sub-limits are applicable to all travel insurance policies regardless of the plan purchased. For more details, refer to the product prospectus.

16. Does travel insurance cover OPD?

17. Do I need a travel insurance before buying a visa?

No, you cannot buy travel insurance after starting your trip. The policy should be bought before the trip has commenced.

18. How do I choose a travel policy?

You should choose a travel insurance plan based on your travel needs. Here’s how –

● If you are travelling solo, choose an individual policy

● If you are travelling with your family, a family travel insurance plan would be suitable

● If a student is travelling for higher education, choose a student travel insurance plan

● You can also choose the plan based on your destination, like a Schengen travel plan, Asia travel plan, etc.

● If you travel frequently, choose an annual multi-trip plan

After you have shortlisted the type of plan that you want, compare the different policies in that category. There are different insurance companies offering travel insurance plans. Compare the available policies on the basis of the following –

● Coverage benefits

● Premium rates

● Ease of claim settlement

● International tie-ups in the country that you are travelling to

● Discounts, etc.

Choose a policy that offers the most inclusive coverage benefits at the most competitive rate of premium. Choose an optimal sum insured and buy the best plan for securing the trip.

19. Can you buy travel insurance at the airport?

Yes, you can buy travel insurance at the airport through kiosks, mobile apps, or insurer websites. It’s a convenient last-minute option, but it’s recommended to buy travel insurance as soon as your trip is booked.

20. How to buy a travel insurance for multiple trips in a year?

Consider purchasing an annual multi-trip travel insurance policy that covers numerous trips. HDFC Ergo offers multiple trip global coverage with options for cashless hospitalization, baggage loss, emergency hotel extension, and much more. The best part is that it eliminates the hassle of multiple renewals. You can buy it for a year and travel as much as you wish without worrying about getting travel insurance for every single trip.

1. Does travel insurance cover flight cancellation?

Yes, we will reimburse the Insured Person for non-refundable flight cancellation expenses incurred in the event of a flight cancellation.

2. What benefit will I get from this insurance in case of a medical emergency?

This benefit covers hospitalization, room rent, OPD treatment, and Road Ambulance costs. It also reimburses expenses incurred on Emergency Medical Evacuation, Medical Repatriation and Repatriation of mortal remains.

Source : https://www.hdfcergo.com/docs/default-source/downloads/prospectus/travel/hdfc-ergo-explorer-p.pdf

3. Will pre-existing diseases be covered under the travel insurance policy?

No. The HDFC ERGO travel insurance policy does not cover any expenses related to the treatment of a pre existing disease or condition in the duration of your insured trip.

4. If I’m being advised to quarantine; are the accommodations or re-booking expenses covered?

Accommodation or re-booking expenses resulting from a Quarantine are not covered.

5. Which conditions are covered under medical coverage?

Medical benefit covers hospitalization, room rent, OPD treatment, and Road Ambulance costs. It also reimburses expenses incurred on Emergency Medical Evacuation, Medical Repatriation and Repatriation of mortal remains. Cashless facility is available for receiving treatments at the insurer’s network hospitals.

6. What is flight insurance?

7. What do I do if I fall sick when I am overseas?

When you fall sick when travelling contact our Toll free no +800 0825 0825 ( add the area code + ) or chargeable no +91 1204507250 / + 91 1206740895 or write to travelclaims@hdfcergo.com

HDFC ERGO has partnered with Alliance Global Assist for its TPA services. Fill up the online claim form available at https://www.hdfcergo.com/docs/default-source/downloads/claim-forms/travel-insurance.pdf Fill up a ROMIF form which is available at https://www.hdfcergo.com/docs/default-source/documents/downloads/claim-form/romf_form.pdf?sfvrsn=9fbbdf9a_2.

Send the filled and signed claim form, ROMIF forms all the claim-related documents to the TPA at medical.services@allianz.com. The TPA would process your claim request, look for the networked hospitals and assist you with the hospital list so that you can get the medical attention that you need.

1. How can I cancel my travel insurance policy?

Cancelling your travel insurance policy is quite easy. You can place your cancellation request via email or fax. Do make sure that the cancellation request reaches up within 14 days from the policy’s inception

date.

In case the policy is already in force, you’ll also need to submit a copy of all the 40 pages of your passport, as a proof that the journey has not been undertaken. Do note that cancellation charges

of Rs. 250 will be applicable, and the balance amount paid will be refunded.

2. Can I extend my policy?

Currently we cannot extend the policy

3. What is the maximum number of days for which I can take the travel insurance policy?

For a single trip policy, one can get insured for up to 365 days. Incase of an annual multi-trip policy, one can get insured for multiple trips, but for a maximum duration of 120 consecutive days.

4. Does HDFC ERGO's travel insurance policy come with a free-look period?

4. Does HDFC ERGO's travel insurance policy come with a free-look period?

No. The HDFC ERGO travel insurance policy does not come with a free-look period.

5. Is there a grace period in travel insurance policy?

Grace period is not applicable to any cover for travel insurance policy.

6. What sum insured should be opted for while traveling to Schengen countries?

The Schengen countries require a minimum insurance of Euro 30,000. Insurance should be bought for an equivalent or higher amount.

7. Are there any sub-limits applicable for Schengen countries?

There are sub-limits applicable for availing travel insurance policy for Schengen countries. Please refer the policy documents to know that sub-limits.

8. If the customer returns home earlier than planned, can he/she get a partial refund on travel insurance?

No, the product does not offer any refund for early returns.

9. What are the charges for policy cancellation?

A cancellation charge of Rs 250 will be levied if you cancel your HDFC ERGO travel insurance, irrespective of whether you raise the request before or after your trip begins.

10. Do I get a grace period for my travel insurance policy?

No. There is no grace period applicable for a travel insurance policy.

11. What is my travel insurance coverage requirement sum insured while travelling to any of the Schengen countries?

30,000 Euros

12. How is the travel insurance premium calculated?

The travel insurance premium is calculated considering the following details –

● Type of plan

● Destination

● Trip duration

● Members to be covered

● Their age

● Plan variant and sum insured

You can use HDFC ERGO’s online premium calculators to find the premium of the policy that you want. Enter in your trip details and the premium would be calculated.

13. What is the document provided as proof of travel insurance?

Upon completion of purchase, you can download the policy schedule which will include all the trip details, insured member details, benefits covered and sum insured opted.

14. What are the modes of payment for buying a travel insurance policy?

To buy travel insurance online, you can pay through online payment modes like Debit card, credit card, Net banking, Mobile wallet, UPI and offline payment modes like Cheque and Demand draft.

1. Does a claim have to be lodged or made in a specific time frame from the time of the accident?

In case any of the insured events covered by the travel insurance policy occurs, it’s best to give us a written notice of the incident as soon as practicable. In any case, the written notice must be given within

30 days of such an event occurring.

In case the insured event is the death of a person covered by the plan, the notice must be given immediately.

2. How long does it take to process a travel insurance claim?

We understand that during any emergency financial distress, the sooner we can assist you, the better you’ll be able to get through the crisis. That’s why we settle your claims in record time. While the exact length of the period varies from case to case, we ensure that your claims are quickly settled upon the receipt of the original documents.

3. What kind of documentation is required while making a travel insurance claim?

The kind of documentation depends greatly on the nature of the insured incident that has occured. In case of any loss covered by the travel policy, the following proof must be submitted.

1. The Policy Number

2. The preliminary medical report describing the nature and extent of all injuries or illnesses, and providing a precise diagnosis

3. All invoices, bills, prescriptions, hospital certificates which will permit

us to accurately determine the total amount of medical expenses (if applicable) incurred

4. In the case another party was involved (like in the case of a car collision), the names, contact details and if possible,

the insurance details of the other party

5. In the case of death, an official death certificate, succession certificate pursuant to the Indian Succession Act 1925, as amended, and any other legal documents

establishing the identity of any and all beneficiaries

6. Proof of age, where applicable

7. Any such other information we may require to handle the claim

In case of any accident covered by the

travel policy, the following proof must be submitted.

1. Detailed circumstances of the accident and the names of witnesses, if any

2. Any police reports concerning the accident

3. The date a physician

was seen consulted for the injury

4. The contact details of that physician

In case of any sickness covered by the travel policy, the following proof must be submitted.

1. The date on which

the symptoms of the sickness began

2. The date on which a physician was consulted for the sickness

3. The contact details of that physician

4. What if I lose my baggage? How do I make a claim in such a case?

Losing your baggage during your trip can be inconvenient, because you may need to replace a lot of essentials and spend out of pocket. With a travel insurance policy, you can cushion the financial impact of such a loss.

If you lose your baggage during the period the insurance cover is valid, you can register a claim by calling our 24-hour helpline centre and quote the policyholder’s name, the policy number, the insurance

company, and the passport number. This needs to be done within 24 hours.

Here are our contact details.

Landline:+ 91 - 120 - 4507250 (Chargeable)

Fax: + 91 - 120 - 6691600

Email: travelclaims@hdfcergo.com

Toll free no.+ 800 08250825

You can also visit

this blog for more information.

5. How do I claim on my travel insurance?

In case any loss or insured event covered by your travel policy occurs, you can register a claim by calling our 24-hour helpline centre and quote the policyholder’s name, the policy number, the insurance company,

and the passport number. This needs to be done within 24 hours.

Here are our contact details.

Landline:+ 91 - 120 - 4507250 (Chargeable)

Fax: + 91 - 120 - 6691600

Email: travelclaims@hdfcergo.com

Toll free no.+ 800 08250825

1. Can I renew my travel insurance policy online?

For policy and renewal related queries, contact us at 022 6158 2020

2. How do I check the status of my HDFC ERGO travel insurance renewal?

Only AMT policies can be renewed. Single trip policies cannot be renewed. Extension of single trip policies can be done online.

1. How To Get Travel Insurance With Covid-19 Cover?

HDFC ERGO’s Travel Insurance covers coronavirus hospitalisation. You don’t have to buy separate insurance for COVID-19. Your travel medical insurance will give you cover for the same. You can buy travel insurance online by visiting our website or calling our helpline number 022 6242 6242.

Following are some of the features covered for COVID-19 in travel insurance -

● Hospital expenses if one gets COVID-19 while covered under overseas travel insurance.

● Cashless treatment in network hospitals.

● Reimbursements of medical expenses.

● Daily cash allowance during hospitalisation.

● Expenses related to transferring mortal remains to home country in case of death due to COVID-19

2. When should I buy Covid-19 travel insurance?

Ideally, it would be best if you buy a travel insurance plan like HDFC ERGO's International Travel plan, which covers coronavirus hospitalisation before embarking on your journey. Your travel insurance covers you from the first day of your journey till you return to India. However, it might not be possible to buy one while you are overseas and reap its benefits. So, make it a point to buy your travel medical insurance ahead of time. To avoid last minute hassles buy your insurance as soon as you book tickets for your destination.

3. Does travel insurance cover a positive PCR test?

No, travel insurance doesn’t cover a Positive PCR Test if detected before your journey. However, hospital expenses, medical reimbursements and cashless treatment in network hospitals are provided as mentioned under your travel insurance policy if you get infected with coronavirus while travelling.

4. Can you get a refund on flights if you have COVID?

No, flight cancellations due to COVID-19 infection are not covered under HDFC ERGO’s International Travel Plan.

5. How much does COVID-19 travel insurance cost?

While buying Travel Insurance online, you can opt for Individual Travel Insurance, Family Travel Insurance or Student Travel Insurance, depending on your need and how you plan to travel. Depending on the sum you want to insure, you can also choose from our Gold, Silver, Platinum, and Titanium plans. However, you don’t have to pay extra for COVID-19 coverage. You will be covered for the same in any of the travel plans you choose.

6. Can I get travel insurance with pre-existing conditions and COVID-19 coverage?

Travel Insurance covers emergency medical expenses due to COVID-19. Coverage for preexisting disease varies from one insurer to another. Currently, pre-existing condition is not covered.

7. Does travel insurance cover quarantine?

No, HDFC ERGO’s travel insurance plan doesn’t cover quarantine expenses.

8. How can I claim for COVID-19 expenses through my travel insurance?

We will help you settle your claims for COVID-19 hospitalisation and expenses as soon as possible. The claim is settled within three working days after receiving all the valid documents related to your hospitalisation and medical expenses for reimbursement. The duration for settling the claim for cashless is as per the invoices submitted by the hospital (approx 8 to 12 weeks).The claim will cover expenses for the patients who test positive for COVID-19. However, it doesn’t cover expenses for home quarantine or quarantine in the hotel.

9. Does travel insurance cover missed flights due to Covid-19 Testing?

No, HDFC ERGO’s travel insurance doesn’t cover missed flights or flight cancellations due to COVID-19 or COVID-19 testing.

10. Who is a Third Party Administrator or TPA in Travel Insurance?

A third-party administrator provides operational services such as claims processing and other benefits as mentioned in your policy under contract with HDFC ERGO and can assist you in times of emergency when on international shores.

11. What would be the documents required to file a travel insurance claim for COVID-19?

Covid-19 coverage comes under the benefit of "Emergency medical expenses" Specific Claim Documents applicable to EMERGENCY MEDICAL EXPENSES – ACCIDENT & ILLNESS

a. Original Discharge Summary

b. Original Medical Records, Case history and investigation reports

c. Original Final Hospital bill with detailed break-up and payment receipt (including pharmacy bills).

d. Original Bills & Payment Receipts of medical expenses and other expenses

Popular Search

- Travel-O-Guide

- International Travel Insurance

- Travel Insurance For Europe

- Family Travel Insurance Policy

- Frequent Flyers Insurance

- Flight Delay

- Student Suraksha Travel Insurance Policy

- Travel Insurance Blogs

- Health Insurance

- Health Insurance Articles

- Bike Insurance

- Bike Insurance Blogs

- Car Insurance

- Car Insurance Blogs

Trusted by over #3.2 Crore customers – Buy the perfect travel insurance policy online now!"

Health Insurance

Health Insurance  Travel Insurance

Travel Insurance  Car Insurance

Car Insurance  Cyber Insurance

Cyber Insurance  Critical Illness Insurance

Critical Illness Insurance

Pet Insurance

Pet Insurance

Bike/Two Wheeler Insurance

Bike/Two Wheeler Insurance  Home Insurance

Home Insurance  Third Party Vehicle Ins.

Third Party Vehicle Ins.

Tractor Insurance

Tractor Insurance

Goods Carrying Vehicle Ins.

Goods Carrying Vehicle Ins.

Passenger Carrying Vehicle Ins.

Passenger Carrying Vehicle Ins.

Compulsory Personal Accident Insurance

Compulsory Personal Accident Insurance

Travel Insurance

Travel Insurance

Rural

Rural