Limitless Add-on in Health Insurance

With medical inflation hovering around 14%, India leads the list of Asian countries where accessing quality healthcare can be a significant financial commitment. Take angioplasty, for example, which in 2018 cost somewhere between ₹1 lakh and ₹1.5 lakh but now requires you to spend around ₹2 lakh to ₹3 lakh. Today, even with health insurance, the sum insured might not be enough if you are diagnosed with illnesses requiring recurring hospital visits. To fill this gap, we have introduced the ‘limitless add-on’.

Key Features of Limitless Add-on in Health Insurance

The core aspects of the limitless add-on are listed here:

Unlimited Coverage

If you have a base plan with a sum insured ranging between ₹10 lakhs and ₹50 lakhs, you are eligible for one claim of infinite value during the policy tenure. If the base plan offers coverage above ₹50 lakhs, filing two claims of infinite value is allowed.

Waiting Periods

You can use this rider for pre-existing diseases only after completing 36 months of continuous coverage. For specific diseases such as a cataract, osteoarthritis, and pancreatitis, the add-on benefits become accessible after 24 months.

Coverage Basis

This add-on must be chosen for all members or none, as individual selection is not allowed. It follows the base policy structure—individual for individual coverage, floater for family floater plans, and multi-individual for multi-individual policies.

Geographical Limit

The add-on is applicable for treatments within India, even if your base policy includes global coverage.

Applicability

You can use this plan once the entire sum insured including any accrued bonuses, inflation-linked sum insured, restoration benefit (if availed), and secure benefits are exhausted for a specific claim.

Benefits of Limitless Cover in Health Insurance

Some of the advantages of having the limitless add-on are:

Comprehensive Cover

Use it to shield yourself against hefty bills associated with inpatient hospitalisation, AYUSH treatment, and daycare procedures.

Simplified Claim

Don’t worry about the hassle of filing separate claims. Once the base sum insured, along with multiplier and continuity benefits, is exhausted, the limitless cover is automatically triggered—you only need to inform your insurer.

Multiple Options

You can purchase the add-on with both an individual health plan and a family floater policy. However, this indemnity rider is not available as a standalone health plan.

Peace of Mind

By reducing your financial burden, it allows you to focus on recovery rather than medical expenses.

How Does Limitless Cover Work in Health Insurance?

Let’s take an example to understand how the limitless add-on works. Suppose you have an Optima Restore base plan with a sum insured of ₹10 lakhs and a deductible of ₹50,000. Your plan has a 10% co-payment clause. One day, you fall severely ill and are rushed to the hospital. After days of treatment, when you are discharged from the hospital, the billing counter hands over an invoice of ₹40 lakhs.

The claim under the limitless add-on will work in the following manner:

• First, subtract the deductible from the total invoice. It will come to ₹39.5 lakhs (₹40,00,000 – ₹50,000).

• Next, determine the co-payment amount. It will be ₹3.95 lakhs (₹39.5 lakhs × 10%). Now, the claim amount will be ₹35.55 lakhs.

• The Optima Restore plan will pay the claim amount of ₹20 lakhs (Base SI + Multiplier Benefit).

• The remaining ₹15.55 lakhs can be settled using the limitless add-on.

Since the sum insured of the base plan is less than ₹50 lakhs, after filing a claim under the limitless add-on, the rider will be terminated.

Who Should Consider Limitless Add-on?

If you belong to any of the following categories, investing in the limitless add-on is recommended:

• A family history of critical illnesses, putting you at risk of hereditary diseases.

• Senior citizen without sufficient financial means to handle medical crises.

• Work in a hazardous environment where you are susceptible to contracting life-threatening diseases.

• Want absolute peace of mind with no financial burden during emergencies.

How to Buy the Limitless Add-on?

Getting the limitless rider is easy—just complete these steps!

Step 1: Visit the HDFC Ergo official website.

Step 2: Go to the Health Insurance section and choose the base plan that fits your needs.

Step 3: Provide your basic and health-related details.

Step 4: Select the ‘Limitless Add-on’ and any other rider you wish to purchase.

Step 5: Pay the premium. We will send the soft copy of your application immediately to your registered email address.

Note: You can purchase the limitless rider only at the time of base plan purchase or during renewal.

Conclusion

Considering the rising healthcare costs, the limitless add-on in health insurance is a must-have. It ensures that you remain financially protected even after your sum insured and coverage under restoration benefits are exhausted. This cover is particularly beneficial for senior citizens, those working in hazardous conditions, and those at risk of hereditary diseases.

So, what are you waiting for? Click here to buy health insurance with the limitless add-on today!

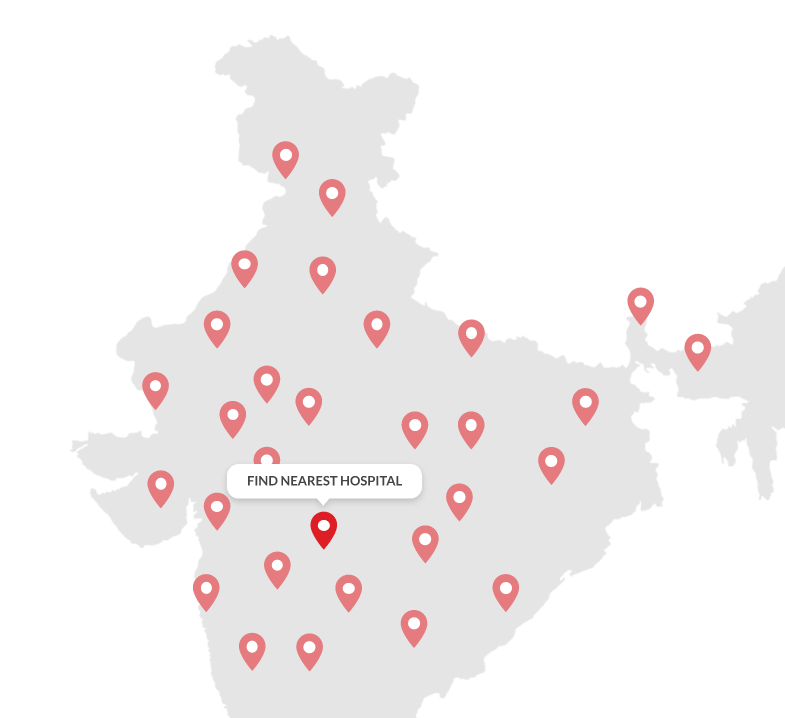

15,000+

Cashless Network Across Indiaˇ

Jaslok Medical Centre

Address

C-1/15A Yamuna Vihar, Pincode-110053

Roopali Medical

Centre Private Limited

Address

C-1/15A Yamuna Vihar, Pincode-110053

Jaslok Medical Centre

Address

C-1/15A Yamuna Vihar, Pincode-110053

Health Insurance Reviews & Ratings

Read Latest Health Insurance Blogs

Frequently Asked Questions

1. Can I purchase the ABCD add-on separately?

No, you can only purchase the rider if you have an active base health insurance policy. It cannot function as a standalone policy.

2. How is the sum insured determined under the ABCD add-on?

The sum insured for the ABCD add-on mirrors the base policy. It follows the same structure if the base policy is on an individual or multi-individual basis. Similarly, if the base policy is a family floater, the add-on also provides coverage on a family floater basis.

3. What happens if the base policy’s sum insured increases?

If the base sum insured increases, the additional amount will be subject to a fresh 30-day initial waiting period. However, the previously covered amount continues without any new waiting period.

4. Does the ABCD add-on provide coverage for all medical expenses?

The ABCD rider enhances coverage but follows the terms and conditions of the base policy. Any exclusions or limitations in the primary policy also apply to this add-on.

5. What happens if I cancel my base policy?

If the base policy is cancelled, the ABCD add-on coverage will also terminate, as it is linked to the primary insurance policy. Refunds, if any, will be as per policy terms.