Health Insurance Plans For Parents

A health insurance plan for parents is designed to cover medical expenses arising from illnesses, injuries, or hospitalisations, helping reduce financial stress during healthcare emergencies. These plans usually include features like cashless hospitalisation, daycare treatments, diagnostic tests, ambulance cover, and pre- and post-hospitalisation expenses. Some plans even offer sum insured restoration, easy top-ups, and no-claim bonuses for added value.

HDFC ERGO’s health plans for parents stand out with benefits like 4X cover, 100% sum restoration, and simple top-up options, ensuring continued protection and peace of mind for your parents as they age gracefully.

Recommended Parents Health Insurance Plans

They spent a lifetime caring for you; now it’s your turn to care for their health with medical insurance.

Why Choose Parents Health Insurance?

Our parents' health insurance plans are designed keeping in mind the growing medical needs and rising inflation.

Cashless Claim Service

15000+ Cashless Network**

4.4 Customer Rating

2 Decades of Serving Insurance

#1.4 Crore+ Happy Customers

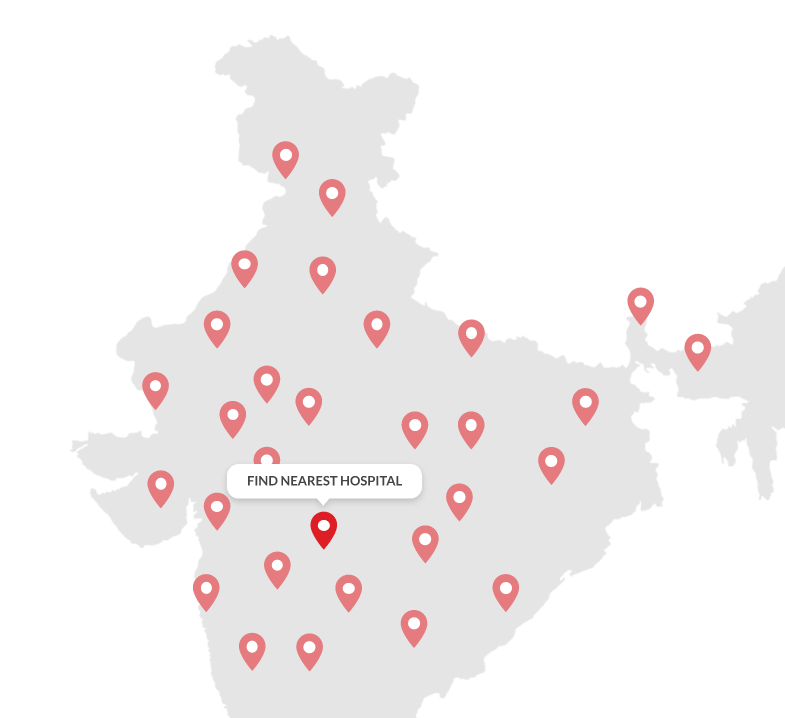

16,000+

Cashless Network

Across India

Jaslok Medical Centre

Address

C-1/15A Yamuna Vihar, Pincode-110053

Roopali Medical

Centre Private Limited

Address

C-1/15A Yamuna Vihar, Pincode-110053

Jaslok Medical Centre

Address

C-1/15A Yamuna Vihar, Pincode-110053

Understand Coverage Offered by Parents Health Insurance Policies

Hospitalization Expenses

In old age, hospitalisations could become frequent and lead to several different expenses like nursing charges, ICU fees and room expenses. The policy covers all the expenses incurred during hospitalisation.

Mental Healthcare

We believe mental healthcare for parents is just as important as hospitalization due to physical illness or injury; hence, we cover hospitalization expenses incurred for treating mental illness coverages.

Pre & Post Hospitalisation

Sometimes several diagnostic tests need to be done to decide the course of treatment, these expenses could lead to a financial strain for a family. To ease the stress, the policy covers all expenses 60 days before pre and post hospitalisation and 180 days after hospitalisation.

Day Care Treatments

The advancement of medical technology has reduced the time required for certain procedures. The policy covers medical treatment that requires less than 24 hours of hospitalisation.

Home Healthcare

In case of hospital bed non-availability, if the doctor approves treatment at home, expenses are covered under the plan. So that, you get medical treatment within the comforts of your home.

Sum Insured Rebound

This benefit acts like a magical backup, which recharges your exhausted health cover to treat the next hospitalization. This ensures uninterrupted medical coverage at the time of need.

Organ Donor Expenses

If you get a suitable organ donor, proceed without worrying about the costs as the policy covers organ donor expenses.

Recovery Benefit

For a hospitalisation that stretches beyond 10 days, the plan compensates for other financial losses that might have happened at home, due to the hospitalisation. It helps to take care of expenses other than the hospitalization.

AYUSH Benefits

If you wish to opt for alternate therapies like Ayurveda, Unani, Siddha, and Homeopathy for your parents, carry on with your preferred choice as we cover expenses for AYUSH treatment as well.

Free Renewal Health Check-up

To ensure that your parents stay on track with their health goals, we provide a free health check-up within 60 days of renewing your policy with us.

Lifelong Renewability

Once you get yourself secured with, our health insurance plan there is no looking back. Our health plan continues to secure your medical expenses for your entire lifetime on break-free renewals.

Multiplier Benefit

For a no claim in the first year, the sum insured will grow by 50% in the next policy year. It means, that instead of ₹ 5 Lakh, your sum insured would now stand at ₹ 7.5 Lakh for the second year.

The above mentioned coverage may not be available in some of our Health plans. Please read the policy wordings, brochure and prospectus to know more about our health insurance plans.

Adventure Sport Injuries

People seek adventure sports for the adrenaline rush. The policy, however, does not cover injuries arising out of adventure sports.

Self-inflicted Injuries

Self-harm can be saddening for the entire family, but the policy does not cover self-inflicted injuries.

War

A war can break out due to a number of reasons and is never the decision of an individual. Any injury sustained in a war is not covered by the policy.

Participation in Defence Operations

Our health insurance plan does not cover accidental injury while you are participating in defence (Army/Navy/Air Force) operations.

Venereal or Sexually Transmitted Diseases

While we understand the seriousness of venereal and sexually transmitted diseases, the treatment of such diseases are not covered under the policy.

Treatment of Obesity or Cosmetic Surgery

Obesity reduction treatment may be inevitable for some people. The policy, however, does not over treatment of obesity and cosmetic surgeries.

Why Should You Buy a Health Insurance Policy for Your Parents?

Here is how having a health insurance plan for your parents can save you from financial stress during hospitalisation or an emergency

Increasing Healthcare Costs

With technological advancement in medicine, the cost of medical treatment and facilities has also increased. That is enough to make a huge impact on your savings during an unexpected medical emergency. To avoid such situations, it is advisable to invest in a wide-ranging health insurance plan for your parents at an early age.

Comprehensive Coverage

The best health insurance plan provides more than just a hospitalization expense in the cover. It also covers expenses incurred pre and post-hospitalization expenses such as ambulance coverage, day-care surgery, and periodic health check-up coverage etc. Some comprehensive health plans will also cover costs for diagnostic tests and medicines as a part of the plan.

Rising Lifestyle Diseases

Lifestyle changes have increased stress and cause a lot of strain on modern life. This, in turn, has increased the likelihood of illnesses, leading to several health complications, which takes place as age increases. Hence, it is crucial to invest in a health insurance plan at an early stage to protect our loved ones.

Tax Benefits

The health insurance premium for parents’ policy is eligible for tax exemption under section 80D of the Income Tax Act. Save as much asRs.50,000 tax benefit on health insurance premiums paid for yourself and your parents below the age of 60 years. If your parents are above 60 years of age, then the limit extends toRs.75,000. However, this may change as per the applicable tax limits.

How to Choose Health Insurance for Your Parents?

Coverage under HDFC ERGO health insurance plans depends on the type of policy that you buy. Usually, you get coverage for the following –

Waiting Period

Most health insurance policies have a compulsory waiting period for pre-existing medical conditions. If your parents are senior citizens, the waiting period could be around 2-3 years, during which time any procedure linked to the pre-existing medical condition will not be covered. So, when buying health insurance for your parents, it is important to keep this.

Renewal Limit

There is generally a maximum or exit age limit for the health insurance policy. Exit policies are generally around 75-80 years, after which renewal of the policy is not permitted. Hence, always look at the age limit on the policy when you are buying a health insurance for your parents.

No Claim Bonus

The No Claim Bonus (NCB) clause in health insurance policies reduces the premium amount payable if there are no claims for a particular period. A number of health insurance providers allow for an increase in the sum insured instead of a reduction of the premium amount payable if there are no claims during the specified period.

Documents Required to Buy Mediclaim Policy for Parents

A list of the documents required while purchasing health insurance plan for your parents:

Age proof

Since most insurance companies set an entry age, it is an important document required at the time of buying health insurance. You can give a copy of any of the following documents:

• PAN Card

• Voter ID Card

• Aadhaar Card

• Passport

• Driving License

• Birth Certificate

Address proof

For communication purposes, the health insurance provider would need to know the postal address of the policyholder. The following documents can be submitted by the policyholder:

• Driving License

• Ration Card

• PAN Card

• Aadhar Card

• Utility Bills such as telephone bill, electricity bills, etc.

• Rental Agreement in case applicable

Identity proof

Identity proofs help the insurance company to distinguish the sort of inclusion proposed to the policyholder. The following documents can be submitted by the policyholder:

• Passport

• Voter ID Card

• Driving License

• Aadhar Card

• Medical Reports (in case asked by the insurance company)

• Passport Size Photo

• Duly filled and signed proposal form

How to Make a Claim for your HDFC ERGO Health Insurance

The sole purpose of buying a health insurance plan is to get financial support at the time of medical emergency. Hence, it is important to read the below steps to know how Health Insurance claims process works differently for cashless claims and reimbursement claim requests.

3 claims processed every minute^^

Intimation

Fill up the pre-auth form at the network hospital for cashless approval

Approval/Rejection

Once hospital intimates us, we send you the status update

Hospitalisation

Hospitalisation can be done on the basis of pre-auth approval

Claim settlement

At the time of discharge, we settle the claim directly with hospital

3 claims processed every minute^^

Hospitalisation

You need to pay the bills initially and preserve the original invoices

Register a claim

Post hospital discharge send us all your invoices and treatment documents

Verification

We verify your claim related invoices and treatment documents

Claim Settlement

We send the approved claim amount to your bank account.

Save Tax with Parents Health Insurance Policy

Tax Benefits on Single Premium Medical Insurance Plans

As per the recent Income tax laws, the health insurance premium paid for a multi-year plan in the lump sum is eligible for a tax deduction under Section 80D. And the tax-deductible amount will be based on the total premium paid for the policy term. This will be subjected to the limits of Rs. 25,000 or Rs. 50,000 as per the case may be.

Higher Tax Benefit on Senior Citizen Health Insurance Plans

The premium that you pay on a health insurance policy purchased for your parents can be claimed for tax deduction up to Rs. 50,000. Moreover, the tax deduction limit for expenses incurred on specific illnesses of elderly people is up to Rs. 1 lac.

Also Read : Income Tax Return

Deduction on medical insurance premium paid for parents

Expenses incurred on preventive health check-ups are also eligible for tax benefits. However, most of the taxpayers end up paying it on their own. The tax exemption limit is Rs. 5,000.

Deduction on preventive health check-ups

YIn addition to the hospitalization expenses, tax exemption benefits are also provided on the out-patient department or OPD consultation charges as well as expenses incurred on diagnostic tests. You can avail tax benefits on cash payments also. Unlike other medical expenses that require payments either through debit/credit cards, cheques, or internet banking to avail tax exemption benefits.

Please note that the above-mentioned benefits are as per the current tax laws prevailing in the country. Your tax benefits may change subject to tax laws. It is advisable to reconfirm the same with your tax consultant. This is independent of your health insurance premium value.

Secure Your Parent's Savings & Ensure their protection with our Parent's Health Insurance Plans

Things to look at when buying a Parents Health Insurance plan

Every time you look for health insurance plan for your parents, you wonder which is the best health insurance plan for parents? How to choose the best health plan online? What coverage should it have? To answer all your queries let’s read more to decode the hacks to get the right health insurance plan.

Get yourself adequate sum insured

If you are residing in the metro cities then the cost of treatment is high hence for an individual your sum insured should ideally range between 7 lacs to 10 lacs. If you are looking for a family cover to insure your spouse and kids a sum insured that ranges between 8 lacs to 15 lacs suits best on floater basis. It should be adequate to cover more than one hospitalisation that may happen in a year.

Affordability

If you wish to pay low premiums for health insurance plan then co-pay your hospital bills. You end up sharing the medical expenses with your health insurer hence you do not have to pay a heavy premium. You could also buy my:health Suraksha health insurance that offers instalment payment facility on monthly, half yearly, quarterly and annual basis.

Vast Network of Hospitals

Always check if the insurance company has a wide list of network hospitals. If the nearest hospital or medical facility is listed by the insurance company it will help you avail cashless treatment. At HDFC ERGO, we have a huge network of 15000+ Cashless Health care centers.

No Sub-limits Help

Usually your medical expenses depend upon your room type and disease. It is recommended to buy a health insurance plan that does not have sub-limits on hospital room rent so that you can choose the hospital room as per your comfort. Most of our policies also don’t imply disease sublimit; this is also an important factor one must keep in mind.

Check Waiting Periods

Your health insurance plan does not come into action while you are waiting period is not completed. Always check health insurance policies with lower waiting periods for pre-existing ailments and maternity benefits before buying a health insurance plan online.

Trusted brand

Always choose a health insurance company that has a good reputation in the market. You must also look at the customer base and claim paying ability to know if the brand will honor the claims that you may make in future.

Worried about paying the one-time premium for your parents? Check our No cost Installment*^ plans!

Why Buy Parents Health Insurance Online?

Convenience

You can sit on the couch lazing around and browse through the internet and look for plans. You save your time and effort by visiting an insurance company’s office or an agent visiting your place. You can make secured transactions from anywhere and anytime. Also, the policy wordings are available online for you to read the fine print to avoid any last moment surprises.

Secured Payment Modes

You do not have to pay premiums in cash or cheque for your health insurance plan! Go Digital! Simply use your credit/debit card or net banking services to make payments online through multiple secured payment modes.

Instant Quotes & Policy Issuance

You can instantly calculate the premium, add or remove members, customize plans, and check coverage online at your fingertips to buy a health insurance plan online.

What You See is What You Get

You no longer have to wait for the physical health insurance policy documents. Your policy PDF copy comes right into your mailbox as soon as you pay the premium online and you get your policy within a few seconds.

Wellness & value added services at your finger tips

Get access to your policy documents, brochure etc in our my:health services mobile application. Download our wellness application to book online consultations, monitor your calorie intake and keep a track on your BMI as well.

How to Buy Parents Health Insurance Policy Online from HDFC ERGO

The easiest and most convenient way of buying health insurance for your parents is to purchase it online. Here’s how you can buy a HDFC ERGO health insurance policy online:

• Visit the health insurance page of HDFC ERGO.

• Right on top, you will find the form. Type your basic information such as contact details, the type of plan etc. Then click on view plans button

• Once you have seen the plans, customize your policy by choosing the preferred sum insured, policy terms, and other information.

• Choose an online payment mode and make the payment through our secure payment gateway.

Health Insurance Reviews & Ratings

Read Latest Health Insurance Blogs

Frequently Asked Questions On Parents Health Insurance

1. Why do I need to get health insurance for my parents?

Our parents took care of us when we were young. It becomes our responsibility to take care of them in their autumn years. With growing medical needs and rising inflation, it is imperative that you buy health insurance for your parents.

2. How to buy health insurance for my parents online?

The advent of technology and accessibility through the internet has made many tasks simpler. Buying health insurance for your parents is simple and convenient and is just a few clicks away. All you need to do is visit the HDFC ERGO page and choose the plan which suits your needs the best. You can compute the premium and check coverage online to buy a health insurance plan for your parents.

3. What is the procedure to make a claim for your parents’ health insurance?

Health claim can be filed in two ways. Cashless claim and reimbursement claim

To make a cashless claim follow these simple steps

• For the cashless claim option, you have to choose a network hospital.• You need to fill a pre-authorisation form at the hospital.

• Once intimated by the hospital, you get an update from the insurance provider regarding the approval.

• Once approved, the claim is settled by the insurance provider directly with the hospital at the time of discharge.

To claim a reimbursement, all you have to do is follow these steps

• Initially, you have to make the payment to the hospital.• Post-discharge, you submit all the required documents such as invoices along with the claim form to your insurance provider.

• Based on the documents shared, verification is done by the claim management team.

• Once approved, the insurance provider deposits the claim amount in your bank account.

4. Is there any age restriction for parents’ health insurance?

Maximum entry age is mentioned in Health Insurance Policies .There is lifelong renewability in health insurance policies

5. My parents have a pre-existing disease, can I buy health insurance?

Yes, you can buy health insurance if your parents have a pre-existing disease. In the case of a pre-existing medical condition, there is a certain length of time you have to serve as a waiting period before you raise the claim. While deciding upon which insurance to buy, it is advisable to select the one which offers the minimum waiting period. This is subject to terms and conditions of the policy.

6. Does health insurance for parents provide any tax benefits?

Yes, under Section 80D the premium paid towards the health insurance is eligible for a tax deduction. The tax-deductible amount will be based on the total premium paid for the policy term. The tax exemptions are subject to the rules and regulations of the Income Tax Act.

7. Why should you opt for HDFC ERGO health insurance plans for parents?

Several reasons listed below highlight why one should opt for HDFC ERGO health insurance policy for parents.

• Additional 5% online discount• 15,000 plus network hospitals

• Lifelong Renewability

• Pre & Post Hospitalisation expenses

• Cashless claim service

• Tax savings under Section 80D of the Income Tax Act

Popular Search

- Health Insurance

- Senior Citizen Health Insurance

- Wellness Corner

- Portability Cover

- Optima Secure

- Critical Illness Insurance

- Individual Health Insurance

- Health Insurance Premium Calculator

- Health Insurance Articles

- Bike Insurance

- Bike Insurance Blogs

- Car Insurance

- Car Insurance Blogs

- Travel Insurance

- Travel Insurance Blogs