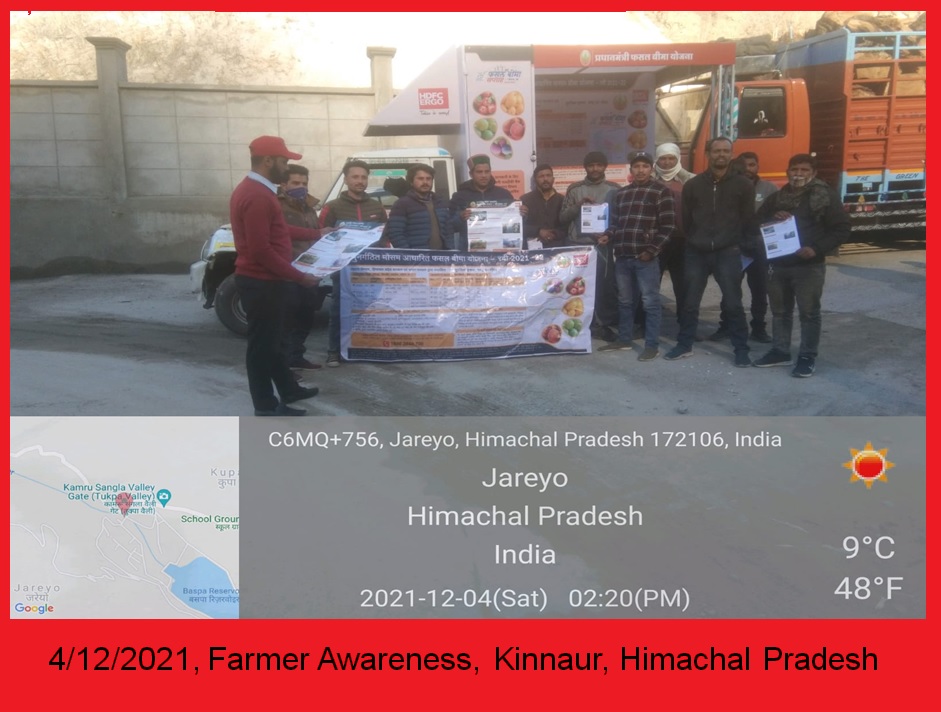

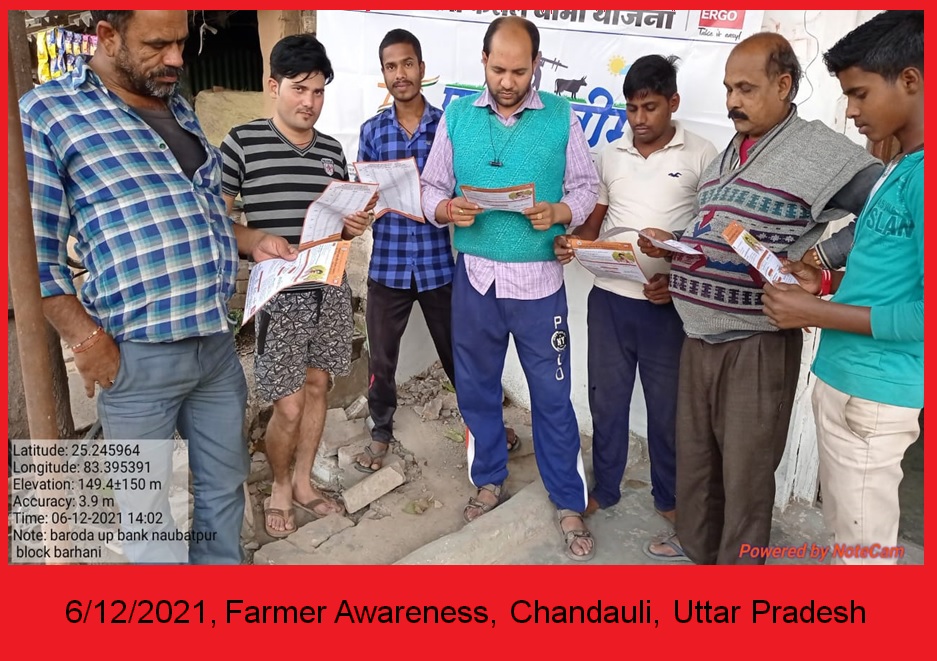

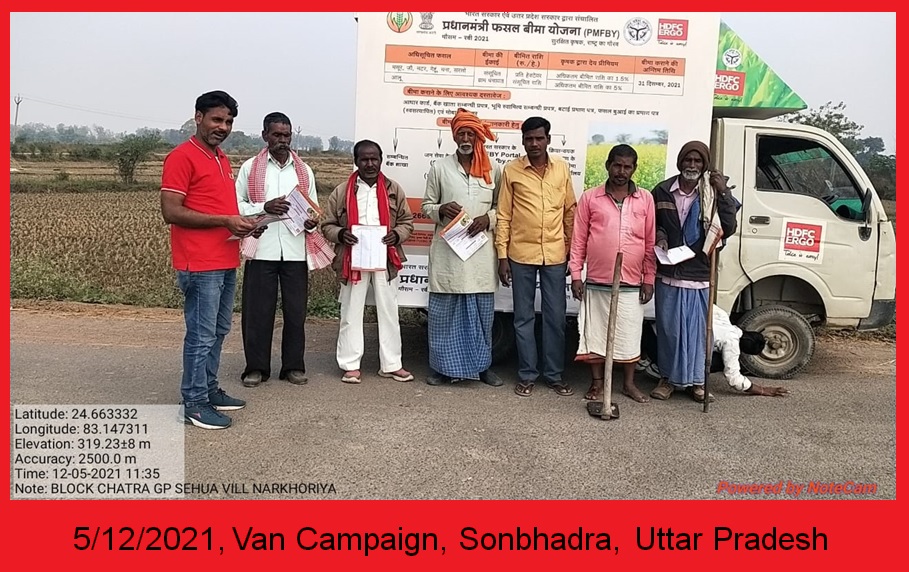

AZADI KA AMRIT MAHOTSAV – CROP INSURANCE WEEK CELEBRATIONS

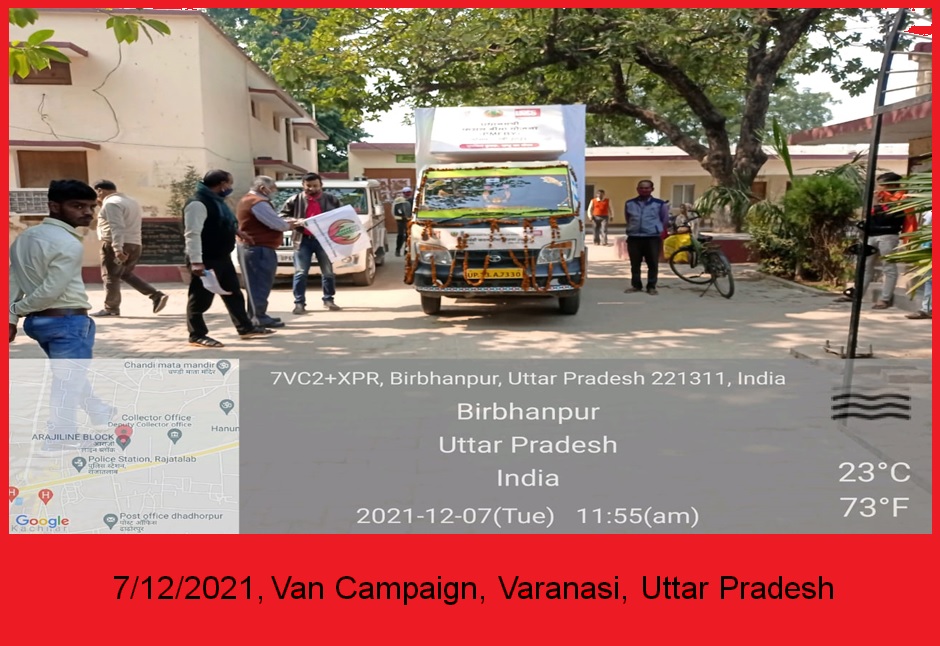

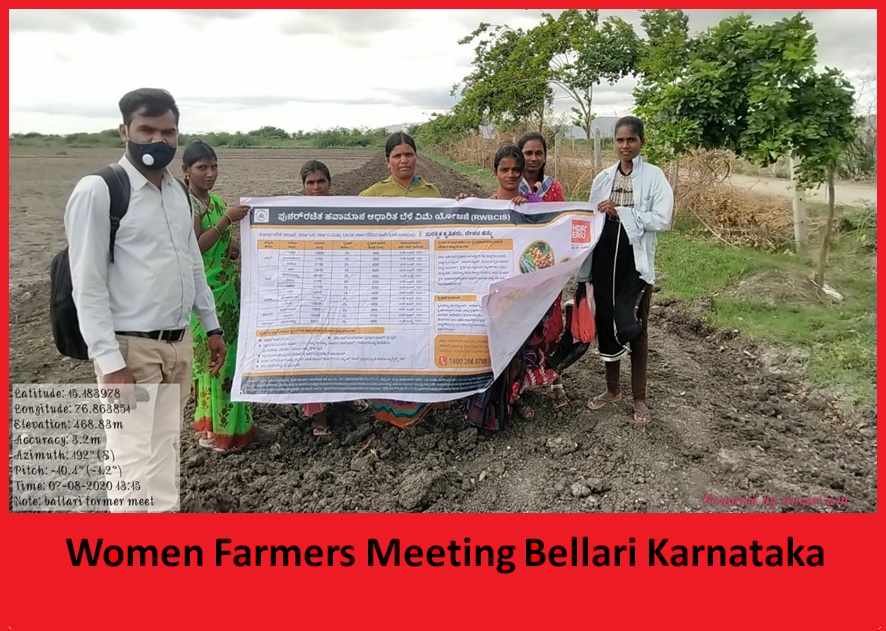

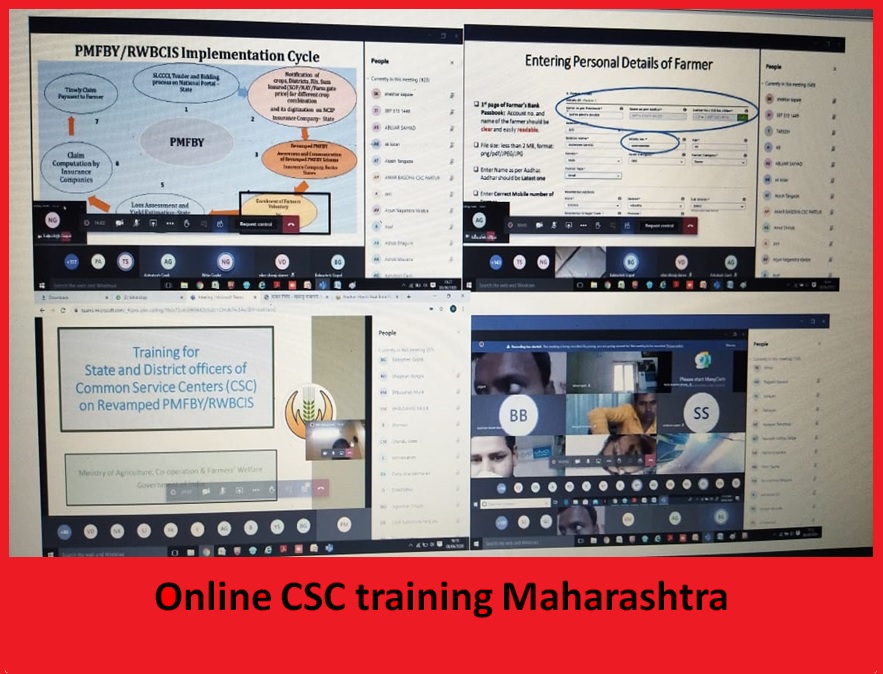

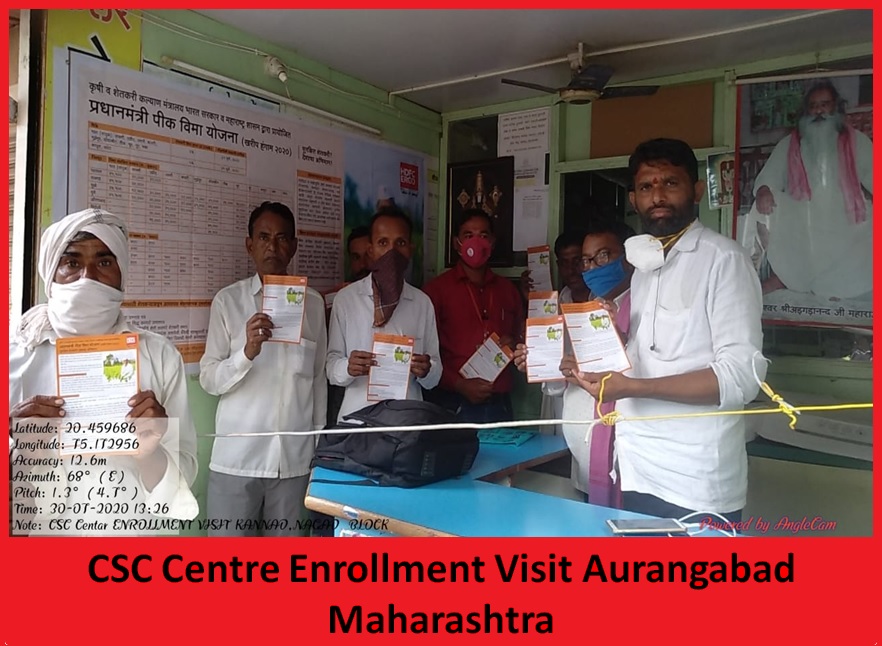

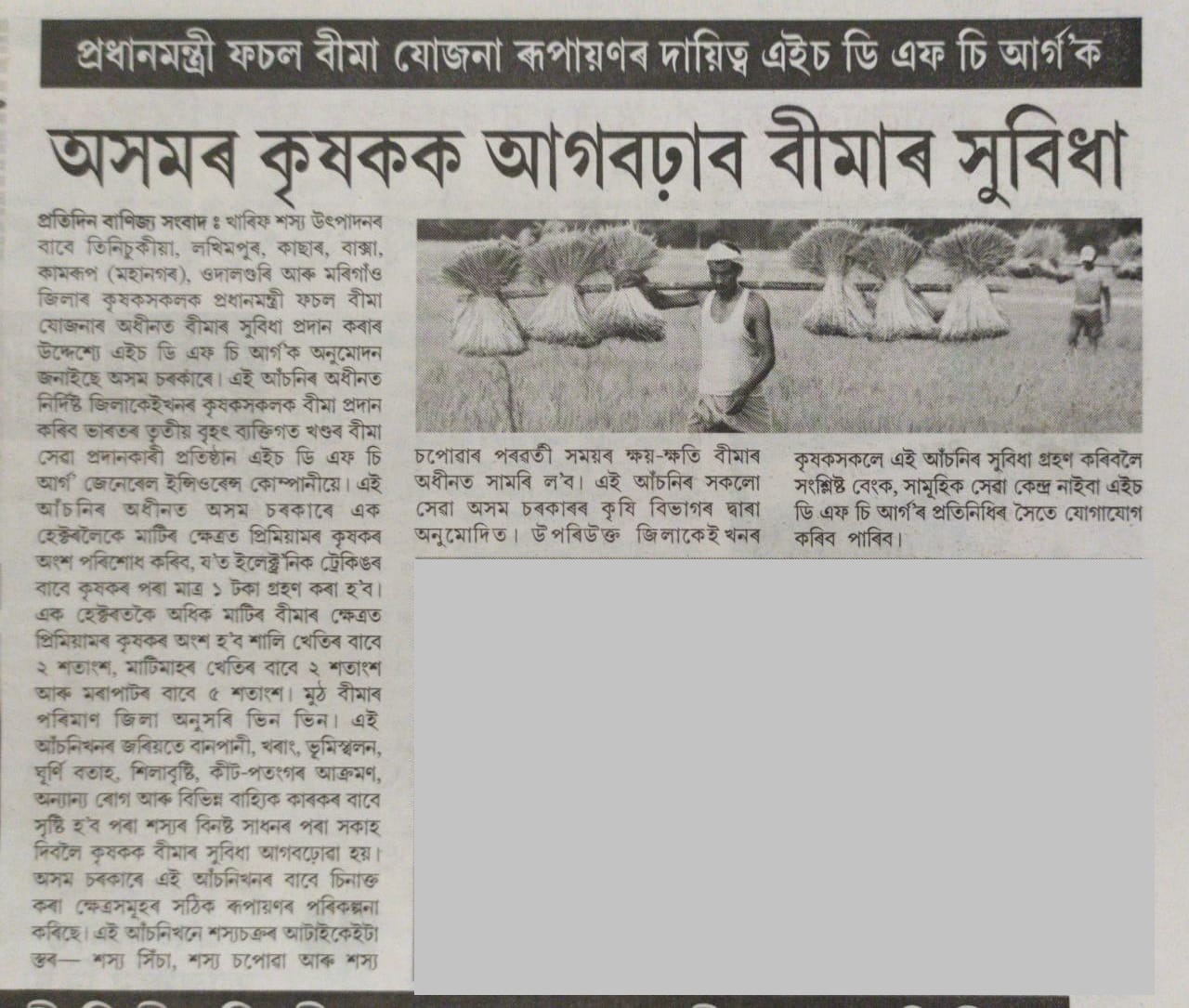

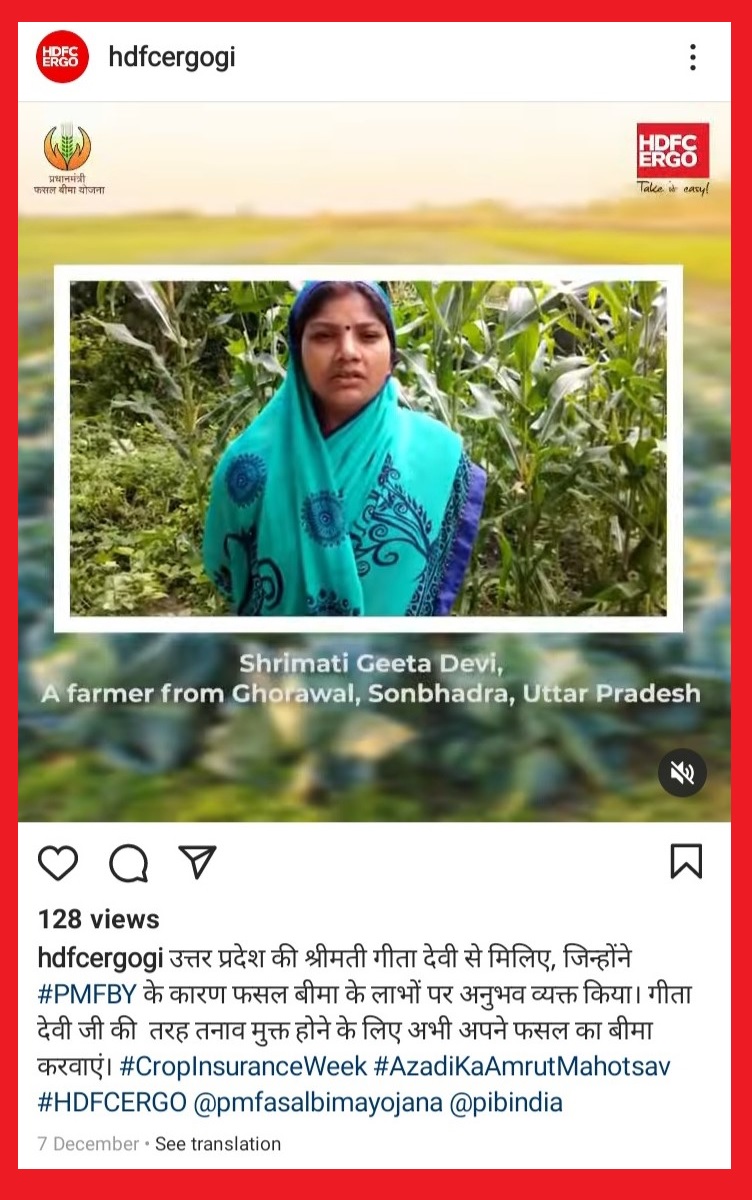

HDFC ERGO participated in a week long “Crop Insurance Week” (for both Kharif and Rabi season respectively) celebration on the occasion of 75th year of Indian Independence, celebrated as "Azadi ka Amrit Mahotsav- India@75" under

the aegis of Governemnt of India, aimed to commemorate the progress made by our Indian farmers over the years by various initiatives of the Ministry of Agriculture & Farmer's Welfare and the success of PMFBY in providing security

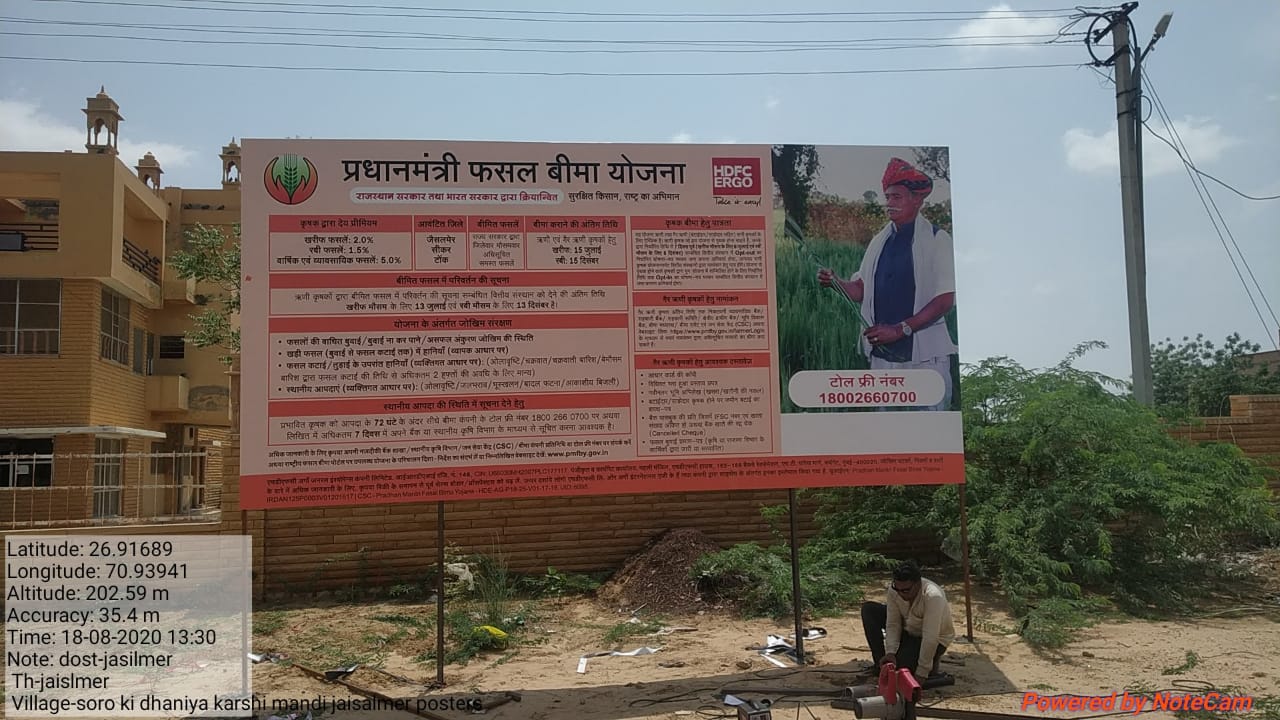

to our farmers. As a part of the celebration, we targeted 10 aspirational districts notified under the PMFBY/RWBCIS, having insignificant or low participation of the farmers in the PMFBY scheme. To create comprehensive awareness in

these aspirational districts, about the PMFBY/RWBCIS scheme, extensive marketing activities were planned focusing on educating the farmers about the benefits of the scheme under HDFC ERGO’s initiative “Kisan Pathshala”

. Our team members actively distributed cogent pamphlets and brochures, conducted awareness workshops and trainings were done using an one of it's kind "Digital Bus" equipped with desktops.. HDFC ERGO effectively connected with our

farmers by distribution of plant saplings and thereby also making sustainable efforts towards the environment. Social Media campaigns were used extensively throughout the week long celebration to reach out to the masses through innovative

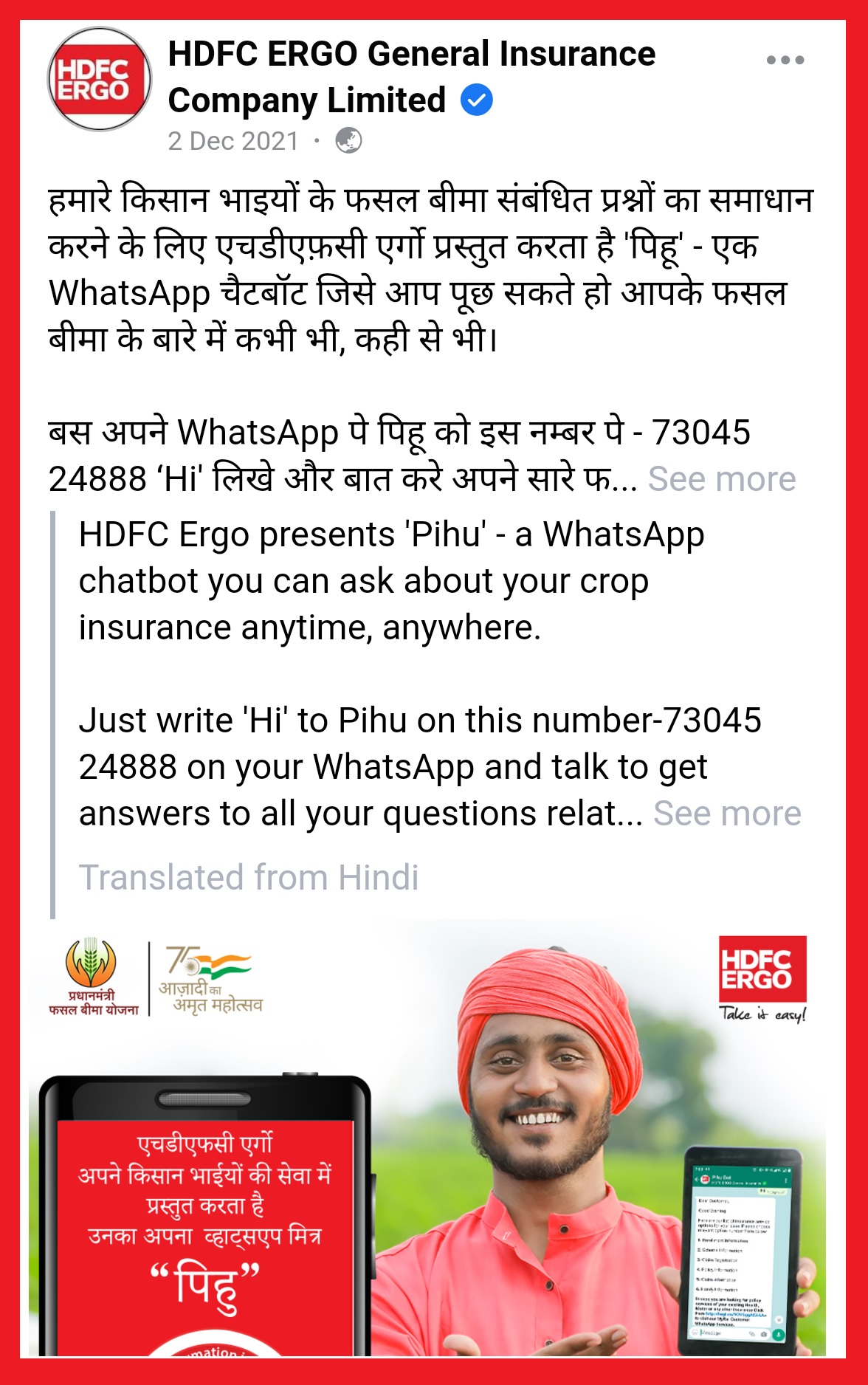

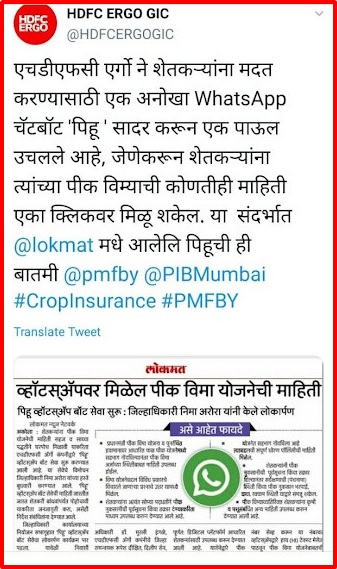

digital creative contents, audio visuals, informative posts and dedicated hash tags. Further, to commemorate the incessant efforts of our farmers, HDFC ERGO was happy to unveil during the Crop Insurance week celebration, “PIHU”

an industry first WhatsApp Chat BoT equipped with Artificial Intelligence tools offering instant messaging services in regional languages to obtain information regarding enrollment in PMFBY Scheme, farmers application status, claim

intimation, claims status, etc.

Rabi 2022-2023

KHARIF 2022

RABI 2021-2022

Kharif 2020

Scheme Features

I. The scheme provides Insurance coverage to all Farmers for their crops as notified by the State Governments

All farmers including sharecroppers and tenant farmers growing the notified crops in the notified areas are eligible for coverage.

- Farmers should have insurable interest for the notified/ insured crops.

- The non-loanee farmers are required to submit necessary documentary evidence of land records prevailing in the State (Records of Right (RoR),Land possession Certificate (LPC) etc.) and/ or applicable contract/agreement details/ other documents notified/ permitted by concerned State Government (in case of sharecroppers/ tenant farmers).

All farmers availing Seasonal Agricultural Operations (SAO) loans from Financial Institutions (i.e. loanee farmers) for the notified crop(s) would be covered compulsorily.

It is mandatory for all loanee cultivators to insist on insurance coverage as per provisions of the Scheme.

- Any change in crop plan should be brought to the notice of the bank at least 2 days before cut-off-date.

- Insurance Proposals are accepted only upto a stipulated cut-off date as declared by the SLCCC/ state Government Notified.

b. Voluntary Component

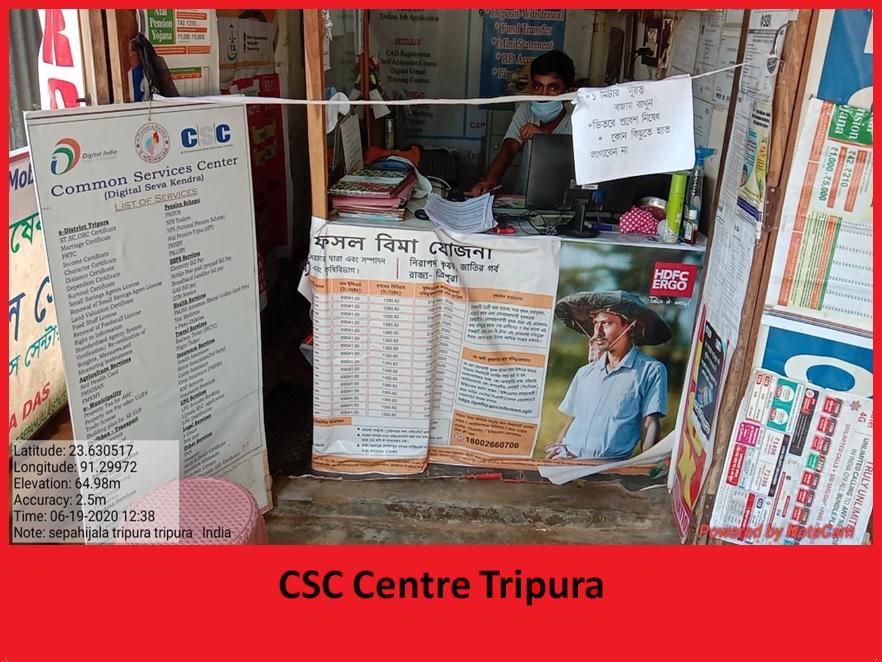

The Scheme would be optional for the non-loanee farmers and cultivators desirous of availing insurance under PMFBY for any notified crop in any notified insurance unit may approach nearest bank branch/ PACS/ authorized channel

partner/ insurance intermediary of insurance company within cut-off date, fill-up proposal form completely in prescribed format, submit form and deposit requisite premium to bank branch/ Insurance Intermediary / CSC Centers along with

necessary documentary evidenceregarding his insurable interest in cultivating land/ crop (e.g.ownership/ tenancy/ cultivation rights) proposed for insurance.

- The farmer desiring for coverage should open/operate an account in the branch of the designated bank, and the details should beprovided in the proposal form.

- The farmers should mention their land identification number in the Proposal and must provide documentary evidence with regard to possession of cultivable land.The cultivator must furnish area sown confirmation certificate.

- The farmer should ensure that he gets insurance coverage for anotified crop(s) cultivated/proposed to be cultivated, in a piece ofland from a single source only. No duplicate or double Insurance is allowed and in any such cases farmer will not be eligible for coverage. The insurance company shall reserve the right to repudiate all such claims and not refund the premium as well in such cases.

- Company may also take legal action against such farmers.

- Any change in crop plan should be brought to the notice of the bank at least 2 days before cut-off-date.

- Insurance Proposals are accepted only upto a stipulated cut-off date as declared by the SLCCC/ state Government Notified.

II. Crops Covered

All crops are covered under the scheme such as Food& Oilseeds crops and Annual Commercial/Horticultural Crops for which past yield data is available.

In addition for perennial crops, pilots for coverage can be taken for those perennial horticultural crops for which standard methodology for yield estimation is available.

III. Coverage of Risks and Exclusions under the scheme

The Scheme operates on the principle of “Area Approach” in the selected Defined Areas which are called Insurance Unit (IU) , basis Crops and Defined Areas in accordance with decision taken in the State level coordination

committees on crop insurance of the respective State/UT Government . These units are notified as insurance unit applicable to Village/Village Panchayat or any other equivalent unit for major crops. For other all other crops it may

be a unit of size above the level of Village / village Panchayat.

Following stages of the crop and risks leading to crop loss are covered under the scheme.

a. Prevented Sowing/ Planting Risk: In case of majority of insured crops of a notified area are prevented from sowing/planting due to adverse weather conditions such as deficit rainfall or adverse seasonal conditions, the insured

crops that will be eligible for indemnity claims upto maximum of 25% of the sum-insured.

b. Standing Crop (Sowing to Harvesting): Comprehensive risk insurance is provided to cover yield losses due to non- preventable risks, viz. Drought, Dry spells, Flood, Inundation, Pests and Diseases, Landslides, Natural

Fire and Lightening, Storm, Hailstorm, Cyclone, Typhoon, Tempest, Hurricane and Tornado.

c. Post-Harvest Losses: coverage is available only up to a maximumperiod of two weeks from harvesting for those crops which are allowed to dry in cut and spread condition in the field after harvesting against specific

perils of hailstorm, cyclone and cyclonic rains and unseasonal rains.For the claims arising out of crop damage due to post-harvest losses and localized risks, arising out of cyclone or cyclonic rains / unseasonal rains throughout the

country, resulting in damage to harvested crop lying in the field in ‘cut and spread’ condition for sole purpose of drying only , upto a maximum period of two weeks (14days) from harvesting is also covered and the assessment

of damage will be made on individual farm basis.

d. Localized Calamities: LLoss/ damage resulting from occurrence ofidentified localized risks of hailstorm, landslide, Inundation, cloud burst and natural fire due to lightening affecting isolated farms in the notified

area.

Note: Losses arising out of war and nuclear risks, malicious damage and other preventable risks shall be excluded.

IV. Indemnity Level applicable for different crops

Coverage is provided upto different indemnity levels of 70%, 80% and 90% corresponding to high, moderate and low risk level, respectively, of the areas basis the type of crops and is notified for crops and areas as per

notified unit applicable.

V. Premium

The Maximum Premium payable by the farmers will be 2% for all Kharif Food & Oilseeds crops, 1.5% for Rabi Food & Oilseeds crops and 5% for Annual Commercial/Horticultural Crops or actuarial premium rate whichever is less.

The difference between premium and the rate of Insurance charges payable by farmers shall be shared equally by the Centre and State.

- Note: The seasonality discipline shall be applicable for loanee and non-loanee farmers as defined in the State Government notification and farmers need to necessarily enroll before the specified cut off dates applicable for the

respective crop in the season.

- The Threshold Yield (TY) shall be the benchmark yield level at which Insurance protection shall be given to all the insured farmers in an Insurance Unit.

- The Average Yield of a notified crop in Insurance Unit (IU) will be average yield of best five years out of last seven years. The Threshold yield of the notified crop is equal to Average Yield multiplied by Indemnity level.

VI. Basis of Claims Settlements

The claims payout would be made, basis the Area Approach, subject to the following:

- State has to conduct requisite number of Crop Cutting Experiments (CCEs) at the level of notified insurance unit area and the CCE based yield data will be submitted to insurance company within the prescribed time limit to calculate the claims payable basis the respective notified insurance unit area.

- Crop Cutting Experiments (CCE) shall be undertaken per unit area /per crop, on a sliding scale, as prescribed under the scheme outline and operational guidelines .

- The Threshold Yield (TY) shall be the benchmark yield level at which Insurance protection shall be given to all the insured farmers in an Insurance Unit Threshold of the notified crop will be. The Average Yield of a notified crop in Insurance Unit (IU) will be average yield of best five years out of last seven years. The Threshold yield of the notified crop is equal to Average Yield multiplied by Indemnity level

IMPORTANT NOTE:

- Farmers can enroll under the scheme via their bank branches, nearest CSC Centers or insurance intermediary as authorized by IRDA.

- All enrolments need to necessarily be completed within the cutoff date as defined in the respective State Government notification and farmer share of premium duly remitted by the Bank or Intermediary within the cut off date to the

Insurance Company.

- Incase the farmer changes the crop to be sown, he should intimate thechange to insurance company, at least 2 working days prior to cut-off-date for buying insurance or sowing either through financial institution/ channel partner/insurance

intermediary/ directly; as the case may be, along with differencein premium payable, if any, accompanied by sowing certificate issued byconcerned village/ sub-district level official of the State. In case thepremium paid was higher,

insurance company will refund the excess.

- Incase of Tenant/ share farmers obtaining coverage necessary documentaryevidence of land records prevailing in the State (Records of Right (RoR) Land possession Certificate (LPC) etc.) and/ or applicable contract/agreement details/

other documents notified/ permitted by concerned State Government should be provided at the time of enrollment.

- Service Tax is exempted for this scheme.

Claim Process

The Scheme operates on the principle of “Area Approach” in the selected Defined Areas which are called Insurance Unit (IU), basis Crops and Defined Areas in accordance with decision taken in the State level coordination committees on crop insurance of the respective State/UT Government . These units are notified as insurance unit applicable to Village/Village Panchayat or any other equivalent unit for major crops. For other all other crops it may be a unit of size above the level of Village/ Village Panchayat.

The main claims payout would be made, basis the Area Approach, subject to the following:

- State has to conduct requisite number of Crop Cutting Experiments(CCEs) at the level of notified insurance unit area;

- CCE based yield data will be submitted to insurance company within the prescribed time limit to calculate the claims payable basis the respective notified insurance unit area

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

-1-12-2021.jpg)

-4-12-2021.jpg)

.jpeg)

Car Insurance

Car Insurance  Bike/Two Wheeler Insurance

Bike/Two Wheeler Insurance  Health Insurance

Health Insurance  Pet Insurance

Pet Insurance

Travel Insurance

Travel Insurance  Home Insurance

Home Insurance  Cyber Insurance

Cyber Insurance  Third Party Vehicle Ins.

Third Party Vehicle Ins.  Tractor Insurance

Tractor Insurance  Goods Carrying Vehicle Ins.

Goods Carrying Vehicle Ins.  Passenger Carrying Vehicle Ins.

Passenger Carrying Vehicle Ins.  Compulsory Personal Accident Insurance

Compulsory Personal Accident Insurance  Travel Insurance

Travel Insurance  Rural

Rural  Critical illness Insurance

Critical illness Insurance