International Travel Insurance

International travel insurance gives you the security and peace of mind to explore a country worry-free and relaxed. As you make memories in a faraway land experiencing the uniqueness of a new culture and its people, ensure that you are financially secured against any unforeseen event. Remember, medical and dental emergencies always come uninvited and might not spare you during your vacation. Such expenses in a foreign land can cost you dearly. Having International travel insurance or overseas travel insurance can save you from such a crisis.

Apart from medical emergencies, other unfortunate events can make a dent in your happiness, like flight or baggage delays. During International travel, loss of check-in baggage is quite common. These situations can lead to additional expenses and make your travel budget go haywire. But with the assurance of foreign travel insurance, you can spend your holidays without fretting over such mishappenings. Moreover, in case of loss of essential documents like a passport or theft or burglary, International travel insurance gives you the cover and security needed at such trying times. If you are planning a foreign trip either for work or leisure opt for HDFC ERGO’s International travel insurance policy online and secure your trip from the comforts of your home.

Why do You Need International Travel Insurance?

While travelling abroad, have a backup plan ready to get the most out of your time if the previously planned itinerary doesn't work out. An overseas travel insurance plan will provide coverage for loss against lost luggage, flight delays, baggage delays or any unforeseen events. HDFC ERGO’s International Travel Insurance provides a network of 1 Lac+ cashless hospitals and 24x7 support to settle claims effortlessly.

Our travel insurance will essentially secure you under following circumstances:

- Luggage Loss

- Baggage Delays

- Medical Expenses

- Flight Delays

- Emergency Dental Expense

- Emergency Financial Assistance

International Travel Insurance Plans by HDFC ERGO

What Does HDFC ERGO International Travel Insurance Policy Cover?

Emergency Medical Expenses

This benefit covers hospitalization, room rent, OPD treatment, and Road Ambulance costs. It also reimburses expenses incurred on Emergency Medical Evacuation, Medical Repatriation and Repatriation of mortal remains.

Dental Expenses

We believe dental healthcare is just as important as hospitalization due to physical illness or injury; hence, we cover dental expenses which can occur during your travel. Subject to policy terms and conditions.

Personal Accident

We believe in seeing you through thick and thin. In the event of an accident, while traveling abroad, our insurance plan provides a lump sum payment to your family to assist with any financial burdens caused by permanent disablement or accidental death.

Personal Accident : Common Carrier

We believe in being by your side through ups and downs. So, under unfortunate circumstances, we will provide a lump sum payout in case of accidental death or permanent disablement arising out of an Injury whilst on a Common Carrier.

Hospital cash - accident & illness

If a person is hospitalized due to injury or illness, we will pay the per day Sum Insured for each complete day of hospitalization, up to the maximum number of days stated in the Policy Schedule.

Flight Delay & Cancellation

Flight delays or cancellations may be beyond our control, but worry not, our reimbursement feature allows you to meet any essential expenses arising from the setback.

Trip Delay & Cancellation

In case of a trip delay or cancellation, we will refund the non-refundable portion of your pre-booked accommodation and activities. Subject to policy terms and wordings.

Loss of Passport & International driving license

Losing important documents can leave you stranded in a foreign land. So, we will reimburse expenses related to obtaining a new or duplicate passport and/or international driving license.

Trip Curtailment

Don't worry if you have to cut your trip short due to unforeseen circumstances. We'll reimburse you for your non-refundable accommodation and pre-booked activities as per the policy schedule.

Personal Liability

If you ever find yourself liable for third-party damage in a foreign land, our travel insurance helps you compensate for those damages effortlessly. Subject to policy terms and conditions.

Emergency Hotel Accommodation for Insured Person

Medical emergencies may mean you need to extend your hotel booking by a few days more. Worried about the added expense? Let us take care of it while you recover.subject to policy terms and conditions

Missed Flight Connection

Don't worry about unexpected expenses due to missed flight connections; we will reimburse you for the expenses incurred on accommodation and alternate flight booking to reach your destination.

Hijack Distress Allowance

Flight hijacks can be a distressing experience. And while the authorities help sort out the issue, we'll do our bit and compensate you for the distress it causes.

Emergency Cash Assistance Service

When traveling, theft or robbery can lead to a cash crunch. But don't worry; HDFC ERGO can facilitate fund transfers from the insured 's family in India. Subject to policy terms and conditions.

Loss Of Checked-In Baggage

Lost your checked-in baggage? Don't worry; we'll compensate you for the loss, so you don't have to go without your essentials and vacation basics. Subject to policy terms and conditions.

Delay of Checked-In Baggage

Waiting is never fun. If your luggage gets delayed, we'll reimburse you for essentials like clothing, toiletries and medication so you can start your vacation worry-free.

Theft of baggage and its contents

Theft of baggage can derail your trip. So, to ensure your trip stays on track, we'll reimburse you in case of baggage theft. Subject to policy terms and conditions.

The above mentioned coverage may not be available in some of our Travel plans. Please read the policy wordings, brochure and prospectus to know more about our travel insurance plan.

What Does HDFC ERGO’s International Travel Insurance Plan Not Cover??

Breach of Law

Sickness or health issues caused due to war or a breach of the law is not covered by the plan.

Consumption of Intoxicant substances

If you consume any intoxicants or banned substances, the policy shall not entertain any claims.

Pre existing diseases

If you suffer from any illness before the travel you’ve insured and if you undergo any treatment for an illness that already exists, the policy does not cover expenses related to these incidents.

Cosmetic and Obesity Treatment

Should you or any member of your family opt to undergo any cosmetic or obesity treatment during the course of the travel you’ve insured, such expenses remain uncovered.

Self Inflicted Injury

Any hospitalization expenses or medical costs arising from self-inflicted injuries are not covered by the insurance plans we offer.

Key Features of HDFC ERGO Overseas Travel Insurance Policy

| Key Features | Benefits |

| Cashless Hospitals | 1,00,000+ cashless hospitals worldwide. |

| Countries Covered | 25 Schengen countries + 18 Other countries. |

| Coverage Amount | $40K to $1000K |

| Health Check-up Requirement | No health check-up is required prior travelling. |

| COVID-19 Coverage | Coverage for COVID-19 hospitalisation. |

Benefits of International Travel Insurance

Here are a few benefits of having International travel insurance -

- Covers for medical expenses: Medical expenses can burn a hole in your pocket during an international trip. But you can get treated in a foreign land with the assurance of International Travel insurance. But International travel insurance ensures that you are covered for such emergencies, saving you a lot of money while ensuring proper treatment and care. HDFC ERGO’s International travel insurance provides cash reimbursements on hospital bills and easy access to 1Lakh+ hospital networks worldwide.

- Promises baggage security: Loss of check-in baggage or delays can derail your holiday plans, but with International travel insurance, you are covered for essentials that can keep you in line with your plans like lost or delayed luggage. Unfortunately, these issues with luggage are quite common on an international trip. With International travel insurance, you are secured against lost or delayed luggage so you can enjoy your holiday seamlessly.

- Covers against uneventful situations: While holidays are all about smiles and joys, life can sometimes be harsh. Flight hijacks, damage to third-party property can dampen your holiday mood. But International travel insurance can ease your stress at such times. International travel insurance secures you from such incidences too.

- Ensures you don’t exceed your travel budget: In case of medical or dental emergencies, your expenses can exceed your budget. Sometimes you might have to extend your stay to complete your medical treatment, which could exceed your expenses. But International travel insurance covers those added hotel expenses too.

- Constant assistance: Robbery, theft or loss of a passport in a foreign land is not unheard of. Having International travel insurance gives financial support at such testing times.

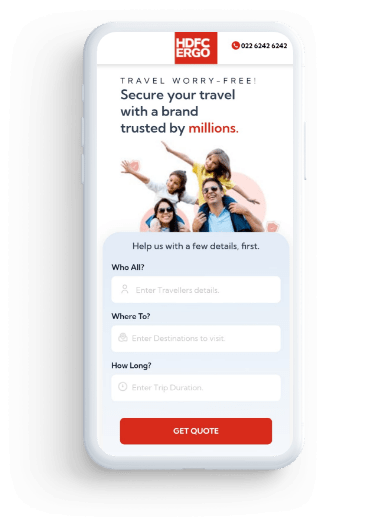

Buy Overseas Travel Insurance Online

Buying international travel insurance is a click away and can be done from the comfort of your home or office at your convenience. Therefore, the online purchase of overseas travel insurance plans has picked up and is growing with each passing day.

• Click here link, or visit the HDFC ERGO travel insurance webpage to BUY our policy.

• Enter traveler details, destination information, and trip start and end dates.

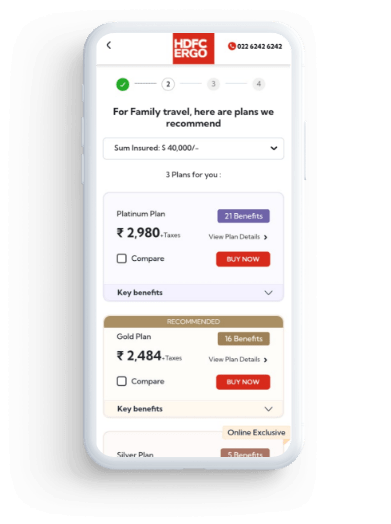

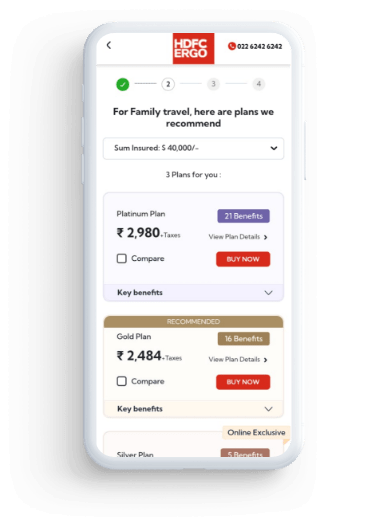

• Choose your preferred plan from our three tailored options.

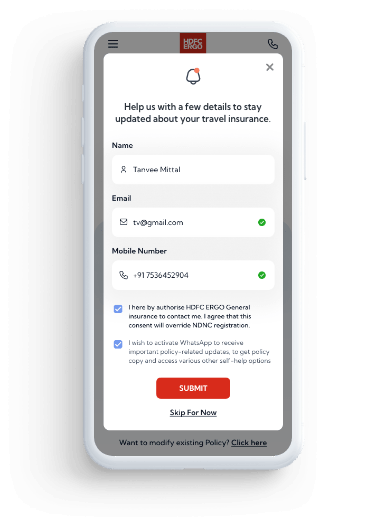

• Provide your personal details.

• Fill in additional details about the travelers and proceed to pay using online payment methods.

• All that's left to do is- download your policy instantly!

Does HDFC ERGO’s International Travel Insurance Cover COVID-19?

While the world is returning to normal and international travel is blooming again, the fear of COVID-19 still looms large over us. Quite recently the emergence of a new variant - Arcturus covid variant – caused much concern among the public and healthcare experts alike. While most countries have relaxed their travel protocols related to COVID-19, precaution and alertness can help us keep another wave at bay. The challenging bit is that any emergence of a new variant is reported to be more transmissible than previous strains. This uncertainty also means that we cannot put anything to chance yet and must follow the basic precautions to prohibit transmission. Masks, sanitisers and compulsive cleaning should still be our mainstay.

Whenever a new variant makes its presence felt, Covid cases in India and abroad increase rapidly highlighting the importance of vaccinations and booster doses. If you aren’t vaccinated yet, it’s high time you get the jab. Remember to take your booster doses on time too. International visits can be interrupted if you have not taken the requisite doses, as it is one of the mandates for overseas travel. Watch out for symptoms such as - cough, fever, fatigue, loss of smell or taste, and difficulty breathing, which could be a matter of concern and get checked at the earliest, especially if you are planning international travel or are at a foreign destination. Medical expenses in a foreign land can be expensive, so having the backing of international travel insurance can be of much help. HDFC ERGO’s international travel insurance policy ensures that you are protected if you catch COVID-19.

Here’s what is covered under the travel medical insurance for COVID-19 -

• Hospitalisation expenses

• Cashless treatment at network hospitals

• Daily cash allowance during hospitalisation

• Medical evacuation

• Extended hotel stay for treatment

• Medical and body repatriation

Factors that Affect Your International Travel Insurance Premium

The country you’re travelling to

If you’re travelling to a safer or economically more stable country, the insurance premium will likely be lower. Also, the farther the destination is from your home, the higher will be the insurance premium.

The duration of your trip

The longer you are away, the higher the probability of you falling ill or getting injured. Therefore, the longer your travel duration, the higher will be the premium charged.

The age of the traveller(s)

The insured's age plays a vital role in determining the premium. Travel insurance premiums for senior citizens could be slightly higher as their risk of illness and injury increases with age.

The extent of coverage you choose

The type of travel insurance coverage the insured person chooses decides the premium of their policy. A more comprehensive travel insurance plan will naturally cost higher than more primary coverage.

Know your Travel insurance premium In 3 Easy Steps

Many countries have made it mandatory for foreign travellers to obtain a valid international travel insurance policy before entering their borders?

How to Claim International Travel Insurance?

The claims process of HDFC ERGO travel insurance is straightforward. You can place a claim on your travel insurance online on cashless as well on a reimbursement basis.

Intimation

Intimate claim to travelclaims@hdfcergo.com and get a list of network hospitals from TPA.

Checklist

Medical.services@allianz.com will share documents required for cashless claims.

Intimation

Intimate claim to travelclaims@hdfcergo.com or call on Global Toll-Free No : +800 08250825

Checklist

Travelclaims@hdfcergo.com will share the checklist/documents required for reimbursement

Mail Documents

Claim documents along with claim form to be sent to travelclaims@hdfcergo.com or processing@hdfergo.com

Processing

Claim is registered by HDFC ERGO call centre executive on respective claims system.

International Travel Insurance for Most Visited Countries

Take your pick from the options below, so you can be better prepared for your trip to a foreign country

Travelling to the US?

There’s nearly a 20% chance that your flight could be delayed. Protect yourself with HDFC ERGO’s travel insurance.

Hear from Our happy customers

Read Latest Travel Insurance Blogs

Frequently Asked Questions on Overseas Travel Insurance

1. Which overseas travel insurance is best?

A unique feature of HDFC ERGOs Overseas Travel Insurance is its 24x7 in-house claim settlement services, complemented by a vast network of 1 Lac+ cashless hospitals

2. How much does it cost for international travel insurance?

The premium on your travel insurance depends upon your destination and the duration of your stay. The age of the insured person and the different types of plans chosen play a vital role in deciding the cost of the international travel insurance policy.

3. Can I buy travel insurance while abroad?

Your policy cover starts from the immigration counter of your home country and ends once you return after your vacation and complete your immigration formalities. This is why you cannot buy travel insurance while you are abroad. Therefore, travel insurance purchased after the commencement of the journey is not considered valid.

4. Can I extend my travel insurance while abroad?

Once abroad, you can extend your travel insurance policy if it is still valid. However, remember you can only extend your existing policy. You cannot buy one while you are away.

5. Can you buy travel insurance the day you leave?

Yes, you can buy the travel insurance policy even at the last minute. So even if it's your departure day and you're not insured, you can buy a travel insurance cover.

6. Can I see a doctor with travel insurance?

Yes, you can seek doctor help when you are abroad, as international travel insurance policies cover medical expenses.

7. Do I need international travel insurance to get a visa?

If you are travelling to Schengen countries, buying travel insurance is a must to get a visa. Apart from this, many countries have mandatory travel insurance for getting a visa. Therefore, it is advisable to check the visa requirement of every nation before travelling.

8. I had to cancel my trip for personal reasons, but I already bought travel insurance. Can I get a refund?

Yes, you can get a refund for trip cancellation if you cancel the journey before the departure date due to unforeseen conditions like an emergency at home, the sudden death of a family member, political turmoil or a terrorist attack. A complete refund of your premium is possible in such situations after the cancellation of the policy.

9. What is the Maximum Trip Duration Covered under an Overseas Travel Insurance Policy?

Total policy period, including extensions, shall not exceed 360 days.

10. Should I buy international travel insurance before booking a flight abroad?

Yes, it is advisable to secure your jour with a travel insurance policy before booking a flight abroad. You can do so by going with a multi trip insurance plan that will save you from the hassle of purchasing travel insurance each time you make a trip and it also proves to be cost-effective.

11. Can You Buy Overseas Travel Insurance After Booking a Flight?

Yes, you can buy overseas travel insurance after booking a flight, even on the day of your departure. However, it is advisable to buy the travel insurance cover within 14 days of booking your holiday.

12. Will Extending the Policy Affect My International Travel Insurance Cost?

You can reschedule your policy free of cost; however, the extension of the policy will affect the cost. The increase in cost will depend upon the number of days you extend.

13. If I Return to India Earlier Than Scheduled, Will I Get a Partial Refund for My Overseas Travel Insurance Policy?

No, you will not get a partial refund if you return to India earlier than the scheduled date.

14. If I Buy International Travel Insurance Online, Will It Cover the Cost of Dental Treatment?

Yes, it covers the cost of dental treatment. In addition, international travel insurance covers the costs of emergency dental work up to $500* arising out of an accidental injury.

15. Will an Overseas Travel Plan Cover Me if I Get Injured While Traveling on a Ship or Train Overseas?

Yes, it will provide coverage for injury caused while travelling on a ship or train overseas.

16. If I Get Injured on the Last Day of the Trip, Will My International Travel Insurance Policy Get Extended?

Suppose you extend your stay on the last day of your trip due to a medical emergency, accident, or injury. In that case, you can extend your travel insurance policy for 7 to 15 days without paying any premium.

17. Can I File an International Travel Insurance Claim After Getting Back to India?

Yes, it is possible to file a claim after travelling back to India. However, remember you need to file the claim within 90 days of any unfortunate event like a medical emergency or loss of documents, except if otherwise stated by your insurer.

18. What is the document provided as proof of travel insurance?

The insurer's soft copy mailed to you is enough to work as proof for your travel insurance. However, it is advisable to jot down your policy number and, more importantly, have our 24-hour assistance telephone number with you, so you can contact us if you need our help while you're away.

19. I bought international travel insurance online through the HDFC ERGO website. How do I contact customer care from a foreign country

in case of a claim?

Call our emergency travel assistance partner on the 24-hour alarm centre for travel, medical advice, and assistance during your trip.

• E-mail: travelclaims@hdfcergo.com

• Toll free number (globally): +80008250825

• Landline (chargeable):+91-120-4507250

Note: Please add the country code while dialing the contact number.

20. When does my international travel insurance policy coverage start?

Travel insurance coverage starts at the immigration counter of the home country and continues until the immigration is completed after returning to the home country.

Car Insurance

Car Insurance  Bike/Two Wheeler Insurance

Bike/Two Wheeler Insurance  Health Insurance

Health Insurance  Pet Insurance

Pet Insurance  Travel Insurance

Travel Insurance  Home Insurance

Home Insurance  Cyber Insurance

Cyber Insurance  Third Party Vehicle Ins.

Third Party Vehicle Ins.  Tractor Insurance

Tractor Insurance  Goods Carrying Vehicle Ins.

Goods Carrying Vehicle Ins.  Passenger Carrying Vehicle Ins.

Passenger Carrying Vehicle Ins.  Compulsory Personal Accident Insurance

Compulsory Personal Accident Insurance  Travel Insurance

Travel Insurance  Rural

Rural  Critical illness Insurance

Critical illness Insurance