Senior Citizen Health Insurance

A Senior Citizen Health Insurance Policy offers financial protection to individuals aged 60 years and above, helping them manage both emergency and planned hospitalisation costs. It ensures that seniors receive timely medical care without worrying about draining their hard-earned savings.

Depending on the chosen plan, the policy typically covers hospitalisation expenses, diagnostic tests, doctor’s consultation fees, ICU charges, and other medical essentials as mentioned in the policy terms. As healthcare costs continue to rise, such a plan becomes essential for maintaining financial stability and peace of mind during medical treatments.

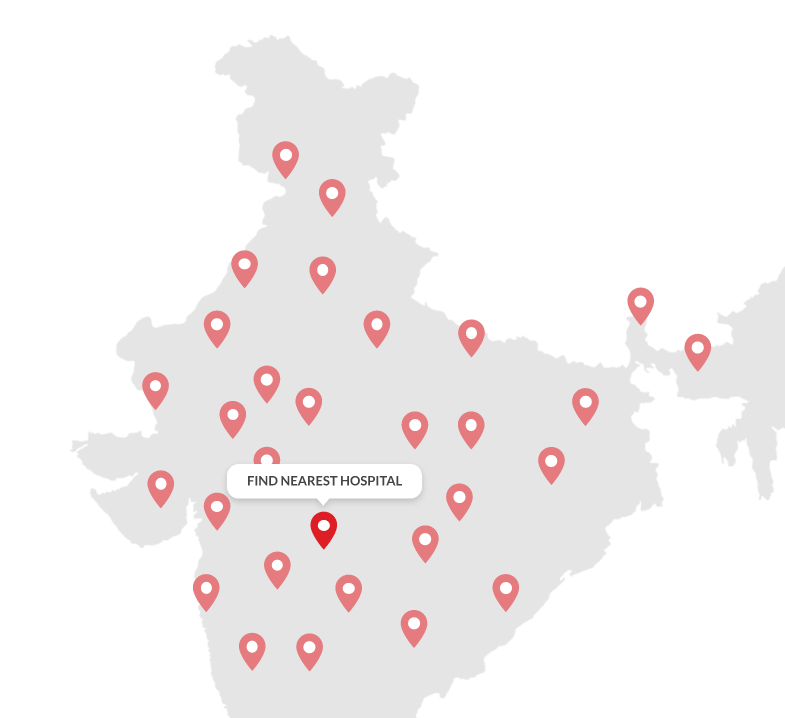

HDFC ERGO offers comprehensive senior citizen health insurance plans crafted exclusively for elderly citizens. These policies cover pre-existing diseases, hospitalisation expenses, and critical illnesses, while also providing tax benefits under Section 80D of the Income Tax Act. With a strong network of 15,000+ cashless hospitals across India, HDFC ERGO ensures that senior citizens can access quality healthcare easily without the stress of searching for a suitable hospital during emergencies.

Recommended Senior Citizens Health Insurance Plans

Age brings wisdom – and health risks!

With 75% of seniors managing chronic diseases, health insurance plans aren't optional

Why Do You Need A Health Insurance Cover for Senior Citizens?

Life can be quite unpredictable. Even if you have taken good care of your health over the years, during your golden years a minute injury or a seasonal cough and cold could take a turn for the worse and lead to hospitalisation or necessitate the need for long-term care. Your entire savings can drain out in a blink of an eye. Health insurance for senior citizens can safeguard your life savings and take care of your medical needs even in an era of rising medical costs.

Covers Medical Expenses

The best health insurance for senior citizens takes care of the medical expenses during an event of hospitalisation or illness, ensuring that your savings remain safe.

Quality Medical Attention

With the backing of a senior citizen’s insurance, you can look for quality medical attention without worrying about the piling bills and ,can heal in peace.

Preventive Health Check-up

Senior citizen insurance plans also provide reimbursement for preventive health check-ups after the completion of a year. These check-ups can help you understand your health status and take the necessary steps needed to keep yourself in the pink of health and avoid hospitalisation in the near future.

Save Tax^

The senior citizen health insurance premium is eligible for tax exemption benefits under section 80D of the Income Tax Act. Save as much as Rs.50,000 tax benefits on health insurance premiums paid for yourself. However, this may change as per the applicable tax limits.

Beats Inflation

A good senior citizen insurance plan helps one stay protected and covered in the face of rising medical costs without compromising on quality medical attention.

Peace Of Mind

Knowing that your finances are protected and you won’t be paying from your pocket during an event of hospitalisation or an emergency, gives you peace of mind and power to spend your days anxiety-free.

Benefits of Senior Citizen Mediclaim Policy

Having a senior citizen medical insurance policy helps people over 60 and above manage their expenses in case of a medical emergency or hospitalisation. As one age, the chances of suffering from an ailment or a medical emergency could increase. So, having the backing of a senior citizen health insurance plan always helps. Here are some benefits of the same:

Easy Hospitalisation

Health insurance for senior citizens provides cashless hospitalisation and reimbursement for medical emergencies and treatments. With HDFC ERGO’S Senior Citizen Medicalim Policy, one can get cashless treatment at our 15000+ network hospitals.

Tax Benefits

One can also avail of tax benefits under section 80d with a senior citizen medical insurance policy.

Preventive Health Check-Ups

A unique feature of the senior citizen policy is that it offers preventive health check-ups, so one can take steps well in advance in case an illness or ailment shows some early signs.

Pre-existing Conditions Covered

Since diseases and conditions can be a part of one’s life as one age, a senior citizen medical insurance policy considers the same and provides coverage for pre-existing diseases as well.

Critical Illness Covered

Most senior citizen medical insurance policy covers critical illness (as mentioned in the policy), which is a huge relief for the elderly population.

Daycare Treatments

In old age, many treatments might need a quick fix or a minor procedure that might not call for a long stay at the hospital. Senior citizen medical insurance covers daycare treatments that provide convenience and seamless medical support.

Rising Medical Cost

The cost of treatments, hospitalisation and medicines are only rising due to inflation and these costs can deplete your savings in times of emergencies. Health insurance for senior citizens can ensure one is covered for such emergencies even in the face of rising healthcare costs.

Cumulative Bonus

Most senior citizen health insurance policy increases the sum insured at the same premium if there is no claim in the previous policy year. This collective sum can be a backup for emergencies if a situation arises. With HDFC ERGO senior citizen health insurance plan you get a 50% increase on the sum amount if there is no claim in the first year of the policy.

Medicines & Diagnostics Covered

With age, one might have to become dependent on medications or undergo certain diagnostic tests that could be very expensive. Most senior citizen medical insurance policies cover costs for medication and diagnostics depending on the plan you choose and the premium you pay.

COVID-19 Hospitalisation

As we are living the new normal, even COVID-19 hospitalisation is covered under HDFC ERGO’s senior citizen health insurance policy to ensure comprehensive support and care.

15,000+

Cashless Network Across India

Jaslok Medical Centre

Address

C-1/15A Yamuna Vihar, Pincode-110053

Roopali Medical

Centre Private Limited

Address

C-1/15A Yamuna Vihar, Pincode-110053

Jaslok Medical Centre

Address

C-1/15A Yamuna Vihar, Pincode-110053

Understand Coverage Offered by Senior Citizens Health Insurance Policies

Hospitalization Expenses

Don’t fret over rising hospitalisation costs. Get seamless coverage for all hospitalisation-related expenses like ICU charges, nursing fees, etc. Seek the best medical facilities without worrying about coverage.

Mental Healthcare

Reasons for mental stress and fatigue can be numerous. Mental healthcare expenses, however, should not be one. We cover hospitalisation expenses for treating mental illness.

Pre & Post Hospitalisation

Multiple checkups and consultations follow and precede hospitalisation. HDFC ERGO health insurance covers all expenses 60 days prior to hospitalisation and 180 days post-discharge.

Day Care Treatments

Enjoy the benefits of advancement in medical technology and opt for daycare procedures, if suitable. The policy covers medical procedures that take less than 24 hours.

Home Healthcare

Get treated in the comfort of your home on the recommendation of a doctor without worrying about the expenses as there is a provision for the same in our senior citizen health insurance plans.

Sum Insured Rebound

In case the existing health cover gets exhausted, the policy magically recharges the sum insured up to the base cover so that you do not have to worry about future diseases.

Organ Donor Expenses

Serious illnesses may require an organ transplant. Getting a suitable organ donor can be a bit difficult but rest assured of the expenses as the plan covers organ donor expenses.

Recovery Benefit

Has your doctor advised hospitalisation of more than 10 days? In case of a lengthy hospitalization (over 10 days), we pay a lump sum amount to help you take care of household expenses.

AYUSH Benefits

We believe you should not leave any stone unturned when it comes to your health. The HDFC ERGO my:health Suraksha Insurance - Silver Smart Plan offers coverage for alternative therapies like Ayurveda, Unani, Siddha and Homeopathy.

Free Renewal Health Check-up

Get a free health check-up within 60 days of renewing your senior citizen health insurance plan with us.

Lifelong Renewability

Get insured and forget as the policy continues for the entire life on break free renewals.

Multiplier Benefit

If there is no claim in the first year, in the next policy year, the sum insured will grow by 50%. It means, instead of ₹ 5 Lakh, your sum insured would now stand at ₹ 7.5 Lakh for the second year.

The above mentioned coverage may not be available in some of our Health plans. Please read the policy wordings, brochure and prospectus to know more about our health insurance plans.

Adventure Sport Injuries

Adventure sports like bungee jumping and paragliding can be extremely enjoyable, but they also expose you to untold risks. We do not cover injuries sustained due to adventure sports.

Self-inflicted Injuries

People may harm themselves under the influence of alcohol or hallucinogenic substances, however, we do not cover self-inflicted injuries.

War

A war can be ruinous and devastating. The policy does not cover claims caused due to wars.

Participation in Defence Operations

Any injury caused while participating in defence operation is not covered by the policy.

Venereal or Sexually Transmitted Diseases

Venereal and sexually transmitted diseases can be devastating for the mind and the body. We do not offer cover for venereal and sexually transmitted diseases.

Treatment of Obesity or Cosmetic Surgery

Many people opt for obesity reduction procedures and cosmetic surgery to improve their appearance. The policy does not cover obesity treatment and cosmetic surgery.

Living your best, healthiest life? Remember, health can change in a heartbeat. Secure it before life surprises you

Documents Required for Claim under a Mediclaim Policy for Senior Citizen

A list of the documents required while purchasing senior citizen health insurance plans:

Age proof

Since most insurance companies set an entry age, it is an important document required at the time of buying health insurance. You can give a copy of any of the following documents:

• PAN Card

• Voter ID Card

• Aadhaar Card

• Passport

• Driving License

• Birth Certificate

Address proof

For communication purposes, the health insurance provider would need to know the postal address of the policyholder. The following documents can be submitted by the policyholder:

• Driving License

• Ration Card

• PAN Card

• Aadhar Card

• Utility Bills such as telephone bill, electricity bills, etc.

• Rental Agreement in case applicable

Identity proof

Identity proofs help the insurance company to distinguish the sort of inclusion proposed to the policyholder. The following documents can be submitted by the policyholder:

• Passport

• Voter ID Card

• Driving License

• Aadhar Card

• Medical Reports (in case asked by the insurance company)

• Passport Size Photo

• Duly filled and signed proposal form

How to Make a Claim for your HDFC ERGO Health Insurance

The sole purpose of buying a health insurance plan is to get financial support at the time of medical emergency. Hence, it is important to read the below steps to know how Health Insurance claims process works differently for cashless claims and reimbursement claim requests.

3 claims processed every minute^^

Intimation

Fill up the pre-auth form at the network hospital for cashless approval

Approval/Rejection

Once hospital intimates us, we send you the status update

Hospitalisation

Hospitalisation can be done on the basis of pre-auth approval

Claim settlement

At the time of discharge, we settle the claim directly with hospital

3 claims processed every minute^^

Hospitalisation

You need to pay the bills initially and preserve the original invoices

Register a claim

Post hospital discharge send us all your invoices and treatment documents

Verification

We verify your claim related invoices and treatment documents

Claim Settlement

We send the approved claim amount to your bank account.

Things to Consider While Buying a Mediclaim Policy for Senior Citizens

Here are a few things that you should look for while buying senior citizen health insurance:

Sum Insured & Coverage Benefits

Invest in a senior citizen health insurance plan that gives maximum coverage for the sum insured. Look for benefits that are necessary during your golden years like pre & post-hospitalisation, cashless mediclaim, ambulance services, critical illnesses coverage and more. Ensure that the sum insured is adequate to take care of your medical needs during any emergency.

Affordable Premium

Look for a plan that’s easy on your pocket and encompasses wide coverage without disturbing your other financial commitments. Most health insurance policies for senior citizens are designed in a way that seniors can opt for one without facing financial strain. In case you are choosing riders or add-ons the premium might increase. Try to work on a premium that offers the benefits you need.

Sublimits & Co-payments

While choosing a senior citizen medical insurance plan pay close attention to the sub-limits on specific expenses and check if you can include those in your plan by paying a suitable premium. Check for the co-payment clause in your plan, which will need you to pay a part of your expenses during a claim. Check if these terms & conditions align with your financial capabilities.

Network Hospitals

Choose a health insurance company that can boast of an extensive network of hospitals to avail cashless hospitalization in times of emergency. At HDFC ERGO we have a vast network of 15000+ network hospitals across India. Enquire about the list of network hospitals of your insurance company to know if a good hospital in your locality is on the list.

Waiting Period & Pre-Existing Diseases3/h4>

Look for a senior citizen health insurance plan that covers your pre-existing diseases or at least has a minimum waiting period to claim the same. The treatment for pre-existing diseases could be expensive and need long-term care and attention. Ensure your plan covers you for the treatment, diagnostic costs and other added expenses.

Renewability & Age Limits

Senior citizen health insurance plans are designed to provide financial security to people over 60, as most health insurance plans have an age limit. So, check if your plan ensures renewal without age restrictions and provides long-term peace of mind. A policy that cannot be renewed, especially after 60 years, is not the right plan for a senior citizen.

Stress-free Claim Process

Claim settlement ratio and the time taken by an insurance company to settle claims should also be taken into consideration while purchasing a senior citizen health policy. If an insurance company’s claim settlement time is less and the claim settlement ratio is high, it means that the chances of your claim getting settled quickly are higher.

Portability

As you age, your health care needs might change and you might be looking for certain benefits that aren’t covered in your plan. So while choosing a senior citizen medical insurance, make sure your plan provides the facility to switch to a new insurer without losing benefits through the portability feature.

Additional Covers & Riders

To ensure that your senior citizen health insurance plan gives to comprehensive coverage, explore the riders and add-ons that you can include in your policy. These add-ons or riders could include certain diagnostic services, specific critical illnesses that aren’t covered in the plan, accidental cover and more. Choose these elements carefully as they can impact your premiums.

No Claim Bonus

Most health insurance plans have this feature but look intently for this if you are investing in health insurance for senior citizens. If you don’t place a claim in a claim year you might get an increase in your sum insured for the next year with the same premium. The cumulative sum acts as a great financial backup for seniors and ensures smooth treatment without compromising on quality care.

Domiciliary Hospitalisation

In case of unfortunate situations, an elderly person’s health condition may not allow him/her to be admitted to a hospital. In such a case, senior citizen health insurance plans with domiciliary hospitalization coverage can take care of home treatment expenses as long as it has been advised by a qualified doctor.

Free Medical Health Check-Up

The most suitable health insurance plan for senior citizens is the one which allows the policyholders to avail medical check-ups for free on an annual basis. This usually is offered after the completion of certain policy years or after every two/three claim-free years. This ensures that one can get medical help on time if an illness or deficiency is diagnosed early.

Exclusions

Health insurance for senior citizens is designed to cater to specific health problems of the elderly population. However, like other policies, this too has its exclusions. So, review the policy's exclusions to understand what is not covered. Common exclusions include cosmetic treatments, self-inflicted injuries, and treatments related to substance abuse. Knowing the exclusions helps prevent any unpleasant surprises when making a claim.

Daycare Facilities

Due to technological advancement in medicine, a lot of medical procedures and surgeries can be done through daycare treatments without the need for 24-hour hospitalization to raise a claim. Hence, it is better to buy senior citizen medical insurance that covers a variety of daycare procedures like dialysis, chemotherapy, radiotherapy, etc.

Robust Customer Support

While wisdom and knowledge might be at their side, senior citizens might need help with little things regarding their policy. Whether it is a renewal, settling a claim, or checking on specifics regarding their policy robust customer support is a boon for them. At HDFC ERGO we boost friendly and supportive customer support that takes every query by senior citizens with zeal and enthusiasm.

Tax Benefits of Senior Citizen Health Insurance

.jpg?sfvrsn=7ee92f2a_2)

A senior citizen health insurance plan covers medical expenses and also helps in tax exemption under section 80D of the Income Tax Act, 1961. You are eligible for an income tax rebate of up to Rs 50,000 if you hold a senior citizen medical insurance policy for your elderly parents.

An additional tax rebate of Rs 5,000 can be earned on payments made towards preventive health check-ups every financial year. Additionally, you can also get a rebate of up to Rs 1 lakh if the senior citizen undertakes a critical disease treatment.

In case you are an earning senior citizen and are also paying the health insurance premium on behalf of your son or daughter, then you can avail an additional income tax rebate of Rs 25,000. This means that you can avail tax deduction of up to Rs 75,000 in a financial year under section 80D.

Why People of 60+ Age Should Take HDFC ERGO Senior Citizen Health Insurance

- HDFC ERGO senior citizen health insurance plan comes with tax benefits under section 80C of the Income Tax Act 1961.

- Pre and post-hospitalization expenses are covered and it pays for doctor's fees, medical bills, room charges, in-patient hospitalization expenses, and emergency ambulance expenses for transporting the insured shall be borne by the insurance company.

- HDFC ERGO senior citizen health insurance offers a hassle-free claim settlement process. So, when the time comes, you will not have to worry about complicated paperwork. The hassle-free claim settlement process will help during health emergencies.

- Our health insurance policy for senior citizens provides cashless hospitalisation in our network hospitals that ease the stress of treatment and compounding medical bills.

- HDFC ERGO senior citizen medical insurance also extends coverage to alternate treatments like Ayurveda, Unani etc, which might be a preferred choice for many senior citizens.

The higher your BMI, the higher your risk for certain diseases.

Check it out now!

Why Buy Senior Citizens Health Insurance Online?

Convenience

With the digital wave sweeping India, a number of new avenues have opened up, buying health insurance being one of them. Getting health insurance for senior citizens online offers unprecedented convenience. You do not require a long and winding explanation, just a click of the mouse and you are done!

Secured Payment Modes

When the world is going contactless, why to rely on paying through cash or cheques. With the emergence of new technologies, online payments have become the most secure modes of translation. Pay through debit/credit card or net banking with extreme safety.

Instant Quotes & Policy Issuance

Want to change the cover or add or remove a member? Rather than waiting for someone to give lengthy explanations, opt for the online mode where all this can be done in a jiffy.

Get instant policy document

With online transactions, you do not have to wait for the policy document to arrive through the mail system. Neither do you have to worry about the safe-keeping of the document. You get the policy document in your mail as soon as you make the first payment.

Everything at your fingertips

Get every piece of information related to your policy and much more in a single place. To ensure that you do not have to search for policy-related documents in various folders and mailboxes, we provide all policy-related documents in the my:health services mobile application. You can also monitor your calorie intake and BMI through the app.

How to Buy Senior Health Insurance Policy Online from HDFC ERGO

HDFC ERGO offers you a wide range of health insurance plans for senior citizens. You can buy the plans online as well as offline. To buy these plans online, you are required to follow the easy steps given below:

1. Visit hdfcergo.com and click on the ‘health insurance’ tab.

2. Enter personal details asked on the form.

3. Then you will be guided to the plans, choose accordingly and follow the instructions.

Ease your premium payment! Go for our No-Cost Monthly Installment^ option*

Health Insurance Reviews & Ratings

Found What You’re Looking For?Get covered with a health plan that fits your needs today!

Read Latest Health Insurance Blogs

Frequently Asked Questions

1. What is a senior citizen health insurance policy?

Senior Citizen Health Insurance is a type of health insurance policy for people over 60 years of age that covers medical expenses and the cost of hospitalisation during medical emergencies. It offers a lot of benefits-such as preventive health check-ups, cashless hospitalization, coverage for pre-existing diseases, critical illness, and pre and post-hospitalization expenses and coronavirus treatment. However, read your policy document carefully to know about all the benefits.

2. Why is health insurance important for senior citizens?

Most forms of employment usually have an upper age limit, after which an employee is expected to retire. At the same time, as you grow older, your body begins to demand greater medical care, necessitating more frequent trips to the hospital. With each passing year, rising medical inflation also makes medical care more expensive. This combination of reduced income and increased medical expenditure makes health insurance a necessity for senior citizens.

3. Do I need to undergo medical screening before purchasing a senior citizen health plan?

Ideally, you should undergo a medical screening before buying a senior citizen health insurance plan. As this will help your insurer asses your condition and work out a plan that suits your needs. This will also give the insurer a better idea about the coverage and the premium that needs to be paid. Doing all these necessities in the beginning will also reduce the chances of rejection during a claim.

4. What is the right time to buy a senior citizen health insurance policy?

If you are 60 or beyond, you are considered to be a senior citizen by age only. Of course, you are much younger at heart and we hope you stay the same. However, while considering buying a senior citizen health insurance plan, we suggest you don’t delay it too much. You can buy them at 60, 70 or even 80. But remember, as you age, the premium on your policy can increase and you might also miss out on certain benefits. So, the sooner the better.

5. Does health insurance cost more as you get older?

Yes, it does. The reason being, as you age you can be prone to various diseases and illnesses. Also, with immunity, taking a dip, health emergencies could be a common occurrence. To ensure that you are adequately covered during such trying times, your insurer might charge a higher premium as you grow old.

6. Do senior citizens get continuity advantages if they port their senior citizen health insurance plans?

Most often, when one switches from one insurer to another, they get to enjoy many continuity benefits and add-ons. In most cases, it is the same with senior citizens as well. However, it might be slightly difficult for senior citizens to switch policies due to advanced old age and a high probability of sickness. But if you are unhappy with the services of your current insurer, you can do research for yourself to know about the benefits you can get in other policies or get your issues resolved with your relationship manager or customer care manager.

7. Do insurance companies offer free annual health check-ups under senior citizen health policies?

Yes, most insurance companies offer free annual health check-ups under senior citizen health policies. You can enjoy the same benefits with HDFC ERGO’s senior citizen health insurance plans too.

8. Are critical illnesses covered under health plans for senior citizens?

Yes, critical illnesses are covered under health plans for senior citizens. However, read your policy documents carefully to understand which critical illnesses are covered and for which ones you need to get a critical illness cover.

9. Do senior citizen health insurance plans come with individual or floater cover?

While you can opt for a family floater plan which covers all family members and senior citizens over the age of 60, it is wise to get individual cover for senior citizens which will promise comprehensive coverage for a larger sum insured against medical emergencies.

10. What if I am above 65 years of age, am I eligible for senior citizen health insurance?

Yes, you can buy health insurance even if you are above 65 years of age if there is no age limit at the time of entry in the policy. There is a lifelong renewability in health insurance policies. This is subject to terms and conditions of the insurance policy. It is advisable to plan for your financial independence and health expenses at an early age.

11. What does a pre-existing condition mean in health insurance?

Pre-existing condition as the name suggests refers to the medical condition or a health problem that an individual had before buying the health insurance policy. There is a waiting period associated with the pre-existing condition. The waiting period is a certain length of time after buying an insurance policy for which you have to wait to be eligible to use full coverage. Subject to terms and conditions of the insurance policy.

12. Do I have the option of paying health insurance premiums in installments?

Yes, you can choose among the options of monthly, quarterly, half-yearly, or yearly premium installments. However, this is subject to the option available in the chosen policy.

13. What are the entry and exit age restrictions for senior citizen health insurance?

For HDFC ERGO senior citizen health insurance policy, there is no entry and exit age restriction in my:health Suraksha Insurance - Silver Smart Plan. Subject to terms and conditions of insurance policy.

14. How do I calculate the premium for senior citizen health insurance?

The amount you pay monthly/quarterly/half-yearly/ yearly for your insurance is called the premium. You can easily compute the premium by using the premium calculator available on the website. Just fill in the basic personal details such as name, email ID, date of birth, etc. and click on calculate premium. Once done, the premium calculator will generate the premium amount.

15. Why should you opt for HDFC ERGO senior citizen health insurance?

Some of the reasons listed below highlight why you should opt for HDFC ERGO senior citizen health insurance policy.

- Hassle-free claim settlement

- 5% additional discount on buying insurance plan online

- 15,000 network hospitals across India.

- Lifelong Renewability

- Pre & Post Hospitalisation expenses

- Tax savings under Section 80D of the Income Tax Act

- Minimum Documentation

Popular Search

- Health Insurance

- Wellness Corner

- Portability Cover

- Optima Secure

- Critical Illness Insurance

- Parents Health Insurance

- Individual Health Insurance

- Health Insurance Premium Calculator

- Health Insurance Articles

- Bike Insurance

- Bike Insurance Blogs

- Car Insurance

- Car Insurance Blogs

- Travel Insurance

- Travel Insurance Blogs