Individual Health Insurance Plan

An individual health insurance plan is designed just for you, covering your personal medical needs. If you’re looking for health insurance for an individual, this type of cover helps you manage hospital bills and treatment costs on your own terms.

Most individual health insurance policies include cashless hospitalisation, daycare procedures, ambulance cover, and pre- and post-hospitalisation expenses. Some medical insurance for individuals also covers alternative treatments and offers no-claim bonuses if you don’t make a claim.

Among health insurance plans for individuals, HDFC ERGO Optima Secure stands out for its wide hospital network, quick claims processing, and 4x health cover benefit, giving you solid protection and peace of mind when you need it most.

Compare our Best Individual Health Insurance Plans

Optima Secure

- No Cost Installment Available*^

Optima Restore

My:health Suraksha

My:health Medisure Super Top-up

4X Coverage*

Wider Pre and Post Hospitalisation

Free Preventive Health Check-ups

Key Features

- Secure Benefit: Get 2X coverage from Day 1.

- Restore Benefit: 100% restores your base coverage.

- No Cost Installment*^ Option: Credit and Debit card holders can now opt for the No Cost Installment*^ Option.

- Aggregate Deductible: You can enjoy up to 50% discount every year by choosing to pay a little bit more. You also have the superpower to waive your opted deductible at renewal after 5 years under this policy.

6,000+ Cashless Network

Cashless Claims Settled in 38 Mins*~

Free Preventive Health Check-ups

Key Features

- 100% Restored Benefit: Get 100% of your cover restored instantly after your first claim.

- 2X Multiplier Benefit: Get up to 100% additional policy cover as no claim bonus.

- Complete coverage 60 days prior to and 180 days post your hospitalisation. This ensures better planning of your hospitalisation needs.

No Room Rent Restriction

Sum Insured Rebound

Cashless Claims Approved Within 38 Minutes*~

Key Features

- No Medical Test Up to 45 Years: It’s better to be safe than sorry. Secure your health when you are young to avoid medical tests.

- Free Preventive Health Check-ups: We offer free health check-ups to help you stay healthier and happier.

- Cumulative Bonus: Don’t think that your health insurance plan is of no use if you do not make a claim. It rewards you with an additional 10% to 25% sum insured up to a max of 200%, depending on the plan opted at the time of renewal.

Higher Cover at Low Premium

Compliments Existing Health Insurance

No Premium Hike Post 61 Years

Key Features

- Works on Aggregate Deductible: This health plan comes into action once your overall total claim amount reaches the aggregate deductible in a year; it’s not necessary for a single claim to meet the deductible, unlike other top- up plans.

- No Health Check-ups up to Age 55: It’s always wiser to plan ahead. Get your health cover early and skip the hassle of medical tests later.

- Pay Less, Get More: Opt for a long-term policy of 2 years and get a 5% discount.

Features And Benefits of Individual Health Insurance Policy

An individual health insurance policy ensures you are adequately covered during a medical emergency or an illness. This plan focuses on safeguarding a single individual. Hence, you can use the total sum insured during an emergency without any stress. There are various benefits of having individual medical health insurance; here are a few of them:

Extensive Coverage

Since an individual health insurance plan focuses on the well-being of a single person, it ensures all hospital expenses are taken care of in case of a sudden hospitalisation, illness or accident. It extensively covers pre-and post-hospitalisation, daycare treatments, AYUSH treatments and comes with benefits like daily hospital cash, reimbursements for ambulance services, preventive health check-ups and more.

Control over coverage

With individual medical health insurance, you can choose coverage depending on your health requirements. Suppose there are any kind of potential health risks that might need attention in the future. In that case, you can opt for a higher sum insured for a higher premium and rest assured that the amount will cover any kind of hospitalisation cost in the future.

Cashless treatment options

Since medical emergencies don’t come with prior notice, nobody stays prepared with cash in hand to pay medical bills. Opting for cashless treatment options on your individual mediclaim policy makes life easier during hospitalisation or treating an illness. Your insurance company will settle the bills directly with the hospital so you can heal peacefully without thinking of money matters.

Secure benefits

With HDFC ERGO’s individual health insurance plan, get 2x coverage of your base sum insured from day 1. This will ensure that the entire amount will take care of your health requirements during testing times without your family worrying about finances or digging into savings, which can lead to a financial strain on your family.

Preventive health check-ups

One of the benefits of having individual health coverage is being eligible for preventive health check-ups after completing a year. This will help to detect any potential health crisis that could be of concern in the future and alert you to take measures to live healthily.

Additional coverage

In an individual health insurance plan you can choose to opt for add-ons that can make your coverage wider and a comprehensive one. For instance, you can add critical illness cover, dental or maternity cover, depending on your needs.

Peace of Mind

Life and health are unpredictable, so with individual health insurance, you can rest assured that your medical expenses will be taken care of in times of emergency hospitalisation or if an illness strikes.

Securing your savings

While your individual medical health insurance takes care of your personal medical expenses, your life savings can stay intact in your bank account, which can be of great financial support for your family in the future.

Tax benefits

Individual health insurance policy also provides tax benefits under section 80D of the Income Tax Act. The total deduction limit stands at Rs. 25,000.

Why Choose Individual Health Insurance?

In today’s time, where getting health insurance has become a necessity, there are still some questions people have in their minds while opting for individual health insurance. Many people think being included in a group insurance policy, family floater, or employer’s insurance plan is enough. However, having an individual health insurance plan has its own advantages, here are a few listed -

Cashless Claims & Benefits

Individual health insurance plan comes with the benefit of cashless claims and other additional features such as daily hospital cash, no room rent capping, reimbursement of non-medical items and more. Getting treated at a network hospital, you don’t have to make any out-of-pocket expenses and get well without any stress or strain regarding finances.

Flexibility of Choice

With individual health insurance plan, you have the flexibility to choose add-ons, modify or customise your plan according to your health requirements and needs. You can also choose a premium amount for the required sum insured, unlike a group insurance plan or a family floater, where your choices might be compromised.

Portability

Your individual health insurance plan is not attached to your employer’s insurance plan or your family insurance plan, so you can avail the benefits even if you switch jobs, or change career paths or your location.

Self-sustaining plan

Since the plan provides individual health insurance coverage, the entire sum insured can be used by the person in times of hospitalisation or illness.

Access to wider treatment options

In the modern-day world, many individuals believe in alternate therapy rather than taking the conventional route for treatment. To ensure one is adequately covered to get the requisite treatment in times of need, individual health insurance plans provide coverage for these services, subject to policy terms.

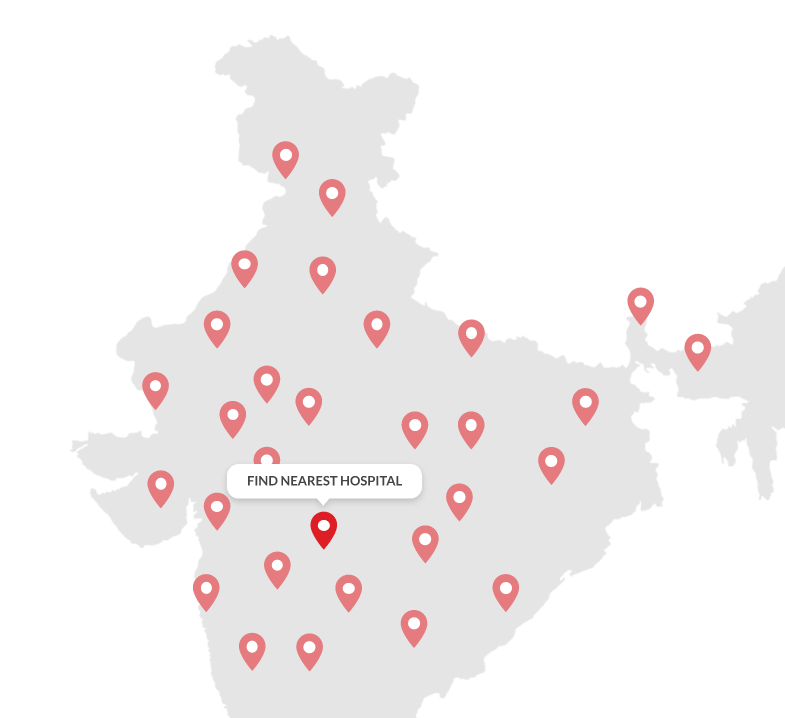

16,000+

Cashless Network Across India

Jaslok Medical Centre

Address

C-1/15A Yamuna Vihar, Pincode-110053

Roopali Medical

Centre Private Limited

Address

C-1/15A Yamuna Vihar, Pincode-110053

Jaslok Medical Centre

Address

C-1/15A Yamuna Vihar, Pincode-110053

Understand Coverage Offered by Individual Health Insurance Policies

Hospitalisation (including COVID-19)

We cover all your hospitalisation expenses arising from illnesses and injuries seamlessly. Most importantly, the Optima Secure plan includes treatment costs for Covid-19 as well.

Pre and Post Hospitalisation

Instead of 30 & 90 days availed normally, get 60 & 180 days pre and post hospitalisation medical expenses covered.

All Day Care Treatments

Medical advancements help in wrapping up important surgeries and treatments in less than 24 hours, and guess what? We cover you for that as well.

Preventive Health Check-Up at No Cost

Prevention is certainly better than cure and that’s why we offer a free health check-up on renewing your health insurance policy with us.

Emergency Air Ambulance

Optima secure plan is tailored to reimburse the cost of air ambulance transport upto ₹5 lacs too.

Road Ambulance

Optima Secure plan covers road ambulance cost upto the sum insured.

Daily Hospital Cash

Get daily cash of ₹800 per day up to a maximum of ₹4800 on hospitalisation, as out-of-pocket expenses under Optima Secure Plan.

E Opinion for 51 illnesses

Avail e-Opinion for 51 Critical Illnesses through network provider in India under Optima Secure plan.

Home Healthcare

We will pay for the medical expenses incurred by you on home hospitalisation, if advised by the Doctor on cashless basis.

Organ Donor Expenses

We cover medical expenses for harvesting a major organ from the donor’s body where insured is the recipient.

Alternative Treatments

We cover treatment costs upto the sum insured towards in-patient care for alternative therapies like Ayurveda, Unani, Siddha, Homeopathy, Yoga and Naturopathy.

Lifelong Renewability

Optime Secure plan has your back. Our health insurance policy covers your medical expenses for a lifetime on break free renewals.

Please read the policy wordings, brochure and prospectus to know more about my Optima Secure.

Adventure Sport Injuries

Adventures can give you an adrenaline rush, but when coupled with accidents, it can be hazardous. Our health insurance plan does not cover accidents encountered while participating in adventure sports.

Breach of Law

We do not cover expenses for treatment directly arising from or consequent upon any insured person committing or attempting to commit a breach of law with criminal intent.

War

War can be disastrous and unfortunate. However, our health insurance plan does not cover any claim that is caused due to wars.

Excluded Providers

We do not cover expenses incurred towards treatment in any hospital or by any Medical Practitioner or any other provider specifically excluded by the Insurer. (Contact us for list of de empanelled hospital)

Congenital external diseases, defects or anomalies,

We understand that treatment towards congenital external disease is critical however, we do not cover medical expenses incurred for Congenital external diseases defects or anomalies.

(Congenital diseases refer to birth

defects).

Treatment for Alcoholism & Drug Abuse

Treatment for Alcoholism, drug or substance abuse or any addictive condition and consequences thereof remains uncovered.

How Does an Individual Health Insurance Policy Work?

When you buy individual medical insurance, you enter into an agreement with the insurer. Simply put, the insurer agrees to cover your medical expenses up to the chosen sum insured, as long as you follow the policy terms. In return, you pay a premium at regular intervals to keep your cover active. This is how health insurance for an individual works at its core.

For example, let’s say you choose a policy with a sum insured of ₹10 lakh. If you are hospitalised during the policy period, your individual medical health insurance will take care of the hospital bills as per the policy conditions.

Now, if the total hospital bill comes to ₹4 lakh, your insurer will pay this amount directly to the hospital (or reimburse you). After this claim, the remaining sum insured available to you for the rest of the year will be ₹6 lakh.

How to Make a Claim for your HDFC ERGO Health Insurance

The sole purpose of buying a health insurance plan is to get financial support at the time of medical emergency. Hence, it is important to read the below steps to know how Health Insurance claims process works differently for cashless claims and reimbursement claim requests.

Health Insurance Cashless Claims get approved within 38*~ minutes

Intimation

Fill up the pre-auth form at the network hospital for cashless approval

Approval/Rejection

Once hospital intimates us, we send you the status update

Hospitalisation

Hospitalisation can be done on the basis of pre-auth approval

Claim settlement

At the time of discharge, we settle the claim directly with hospital

We settle reimbursement claims within 2.9 days~*

Hospitalisation at non network hospital

You need to pay the bills initially and preserve the original invoices

Register a claim

Post hospital discharge send us all your invoices and treatment documents

Verification

We verify your claim related invoices and treatment documents

Claim Settlement

We send the approved claim amount to your bank account.

Save Tax with Individual Health Insurance Policy

Tax Benefits on Single Premium Medical Insurance Plans

Buying individual health insurance not only financially safeguards your health but also helps you reduce your tax burden. If you opt for a multi-year policy and pay the premium upfront, you can still claim tax benefits under Section 80D of the Income Tax Act.

Here’s how it works: the total premium paid in a lump sum is allowed as a deduction, but it must be claimed proportionately for each year of coverage, not all at once. The deduction is available within the prescribed limits, i.e., up to ₹25,000 per year (or ₹50,000 if you’re a senior citizen), as applicable.

This makes health insurance for an individual a practical choice that supports both your healthcare needs and your financial planning.

Deduction on preventive health check-ups

Along with hospitalisation expenses, individual health insurance also offers tax benefits on preventive healthcare. You can claim deductions for expenses related to OPD consultations and diagnostic tests taken as part of preventive health check-ups.

What makes this benefit especially convenient is that you can claim the deduction even if you’ve paid in cash. Unlike other medical expenses that require digital or banking transactions to qualify for tax benefits, preventive health check-up expenses are eligible regardless of the payment mode, within the limits specified under Section 80D. This adds extra value to health insurance for an individual, encouraging you to stay proactive about your health.

Please note that the above-mentioned benefits are as per the current tax laws prevailing in the country. Your tax benefits may change, subject to tax laws. It is advisable to reconfirm the same with your tax consultant. This is independent of your health insurance premium value.

Things to Look at When Buying an Individual Health Insurance Plan

When you start looking for health insurance for an individual, it’s natural to wonder which plan is right for you. From choosing the right coverage to buying online with confidence, here’s a quick guide to help you understand what really matters and pick the right health insurance plan:

Adequate Sum Insured

If you live in a metro city, medical costs can be high. For individual health insurance, a cover of ₹7–10 lakh is usually recommended. Planning a family floater for your spouse and children? A sum insured of ₹8–15 lakh works better and helps manage multiple hospitalisations in a year.

Affordable Premium Options

Want to keep premiums low? You can choose a co-pay option and share a portion of the medical costs with the insurer. This reduces your premium. Plans like my:health Suraksha also offer flexible payment options – monthly, quarterly, half-yearly, or annually.

Wide Hospital Network

Cashless treatment is easier when your nearby hospital is part of the insurer’s network. HDFC ERGO gives you access to 16,000+ cashless healthcare centres across India.

No Restrictive Sub-limits

Choose a policy without room rent or disease-wise sub-limits so that you can select hospital rooms and treatments based on comfort, not restrictions.

Shorter Waiting Periods

Check waiting periods for pre-existing conditions and maternity benefits before buying individual health insurance. Shorter waiting periods mean faster coverage.

Trusted Insurance Provider

Always go with a brand that has a strong reputation, a large customer base, and a reliable claim settlement record, so you’re supported when it matters most.

Documents Required for Individual Health Insurance

Buying individual health insurance with HDFC ERGO is a simple and easy process. You usually need just a few basic documents to get started:

◦ Identity proof (Aadhaar card, PAN card, or passport)

◦ Address proof (Aadhaar, passport, voter ID, or utility bill)

◦ Age proof (if not covered in your ID document)

◦ Medical details, if asked, based on your age or health declaration

In most cases, you can upload these documents online and complete the application from home. Medical tests are required only if your profile or age demands it, making health insurance for an individual easy and hassle-free to purchase.

Which Plan Should You Choose: Individual or Family Health Insurance Plans?

The right choice depends on who you want to cover and how you want your policy to work.

If you’re looking for coverage just for yourself, individual health insurance is a good fit. It gives you a dedicated sum insured that is used only by you. This works well if you want personalised coverage or already have family members covered under separate plans.

On the other hand, a family health insurance (floater) plan covers your spouse and children under one policy with a shared sum insured. It can be more cost-effective for young families, but the cover is shared among all members.

With HDFC ERGO, you have the flexibility to choose either option based on your needs. If you value independent coverage and clear benefits, health insurance for an individual may be the better choice. If you’re planning protection for your entire family under one plan, a family floater could make more sense.

The key is to choose a plan that matches your life stage, budget, and healthcare needs.

Am I Eligible to Buy a Health Insurance Plan?

When you consider buying health insurance for an individual, questions about eligibility often come first. You might wonder if medical tests are required or if there’s an age limit before you can sign up.

The good news? With HDFC ERGO, checking your eligibility is quick and easy. When buying a health insurance plan online, you can instantly see if you meet the criteria and proceed with the right plan for your needs – no guesswork, no hassle.

Key Factors That Decide Your Eligibility for Buying Health Insurance Plans

Pre-Existing Conditions

Be honest about any past illnesses, surgeries, birth defects, or serious conditions like cancer. Some conditions may have waiting periods, exclusions, or additional premiums, so declaring them helps avoid claim issues later.

Age

You can buy individual health insurance from the age of 18 onwards. Newborns can be covered under a family floater or a separate plan, depending on the policy terms. Senior citizens can also buy or renew health insurance.

Why Buy Individual Health Insurance Online?

Convenience

You can sit on the couch, lazing around, browsing the internet, and looking for plans. You save time and effort by visiting an insurance company’s office or by having an agent visit your place. You can make secured transactions from anywhere and anytime. Also, the policy wordings are available online for you to read the fine print to avoid any last-minute surprises.

Secured Payment Modes

You do not have to pay premiums in cash or cheque for your health insurance plan. Go digital! Simply use your credit/debit card or net banking to make payments online through multiple secure payment methods.

Instant Quotes and Policy Issuance

You can instantly calculate the premium, add or remove members, customise plans, and check coverage online at your fingertips to buy a health insurance plan online.

What You See is What You Get

You no longer have to wait for the physical health insurance policy documents. Your policy PDF arrives in your mailbox as soon as you pay the premium online, and you receive your policy within a few seconds.

Wellness and Value-added Services at Your Fingertips

Get access to your policy documents, brochure, etc., in our my:health services mobile application. Download our wellness application to book online consultations, monitor your calorie intake, and track your BMI.

How Much Individual Health Insurance Coverage Should You Have?

.jpg?sfvrsn=7ee92f2a_2)

When buying individual health insurance, it’s important to choose a coverage amount that realistically meets your medical needs. While a common guideline is to have a sum insured of at least half your annual income, rising healthcare costs mean this may not be enough. Experts generally recommend a minimum cover of ₹5 lakh to comfortably handle most medical expenses.

Buying insurance in your 20s can be especially beneficial. With fewer claims early on, you can increase your sum insured over time through cumulative bonuses for every claim-free year, giving you more protection without extra premium.

How to Buy an Individual Health Insurance Policy Online from HDFC ERGO

Visit the Website

Go to www.hdfcergo.com and navigate to the health insurance section.

Choose Your Policy

Select the plan that best suits your needs based on coverage and benefits.

Start the Online Purchase

Click “Buy Online” to reach a secure page. Ensure your browser is secure before entering personal information.

Calculate Your Premium

Use the premium calculator by entering details like policy type (individual or family floater), desired sum insured, and your date of birth.

Fill Personal Details

Enter your name, address, contact information, and medical history (if applicable).

Make Payment

Complete the purchase through the secure payment gateway to instantly activate your individual health insurance policy.

Health Insurance Reviews & Ratings

Read Latest Health Insurance Blogs

Frequently Asked Questions on Individual Health Insurance

1. Do I need a separate family health insurance if I am covered under my employer’s group plan?

Even if you have an employer health insurance plan for your family, you will need a separate health insurance plan. The insurance offered by the employer is valid only till you work in the organisation, and generally, group plans only provide basic coverage.

2. What are the benefits of health insurance portability?

Health insurance portability ensures that you do not have to go through a fresh waiting period when you change insurers. With portability, you can easily change your insurer without losing any benefits.

3. What is a pre-existing disease?

A pre-existing disease is an injury or illness you already have when you buy the policy. Typically, insurers offer coverage for pre-existing diseases only after the waiting period.

4.What are pre- and post-hospitalisation expenses?

There are many expenses related to hospitalisation. Before you are admitted, you must consult a doctor and have diagnostic tests performed. A similar process is followed after discharge. Expenses incurred before and after hospitalisation are known as pre- and post-hospitalisation expenses.

5. Do I have to go through a medical examination before buying health insurance?

Yes, a medical examination is required when you buy family health insurance. However, some policies do not require examination if you are below a certain age limit.

6. Can I add my family members to an existing policy?

Yes, you can add family members while buying the policy or at the time of renewal.

7. At what age can I include my children in the plan?

You can include your children in family health insurance after 90 days of birth and up to 21 years at the time of renewal.

8. What is the benefit of buying family health insurance at a young age?

The younger the applicant, the lower the health insurance premium. You also get more benefits when you buy insurance at a young age.

9. Can an individual have more than one insurance policy?

Yes, you can have more than one health insurance policy, depending on your or your family's needs.

10. What is meant by waiting period?

Waiting period is the time during which the policyholder cannot avail of some or all of the benefits related to a specific illness.

11. What is a ‘free look period’?

The free look period is the period during which you can cancel your policy without penalty. Generally, the free-look period ranges from 10 to 15 days, depending on the insurer.

12. What is network/non-network hospitalisation?

Insurance companies have several hospitals in their network. You can receive cashless treatment only at in-network hospitals. If you opt for a non-network hospital, you will have to pay the hospital bill, then claim reimbursement from the insurer.

13. What is ‘domiciliary hospitalisation’?

If the insured person cannot be taken to the hospital due to their medical condition, or the treatment is provided at home due to the non-availability of a hospital bed, it is known as domiciliary hospitalisation.

14. What are the benefits of basic hospitalisation?

Expenses such as pre- and post-hospitalisation, diagnostic tests, medicines, and consultation costs are covered under basic hospitalisation.

15. What is the right age to buy a health insurance policy?

The younger you get health insurance, the better. You can get health cover after the age of 18. One can be covered under family health insurance before the age of 18.

16. Can a minor buy health insurance?

A minor cannot buy health insurance individually; however, parents can cover a minor under family health insurance.

17. What if I get admitted in a non-network hospital?

If you get treated at a non-network hospital, you have to pay the bills first and then claim reimbursement from your insurer.

Disclaimer: The above information is for illustrative purposes only. For more details, please refer to the policy wordings and prospectus before concluding the sales.

Popular Search

- Health Insurance

- Senior Citizen Health Insurance

- Wellness Corner

- Portability Cover

- Optima Secure

- Critical Illness Insurance

- Parents Health Insurance

- Health Insurance Premium Calculator

- Health Insurance Articles

- Bike Insurance

- Bike Insurance Blogs

- Car Insurance

- Car Insurance Blogs

- Travel Insurance

- Travel Insurance Blogs

Health Insurance

Health Insurance  Travel Insurance

Travel Insurance  Car Insurance

Car Insurance  Cyber Insurance

Cyber Insurance  Critical Illness Insurance

Critical Illness Insurance

Pet Insurance

Pet Insurance

Bike/Two Wheeler Insurance

Bike/Two Wheeler Insurance  Home Insurance

Home Insurance  Third Party Vehicle Ins.

Third Party Vehicle Ins.  Tractor Insurance

Tractor Insurance  Goods Carrying Vehicle Ins.

Goods Carrying Vehicle Ins.  Passenger Carrying Vehicle Ins.

Passenger Carrying Vehicle Ins.  Compulsory Personal Accident Insurance

Compulsory Personal Accident Insurance  Travel Insurance

Travel Insurance  Rural

Rural