HDFC ERGO General Insurance Company, India’s third largest non-life insurance provider in the private sector, has been authorized by the Government of Goa to implement the Pradhan Mantri Fasal Bima Yojana (PMFBY) for loanee and non-lonee farmers in the district of North Goa, for Rabi 2018.

- Crops: Paddy, Pulses & Groundnut

Scheme Related Information

- Scheme Overview

- Scheme Features

- FAQ’s

- Claim Process

- Contact Us

- Photo Gallery

- Brochures

- Premium

PMFBY scheme insures famers against any losses in crop yields arising out of a wide range of external risks such as draughts, flood, dry spells, landslides, cyclones, hurricanes, pest and diseases and many more. For the purpose of determining the loss in the yield, the State government will plan and conduct Crop Cutting Experiments (CCEs) on the notified crops in areas notified for the scheme. In case the yield data, based on CCEs conducted, concludes to be low then the farmers will be considered to have suffered a shortfall in their yield for which the claims will be paid out to the farmers.

The scheme provides insurance cover for all stages of the crop cycle including pre- sowing to harvesting and post-harvest risks. All the products under the PMFBY scheme are approved by the Department of Agriculture, Government of Goa. Farmers from the district of North can reach out to their respective banks, Common Service Centres (CSCs) in their district or contact the authorized HDFC ERGO agents to obtain the Insurance cover under the PMFBY scheme for the corps listed above. The details of the validity period to obtain the insurance cover will be available for the farmers on the website of the Department of Agriculture.

Scheme Features

Following stages of the crop and risks leading to crop loss are covered under thescheme.

a) Prevented Sowing/ Planting Risk: Insured area is prevented from sowing/ planting due to deficit rainfall or adverse seasonal conditions

b) Standing Crop (Sowing to Harvesting): Comprehensive risk insurance is provided to cover yield losses due to non- preventable risks, viz. Drought, Dry spells, Flood, Inundation, Pests and Diseases, Landslides, Natural Fire and Lightening, Storm, Hailstorm, Cyclone, Typhoon, Tempest, Hurricane and Tornado.

c) Post-Harvest Losses: coverage is available only up to a maximum period of two weeks from harvesting for those crops which are allowed to dry in cut and spread condition in the field after harvesting against specific perils of cyclone and cyclonic rains and unseasonal rains.

d) Localized Calamities: Loss/ damage resulting from occurrence of identified localized risks of hailstorm, landslide, and Inundation affecting isolated farms in the notified area

Pradhan Mantri Fasal Bima Yojana Brief Guidelines and FAQ’s

- What is the objective of implementation of PMFBY scheme? PMFBY is a risk mitigation tools aims at providing financial support and stabilizing the income of farmers to ensure their continuance in farming. It covers the perils to the crops arising out of unforeseen events at all stages, i.e. from sowing to post harvest,. It also encourages the farmers to adopt the modern and innovative agriculture practices in order to have a stabilize income and sustainable production in agriculture sector.

- Who are eligibly covered under this scheme? All Farmer having insurable interest can be covered under these scheme including sharecroppers and tenant farmers. Further, Covered farmer are divided under 2 components:-

- Which crop can be covered under this scheme? a. Food Crops (Cereals, Millets and Pulses)

b. Oilseeds

c. Annual Commercial /Annual Horticulture Crops

Claim Process

To make the risk mitigation via PMFBY effective in real sense, timely settlement of admissible claims is required. This is in line with the basis objective of the scheme for

- providing financial support to farmers suffering crop loss/damage arising out of unforeseen events

- stabilizing the income of farmers to ensure their continuance in farming

- ensuring flow of credit to the agriculture sector

The various risks covered in the PMFBY scheme covers various stages of the crop and is spread over the entire crop season i.e. from Sowing to Post Harvesting. Following stages of the crop and risks leading to crop loss are covered under the scheme.

- Prevented Sowing/ Planting Risk: Insured area is prevented from sowing/ planting due to deficit rainfall or adverse seasonal conditions

- Standing Crop (Sowing to Harvesting): Comprehensive risk insurance is provided to cover yield losses due to non- preventable risks, viz. Drought, Dry spells, Flood, Inundation, Pests and Diseases, Landslides, Natural Fire and Lightening, Storm, Hailstorm, Cyclone, Typhoon, Tempest, Hurricane and Tornado.

- Post-Harvest Losses: coverage is available only up to a maximum period of two weeks from harvesting for those crops which are allowed to dry in cut and spread condition in the field after harvesting against specific perils of cyclone and cyclonic rains and unseasonal rains.

- Localized Calamities: Loss/ damage resulting from occurrence of identified localized risks of hailstorm, landslide, and Inundation affecting isolated farms in the notified area.

Contact Us

State Level District Co-Ordinators:

| Contact Person | Contact Address | Contect Number |

|---|---|---|

| Mahesh Pawar | HDFC ERGO General Insurance Company Limited, Onyx, 4th Floor, North Main Road, Next to Westin Hotel | 7588067900 |

| Vishal Gaikwad | HDFC ERGO General Insurance Company Limited, Onyx, 4th Floor, North Main Road, Next to Westin Hotel | 9152928691 |

Marketing / Advertising:

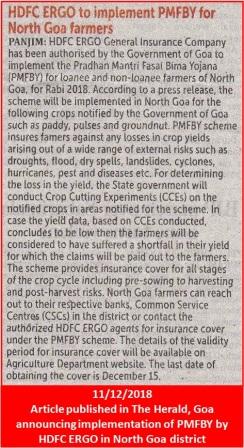

Press Coverage

For more information about the premium details of plans and notified crops, please see the customer information sheet:

State Level District Co-Ordinators:

| Contact Person | Contact Address | Contect Number |

|---|---|---|

| Mahesh Pawar | HDFC ERGO General Insurance Company Limited, Onyx, 4th Floor, North Main Road, Next to Westin Hotel | 7588067900 |

| Vishal Gaikwad | HDFC ERGO General Insurance Company Limited, Onyx, 4th Floor, North Main Road, Next to Westin Hotel | 9152928691 |

For more information about the claims process:

For any kind of other information, contact our dedicated call center number @ 1800 266 0700 or the state level district coordinator above.

Videos

Health Insurance

Health Insurance  Travel Insurance

Travel Insurance  Car Insurance

Car Insurance  Cyber Insurance

Cyber Insurance  Critical Illness Insurance

Critical Illness Insurance

Pet Insurance

Pet Insurance

Bike/Two Wheeler Insurance

Bike/Two Wheeler Insurance  Home Insurance

Home Insurance  Third Party Vehicle Ins.

Third Party Vehicle Ins.  Tractor Insurance

Tractor Insurance  Goods Carrying Vehicle Ins.

Goods Carrying Vehicle Ins.  Passenger Carrying Vehicle Ins.

Passenger Carrying Vehicle Ins.  Compulsory Personal Accident Insurance

Compulsory Personal Accident Insurance  Travel Insurance

Travel Insurance  Rural

Rural