Chapter 06 Insurance Sector in India

Insurance Quotient Boosters

- The insurance sector plays a vital role in the economic development of the country.

- The industry has seen a gradual growth over the last 15 years in terms of product innovation, vibrant distribution channels, penetration and density.

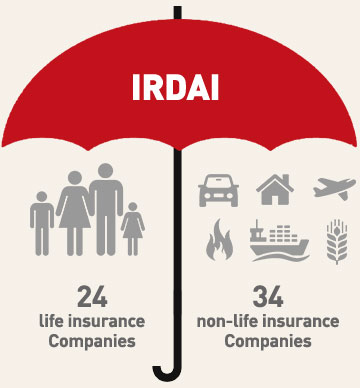

- Insurance Regulatory and Development Authority of India (IRDAI) regulates the Indian insurance industry to protect the interests of the policyholders and work for the orderly growth of the industry.

- Considering its ever growing population and demographic dividend, it has a huge unexplored potential that provides ripe business opportunity.

The insurance sector also plays a vital role in the economic development of the country by providing various useful services like:

Realizing the potential of the insurance sector in mobilizing savings for productive use and social safety, the government has taken various steps to improve its quality, reach and popularity. The insurance market in India was opened up for the private sector in 2000 with the enactment of the Insurance Regulatory and Development Authority of India (IRDAI) Act.

Post-liberalization, the insurance industry in

India has recorded significant growth.

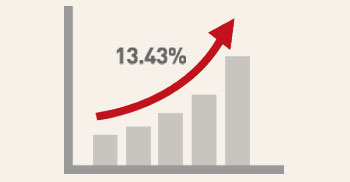

In FY19 (up to Feb 2019), gross direct premiums of non-life insurers reached Rs. 1.51 trillion showing a year-on-year growth rate of 13.43%.

The industry has been spurred by product innovation, vibrant distribution channels, coupled with targeted publicity and promotional campaigns by the insurers. The market share of private sector companies in the non-life insurance market stands at 54.72 % in FY19 (up to Feb 2019) where as in life insurance segment, private players had a market share of 33.74 per cent in new business in FY19 (up to Feb 2019).

Together with banking services, insurance services add about 7% to the country’s GDP.

A well-developed and evolved insurance sector is a boon for economic development as it provides long-term funds for infrastructure development at the same time strengthening the risk taking ability of the country. The industry has seen a gradual growth over the last 15 years in terms of product innovation, vibrant distribution channels, penetration and density. Considering its ever growing population and demographic dividend, it has a huge unexplored potential yet to be explored.

The Indian insurance market is a huge business opportunity waiting to be harnessed. India is the second most populous nation in the world.

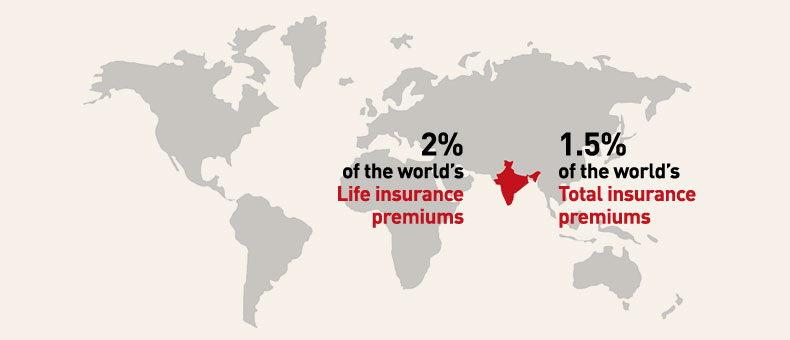

It currently accounts for less than 1.5% of the world's total insurance premiums and about 2% of the world's life insurance premiums

The country is the fifteenth largest insurance market in the world in terms of premium volume, and has the potential to grow exponentially in the coming years.

The future looks promising for the insurance industry with several changes in regulatory framework which will lead to further change in the way the industry conducts its business and engages with its customers. Demographic factors such as a growing middle class, young insurable population and the increasing awareness of the need for protection and retirement planning will support the growth of Indian insurance industry.

Road Ahead

India’s insurable population is anticipated to touch 750 million in 2020, with life expectancy reaching 74 years. Furthermore, Life Insurance is projected to comprise 35% of total savings by the end of this decade, as against 26% in 2009-10.

The future looks promising for the insurance industry with several changes in regulatory framework which will lead to further change in the way the industry conducts its business and engages with its customers.

Insurance Regulatory and Development Authority of India (IRDAI) regulates the Indian insurance industry to protect the interests of the policyholders and work for the orderly growth of the industry.

IRDAI’s Mission

To protect the interests of policyholders, to regulate, promote and ensure orderly growth of the insurance industry and for matters connected therewith or incidental thereto.

IRDAI’s Activities

Frames regulations for insurance industry in terms of Section 114A of the Insurance Act 1938

From the year 2000 has registered new insurance companies in accordance with regulations

Monitors insurance sector activities for healthy development of the industry and protection of policyholders’ interests

Functions of IRDAI

IRDAI has been set up mainly

To protect the interests of holders of insurance policies

To regulate, promote and ensure orderly growth of the insurance business and reinsurance business