Health insurance safeguards you from financial woes in times of medical emergencies covering all your expenses as outlined in your policy. Investing in a comprehensive health insurance plan offers various benefits, including cashless hospitalization, coverage for outpatient department (OPD) expenses, daily cash allowances, diagnostic costs, and more. You can also opt for add-ons or riders to make your plan an all-encompassing one including all family members in the policy.

We at HDFC ERGO are committed to making your life easier with our services. To ensure you get the right support we ensure seamless settlement of claims by settling one claim every minute*. Our range of health insurance plans has brought smiles to 1.4 crore happy customers, with the numbers growing daily. With our my:Optima Secure plan, you get 4X coverage at no extra cost. Additionally, our health insurance policies come with various benefits including cashless hospitalization, tax savings under Section 80D of the Income Tax Act, and a no-claim bonus. So, take a step towards securing the future of your loved ones by prioritizing their health and well-being.

Optima Secure

Optima Lite

Optima Secure Global

Optima Restore

my:health Medisure Super Top-up

Critical Illness Insurance

iCan Cancer Insurance

Here is some data to help you understand why staying healthy should be a conscious choice

Chronic diseases contribute to an estimated 53% of deaths and 44% of disability-adjusted life-years lost. Cardiovascular diseases and diabetes are highly prevalent in urban areas. Tobacco-related cancers account for a large

proportion of all cancers.

Read More

The estimated number of cases of cancer in India for the year 2022 was found to be 14,61,427. In India, one in nine people are likely to develop cancer in his/her lifetime. Lung and breast cancers are the leading sites

of cancer in males and females, respectively. The incidence of cancer cases is estimated to increase by 12.8 per cent in 2025 as compared to 2020.

Read More

According to 2024 Global Hepatitis Report by the World Health Organization (WHO) India accounted for a significant 11.6 per cent of the world's hepatitis cases in 2022, with 29.8 million hepatitis B and 5.5 million hepatitis

C cases. Half the burden of chronic hepatitis B and C infection is among people 30–54 years old and men account for 58 per cent of all cases, the report noted.

Read More

India is considered to be the global diabetes capital with an estimated 77 million people above the age of 18 years suffering from diabetes (type 2) and nearly 25 million are prediabetics. In India, the median average annual

direct and indirect costs associated with diabetes care were estimated at ₹ 25,391 and ₹ 4,970, respectively. Extrapolating from the Indian population, the annual cost of diabetes was found be USD 31.9 billion in 2010.

Read More

In 2021, pneumonia was the leading cause of death from communicable diseases in India, killing over 14,000 people. Acute respiratory infections were the second leading cause of death, killing over 9,000 people.

Read More

India has one of the highest burdens of cardiovascular disease (CVD) worldwide. The annual number of deaths from CVD in India is projected to rise from 2.26 million (1990) to 4.77 million (2020). Coronary heart disease

prevalence rates in India have been estimated over the past several decades and have ranged from 1.6% to 7.4% in rural populations and from 1% to 13.2% in urban populations.

Read More

| Key Features | Benefits |

| Cashless Hospital Network | 15000+ˇ across India |

| Tax Savings | Upto ₹ 1 lac**** |

| Renewal Benefit | Free Health Check-up within 60 Days of Renewal |

| Claim Settlement Rate | 2 Claims/Minute* |

| Claim Approval | Within 38*~ Minutes |

| Coverage | Hospitalization Expenses, Day Care Treatments, Home Treatments, AYUSH Treatment, Organ Donor Expenses |

| Pre & Post Hospitalization | Covers Expenses upto 60 days of admission & 180 days post discharge |

Just like every other health insurance plan, we too cover your hospitalization expenses such as room rent, ICU charges, investigations, surgery, doctor consultations etc. when hospitalised either due to an accident or for a planned surgery.

We believe mental healthcare is just as important as physical illness or injury. Our health insurance plans are designed in a way to cover hospitalization expenses incurred for treating mental illnesses.

Our medical insurance policies include all your pre and post hospitalisation expenses up to 60 days of admission and post-discharge expenses till 180 days

Medical advancements help in wrapping up important surgeries and treatments in less than 24 hours, and guess what? We have included daycare treatments in our health insurance plans to cover you for that as well.

In case of non-availability of hospital beds, if the doctor approves treatment at home our medical insurance policy covers you for that as well. So that, you get medical treatment right in the comfort of your home.

This benefit acts like a magical backup, which recharges your exhausted health cover up to the sum insured even after a claim. This unique feature ensure uninterrupted medical coverage at the time of need.

Organ donation is a noble cause and at times this could be a life-saving surgery. This is why our health insurance plans cover the medical and surgical expenses of the organ donor while harvesting a major organ from the donor’s body.

If you stay in a hospital for more than 10 days at a stretch, then we pay for other financial losses that might have happened due to your absence at home. This feature in our plans ensure you can take care of your other expenses even during your hospitalization.

If you are a believer in alternate therapies like Ayurveda, Unani, Siddha, and Homeopathy let your belief system stay intact as we cover hospitalization expenses for AYUSH treatment as well in our health insurance plans.

Health insurance policies often offer a complimentary annual health checkup to help you stay fit and active and prevent illnesses. These checkups include multiple diagnostic tests, such as liver function tests, lipid profiles, and tests for vitamin deficiencies, among others.

Once you get yourself secured with us, there is no looking back. Our health insurance plans continue to secure your medical expenses for your entire lifetime on break-free renewals.

A multiplier benefit equal to 50% of the base sum insured from the expiring policy will be provided at renewal, regardless of any claims made during the policy term. This benefit can accumulate up to a maximum of 100% of the base sum insured.

The above mentioned coverage may not be available in some of our Health plans. Please read the policy wordings, brochure and prospectus to know more about our health insurance plans.

Adventures can give you an adrenaline rush, but when coupled with accidents, it can be hazardous. Our health insurance plan does not cover accidents encountered while participating in adventure sports.

If you ever end up causing injury to your precious self, then unfortunately our health insurance plan will not cover for self imposed injuries.

War can be disastrous and unfortunate. However, our health insurance plan does not cover any claim that is caused due to wars.

Our health insurance plan does not cover accidental injury while you are participating in defence (Army/Navy/Air Force) operations.

We do understand the criticality of your disease. However, our health insurance plan does not cover venereal or sexually transmitted diseases.

Treatment of obesity or cosmetic surgery is not eligible for coverage under your health insurance plan.

Address

C-1/15A Yamuna Vihar, Pincode-110053

Address

C-1/15A Yamuna Vihar, Pincode-110053

Address

C-1/15A Yamuna Vihar, Pincode-110053

The sole purpose of buying a health insurance plan is to get financial support at the time of medical emergency. Hence, it is important to read the below steps to know how Health Insurance claims process works differently for cashless claims and reimbursement claim requests.

Fill up the pre-auth form at the network hospital for cashless approval

Once hospital intimates us, we send you the status update

Hospitalisation can be done on the basis of pre-auth approval

At the time of discharge, we settle the claim directly with hospital

You need to pay the bills initially and preserve the original invoices

Post hospital discharge send us all your invoices and treatment documents

We verify your claim related invoices and treatment documents

We send the approved claim amount to your bank account.

Below are the documents that you need to keep handy when making a claim against your health insurance policy. However, do read the policy terms and conditions carefully, in order to avoid missing out any important document.

A health insurance plan not only covers your medical expenses but also offers tax benefits so that you can save upto ₹ 1 lac**** under Section 80D of Income Tax Act 1961. It plays an important role in planning your finances.

By getting yourself a health insurance plan, you can get a deduction of up to ₹ 25,000 per budgetary year for medical insurance premium under Section 80D of Income Tax Act 1961.

If you are paying the medical insurance premium for guardians, then you can also claim an additional deduction of up to ₹ 25,000 every budgetary year. If your parents or either of them is a senior citizen, then this limit can go up to ₹ 50,000.

You can also claim tax benefits on preventive health check-ups annually under Section 80D of the Income Tax Act. You can claim up to ₹ 5,000 every budgetary year as expenses incurred for preventive health check-ups, while filing your Income Tax Return.

Please note that the above-mentioned benefits are as per the current tax laws prevailing in the country. Your tax benefits may change subject to tax laws. It is advisable to reconfirm the same with your tax consultant. This is independent of your health insurance premium value.

It is always advisable to buy a good health insurance plan as early as possible because health emergencies can happen anytime, without any prior notice. The following points will make it even clearer, why it is important to buy a health insurance policy at an early age:

Premium is comparatively lower when you get a health policy at a young age. This reason for it is that, for the insurance company, the lower the age, the lesser is the health risk associated.

In certain cases, you might be excused from the mandatory health check-ups that people of a certain age must undergo to obtain health insurance.

Health insurance policies have waiting periods for a few health conditions. If you purchase a mediclaim policy when you’re young, you complete them sooner.

Dependency On Employer’s Health Insurance plan

Most of us consider employee health insurance as a secured cover for taking care of medical expenses. However, you must know that employer health insurance covers you only during your job tenure. Once you leave the company or switch jobs, you lose your health insurance benefits. Some companies do not offer health cover during initial probation period. Even if you have a valid corporate health cover it may offer a lower sum insured, lack modern medical coverage and may also ask you to co-pay for claims. Hence, always have a personal health insurance plan for yourself and your family to be double sure.

Unaware Of The Benefits Of Including Health Insurance in Financial Planning

Just like you pay EMIs, credit card bills, invest in mutual funds or pay premium for life insurance plans to ensure a sound financial planning, similarly you need to buy a health insurance to secure your savings in the longer run. Because, most of us do not realize the importance of health insurance until something fatal hits us or people around us. Lack of awareness may hamper your savings if an unexpected medical expense comes up.

Thinking a Higher Sum Insured Might Not Be Necessary

It is important to understand that you need a higher sum insured if you reside in a metro city where medical treatment expenses are high. If a single hospitalization in a year is enough to exhaust your sum insured then you should consider a higher sum insured. Just buying a health insurance won’t help in the long run. Getting a sum insured that’s enough to cover your medical expenses is equally important. Also, if you are covering more family members then consider taking a health insurance policy with a sum insured above 10 lacs.

Miscalculating The Benefits of Premium Vs Coverage

Don’t just look at the premium and go back thinking if you should buy this health insurance plan. Looking at the list of coverage and benefits before buying a health insurance plan is important and should not be overlooked. If you think of buying a health insurance plan with a low premium then there are high chances that you may miss out critical coverage. In future, you may feel that certain coverage is important but your policy doesn’t cover it. Scout for a health insurance plan that is not just pocket friendly but also value for money.

Buying Health insurance Only To Save Tax

Many of us buy health insurance just to save tax under section 80 D. A health insurance plan helps you save tax upto ₹ 1 lac****. However, there is a lot more beyond saving taxes. Get yourself a health insurance plan that helps you during critical times and helps in saving finances in the long run. You must also get a health insurance plan for your parents, spouse, and kids to ensure complete financial security.

Undermining the importance of buying a health insurance at a younger age

If you are young, hale and hearty you should buy a health insurance plan now to get lower premiums. Secondly, if you do not make claims post buying a health insurance cover you get cumulative bonus, which gives you hike in sum insured without charging extra premium as a reward for staying fit. Thirdly, every health policy comes in with waiting period, so if you buy health insurance while you are young your waiting period gets over during the initial years. Later, if you have any disease your policy covers you seamlessly. Lastly, looking at the pandemic situation it’s not wrong to say that any one at any point of time may need hospitalisation if not due to ailment may be due to an accidental injury; hence it’s important to stay prepared.

Every time you look for a health insurance plan, you wonder which is the best health insurance plan? How to choose the best health plan online? What coverage should it have? To answer all your queries let’s read more to decode the hacks to get the right health insurance plan.

If you are looking to insure yourself consider a health insurance plan with a sum insured ranging between 7 lacs to 10 lacs. For a family a policy the sum insured could range between 8 to 15 lakhs on floater basis. Remember, your health insurance plan should be adequate to cover for more than one hospitalisation that may happen in a year.

Health insurance premiums are quite affordable. So when you chose a plan, don’t make a hasty decision of paying low premiums for a smaller sum insured and then co-pay your hospital bills later. You might end up paying hefty amount for your medical bills. Instead, work on a co-payment clause that’s easy on your pocket.

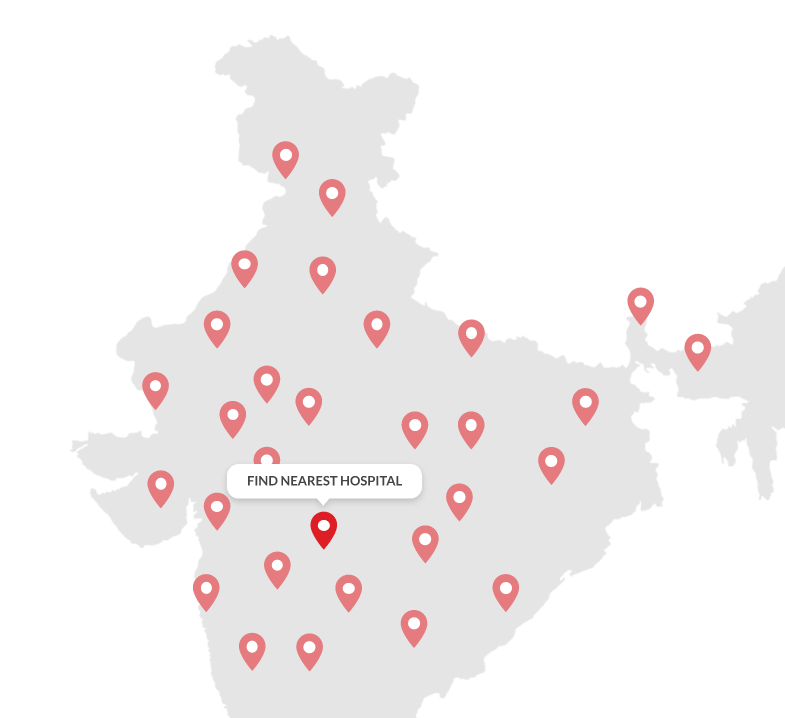

Always check if the insurance company has a wide list of network hospitals included in your health insurance plan. Also check, if the nearest hospital or medical facility is listed by the insurance company, so it will help you avail cashless treatment. At HDFC ERGO, we have a huge network of 15,000+ Cashless Health care centers.

Usually your medical expenses depend upon your room type and disease. It is recommended to buy a health insurance plan that does not have sub-limits on hospital room rent so that you can choose the hospital room as per your comfort. Most of our policies also don’t imply disease sublimit; this is also an important factor one must keep in mind.

Your health insurance plan does not come into action while you are waiting period is not completed. Always check health insurance policies with lower waiting periods for pre-existing ailments and maternity cover benefits before buying a health insurance plan online.

Always choose a health insurance company that has a good reputation in the market. You must also look at the customer base and claim paying ability to know if the brand will honor the claims that you may make in future. Choosing a health insurance plan is a commitment of both policyholder and insurer, so take a decision calmly.

With the development in technology, treatments and the availability of more effective medicines the cost of healthcare has steeply increased.

All this increase ends up being a burden on your savings, making healthcare unaffordable for many.

This is where HDFC ERGO’s health insurance policies come into play, as they take care of the hospitalization and treatment charges, leaving the consumer free of financial woes.

You are a young, healthy youth in the late 20s or early 30s with a few financial responsibilities.

With the development in technology, treatments and the availability of more effective medicines the cost of healthcare has steeply increased. All this increase ends up being a burden for the consumers, making healthcare unaffordable for many. This is where HDFC ERGO’s health insurance policies come into play, as they take care of the hospitalization and treatment charges, leaving the consumer free of financial woes. Get yourself a health insurance plan now.

This affordable health insurance plan will offer you a large coverage. It will help you save tax as well. In future, you can add your spouse and child to this plan as well.

Acts as a magical tool to bring back the exhausted sum insured in your health insurance policy, covering future hospitalization that may happen in the same policy period. Therefore, you always hold double protection although you pay only for a single sum insured.

If you do not make any claim, your sum insured in your health insurance policy is increased by 10% as a bonus or reward upto a maximum of 100%.

This is our most-recommended plan for all those who are just willing to buy their first insurance plan.

You already have a corporate health cover & do not wish to spend too much on health insurance.

Even though your employer covers you, the freedom to customize it as per your growing need does not remain in your hands; additionally, if you ever quit your job then your health insurance cover ends. So, why risk your health cover with an employer, when you can easily get one for yourself.

However, if you still feel that your employer’s health cover or existing health cover suits well then there is no harm in topping it up for a higher cover at a much lower premium.

This health insurance plan gives you a much higher cover at a lower premium. It acts as a top-up to your existing health insurance.

You have a family to take care of and want to cover your spouse & kids under a single health insurance policy.

If you are looking for a family health insurance plan then go for our best selling health insurance plan that aims at securing your family’s growing medical needs.

This health insurance plan will take care of your family’s growing medical needs by offering sum insured restoration benefit, so that you never run out of health cover. It also gives 2x multiplier benefit to get a increase in sum insured when you do not make claims.

You are looking for a comprehensive health insurance plan to secure your parents

We understand that you are deeply concerned about your parent’s growing age and willing to cover them. It’s important to gift then a health insurance plan, so that they don’t dig into their lifelong savings for paying hospital bills.

for your parents who may or may not be senior citizens. It is a simple no-fuss health insurance plan that gives all basic coverage at a premium that is pocket friendly.

You are a confident and independent woman willing looking for a health insurance policy to secure your health.

For all those confident and self-reliant women,

to take care of women related 41 critical illnesses, cardiac ailments, and cancer cover.

Your family has a Critical Illness History so you need a health insurance policy for critical cover.

A single critical illness is enough to put a pause to your life be it due to the long treatment course or the financial requirements. We help you cover the medical expenses so that you focus only on recovering.

for securing 15 major critical illnesses, which include stroke, cancer, kidney-liver failure, and many more.

When considering purchasing a health insurance plan, common questions that may arise include eligibility, required medical tests, and age criteria. However, these days it is easy to check your eligibility for a specific health insurance plan in

India before making a purchase online.

At the time of buying a mediclaim policy, it's essential to disclose any prior health conditions you may have. This includes serious diseases, birth defects, surgeries, or cancers, not just common

ailments like flu or headaches. Failing to do so may result in certain conditions being permanently excluded from coverage, or covered with a waiting period or additional premium. It's important to inform your insurance company about any pre-existing

conditions to ensure full coverage.

While buying a mediclaim policy, you have to be honest enough to declare all your pre-existing illnesses. These illnesses need not be your usual fever, flu, or headaches. However, if in past you have ever been diagnosed with any disease, birth defects, undergone surgery, or cancer of any severity it is important to inform your medical insurance company. Because, many ailments are listed under permanentexclusion, few are covered with a waiting period and few others are covered by charging additional premium with a waiting period. Also Read : Should you disclose pre-existing illnesses while buying health insurance?

If you are above 18 years of age, you can easily buy a health insurance plan for yourself. We also cover newborn babies but the parent needs to have a mediclaim insurance policy with us. If you are a senior citizen,you can get yourself insured upto the age of 65 years. Also Read : Is there an Age Limit for Availing of Health Insurance ?

Gone are the days when you wait for someone to come and explain the policy to make a buying decision. With digital trends taking over the world, buying a health insurance plan from anywhere across the globe helps you in saving time, energy, and effort.

You do not have to pay premiums in cash or cheque for your health insurance plan! Go Digital! Simply use your credit/debit card or net banking services to make payments online through multiple secured payment modes.

You can instantly calculate the premium, add or remove members, customize plans, and check coverage online at your fingertips to buy a health insurance plan online.

You no longer have to wait for the physical health insurance policy documents. Your policy PDF copy comes right into your mailbox as soon as you pay the premium online and you get your policy within a few seconds.

Get access to your policy documents, brochure etc in our my:health services mobile application. Download our wellness application to book online consultations, monitor your calorie intake and keep a track on your BMI as well.

The easiest and most convenient way of buying the best health insurance is to purchase it online. Here’s how you can buy a HDFC ERGO health insurance policy online:

.jpg?sfvrsn=7ee92f2a_2)

Mediclaim policy is a type of insurance that provides financial coverage for medical expenses. The policy covers all hospitalization expenses, including room charges, medication, and other treatment costs. However, the sum insured in a mediclaim policy is limited compared to a health insurance plan. The amount of coverage you receive depends on the sum insured that you have selected, which is usually up to a few lakhs. During a claim, in some cases, you may need to provide proof of expenses, such as hospital bills or discharge reports, to be reimbursed.

Mediclaim insurance provides financial coverage for healthcare expenses, similar to health insurance. However, under a mediclaim policy, you typically need to be hospitalized to receive the benefits. This means that you may not be able to receive home healthcare benefits without actually being hospitalized. Additionally, mediclaim policies usually do not offer the flexibility to add family members, increase the sum insured, or add additional benefits as needed. Overall, mediclaim policies are generally not customizable. Also Read: Know the Difference between Health Insurance Policy and Mediclaim.

There are a plethora of options available in the market when it comes to buying health insurance but choosing the best health insurance plan in India is in your hands. Have you ever wondered why some insurance plans have a higher premium and low coverages, while some might have high coverages but a low claim settlement ratio? Finding a health insurance plan which offers comprehensive coverages and affordable premium is ideal, you can find them by researching online. Best health insurance plan must consist of the following:

When you get admitted in a network hospital your claim process becomes very simple and quick. Always check if the insurance company has a wide list of network hospitals. If the nearest hospital or medical facility is listed by the insurance company it will help you avail cashless treatment.

Having Cashless Health Insurance is must in India in today’s time. You do not have to worry about the bill as the hospital and the insurance company settles it internally.

What is the use of having a health insurance policy when the claims continuously keep getting rejected? Hence the best health insurance plan in India must have a good claim settlement ratio.

Having a range of sum insured amount to choose from can be helpful as you can select the amount based on your requirement. Your sum insured amount must able to support you at the time of a medical emergency.

Best health insurance policy is highly recommended by all the customers as they give remarkable reviews and ratings to the health insurance plan. You must go through the ratings and reviews available online for better decision making.

Medical science has advanced a lot and there are various diseases can be treated at home. Hence, the best health insurance plan in India must consist of home care facility as the medical expenses incurred at home are also covered.

| Brochure | Claim Form | Policy Wordings |

| Get details on various health insurance plans with their key features and benefits. Visit the Health category to know more about HDFC ERGO health insurance policy covers. | Want to claim your health insurance? Download the health policy claim form and fill in the required details for faster claim approval and settlement. | Please refer the policy wordings to know more about the terms and conditions under health insurance plans. Get more details on coverages and features offered by HDFC ERGO Health Insurance. |

A dependent in health insurance is a person who is related to the policyholder. Any family member whom the insured wants to provide health insurance coverage to in their health insurance plan can be included as a dependent. In simple terms, a dependent is a person who is a family member or relative of an insured person.

Having This component of health insurance can reduce your policy premium, but it also means that you have to pay a fixed sum at the time of insurance claim. So, do read the policy documents for the deductible clause and choose the one that does not include it, until you are ready to bear the treatment cost.

The sum insured is the maximum amount an insurance company will pay for the covered medical expenses of the insured individual within a policy period. For example, if your sum insured is ₹5 lakh, the insurer will cover hospital bills and treatments up to ₹5 lakh. If your bills go beyond that, you will have to pay the extra amount yourself.

A few health insurance plans have a co-payment or co-pay clause. It is a fixed percentage of a sum the policyholder has to pay to the insurance company before receiving the healthcare service. It is mentioned pre-decided and mentioned in the policy wordings, e.g. if someone agrees to pay 20% co-pay at the time of claim, for each time a medical service is availed, they have to pay that sum.

Critical illnesses medical conditions refer to life-threatening medical diseases like cancer, kidney failure, and cardiovascular diseases. There are separate health insurance plans that cover these illnesses. They can also be purchased as a rider or add-on cover for the same.

Health issues like COPD, hypertension, diabetes, kidney problems, cardiovascular issues, and other underlying diseases are considered to be risk factors in terms of health insurance. Patients with pre-existing medical conditions as stated above are considered to be at a higher risk and are therefore charged a higher premium.

Are you tired of going to multiple people to clear your doubts? What if we tell you there's a solution that can help you make better decisions in life.

Access verified articles and videos on health topics, created by healthcare experts and doctors from around the world.

Make healthcare affordable with a range of offers from partner e-pharmacies and diagnostic centres.

Connect with verified volunteers who have gone through a similar medical experience.

Yes, having a separate individual health insurance plan is important. Your employee health insurance covers medical expenses only till the time you are working in the organization. Once you quit the company, your policy term ends. Keeping medical inflation in mind, it is important to buy personal health insurance as per your medical needs. Also, a corporate health plan is a common plan designed for all employees.

Health insurance portability helps you to change your health insurance plan without having to go through a fresh waiting period term. There is a smooth transfer from one insurer to another if your current plan is not sufficient to cover rising medical costs.

Network hospitals better known as cashless hospitals have an agreement with your insurance company, because of which you can avail cashless hospitalisation benefit. On the other hand, if you get treated In a non-network hospital, you have to pay the bills first and later apply for reimbursement claim. So, it is always wise to buy a health insurance company which has a large network hospital tie-up.

Cashless hospitalisation is a procedure in which the policyholder doesn't have to pay medical expenses out of his pocket in case they are admitted to a hospital or have undergone a surgery. However, there are certain deductibles or non medical expenses at the time of discharge, which are not included in the policy terms, have to be paid at the time of discharge.

In case you have to undergo a surgery, there are certain pre hospitalization expenses such as diagnosis cost, consultations etc Likewise, post the surgery, there could be expenses to monitor the health of the policyholder. These expenses are known as pre and post hospitalization expenses.

You can file multiple numbers of claims during a policy term, provided it is within the limit of the sum insured. A policyholder can get coverage up to sum insured only.

Yes, it is possible to buy more than one medical insurance plan. This entirely depends on an individual’s necessity and coverage requirements.

Yes, you can claim medical bills in health insurance, as long as it is within the sum insured. For more information, read the policy wording document.

It usually takes approx.7 working days in settling a claim if documents are in order.

You can check your claim status through self-help portals or mobile apps extended by insurers.

There may be a few medical tests that needs to be taken before buying health insurance. For some health insurance policies, the medical tests are required if there are pre existing illnessed or if someone is above 40 years of age.

At the time of purchasing or renewal of your health insurance policy, you can add your family members.

Yes, children can be added to your health insurance plan. They can be added post 90 days of birth up to the age of 21 or 25 years. It varies from company to company, so please go through plan eligibility from the product brochure.

You are eligible to pay a lower premium and higher benefits. Since the probability of having a pre-existing illness is low, the waiting periods may also not impact you. Apart from that, common diseases such as flu or accidental injuries can happen at any age, so buying a health insurance when you are young is important.

Yes. You can always have more than one health insurance plan based on necessity and coverage requirements as every plan works differently and offer varied benefits.

The time span during which you cannot raise a claim to avail some or all benefits of the health insurance from your insurance provider for a specified illness is known as waiting period. So, basically, you have to wait for a specified amount of time before you request for a claim.

During this free look period, you have the option of canceling your policy without penalty if you feel your policy is not beneficial. Depending on the insurance company and the plan offered, the free look period can be 10-15 days or even longer. Know more, to know more on free look period.

Network hospitals better known as cashless hospitals have an agreement with your insurance company, because of which you can avail cashless hospitalisation benefit. On the other hand, if you get treated In a non-network hospital, you have to pay the bills first and later apply for reimbursement claim. So, it is always wise to buy a health insurance company which has a large network hospital tie-up.

In case of a hospitalization cover we cover expenses like pre and post hospitalization expenses for your diagnostic tests, consultations and medicine costs. We also cover ICU, Bed charges, medicine cost, nursing charges and Operation theatre expenses widely.

There is no right or wrong age to buy a health insurance policy. However, it is recommended to buy a health plan early to get lower premiums. Once you turn 18 years old, you can buy a health insurance plan for yourself. Before that a family health insurance plan can cover your healthcare expenses.

No, a health insurance policy cannot be purchased by a minor. But they can be covered under the a family floater health insurance bought by their parents

In case you get admitted at a non-network hospital have to pay the bills from your pocket first and later raise a reimbursement claim from your insurance company. However, your health insurance company will provide reimbursement only up to the amount of Sum Insured.

The annual sum insured is the maximum amount upto which your health insurance will pay for admissible medical expenses during a given policy year. For example, if the annual sum insured is ₹5 lakh and you are diagnosed with an illness requiring hospitalisation, and the bill amounts to around ₹6 lakh, the insurer will only pay ₹5 lakh.

Yes, waiting periods shall apply afresh to the increased portion of the sum insured [SI] amount. Suppose your original sum insured is ₹5 lakh, and the plan had a waiting period of 3 year for declared pre-existing conditions [PED]. After one year, if at renewal you increase the sum insured from ₹5 lakh to ₹15 lakh, then for the original SI ₹5 lakh PED waiting period of 2 years shall apply while for the increased ₹10 lakh portion afresh PED waiting period of 3 years shall apply.

Yes. Most health insurance plans cover diagnostic charges during hospitalization, pre-hospitalization and post discharge as well.

All HDFC ERGO health insurance plans cover diagnostic charges during hospitalization, pre-hospitalization and post discharge as well.

Yes. Once your specified waiting period is over you will get coverage for your pre-existing illnesses. Read this blog, to know more on coverage for pre-existing diseases.

You need to check your policy document and enroll your family members by mentioning their name and age to get them covered.

Buying online health insurance is no different than purchasing it offline. In fact buying online health insurance is quick and hassle-free. A cashless card via courier/postal services is provided to you. To know more, visit the company website or dial customer care number.

Important medical expenses such as blood investigations, diagnostic charges such as CT scan, MRI, sonography etc. are covered. In certain cases, hospital room rent, bed charges, nursing charges, medicines and doctor visits etc can also be covered.

Yes. It depends on the policy terms and conditions. However, most health insurance companies offer coverage for modern treatments and robotic surgeries.

Yes. Your HDFC ERGO Health Insurance Policy covers hospitalization expenses for Corona Virus (COVID-19). We will pay the below medical expenses for hospitalization during the policy period for treatment of COVID-19:

In the event you are admitted to a hospital for over 24 hours, your medical bills would be covered by us. We would take care of:

• Stay Charges (Isolation Room / ICU)

• Nursing charges

• Treating Doctor Visit Charges

• Investigations (Labs/Radiological)

• Oxygen / Mechanical Ventilation Charges (if required)

• Blood / Plasma Charges (if required)

• Physiotherapy (if required)

• Pharmacy (except non-medicals/consumables)

• PPE Kit charges (as per government guidelines)

No, home isolation is not covered in our Health policies. You can only file a claim for medical treatment undertaken at a hospital or nursing home. The treatment should be on the advice of and be actively managed by a qualified doctor.

The testing charges will only be covered in case of hospitalization for each insured member(s) covered under the policy.

You can include your child dependents in a family floater policy after 90 days of their birth and upto the age of 25 years.

It can be done. An endorsement request needs to be raised by the policyholder for a change in nominee details.

Does not worry if your policy expires during hospitalization because you get a grace period of 30 days post the policy lapse. However, if you do not renew your policy within the grace period and hospitalization happens post grace period then you will have to pay for the medical expenses.

At the start of every health insurance policy, waiting periods are applied. This doesn't change with renewal. However, with every renewal , the waiting period is waived off until you reach a time when you have no waiting period and the coverage includes most of the treatments.

If your child is an Indian citizen, then you can purchase a health insurance policy. If not, you should opt for student travel insurance for your child.

Tobacco users are prone to higher health risks. If tobacco is consumed in any form, the chances of an individual developing some health issue later in life is higher, and this means you might have to claim the treatment cost. So, these individuals are categorized as high-risk by the insurance company and high premiums are charged from them.

The bonus/ reward that one gets for remaining fit and not filing a claim is known as a cumulative bonus. The cumulative bonus benefit is given in the renewal year by increasing the sum insured amount only up to a certain year for every claim-free year. This helps you to get a higher Sum Insured without paying anything extra.

Many companies may offer a family discount if you cover 2 or more family members under a single health plan on an individual sum insured basis. Even long term policy discounts can be availed on buying health insurance for more than 2-3 years. Some insurers also give fitness discounts on renewals.

No. Only Indian citizens can purchase Health insurance plans in the country.

If a health insurance plan is cancelled within the free look period ,you will get your premiums refunded, after adjusting underwriting cost and pre-acceptance medical costs, etc.

Yes. There is a pre-decided agreement between your health insurance company and network hospitals and hence cashless treatment facility is available at every network hospital.

You can raise a claim as many times you want, until you exhaust your sum insured amount. The best way is to buy plans that help you by restore the sum insured once it gets exhausted. This helps you register more claims in a year.

Yes. A pre-authorization request for cashless claim can be rejected if the policyholder files a claim for an ailment/disease which is either excluded, falls in waiting period or if the sum insured has been already used up.

In case of reimbursement claims, the insurance company needs to be informed within a period of 30 days post discharge.

The percentage of the number of claims that the insurance company paid out during a financial year out of the total claims incurred is known as claim settlement ratio (CSR). It reflects if the insurer is financially secured enough to pay for its claims.

It depends on the policy terms and conditions. Say, if you have a health cover of ₹1 crore, this helps you take care of all the possible medical expenses.

A cashless claim request can be raised by contacting the insurance department at the network hospital or your health insurance company. For reimbursement claims, post discharge, you need to send the invoices to your insurance provider.

Within 30 days post-discharge. A claim should be raised with the insurance provider as soon as possible, without any delay.

Mediclaim process is the modern day reimbursement process, wherein you raise a claim post discharge by submitting original invoices and treatment documents.

Waiting periods depend on the policy terms and conditions. There is a waiting period for specific ailments/diseases which could be for 2-4 years.

You can visit www.hdfcergo.com or call our helpline 022 62346234/0120 62346234 Read more on how to claim health insurance for covid-19 here.

Whenever you get admitted at a non-network hospital you have to pay the bills first and later claim for reimbursement. HDFC ERGO has 15000+ˇ cashless network.

The following documents required:

1. Test reports (from Govt Approved Laboratories )

2. Bills for the tests underwent

3. Discharge summary

4. Hospital bills

5. Medicine bills

6. All payment receipts

7. Claim form

Original documents to be submitted

With the development in technology, treatments and the availability of more effective medicines the cost of healthcare has steeply increased. All this increase ends up being a burden for the consumers, making healthcare unaffordable for many. This is where HDFC ERGO’s health insurance policies come into play, as they take care of the hospitalization and treatment charges, leaving the consumer free of financial woes. Get yourself a health insurance plan now.

You can renew health insurance policies within a few minute. Click here to renew instantly.

Yes. You can port your health insurance policy with any other insurer without impacting your waiting periods.

Waiting period is fixed at the inception of the policy it is not dependant on the sum insured. Hence, even if you increase your sum insured your waiting period continues until you keep renewing to get away with the waiting period term.

Yes. If you have not made claims then you get a cumulative bonus, which is increase in sum insured without paying for the same. You can also get fitness discount if your health parameters such as BMI, diabetes, Blood pressure is improved.

Possibly yes. If you have not renewed your policy within the grace period then there are high chances that your policy may lapse.

Yes. You can add or remove optional/add on cover at the time of renewal. This is not permitted during the policy tenure. Read this blog for more information.

Usually it takes not more than 5 minutes but you need to keep details such as your policy number and other information ready.

You get a grace period of 15-30 days to renew your health insurance policy. You need to renew within that period. But, if your grace period is also over then your policy will expire. Then, you have to buy a new policy with a fresh waiting period and other benefits.