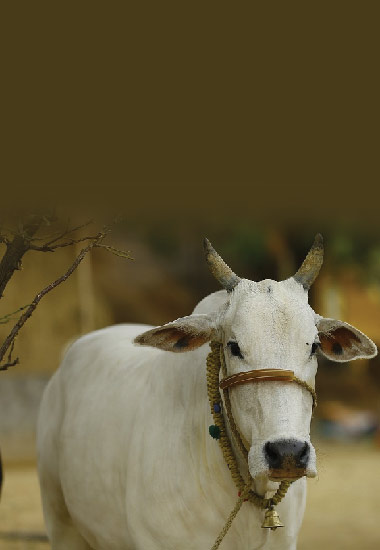

The Indian Agriculture Industry is on the brink of another green revolution that makes it more lucrative and profitable, as the total agriculture production in India is likely to Double in next ten years that too in an organic way. HDFC ERGO offers Cattle Insurance Policy for protection of Indian rural people from financial loss due to death of their cattle, which is one the most valued possessions of the rural community.

The Policy covers the persons having cows, bullocks or buffaloes of either sex certified as being in sound and perfect health and free from injury or disease by a veterinary doctor / surgeon and who are Members (in groups) of Micro Finance Institutions, Non Government Organisations, Government Sponsored Organisations and such affinity groups / institutions in rural and social sector. Any person having insurable interest in cattle is eligible to apply for obtaining insurance.

Death of cattle Covers the cattle insured whilst within a geographical area specified in the policy schedule, in case of loss of life accident or diseases contracted or surgical operation. The policy also covers death of cattle which are the subject matter of insurance occurring outside the said geographical area in the event of drought, epidemics and other natural calamities. Other natural calamities shall mean fire, lightning, storm, cyclone, typhoon, tempest, hurricane, tornado, flood and inundation, landslide including rock slide and bush fire. This is our base offering (minimum necessary coverage).

In case of the unfortunate event of death of cattle, we will pay the sum insured (the maximum sum payable as a whole under the policy during the policy period for all the insured perils) or market value of cattle at the time of its death whichever is lesser. Compare with alternative

Optional Benefits

Permanent disability Cover Covers the risk of permanent and total disablement of cattle.

Please note that all benefits are subject to a maximum amount as stated in the policy. These will be clearly noted in any quotation released or any policy issued.

A policy will be issued in the name of the group with a schedule of names of the members / clients including his / her cattle details called “Insured Cattle” forming part of the policy. The age of the calf (of Cow / Buffalo) should be more than 90 days and lactatic animals (Cow / Buffalo) should be upto 4 th Lactation.

The policy does not cover the following:

Malicious or wilful misconduct or neglect, over loading, unskilled treatment.

Use of animal for purpose other than stated in the proposal form without the consent of the Company in writing.

Intentional acts or gross negligence

Failure to prevent death of cattle

Accidents occurred or diseases contracted prior to commencement of risk. Disease contracted within 15 days from commencement of policy period.

Transit by air or sea.

Intentional slaughter. slaughter unless it has been directed by a veterinary doctor or a proper governmental authority.

Theft or clandestine sale.

Missing of Insured animal

Acts of terrorism, war, radioactivity and Nuclear perils

Consequential loss

This is an illustrative list of Exclusions. For detailed list kindly refer the policy wordings.

Documents required for purchasing an Insurance Policy:

A duly filled & signed proposal form

Certificate by veterinary doctor in the prescribed form confirming the health status and market value of the animal

Receipt of payment made while purchasing the animal

Photograph of the animal

Claims shall be assessed and paid on the basis of the relevant documents submitted to the Company. The policy will be considered for payment on production of following documents.

Duly completed claim form.

Death certificate from a qualified veterinary surgeon.

Policy / Certificate.

Ear tag.

A fully online Cattle tagging, and claims module . A complete paperless environment in policy enrolment to claims, via integrated mobile app which is the first of its kind in the livestock insurance market.

This content is descriptive only. Actual coverage is subject to the language of the policies as issued.

For queries related to cattle insurance policy, please call us on our toll-free number 022 6234 6256

Secured Over 1 Crore+ Smiles!

All the support you need 24x7

Catering customer needs

Transparency at its best

Awards

Secured Over 1 Crore+ Smiles

All the support you need-24x7

Catering customer needs

Transparency at its best

Awards