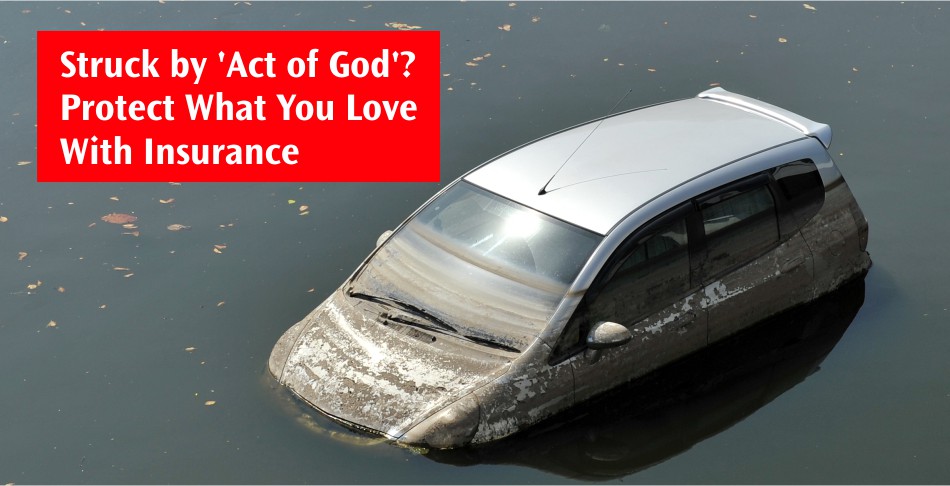

Struck by ‘Act of God’? Protect What You Love With Insurance.

Struck by ‘Act of God’? Protect What You Love With Insurance.

Published on February 19, 2021. EST READ TIME: 4 MIN

Natural disasters like landslides, floods, hurricanes, and earthquakes, also known as Acts of God, can wreak havoc on residents, and take away a huge chunk of one’s assets within minutes. Not only are such disasters difficult to predict, but also when they strike — depending upon their severity — one can exercise very little control to protect oneself.

But there are ways to prepare for natural calamities financially. Insurance cover is one such means. When natural calamities strike, opting for comprehensive motor insurance and home insurance policies come in handy if one wishes to tackle losses. Unless there is something that is specifically excluded from these policies, loss from natural disasters will be covered up till the sum insured. Hence, these covers prove to be essential for those who care to protect their assets from unforeseen calamities.

Motor Insurance

But how does insurance protect your vehicle during a natural disaster? Let’s say you had opted for Comprehensive Motor Insurance policy as you live in a flood-prone area. In the event of a flood, your vehicle will likely be heavily damaged, if not unusable. Through your policy, you can now avail coverage up to the sum that was insured to you, which can be used to repair your existing vehicle or buy a new one. The sum insured will be given to you once the condition of your vehicle is assessed and it is verified that the damages incurred are covered by your motor insurance policy. Two-wheeler insurance plans also work the same way.

Additionally, motor insurance for other natural disasters also works to protect one’s vehicle in the same manner. Once you identify your disaster-prone geography, opting for HDFC ERGO’s comprehensive motor insurance provides protection to your vehicle from damages like fires, earthquakes, cyclones, floods, vandalism, and theft. Today’s motor insurance plans – like Single Year Comprehensive policy for cars and Multi-Year Comprehensive for two-wheelers or Covers for new cars or two-wheelers – come with a host of add-on covers for an enhanced coverage. One such being the zero depreciation coverage, wherein your vehicle’s value might drop each year, but the amount insured to you remains unchanged.

Home Insurance

When it comes to insuring a home, you might find the idea unnecessary. It is important to consider how quickly a natural disaster that affects your home can instantly drain your savings. Home insurance is valuable at a time like this. A home insurance plan generally protects policyholders from any structural damage that was caused to their homes because of natural disasters. Thus, in case of an earthquake, a flood, or any other kind of accidental damage, your home insurer covers your expenses for renovation and repair.

The Bottom Line

A comprehensive motor insurance and home insurance policy will give you widespread protection against a slew of natural disasters that could strike. Depending upon your geographical location, you may be prone to experiencing certain types of natural disasters more than others. Hence, it is wise to opt for coverage against these potentially damaging events, especially if one is a homeowner or a vehicle owner. Protecting yourself with a comprehensive vehicle insurance policy and home insurance policy can not only aid in covering the losses incurred when disasters strike but can also ease the feeling of uncertainty that comes these events.

Disclaimer: The above information is for illustrative purposes only. For more details, please refer to policy wordings and prospectus before concluding the sales.

This blog has been written by:

S. Gopala Krishnan | Motor Insurance Expert | 40+ years of experience in insurance industry

A veteran in the insurance industry, S. Gopala Krishnan is a name to reckon with in the field of reinsurance. He has headed the Reinsurance department and has rich experience in other fields of motor insurance. He loves to share his opinion on latest topics in the insurance industry and how he can help people in safeguarding their assets using insurance products.

Few Other Articles:

Car insurance for protection against natural calamities

The importance of home insurance against natural calamities

All you need to know about engine protection cover in car insurance

Health Insurance

Health Insurance  Travel Insurance

Travel Insurance  Car Insurance

Car Insurance  Cyber Insurance

Cyber Insurance  Critical Illness Insurance

Critical Illness Insurance

Pet Insurance

Pet Insurance

Bike/Two Wheeler Insurance

Bike/Two Wheeler Insurance  Home Insurance

Home Insurance  Third Party Vehicle Ins.

Third Party Vehicle Ins.  Tractor Insurance

Tractor Insurance  Goods Carrying Vehicle Ins.

Goods Carrying Vehicle Ins.  Passenger Carrying Vehicle Ins.

Passenger Carrying Vehicle Ins.  Compulsory Personal Accident Insurance

Compulsory Personal Accident Insurance  Travel Insurance

Travel Insurance  Rural

Rural