ABCD Add-on in Health Insurance

In recent years, India has witnessed a sudden spike in lifestyle diseases such as high blood pressure and diabetes. The surge is driven mainly due to sedentary lifestyles, dietary shifts, and rapid urbanisation. The growing number of patients has significantly strained healthcare infrastructure, resulting in medical inflation. If you don't have a financial backup, managing medical bills arising from the treatment of diabetes, asthma, and a few other diseases can be challenging. This is where the ABCD cover in health insurance comes in handy.

Key Features of ABCD Add-on in Health Insurance

The notable characteristics of ABCD in health insurance are:

Waiting Period

Medical expenses covered by this add-on are payable after a 30-day waiting period. If the base sum insured of the policy increases, a new 30-day initial waiting period will apply specifically to the increased portion of the base sum insured.

Individual Plan

If the base policy provides coverage on an individual basis, each insured person will have a separate sum insured under the add-on. Similarly, if the base policy is on a multi-individual basis, multiple individuals will have separate coverage.

Family Floater

If the base policy operates on a family floater basis, where a single sum insured is shared among all insured members, the add-on coverage will also be shared accordingly. That means if any uses this rider, the coverage will be reduced by the amount used.

Geographical Limit

Whether the coverage under the ABCD add-on will be valid only in India or abroad too, will depend on the geographical limits defined in the policy wordings of the base plan..

Coverage

This add-on does not have a separate sum insured. Any claims made under it will be deducted from the base policy’s sum insured, reducing the overall coverage available under the standard policy.

Benefits of ABCD in Health Insurance

The benefits of buying ABCD rider with your health insurance are:

Covers Asthma

As per the Global Asthma Report of 2022, over 35 million people in India have asthma. According to a survey report from 2018, the average cost of managing this condition is ₹18,737 a year, and if it worsens, hospitalisation expenses can drain your savings. The ABCD add-on supports financially by covering medical bills associated with asthma.

Covers Cholesterol

If you do not manage high cholesterol levels, it can result in plaque buildup in your arteries, obstructing blood flow. This situation can eventually lead to peripheral artery disease and a heart stroke. With ABCD, you receive coverage for medical bills arising from threatening cholesterol levels.

Covers Diabetes

According to the Lancet study in 2023, India has over 101 million diabetic cases and around 136 million pre-diabetic cases. Diabetes, if not managed, can lead to kidney diseases, nerve damage, foot problems, blood vessel issues, and eye damage. However, with ABCD cover in place, you get financial support to deal with hospitalisation bills arising out of this lifestyle disease.

Covers Blood Pressure

It compensates for the medical bills arising from hypertension (uncontrolled blood pressure), which can increase the risk of aneurysm, angina, vascular dementia, and various cardiovascular diseases.

How Does ABCD Cover Work in Health Insurance?

ABCD cover is an add-on to your base health insurance policy designed to cover chronic conditions like asthma, diabetes, blood pressure, and cholesterol. Here's how it works:

Suppose you have a base health insurance policy

with HDFC Ergo and opt for the ABCD cover. One day, you experience complications due to diabetes and require hospitalisation. The ABCD cover steps in to cover the medical expenses related to this condition, as long as it

aligns with the terms of your base policy. For instance, if your basic insurance has a sum insured of ₹5 lakhs, the expenses for your diabetes-related treatment will be deducted from this amount. However, note that the

ABCD cover cannot be removed once opted for and renews automatically with your base policy.

Who Should Consider the ABCD Add-on?

Getting the ABCD in health insurance is a must-have in the following scenarios:

• If you work in a toxic environment or have a demanding job with late hours. These factors put you at risk of lifestyle diseases.

• If you live in a city known for its high pollution levels that puts you at risk of asthma.

• If you have a family history of cardiovascular disease or diabetes.

• If you have poor dietary habits and do not engage in high-intensity activities at the same time.

How to Buy the ABCD Add-on?

Follow these quick steps to get the ABCD add-on today!

Step 1: Visit the HDFC Ergo official website.

Step 2: Go to the Health Insurance section and choose the base plan that fits your needs.

Step 3: Provide your basic and health-related details.

Step 4: Select the ‘ABCD Add-on’ and any other rider you wish to purchase.

Step 5: Pay the premium. We will send the soft copy of your application immediately to your registered email address.

Note: You can purchase the ABCD rider only at the time of base plan purchase or during renewal.

Conclusion

The ABCD cover in health insurance offers crucial financial support for managing lifestyle diseases like asthma, diabetes, high blood pressure, and cholesterol. As India faces rising medical costs, this add-on can alleviate the financial burden of hospitalisation and treatment.

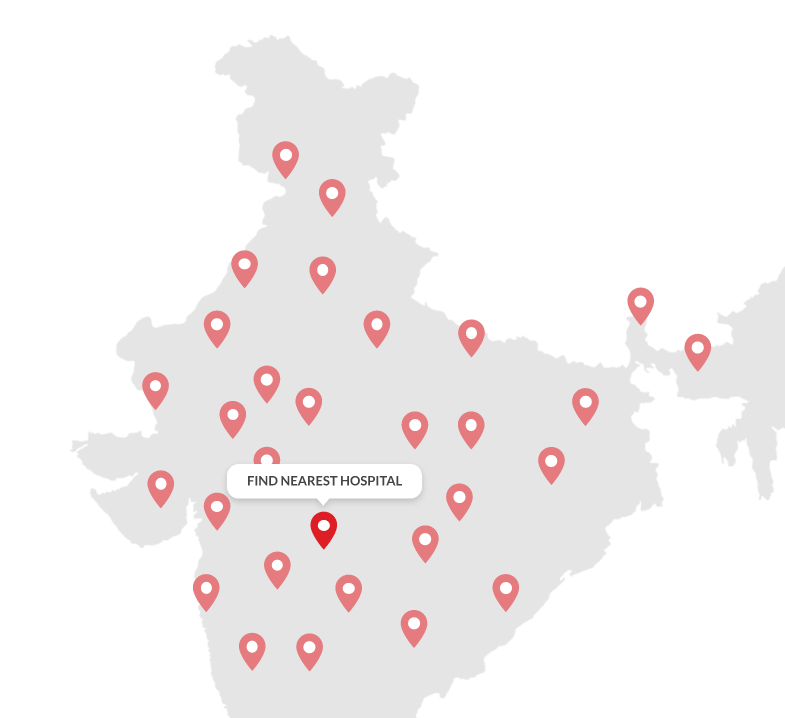

15,000+

Cashless Network Across Indiaˇ

Jaslok Medical Centre

Address

C-1/15A Yamuna Vihar, Pincode-110053

Roopali Medical

Centre Private Limited

Address

C-1/15A Yamuna Vihar, Pincode-110053

Jaslok Medical Centre

Address

C-1/15A Yamuna Vihar, Pincode-110053

Health Insurance Reviews & Ratings

Read Latest Health Insurance Blogs

Frequently Asked Questions

1. Can I purchase the ABCD add-on separately?

No, you can only purchase the rider if you have an active base health insurance policy. It cannot function as a standalone policy.

2. How is the sum insured determined under the ABCD add-on?

The sum insured for the ABCD add-on mirrors the base policy. It follows the same structure if the base policy is on an individual or multi-individual basis. Similarly, if the base policy is a family floater, the add-on also provides coverage on a family floater basis.

3. What happens if the base policy’s sum insured increases?

If the base sum insured increases, the additional amount will be subject to a fresh 30-day initial waiting period. However, the previously covered amount continues without any new waiting period.

4. Does the ABCD add-on provide coverage for all medical expenses?

The ABCD rider enhances coverage but follows the terms and conditions of the base policy. Any exclusions or limitations in the primary policy also apply to this add-on.

5. What happens if I cancel my base policy?

If the base policy is cancelled, the ABCD add-on coverage will also terminate, as it is linked to the primary insurance policy. Refunds, if any, will be as per policy terms.