Home Insurance

Your home is a place where you reside, make lifelong memories and feel safe from the outside world. But what happens if that sanctuary is threatened? As a homeowner or tenant, it is your responsibility to protect your home against threats of damage or loss, and a home insurance policy helps you do just that. It is a policy that protects your home and its contents against damage/loss due to fire accidents, burglary & theft, natural calamities, man-made hazards and other unfortunate events.This Diwali, as you illuminate your home with lights and laughter, take a moment to secure it with the protection it deserves.

From walls to wardrobes, protect every corner of your home with HDFC ERGO Home Insurance. Get covered today!

Why Should You Buy HDFC ERGO Home Insurance?

Affordable Premiums

Purchasing a home (or renting it) may be expensive. But securing it is not. With reasonable premiums and discounts up to 45%*, there’s affordable protection for every kind of budget.

All-inclusive Home Protection

Our homes are vulnerable to natural calamities and various crimes. Natural disasters like earthquakes or floods, and even, burglary and theft may occur any time. Home insurance covers all these circumstances and more.

Safety For Your Belongings

If you thought home insurance only secured the structural aspects of your home, we have good news. These plans also cover your belongings, including expensive electronics, jewellery and more.

Flexible Choice Of Tenures

HDFC ERGO offers home insurance plans with a flexible choice of tenures. You can avail the policy for multiple years and thereby avoid hassle of renewing it annually.

Comprehensive Content Coverage

Nobody knows the true value of your belongings like you do. With comprehensive content coverage up to Rs. 25 lakhs, you can secure any of your belongings - no specifications or conditions attached.

Security For Owners and Tenants

Calamities come unannounced. Fortunately, home insurance makes you prepared for any situation. Whether you’re a homeowner or a tenant, you’ll find a home insurance policy that protects your safe space.

For Benefits related details, click here

Types of Home Insurance Policies by HDFC ERGO

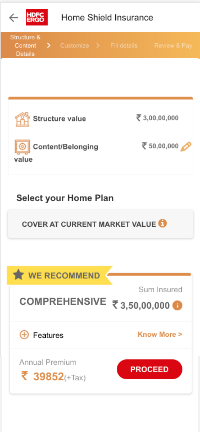

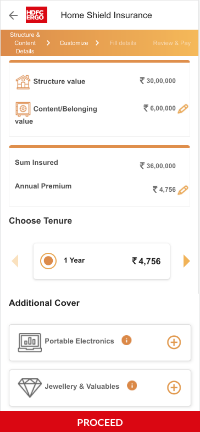

Comprehensive (Home Shield Insurance)

You get building cover up to ₹10 crore and contents cover up to ₹50 lakh for up to five years. The policy runs on an all-risk basis with useful add-ons and value-based pricing options.

• Covers fire, flood, earthquake, storm, riots, burglary, theft, breakdown, and accidental damage.

• Includes rent for alternate stay, hotel costs, emergency purchases, and shifting in the base cover.

• Add-ons: portable electronics, jewellery (20%), terrorism, public liability, and bicycles.

• Security feature discounts up to 30% and a 10% annual increment option.

Bharat Griha Raksha

You get cover for your home building and contents against fire, allied risks, and natural disasters. The sum insured is calculated by multiplying the construction cost by the carpet area.

• In-built covers: terrorism, debris removal (3%), architect/surveyor fees (5%).

• Policy tenure is up to 30 years, with a 10% annual auto-increase.

• Premium stays fixed for the full term.

• Includes coverage for buildings under construction.

Fire & Burglary (Home Insurance)

You get cover for the building and contents against fire, allied risks, burglary, and theft. The sum insured is calculated by multiplying the construction cost by the carpet area.

• Construction cost available for structures up to ₹6,500 per sq ft.

• The policy term is up to 5 years.

• The building sum insured increases 10% each year.

Shocking but true, a burglary happens every 3 minutes in India. Don’t wait for it to happen to you. Get instant home insurance quotes today!

Best Home Insurance Plans by HDFC ERGO

Key Features of HDFC ERGO Home Insurance Policy

| Key Features | Benefits |

| Covers Home Structure | Up to ₹ 10 crore. |

| Covers Belongings | Upto ₹ 25 lakhs. |

| Discounts | Upto 45%* |

| Additional Coverage | Covers 15 types of belongings & perils |

| Add-on Covers | 5 add-on covers |

What do HDFC ERGO Home Insurance Policies Cover

Fire Accidents

A fire accident is quite traumatic and painful. But you can count on us to help you rebuild and restore your home the way it was.

Thefts and Burglaries

Burglars and thieves come uninvited to your home. Hence, it is better to secure your house with a home insurance policy to avoid financial losses. We cover losses from thefts and try to help you during your hard times.

Electrical Breakdown

You may take care of your electronic appliances and gadgets as much as you can. But sometimes they might breakdown. Worry not, we cover the sudden expenses incurred in case of electrical breakdowns.

Natural Calamities

Natural calamities like floods and earthquakes are beyond anyone’s control and within short span of time it can cause major damage to the home and its content. However, what’s in our control is to protect against potential loss of your home and its belongings with our home insurance policy.

Alternate Accommodation

When you are searching for a temporary roof over your head when your home is uninhabitable due to an insured peril, we are there to help. With our alternative accommodation clause**, we ensure that you have a temporary place to stay comfortably till your house is ready for accommodation again.

Accidental Damage

Put a seal of safety on expensive fittings and fixtures with our home insurance plan. We truly believe in retaining that you need to protect your precious belongings whether you’re a homeowner or a tenant.

Man-made Hazards

A man-made hazard such as riots and terrorism can be just as damaging as a natural disaster. That’s why we’ve committed to doing all we can to help protect you from the financial burden in the aftermath.

War

Loss/Damages arising of events including war, invasion, act of foreign enemy, hostile. are not covered.

Precious collectibles

Losses arising out of damage to bullions, stamps, work of art, coins etc. will not be covered.

Old Content

We understand that all your precious possessions hold emotional value but anything that’s over 10 years old will not be covered under this home insurance policy.

Consequential Loss

Consequential losses are losses that are not the natural result of the breach in the usual course of things, such losses remains uncovered.

Willful Misconduct

We ensure your unforseen losses are covered, however if the damage is willfully conducted then it is not covered.

Third party construction loss

Any damage caused to your property due to third party construction is not covered.

Wear & Tear

Your home insurance does not cover usual wear and tear or maintenance/renovation.

Cost of Land

Under circumstances, this home insurance policy shall not cover the cost of land.

Under construction

Home insurance cover is for your home where you reside any under-construction property will not be covered.

Optional Cover Under HDFC ERGO Home Insurance Policies

Portable Electronic Equipment Cover

Jewellery & Valuables

Public Liability

Pedal Cycle

Terrorism Cover

Make sure your gadgets are protected every time you travel.

It’s a digital world, and life is hard to imagine without devices that help us connect, communicate, and capture. At the same time, travel is unavoidable in the modern world, be it for business, leisure, or work. This is why you need to secure your valuable electronics such as laptops, cameras, musical equipment, etc., with HDFC ERGO’s portable electronic equipment cover. This cover ensures that you can enjoy your travel without having to worry about your valuable electronics getting damaged or lost in travel.

Suppose you damage or lose your laptop while travelling. This add-on policy covers the cost of repair/replacement of your laptop subject to the maximum sum assured. The damage, however, should not be intentional, and the device should not be more than 10 years old. Policy excesses and deductions apply in this case, as they do in others.

Our jewellery is the legacy we inherit and pass on to future generations.

In an Indian home, jewellery is more than just ornaments. It is tradition, heirloom, and heritage, passed down to us through the generations, so that we may in turn pass it down to those who come after us. This is why HDFC ERGO brings to you its jewellery and valuables add-on cover that provides insurance cover to your jewellery and other valuables such as sculptures, watches, paintings, etc.

The cover provides a sum assured of up to 20% of the value of the belongings in case of damage to or theft of your precious jewellery or valuables. The value of the jewellery or valuables, in this case, is calculated based on the prevailing market value of the asset.

Your home is your most prized possession. Protect it from the vicissitudes of life.

Life is unpredictable, and we can not always predict untoward accidents. We can however, be prepared for the financial liabilities arising out of accidents. HDFC ERGO’s Public Liability cover offers a sum insured of up to Rs. 50 Lakhs in case of injury/damage occurring to a third party on account of your house. For instance, if a neighbour or a bystander gets injured due to renovation being carried out at your house, this add-on covers the financial costs. Similarly, any damage to third party property occurring in and about the insured's dwelling.

Four wheels move the body, two wheels move the soul.

We know that you love pedalling away to fitness, which is why you’ve invested time and money in selecting and buying the best bicycle. Modern bicycles are sophisticated machines engineered with state-of-the-art technologies, and don’t come cheap. It is important therefore, that you protect your valuable bicycle with an adequate insurance cover.

Our pedal cycle add-on insurance cover policy covers your bicycle or your exercise bike from any loss or damage on account of theft, fire, accidents, or natural calamities. What’s more, we even cover you in case of any liabilities arising out of injury/damage to a third party from your insured bicycle such as in the case of an accident. The policy provides a cover of up to Rs. 5 Lakhs excluding damage/loss to tyres, which is not covered.

Be a responsible citizen and protect your home in case of a terrorist attack.

Terrorism has become a persistent threat in the world we live in. As responsible citizens, it becomes our duty to be prepared to face up to it. One way in which ordinary citizens can help is by making sure that their homes and other premises are financially secured in the event of a terrorist attack. The cover covers damages occurring to your home either from a direct terrorist attack or due to defensive proceedings by security forces.

Add-On Coverage Under Home Insurance Plan

Looking at the big picture is important. But taking care of the little details - that’s a superpower too. And now, with the variety of home insurance plans we offer, you can ensure that every little thing in your house is secured. That way, there’s nothing that can shake off that #HappyFeel vibe in your home.

Why there is a Need for Home Insurance in India?

While home insurance is not mandatory in India, you may think of getting a home insurance plan depending upon the risk factors in India. For example, many regions are prone to natural calamities like floods, earthquakes and cyclones; do not forget those fire incidents and thefts/burglaries that happen here most of the times. Hence, buy a home insurance plan to get coverage under following circumstances:

Fire Accidents

Thefts and burglaries

Natural calamities

Man-made hazards

Damage to belongings

Natural Calamities Can Uproot Live And Livelihood

Floods in India can be devastating. According to reports, in 2024, floods in Tripura severely damaged 3,243 houses and partially damaged 17,046. Furthermore in Gujarat 20,000 were rendered homeless because of the wrath

of nature.

Read More

Theft and Burglary Can Lead to Financial Distress

In 2022, over 652 thousand theft cases were reported across India. In 2022, Delhi had the highest reported theft rate with over 979 cases per 100,000 people, followed by Mizoram and Chandigarh. Loss of content could be

a big financial blow for a family.

Read More

Living on rent? Shield your home contents from risks like fire, burglary, and more with renters’ insurance. Get insured in just a few clicks!

Home Insurance policies available for Every Type of Residence

Home insurance is a very important policy that financially protects the structure of your home and its contents. This policy can be bought for the following types of properties;

Flat

Individuals who live in a flat can buy home insurance for it. Flat owners can protect the structure of their home unit and their belongings with this policy against unforeseen damages/losses. Individuals living in flats as tenants can also opt for this policy to cover their belongings.

Apartment

Apartments are a great choice for residence as they are housing units within larger buildings, offering more living space and a choice of shared amenities. Apartment owners and tenants can get home insurance to protect their lovely abode and/or its contents against damages/losses due to perils like fire accidents, theft, natural calamities, etc.

Condo

Living in condominiums has its own perks. Mostly owned by individuals or privately rented out, they feature common areas and shared maintenance under a board of unit owners, offering a sense of community living. To protect such a wonderful residential arrangement, condo owners can buy home insurance, which covers the condo unit structure and contents from unwanted losses/damages..

Villa

Living in a villa is as lavish as it gets. It highlights the rich taste and sense of elegance of its owner. These large and luxurious houses have a steep ownership price. Hence, dealing with damages/losses to its structure or contents can be challenging. Hence, villa owners can get home insurance to financially cover their structure and/or contents against perils.

Who should buy a Home Insurance ?

The Proud Home Owner

Few things in life match up to the joy of unlocking the door and taking that first step into a house you call your own. But with that joy also comes a nagging worry - “what if something happens to my home?”

Put that worry to rest with the HDFC ERGO Home Shield Insurance for Owners. We protect your house and your belongings in case of natural calamities, man-made hazards, fires, thefts and more.

The Happy Renter

First off, congratulations if you’ve found the perfect home to rent in your city. It gives you all the perks of a fabulous house without any added responsibilities, doesn’t it? Well, that may be true, but the need for safety is universal, even if you’re a tenant.

Protect all your belongings and keep yourself safe from financial losses in case of natural disasters, burglaries or accidents with our Tenant Insurance Policy.

Home Insurance Policy: Eligibility Criteria

You can purchase the HDFC ERGO Home Insurance Policy if you are:

The owner of an apartment or an independent building can insure the structure and/or its contents, jewellery, valuables and portable electronic equipment.

The owner of a flat or apartment can insure the structure of their property as per carpet area and cost of reconstruction.

A tenant or a non-owner, in which case you can insure the contents of the house, jewellery and valuables, curios, paintings, work of art and portable electronic equipment

Factors that affect Home Insurance Premium

The extent of coverage

With additional coverage, the extent of protection to your home will also increase along with the premium.

The location and size of your house

A house that’s located in a safer area is more economical to insure than a house that’s located in a place prone to floods or earthquakes, or where the rate of thefts is higher. And, with bigger carpet area, the premium also tends to rise.

The value of your belongings

If you’re insuring high-value possessions like expensive jewellery or valuables, then the premium payable also rises correspondingly.

The security measures in place

A house that has a good deal of safety measures in place costs less to insure than a house that doesn’t come with any security or safeguards. For eg: A house with fire fighting equipment in place will cost lesser than the others.

The mode of purchase

Buying your home insurance online can actually be more affordable, since you get to take advantage of discounts and offers from us.

The nature of your occupation

Are you a salaried employee? Well, if you are, we have some good news. HDFC ERGO offers some attractive discounts on home insurance premiums for salaried folks.

Home Insurance Premium Calculator

The home insurance premium calculator is an online tool that assists interested buyers in getting an estimate of their preferred home insurance plan prior to purchase. It gives a clear idea of price, helping buyers make a more informed decision.

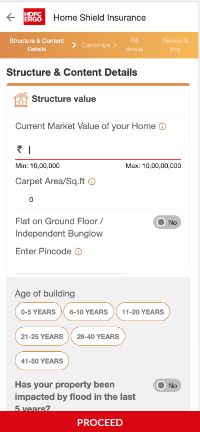

How to Calculate Home Insurance Premium In 4 Easy Steps?

Calculating your home insurance premium has never been easier. All it takes is 4 quick steps.

What is deductible in Home Insurance?

A deductible in home insurance is the amount you pay out of pocket before your insurer covers the rest of a claim. During the time of a claim, the amount you receive from your insurer is minus that of the deductible.

There are two types of deductibles:

1. Fixed Deductible: This is an amount pre-decided by you and your insurer at the beginning of buying the policy, which you have to pay before insurance kicks in. So, for example, if your deductible is Rs 10,000 and your claim amount is Rs 100,000, you will pay Rs 10,000 from your pocket and the rest Rs 90, 000 will be paid by the insurer.

2. Variable Deductible: This deductible is a calculated percentage of your home’s insured value. So, if your home is insured for Rs 300,000 and your deductible is 2% of your sum insured, it turns out to be Rs 6000. If you place a claim of, say Rs 20,000, your insurer will pay Rs 14,000 after subtracting the deductible.

Why Buy Home Insurance Policy Online?

Convenience

Online purchases are more convenient. You can buy insurance from the comfort of your home, and save time, energy and efforts. What a win!

Secured Payment Modes

There’s a plethora of secure payment modes you can choose from. Use your debit card, credit card, net banking and even wallets and UPI to settle your purchase.

Instant policy issuance

Payment done? That means no more waiting for your policy document. Simply check your email inbox, where your policy documents arrive within seconds of making your payment.

User-friendly features

There’s no dearth of user-friendly features online. Calculate the premium in an instant, customize your plans, check your coverage with just a few clicks, and add or remove members from your policy without any trouble.

How To Compare Home Insurance Plans Of Different Companies?

To compare home insurance plans of different companies and then settle for the one that suits your needs, keep these things in mind:

Coverage Offered

For each plan that you have shortlisted, check if it covers natural disasters, fire, theft, and other perils in its base coverage. Some plans can be customised, so check if the option is available to make your policy a comprehensive one.

Additional Benefits

Check if you can include coverage for personal belongings, jewellery, and electronic coverage. This gives wider security and peace of mind.

Sum Insured

Choose a sum insured that is enough to cover rebuilding costs and covers your valuables. A lower sum insured might add to financial strain during a crisis hour.

Premium Cost

A lower premium would also mean less sum insured. So, work on your premium, taking into consideration the cost of rebuilding and valuables and check for exclusions in your plan. Also, check premium rates for coverage similar to your shortlisted companies.

Claim Process & Settlement Ratio

Don’t miss this. Do your research and read reviews about the ease of claim filing and approval time of your shortlisted companies. The higher the claim settlement ratio, the better.

Exclusions & Limitations

Understand What’s covered and Not covered in your plan to avoid claim rejections later. Take your time and read the fine print.

Add-On Covers

Check for optional riders like rent loss coverage, terrorism cover, or appliance breakdown cover, as these can save you from shelling out money during any untoward incident.

Customer Reviews & Reputation

Take your time to read online reviews and ratings for service quality and claim experiences. This will help you make an informed decision about the policy you choose.

Discounts & Offers

One way to lower your premiums and still secure your home and belongings is to look for discounts on security features, long-term policies, or bundled insurance plans.

Policy Terms & Conditions

Go through the fine print for deductibles, waiting periods, and renewal terms. Different insurers have different clauses, check them before you seal the deal.

Financial Security

While different companies might give you options to choose from various benefits, add-ons and base coverage, choose a company with a strong financial background to ensure claim security.

Steps to Buy a Home Insurance Policy

Assess Your Needs

Determine the coverage you need based on your home’s value, location, and belongings.

Research & Review

Compare different plans based on reputation, customer reviews, and claim settlement ratio.

Understand Coverage Options

Choose between basic coverage (fire, theft, natural disasters) and additional coverage (floods, earthquakes, valuables) for a comprehensive plan.

Calculate the Sum Insured

To avoid underinsurance, ensure your home and belongings are insured for their correct value.

Get Quotes & Compare Policies

Request quotes from multiple insurers and compare premiums, deductibles, and policy benefits.

Check Policy Exclusions

Read the policy document carefully to understand what is not covered.

Consider Add-ons & Riders

If needed, opt for additional coverage, such as personal accident cover or alternate accommodation expenses.

Evaluate Claim Process

Choose an insurer with a hassle-free and quick claims settlement process.

Purchase the Policy

Buy the policy online or offline after reviewing all details and ensuring it meets your needs.

How to Make a Claim for your HDFC ERGO Home Insurance

For registering or intimating claim, you can call on helpline no. 022 6158 2020 or email to our customer service desk at care@hdfcergo.com After claim registration, our team will guide you in every single step ahead and help you settle your claims without any hassle.

Documents required to raise home insurance claims:

Following standard documents are required for processing claims:

- Policy or Underwriting Booklet

- Photographs of the damage

- Filled up claim form

- Logbook, or Asset Register or Item list (wherever shared)

- Invoices for repairs and replacement costs along with payment receipt

- All certificates (which are applicable)

- First Information Report Copy (wherever applicable)

Please refer to the Policy Issuance & Servicing TATs

Importance of creating a home insurance inventory for insurance purposes

Creating a home inventory for insurance purposes is essential for several reasons:

Easier Claims Process

A detailed inventory helps speed up and simplify the insurance claim process in case of loss or damage.

Accurate Valuation

It ensures you have an accurate record of your possessions, preventing underinsurance or overinsurance.

Proof of Ownership

It provides evidence of ownership, making it easier to claim compensation for lost or damaged items.

Disaster Preparedness

It helps recover financially after disasters like fires, floods, or theft.

Better Coverage Selection

It assists in selecting the right insurance coverage based on the value of your belongings.

Quicker Settlements

It reduces disputes with insurers, leading to faster claim settlements.

Tax and Legal Benefits

It can be useful for tax deductions (e.g., after a loss) or legal matters like estate planning.

Peace of Mind

Gives confidence that you are well-prepared for unexpected events.

Steps to Renew Your Home Insurance Policy

Check Policy Expiry Date

Review your policy’s expiration date to ensure timely renewal and avoid coverage gaps.

Evaluate Coverage Needs

Assess if your coverage needs have changed due to home improvements, new valuables, or location risks.

Compare Insurance Providers

Check if better options are available by comparing premiums, coverage, and claim processes.

Review Policy Terms & Exclusions

Ensure you understand any changes in terms, conditions, and exclusions before renewing.

Update Policy Details

Inform the insurer about any changes in the home structure, security features, or new add-ons required.

Check for Discounts & Offers

Look for loyalty discounts, no-claim bonuses, or bundled policy benefits to reduce premiums.

Renew Online or Offline

Pay the renewal premium through the insurer’s website, mobile app, or offline channels.

Verify Renewal Confirmation

Ensure you receive a confirmation email or policy document with updated details.

Save & Store the Policy Document

Keep a digital and printed copy of your renewed policy for future reference.

Home Insurance Policy Documents

| Brochure | Claim Form | Policy Wordings |

| Get details on various home insurance plans with their key features and benefits. Click here and visit the Home category to know more about HDFC ERGO home insurance policy covers. | Want to claim your home insurance? Click here and visit the Home category to download the home policy claim form and fill in the required details for hassle free claim settlement. | Please refer the policy wordings under Home Insurance category to know more about the terms and conditions applied. Get more details on coverages and features offered by HDFC ERGO Home Insurance Plans. |

Decoding Home Insurance Terms

Home insurance may seem a bit complex, but that’s only until you’ve figured out all the jargon. Here, let’s help you out with that by decoding some commonly used home insurance terms.

Sum Insured

The sum insured is the maximum amount the insurance company will pay you in case of loss due to defined peril occurs. In other words, it’s the maximum coverage that you have opted for under your home insurance plan.

Third-party liability cover

This kind of cover protects you in case you are held liable for the damages, losses, or injuries to any third-party (whether it’s a person or property) occurring in and about the insured's property. Such a loss, damage or injury must be a result of the insured property or belonging.

Deductible

In some cases, when an insurable event happens, you will have to pay some of the expenses involved out of your own pocket. This amount is known as the deductible. The rest of the expenses or losses will be borne by the insurance company.

Claims

Insurance claims are formal requests from policyholders to insurers, made for claiming the coverage or compensation due under the terms of the home insurance plan. Claims are made when any of the insured events have occurred.

Alternative Accommodation

This is an additional clause/cover in some home insurance policies, where the insurer also arranges for temporary alternative accommodation for the insured person in case their home is damaged and deemed unfit for living due to an insurable peril.

Policy lapse

Policy lapse occurs when your insurance ceases to be active. In other words, the benefits and the coverage offered by your home insurance plan no longer remain applicable. Policy lapse can occur if you fail to pay your premiums on time.

Home Insurance Terminologies

Here are concise definitions for the home insurance terminologies:

Actual Cash Value

The value of your insured property after deducting depreciation from the replacement cost. This represents the Actual Cash Value of the property.

Structure

Structure refers to the physical building or the house, which consists of its walls, roof and foundation.

Contents

Your possessions and items inside your home, like furniture, electronics and clothing, are covered for loss or damage under the policies associated with building insurance.

Deductibles

This is the minimum amount you need to pay out-of-pocket before your insurance kicks in to cover a claim. Higher deductibles generally lower your premium but could increase your out-of-pocket expenses.

Dwelling Policy

A type of insurance that covers the home itself but may not cover personal property or liability. The primary use is for rental properties.

Replacement Cost

It is the actual cost of replacing or repairing your home or belongings with new items of similar kind and quality without subtracting depreciation.

Appraisal

An appraisal is a professional judgment of the worth or value of real property, antiques, estate items and classics used for insurance purposes.

Depreciation

A decrease in the value of your property or possessions over time as a result of daily use, age, or simply being outdated.

Grace Period

The additional time is given after a premium due date, during which you can pay without losing coverage, which usually ranges from a few days to a month.

Lapse

A situation where your insurance coverage is ultimately terminated due to non-payment of premiums, leaving your property uninsured.

Market Value

The price your home would likely sell for on the open market. It may differ from its replacement cost or insured value.

Reinstatement

It is restoring lapsed insurance coverage after overdue premiums are paid. It often requires approval from the insurer.

Renter’s Insurance

A type of insurance that covers a tenant’s personal belongings and liability, not the physical structure, which the landlord covers.

Public Liability

Insurance that covers legal costs and compensation if someone is injured or their property is damaged while on your premises.

Cost of Reconstruction

The expense of rebuilding your home from scratch after a total loss, including materials, labour, and compliance with current building codes.

Handy Tips for Choosing Home Insurance Plans in India

Are you a proud owner of a new home? Do you feel an unsuppressed urge to protect all you have so painstakingly built? Read on to find out what you need to look for in a home insurance policy :

Coverage for Physical Structure

This is the basic coverage offered in any home insurance. It only includes the physical structure along with the electrical wiring, plumbing, heating or air conditioning. It does not include the land though, on which the building stands.

Structures within residence premises

Some of you must have attached pools, garages, fencing, a garden, a shade or a backyard around your precious homes. Any damages caused to these structures around are also covered under home insurance.

Content Coverage

Your personal belongings inside your house – whether the television set, laptops, washing machine, furnishings or jewellery – are equally expensive and high-priced, costing you a fortune. Secure these contents under home insurance for damage, burglary or loss.

Substitute residence

You might have occasions when the damage to your building is so severe that you will need a temporary residence. The insurance policy covers the expenses for rent, food, transportation, and hotel rooms. However, to avail of the benefits, the reason for moving should be covered under the insurance plan.

Third-Party Liability Coverage

This benefit might not be talked about often, but is an interesting feature of home insurance. This means that your insurance will cover any accident or damage caused within or around your property to any third party. For example, if your neighbour's cat is accidentally electrocuted by your fence, the medical expenses will be under this facility.

Landlord and Tenant Insurance

Landlord insurance safeguards the home structure and its contents of the landlord’s property. It also protects tenant contents if the tenant has taken a renters insurance.

Difference Between BGR & Home Shield Insurance

Bharat Griha Raksha Raksha Cover is a policy that has been mandated to all insurance providers, by IRDAI, to offer, with effect from 1st April 2021. HDFC ERGOs Home Shield is an umbrella insurance that covers damages caused by natural calamities and fire breakouts.

| Features | Bharat Griha Raksha Policy | Home Shield Insurance Policy |

| Premium Amount | This is a standard home insurance covering residential houses with affordable, low-cost premiums. | Homeowners and tenants can get 30% discounts on their premiums for security deposits, salaried discounts, and long-term discounts. |

| Tenure | This covers property and content damage for 10 years. | It can cover your home and its interiors for as long as 5 years. |

| Sum Insured | Auto escalation of the sum insured of 10% is done annually. | This has an optional cover in Home Shield. |

| Coverage | This has a waiver of under insurance. It compensates for replacing the covered items and not their market cost. | Coverage is only to the value of the sum insured as issued by the company. |

| Content Coverage Amount | Valuable content of the house is covered up to 5 lakhs of the sum insured. | Rupees 25 lakhs coverage is offered for content safeguard without a specified list being shared for belongings. |

| Inclusions | The inbuilt add-ons include damage due to riots and terrorism, rent for alternate accommodation, and debris removal compensation. | This covers damages due to fire, natural and man-made hazards, theft, electrical breakdown of your machines and accidental damages to fixtures and fittings. |

| Optional Cover | Here too, optional covers for valuable items like jewellery, paintings, works of art etc are available. Moreover, you and your spouse will also receive personal accident cover for death due to damaged building or contents. | Here, optional covers include sum insured escalation of 10%, expenses incurred while shifting to a new residence, hotel accommodation, portable gadgets and even jewellery. |

| Exclusions | What does not come under this policy purview are loss of precious stones, or manuscripts, damage to any electrical goods, war, or any willful negligence. | Home Shield does not cover direct or indirect damages due to war, contamination from nuclear fuel, waste, loss due to structural defects of buildings, manufacturing defects of electronics gadgets etc. |

Difference between Home Insurance & Home Loan Insurance

Home insurance and home loan insurance are victims of mismatch. These both sound pretty interchangeable, though they serve very different purposes. Let’s understand the two so that you can make an informed decision concerning protecting your home and financial well-being.

| Home Insurance | Home Loan Insurance |

| Home insurance protects you against loss or damage to your home and contents due to unforeseen causes such as fire, burglary, floods, earthquakes, or other catastrophes. | Home loan insurance is designed to pay the outstanding amount of the home loan on your behalf in case of certain events, such as death, critical illness, or loss of a job, which would prevent one from repaying it. |

| This kind of insurance covers damage to a structure, like a home, and contents therein like furniture, electronics, and appliances. It may also include liabilities arising from accidents occurring on the property. | Home loan insurance covers the remaining balance of the loan just in case the borrower is unable to continue repaying it for unpredictable reasons, therefore ensuring the loan is off the books. |

| Both house owners and tenants can buy home insurance, although in the latter case, only the contents will be covered and not the structure. | Home loan insurance applies to personal homeowners who have acquired their homes through loans and is not an option for those who do not have such a similarly relative repayment of the loan. |

| Home Insurance is intensive in the sense that, even if you face property risks from natural calamities or man-made incidents, you are assured not to carry that burden financially. | Home loan insurance becomes very important when a borrower gets into some unforeseen problem due to losing his job or severe health issues, so much so that it may become impossible to pay the loan and thus protect the family from financial stress. |

| The premium normally charged for the insurance is low because insurance for a house is directly rated on the value of the structure and its contents, thus considered a very cost-effective way of home protection. | In contrast, the premiums for home loan insurance are generally higher since it is associated with the amount one has in a home loan and possible risks in repayment. |

| Premiums that are paid towards home insurance are not deductible, meaning that it provides the protection of finances but does not offer direct tax benefits of any kind. | However, premiums paid for home loan insurance are allowed as a deduction under Section 80C of the Income Tax Act, thus offering some relief in your tax liabilities. |

| Home insurance provides complete coverage that can also provide alternate accommodation in the worst case where your home becomes uninhabitable so that you are guaranteed a place to stay as repairs take place. | Home loan insurance gives you the peace of mind that if something happens to you, the loan repayment will not come onto your family's shoulders, ensuring that their future is protected with regards to the property. |

Difference between landlord & tenant insurance

Here are the differences between landlord and tenant home insurance;

| Categories | Landlord home insurance | Tenant home insurance |

| Who can buy it? | This type of home insurance can only be bought by individuals who want to cover their home that they own. | Individuals who live as tenants can opt for this home insurance plan. |

| What can be covered? | Under this plan, home structure, contents or both can be covered. | Under this plan, tenants can only get insurance coverage for the home contents, not the structure. |

| Average cost | The average cost of a landlord's home insurance can be higher if opted for both structure and content coverage. | The average cost of tenant home insurance is lower as it only includes the cost of covering home contents. |

Benefits of Home Insurance

| Benefit | Description |

| Comprehensive Protection | Home insurance does not only insure the house but further provides cover against other structures, for example, the garage, shed, or even the boundary walls, and additional coverage to your valuables, such as electronics, furniture, and appliances. |

| Replacement and Repair Costs | Home insurance will take care of any purchase or repair costs in case of damage or theft to your property. This way, the stability of your funds does not easily fray because of such happenings. |

| Continuous Coverage | Home insurance also comes in handy when your house becomes uninhabitable due to an accident or disaster. It may pay for your temporary living expenses, like rent or hotel bills, in case your house got partially damaged in a fire or another such disaster, so you will still have a roof over your head. |

| Liability Protection | This is particularly useful if you happen to be a homeowner. In case of an accident on your property, somebody gets hurt; your home insurance will take care of the resulting litigation and damages. |

| Fire Accidents | Fires can leave you devastated. Home insurance can assist you in rebuilding and repairing so you do not have to completely shoulder everything on your own. |

| Thefts and Burglaries | Nobody wants to think about being robbed, although it can happen to anyone. Home insurance will protect you against financial loss should you fall victim to burglary or theft. |

| Electrical Breakdown | Electronic gadgets and appliances are sensitive and sometimes break down for no apparent reason. The home insurance thus will help in covering the unexpected costs of repairs or replacements. |

| Natural Calamities | In a country like India, with its frequent floods and earthquakes, the importance of home insurance increases leaps and bounds. It can cover your home and its contents against such eventualities. |

| Alternative Accommodation | If your home becomes uninhabitable due to an insured event, your policy will cover the rent of a temporary place to stay. |

| Accidental Damage | Accidents happen, and when they do, home insurance can help cover the costs of any damages to expensive fittings and fixtures in your home. |

| Man-Made Hazards | Man-made events like riots or terrorism can cause significant property damage. Home insurance can protect you from the financial burden that comes with these events. |

How are Homeowner’s insurance rates determined?

Homeowner's insurance premiun are determined based on several factors, including:

| Factors | Details |

| Location | This is the prime factor that is taken into consideration. If your property is situated in an area that threatens the risk of natural disasters, high crime rates, or located on the outskirts of the city limits, the premium rates could go up. |

| Home Value & Replacement Cost | The insurers would take into consideration the cost to rebuild the home, not just market value, before defining the premium. |

| Wear & Tear | Older homes may have higher premiums due to the potential repair costs attached to the structure. |

| Sum Assured | A higher sum assured increases premium rates. |

| Deductible | Opting for deductibles can impact your premium rates. Higher deductibles lower premiums, while lower deductibles raise them. |

| Claims History | The number of past claims made on your property considerably increases the premium. |

| Credit Score | Having a higher credit score can influence your insurer to work out a lower premium for your property. |

| Home Security Features | Maintaining your property by installing security systems, smoke detectors, and fire alarms ensures damage control methods are in place, which can reduce premium rates. |

| Durable Structure & Roof | Insuring a durable and weather-resistant structure may lower premium costs. Insurers pay emphasis on the roof of the structure, which should be resistant to changing weather and compatible with various climatic conditions. |

Hear from Our happy customers

Home Insurance News

Read Latest Home Insurance Blogs

Frequently Asked Questions on Home Insurance

1. What is home insurance?

It is a policy that covers the physical structure of your residential building and the content within your residence. Be it a homeowner or a tenant, this insurance covers damages caused by floods, earthquakes, theft, fire etc.

2. Can the sum insured for this policy be increased or decreased during the term?

The sum insured can be increased by opting for a higher premium. It can however, not be decreased.

3. What is the duration of the policy?

This policy has a maximum duration of 5 years. Buyers are offered discounts ranging from 3% to 12% depending on the length of the tenure.

4. Can I cancel the policy at any time during the tenure?

Yes. You can cancel the policy anytime you want. However, please note that retention of premium as per short period scales would be applicable.

5. What is the criteria for applying to this policy?

To be eligible to apply for this policy, your property should meet the following requirements:

- - It should be a registered residential property.

- - Its construction should be complete in every respect.

6. Do I really need home insurance?

A home is more than just a house. It is the one place in the whole world that we can truly call our own. It becomes our responsibility to protect it from unforeseen events, forces of nature, and the ravages of time. A home insurance policy is the best tool we have for protecting our most prized possession. Read more to understand the importance of Home Insurance.

7. Is it compulsory to buy home insurance from the designated bank?

Most people need to take a home loan to buy a home. While the loan agreement may require you to get home insurance, there is no compulsion to get the home insurance from a specific bank or insurance company.The loan provider may require you to get insurance for a certain value but as long the insurance company is authorised by IRDAI, the lender cannot refuse to accept the policy.

8. What do you mean by reinstatement cost?

Reinstatement cost is the cost of repairing the damaged property using materials of the same quality or kind. Reinstatement intends to indemnify your loss. The idea is to reconstruct the property in a similar condition that it was before the damage. Reinstatement cost primarily includes labour and material cost.

In the case of home contents insurance, reinstatement cost includes the cost of replacing the lost or damaged articles with articles of the new kind without factoring in depreciation.

9. How is the sum assured computed?

The sum insured is usually calculated based on the type of property, its market value, the area of the property, rate of construction per square feet. If, however, a comprehensive home insurance plan is bought, the sum insured would also include the cost or value of the articles of the home which are to be insured.

10. Are structure and building the same thing in home insurance?

The structure is a wider term which can be used to include the building of the property, the compound wall, terrace, garage, etc. The structure, thus, includes the vicinity of the building too. Building, on the other hand, means only the standalone building which is insured. It does not include the surrounding property.

11. What should I do in case of damages to my house?

In the case of damages, you should immediately inform the insurance company if such damages are within the scope of coverage. To inform HDFC ERGO, call 022 6158 2020. You can also send an email to the company at care@hdfcergo.com. You can also call on the number 1800 2700 700 for informing about the claim. Claim intimation should be made within 7 days of the damage.

12. How do I calculate my Sum Insured for Structure & Content?

A set formula has been defined to calculate the sum insured for the home building, including all structures. The prevailing cost of construction of the home building being insured, as declared by the policy buyer and accepted by the insurance company, becomes the sum insured. For home contents, built-in cover of 20% of the building sum insured, subject to maximum INR 10 lakhs, is provided. Further cover can be purchased.

13. Which insurance is best for your home?

Policies that provide comprehensive coverage for your home are always best. With affordable premiums and discounted rates, Home Shield and Bharat Griha Raksha policies are two of the best policies you can look for.

14. What is the meaning of Housing Insurance?

Home insurance in India offers financial security for your residential building and its internal contents against damages from man-made and natural disasters.

15. How much does home insurance cost in India?

The basic home insurance is quite cheap and affordable. Further discounts are also offered on premiums.

16. Is home insurance worth it in India?

A comprehensive policy covers losses due to theft and burglary. Every Indian household has some amount of precious jewellery at any given time. It also covers man-made perils like riots, vandalism and natural calamities like floods, earthquakes, storms etc.

17. Can tenants take home insurance?

Yes. Tenants can also invest in home insurance to protect their precious possessions. Insurance here, too, covers losses against natural disasters and man-made hazards.

18. Is it mandatory to buy home insurance?

It is not mandatory in India but is advisable due to the multiple benefits they offer.

19. Can we buy home insurance online?

HDFC ERGO home insurance can be purchased online seamlessly. Customer support is available 24/7 to solve all queries relating to any policy or any claim.

20. What insurance do I need for my home?

To insure your home, you will need a comprehensive home insurance plan or homeowners insurance. Choose a plan that will protect you against property damage, theft, and liability, and also extend coverage to secure the valuable contents of your home. The right home insurance plan will provide coverage for both structure and contents along with additional coverage for the premium you pay. Check HDFC ERGO’s comprehensive home insurance plan to select one that suits your needs.

21. Which is the affordable homeowners insurance?

An affordable homeowners insurance or home insurance varies based on location, property value, and coverage needs. However, premiums can be reduced by opting for higher deductibles, bundling policies, and installing safety features like smoke detectors or security systems, which ensures that risks attached to your home is considerably less. It's essential to compare quotes from multiple providers, as discounts and rates can vary significantly. You can also check out HDFC ERGO’s comprehensive home insurance plan as we provide customisable plans with required add-ons at competitive premiums.

22. How do I insure my house?

To insure your house, start by assessing the value of your home and belongings. Research different insurance providers and compare homeowners insurance policies that offer coverage for structural damage, personal property, and liability. Get quotes from multiple insurers, either online or through an agent. Choose the right level of coverage, factoring in potential risks like floods or earthquakes if applicable. Once you've selected a provider, complete the application process, undergo any required inspections, and pay the premium to activate your policy. Review your coverage regularly to ensure it meets your needs. Check HDFC ERGO’s comprehensive home insurance plan that comes with extra add-ons and boosts a smooth claim process.

23. Is property insurance & home insurance the same?

Depending on specific circumstances, property insurance and home insurance can sometimes be used interchangeably in India. In general, home insurance is a type of property insurance that covers your home’s structure and/or its contents. Property insurance is a policy that covers assets, like land, buildings, machinery, goods, etc.

24. What is home content insurance?

Home content insurance is a type of home insurance that covers the belongings in your house against loss or damage caused by perils like natural disasters, theft, fire, etc.

25. What are add-on covers that we can opt for while taking home insurance?

When buying home insurance, you can opt for add-ons like portable electronic equipment cover, jewellery & valuables cover, public liability cover, pedal cycle cover and terrorism cover.

26. What is home shield insurance?

Home shield insurance is a policy that offers comprehensive coverage for your home. It protects your assets for up to 5 years against various unanticipated events.

27. Who offers a home shield insurance policy?

HDFC ERGO offers the home shield insurance policy in India. Owner-occupants of apartments/flats/independent buildings and tenants/renters are eligible for this policy.

28. Does home insurance cover natural disasters?

Yes. Natural calamities are one of the many perils that home insurance offers coverage for. Floods, earthquakes, landslides, rockslides, etc., are some examples.

29. What are the things covered in home contents insurance?

The coverage of your home insurance policy depends on the plan that you have chosen. However, typically, furniture, fixtures, electronics, gadgets, and valuables such as jewellery, pieces of art, etc., can be covered.

30. What is the difference between homeowners' and tenants' insurance?

Homeowners generally prefer getting insurance that covers the physical structure. They may also want to protect the contents of the house, such as furniture, valuables, electronics,, etc. Tenants,, on the other hand, as they do not own the building, may only want to safeguard their belongings.

1. What is the maximum cover provided under this policy?

The policy provides a cover of up to Rs. 25 Lakhs for theft/damage to your home contents and a cover of up to Rs. 50 Lakhs for third party liabilities on account of accidents.

2. When will the policy cover start?

The policy cover starts 1 day after purchasing the policy online.

3. What is covered under the policy?

The following events are covered under the policy:

- - Fire

- - Burglary/theft

- - Electrical Breakdown

- - Natural Calamities

- - Manmade Hazards

- - Accidental Damage

Read this blog on Home Insurance Coverage for detailed information.

4. What is not covered under the policy?

The policy does not cover the following:

- - War

- - Precious Collectibles

- - Old Content

- - Consequential Loss

- - Wilful Misconduct

- - Third-Party Construction Loss

- - Wear and Tear

- - Cost of Land

- - Properties Under Construction

5. I own a house but it has been rented out to a tenant. Can I avail of this policy?

Yes, you can insure your house even if it is let out for rent. In the case of a house without any contents, you can opt for only building or structure damage cover. On the other hand, if you let out a fully furnished house, you should opt for a comprehensive policy that covers both the structure and the contents of your home in the case of a loss.

Infact even your tenant can opt for a home insurance policy wherein he/she would opt only for contents insurance that covers their belongings. Your home structure and its contents would not be insured under such a plan. In the case of damage or theft, your home might suffer damages for which the tenant would not be liable. A home insurance policy in that case would prove beneficial.

6. Is compound wall covered by home insurance?

Yes, while this was not the case earlier, but now, insurance companies consider the compound wall to be a part of the building. As per Honourable Supreme Court of India, the term building needs to be read where it includes structures outside of the main structure. These external structures can be garage, stable, shed, hut or another enclosure. So, compound walls are now considered to be covered by home insurance.

7. When does the insurance cover start?

The insurance cover starts from the date and time mentioned in the policy under the section of Date of Commencement. You can find the date of commencement in the policy schedule. Keep in mind that your policy will not cover anything before the date of commencement even if you have made full payment of the policy premium. Also, the date of policy expiry will be calculated on its basis.

8. Can an entire building or society be covered under a home insurance policy?

Yes, you can opt for the coverage of an entire building or society under a home insurance policy. However, policy issued to a housing society/ non-individual dwelling is an annual policy and not a long term policy.

1. Are there any deductibles under this policy?

Yes. Deductibles and excess are applicable on the policy as mentioned in the policy document.

2. Are there any discounts on the policy?

Yes. The policy offers discounts of up to 45%, including security discount, salaried discount, intercom discount, long-term discount and more.

3. What is the difference between an occupied owners policy and a non-owner occupied policy?

An occupied homeowners policy applies to a home in which the owner resides within the house he or she owns. The cover in this case is applicable to both the house and its contents. A non-owner occupied policy applies to a case where the owner has bought the property for the purpose of rental income. In this case the cover applies only to the contents of the house.

4. Is the policy assignable at the time of sale of premises?

The company is not bound by any assignment of this insurance without prior consent.

5. Are there any add-ons to the policy?

Yes. The policy offers several add-ons such as portable electronics cover, jewellery and valuables cover, terrorism cover, pedal bicycle cover, etc. Read this blog on Add-on Covers under Home Insurance.

6. What happens to the home insurance policy if I sell my house?

Once the property that has been insured is sold by the policyholder, the said policyholder ceases to hold any more insurable interest in the policy. As a result, the policy also ceases to be able to provide any protection to the policyholder. The new homeowner is required to get a new home insurance policy from an insurer. The original policyholder should inform the insurer about the sale for policy cancellation. Read this blog to know more on the importance of Home Insurance while selling the house.

7. Can I take a home insurance policy from 2 companies?

Yes, you can take home insurance from two companies. However, you should disclose the existing policy in the proposal form when you buy the second plan. Moreover, in the case of a claim, if you make a claim in both the plans, you would have to inform each insurance company about making the claim in another policy.

1. What are the documents needed for processing a claim?

You would need to submit a duly signed claim form, along with relevant documents attesting theft of or damage to your insured property. In case of theft, a copy of the FIR would be required.

2. How is the sum insured for the contents of the property assessed?

There are two methods of assessment used:

1. New for Old Basis: The item damaged beyond repair is replaced with a new one or the insurer pays the cost in full of the item irrespective of its age, subject to the maximum sum assured.

2. Indemnity Basis: Sum insured will be equal to the cost of replacement of the property with one of the same kind and same capacity minus the cost of depreciation.

3. How can i make the claim for this policy?

You can make a claim either of these three modes:

- - Phon: Call 022 6158 2020.

- - Text: Drop a WhatsApp text on 8169500500.

- - Email: Write us an email at care@hdfcergo.com

Please check out this blog , for more information.

4. How can I check my policy claim status?

To check your policy claim status follow these simple steps:

- 1. Log on https://www.hdfcergo.com/claims/claim-status.html

- 2. Enter your policy number or email/registered phone number.

- 3. Verify your contact details

- 4. Click on check policy status.

Your policy details will be displayed to you.

5. How will I receive my claim amount?

The claim amount is either transferred through NEFT/RTGS directly to your bank account linked with the policy or via a cheque.

6. Is FIR necessary for home insurance claim?

A FIR might be necessary for home insurance claims, particularly in case of impact damage like a vehicle ramming into the building, cases of damage caused in riots, strikes, malicious events, theft, burglary or the house being broken into. Generally, the home contents that are damaged or lost in such cases, as well as the damage caused to the home building, will be covered within the limits of repair costs.

7. Can I make a claim on my partially damaged home? What is the procedure to make a claim on a partially damaged house?

Yes, you can make a claim on your partially damaged home. The procedure for making a claim would be as follows –

• Call HDFC ERGO’s helpline number 022 6158 2020 or send an email to the customer service department at care@hdfcergo.com. This would get your claim registered with the insurance company

• Once the claim is registered, the claiming team of HDFC ERGO would guide you with the steps to get your claim settled.

• You would have to submit the following documents for claim settlement –

1. Photographs

2. Policy or underwriting documents

3. Claim form

4. Repair or replacement invoices with their receipts

5. Logbook or asset register the capitalized item list wherever applicable

6. All the valid certificates as applicable

7. Police FIR ,if applicable

After the documents are submitted, HDFC ERGO would verify the claim and settle it at the earliest.

1. Can this policy be renewed?

Yes the policy can be renewed on expiration. Follow these simple steps:

1. Log on to https://www.hdfcergo.com/renew-hdfc-ergo-policy 2. Enter your policy number/mobile number/email ID. 3. Check your policy details. 4. Make a quick online payment through your preferred mode of payment.

And that’s it. You’re done!

2. What documents do I need to renew my policy?

Renewing an existing HDFC ERGO policy is simple and hassle free. Simply provide your policy number along with the documents of your residential property and you are done.

3. How long can I renew this policy for?

You can renew the policy for any duration between 1 year to 5 years.

4. I have made some renovations to my home. Will the policy premium stay the same?

In case you have made renovations or added contents to the house that have significantly increased the value of your property, you might want an increased coverage to secure the same. In such a case the amount of premium would go up. However if you do not want to increase the coverage, you can renew the policy with the old premium.

5. How is the valuation of the property done for the purpose of policy renewal?

To arrive at a property valuation, the built up area of the property is multiplied by the cost of construction.

Health Insurance

Health Insurance  Travel Insurance

Travel Insurance  Car Insurance

Car Insurance  Cyber Insurance

Cyber Insurance  Critical Illness Insurance

Critical Illness Insurance

Pet Insurance

Pet Insurance

Bike/Two Wheeler Insurance

Bike/Two Wheeler Insurance  Home Insurance

Home Insurance  Third Party Vehicle Ins.

Third Party Vehicle Ins.  Tractor Insurance

Tractor Insurance  Goods Carrying Vehicle Ins.

Goods Carrying Vehicle Ins.  Passenger Carrying Vehicle Ins.

Passenger Carrying Vehicle Ins.  Compulsory Personal Accident Insurance

Compulsory Personal Accident Insurance  Travel Insurance

Travel Insurance  Rural

Rural