Property Insurance

When we say property insurance, it's a type of home insurance that provides protection coverage for property owners. Property insurance can help the owner avoid financial losses, which might occur due to damage caused to the property by natural calamities, theft, fire etc.

You invest your lifelong savings to buy a property you can call your own! However, mere buying it isn't enough. You need to secure your property from unforeseen events. Hence, to protect your property, you need to get property insurance.

Property insurance plan is designed uniquely with affordable premiums to let you bask in the glory of protection and safety. Therefore, to safeguard your finances and protect your property from natural calamities, theft, accidental damage, etc., we recommend you buy property insurance and thereby avoid getting a big hole in your pocket due to unwanted scenarios.

Why Do You Need Property Insurance?

It is necessary to buy property insurance to avoid any sort of financial burden that might occur due to damage caused to your home content/structure by fire, riots, natural calamities and other unforeseen events. Apart from this, there are numerous reasons to have a property insurance, which we will discuss below

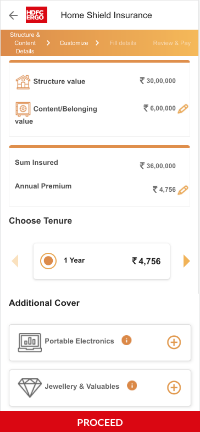

1. With HDFC ERGO property insurance you can avail a comprehensive coverage for both the content and structure of your home.

2. Property insurance plan will help secure your valuable asset from any mishap.

3. If any damage incurs to your insured property, the cost of repair will be covered by property insurance.

4. Property insurance provides coverage for even vacant houses. Even if you are away from your home, the cost of repairment/reconstruction will be covered.

5. Property insurance is beneficial for people who live at a rented apartment as it provides coverage for the content (belongings) and thereby avoid financial stress.

6. HDFC ERGO property insurance can be purchased online without any hassle and our customer support team is available 24x7 to help process your claims or solve any query related to your respective insurance plan.

Factors Impacting Premium for Property Insurance

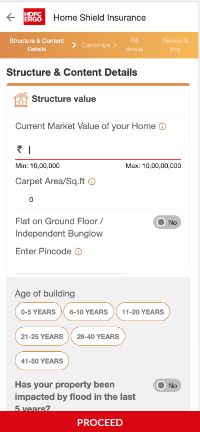

Location

If your property is located in a flood prone locality or a location where earthquake happens way too frequently then your premium may slightly be on the higher side.

Age and Structure of Your Building

If your property is a bit old and has structural challenges then your premium may be a bit high.

Home Security

If your property has all the security systems in place then there could be low chances of theft hence your premium may go low in such a scenario.

Amount of Belongings It Contain

If your property has quite some valuable content which you choose to insure then in that case your premium may depend on the value of the content you choose to insure.

Sum Insured or Total Value of Your Property

Your property’s total value matters at the time of deciding the premium. If your property’s structure value is high your premium is likely to rise and vice versa. It can also be termed as the market value of your home, because if the market value of your property is high then the sum insured shall also be high.

Reasons to Cover Your Property with HDFC ERGO

Short Stay? Long Benefits

Worried that your property insurance will go waste? Our property insurance offers you the flexibility of choosing the tenure as per your convenience. However, the minimum tenure should be at least one year.

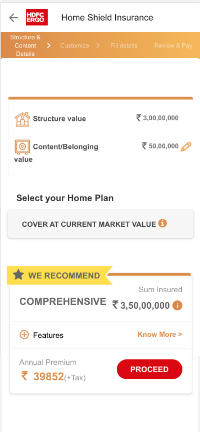

Discounts Upto 45%

With HDFC ERGO’s property insurance, you can get your home insured with some attractive discounts on premiums. We offer discounts on buying policy online, for salaried employee, for long term policy, etc.

Contents Covered Upto Rs 25 Lakhs

HDFC ERGO’s property insurance give you the option to cover all your possessions (upto Rs. 25 lakhs) without sharing any specified list of home belongings.

Portable Electronics Covered

Get your electronic gadgets like laptops, cell phones and tablets insured with HDFC ERGO property insurance and thereby avoid financial losses that might occur due to damage caused to these electronic equipments.

India has been bearing the brunt of climate change in form of flash floods and landslides. Now is the time to take action and secure your property against natural disasters.

Understanding Coverage Offered by HDFC ERGO’s Property Insurance

Fire

Fire can annihilate your dream property. Our property insurance covers for the damages caused due to fire so that you can rebuild your home.

Burglary & Theft

Thieves can run away with your precious jewellery or other valuables. You can rest easy if you get them covered.

Electrical Breakdown

Can't imagine our lives without appliances! Insure them to get coverage in event of electrical breakdown.

Natural Calamities & Manmade Hazards

If your property gets damaged due to cyclone, earthquake, flood etc we cover you! Also, secure your home against strikes, riots, terrorism, and malicious acts.

Alternate Accommodation

If the insured property gets damaged and deemed unfit for living due to an insurable peril, the owner gets the arrangement for temporary alternate accommodation by the insurer.

Accidental Damage

With property insurance, you get protection for expensive fittings and fixtures, where coverage is provided to your precious belongings if accidental damage occurs.

War

Loss/Damages arising of events including war, invasion, act of foreign enemy, hostile are not covered in the property insurance plan.

Precious Collectibles

Losses arising out of damage to bullions, stamps, work of art, coins etc. will not be covered.

Old Content

We understand that all your precious possessions hold emotional value but anything that’s over 10 years old will not be covered under this property insurance policy.

Consequential Loss

Consequential losses are losses that are not the natural result of the breach in the usual course of things, such losses remains uncovered.

Willful Misconduct

We ensure your unforeseen losses are covered, however if the damage is willfully conducted then it is not covered.

Third party construction loss

Any damage caused to your property due to third party construction is not covered.

Wear & Tear

Your property insurance does not cover usual wear and tear or maintenance/renovation.

Cost of Land

Under circumstances this property insurance policy shall not cover the cost of land.

Under construction

Property insurance cover is for your home where you reside, any under construction property will not be covered.

Optional Cover under Home Insurance for Property Coverage

Portable Electronic Equipment Cover

Jewellery & Valuables

Pedal Cycle

Terrorism Cover

Secure your electronic gadgets even when you are on the move.

With HDFC ERGO’s property insurance, get add-on coverage for portable electronic items like laptop, camera, musical equipments, etc. However, there are no coverage benefits for electronic equipments which are more than 10 years old.

Suppose you go on a vacation and your camera gets accidentally damaged, we shall cover against this loss of camera however it should not be an intentional damage.

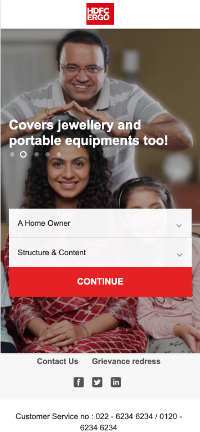

Know your Property Insurance Premium in 4 Easy Steps

Calculating your home insurance premium has never been easier. All it takes is 4 quick steps.

How to Make a Claim for your HDFC ERGO Property Insurance Policy

For registering or intimating claim, you can call on helpline no. 022 - 6234 6234 or email to our customer service desk at care@hdfcergo.com After claim registration, our team will guide you in every single step ahead and help you settle your claims without any hassle. Following standard documents are required for processing claims:

- Policy /Underwriting documents

- Photographs

- Claim Form

- Log book / Asset register / capitalized item list (wherever applicable)

- Repair / Replacement invoices with receipt

- Claim Form

- All

Applicable valid Certificates

- FIR copy (If applicable)

Read Latest Property Insurance Blogs

Frequently Asked Questions on Property Insurance

1. Which contents are covered under a property insurance policy?

The contents of your home are covered under a property insurance policy. These contents include the following –

● Furniture and fixtures

● Television sets

● Home appliances

● Kitchen appliances

● Water storage equipment

● Other household items

Moreover, you can also pay an additional premium and insure your valuables like jewellery, pieces of art, curio, silverware, paintings, carpets, antiques, etc.

2. Is it compulsory to buy property insurance from a designated bank?

No, it is not compulsory to buy property insurance from a designated bank. Usually, banks allowing home loans might offer the property insurance policy clubbed with the home loan. However, you have the choice to compare the different property insurance plans available in the market and choose a plan that best suits your need.

To compare you should look at the coverage benefits, the sum insured and the premium charged. Choose a plan that offers the most comprehensive scope of cover so that the most possible damages are insured. Moreover, the premium should be competitive so that you get the best deal.

3. Is property insurance same as home insurance with HDFC ERGO ?

Yes, we mean to say that if you stay in a building you can get your home secured with our home shield insurance plan. Click here to check premium rates.

4. Is it illegal to own a property without insurance ?

Absolutely No, however situations today like natural calamities, fire incidents or theft cases encourage buyers to secure their most valuable asset with a home insurance plan.

5. Do you also secure the content in property coverage of home shield cover?

Yes, we secure your home content like furniture, valuables, and portable electronics.

6. If anything happens to my property and I am not able to stay in it will you give me alternate accommodation ?

We do cover you for alternate accommodation in case of structural damage to your home, so we cover you for moving and packing, rent and brokerage for alternate stay.

7. I want to secure my paternal/maternal property under home insurance can I do that, it’s not on my name though?

You can insure the property in the name of the actual owner of the house. Also, you can jointly get in insured in the name of the owner and yourself.

8. Which type of property does HDFC ERGO secure?

You can insure individual residential premises. As a tenant you could cover your home belongings.

9. Which type of property is not covered in home insurance?

Property under construction cannot be covered under Home Insurance. Also, Kutcha construction is not be covered.

10. Will the company pay for debris removal during the reconstruction of the property? If yes how much?

Sum Insured affixed for Removal of Debris is 1% of claim amount.

Car Insurance

Car Insurance  Bike/Two Wheeler Insurance

Bike/Two Wheeler Insurance  Health Insurance

Health Insurance  Pet Insurance

Pet Insurance  Travel Insurance

Travel Insurance  Home Insurance

Home Insurance  Cyber Insurance

Cyber Insurance  Third Party Vehicle Ins.

Third Party Vehicle Ins.  Tractor Insurance

Tractor Insurance  Goods Carrying Vehicle Ins.

Goods Carrying Vehicle Ins.  Passenger Carrying Vehicle Ins.

Passenger Carrying Vehicle Ins.  Compulsory Personal Accident Insurance

Compulsory Personal Accident Insurance  Travel Insurance

Travel Insurance  Rural

Rural  Critical illness Insurance

Critical illness Insurance