Global Health Insurance

A health insurance plan safeguards your finances during a medical emergency or hospitalisation, keeping your bank savings intact. But have you ever wondered how you would pay your medical bills if a medical emergency happened when overseas? Well, this is where International Health Insurance comes to your rescue. Also known as Global Health Insurance, it provides broader coverage against planned and emergency medical services opted when in India or across the globe. Global Health Insurance Plans are designed to offer greater coverage and ensure you receive quality treatment when overseas without worrying about your finances. Whether it is a planned treatment, emergency or an accident, health insurance with global coverage will cover medical expenses incurred during a hospitalisation or while availing treatment abroad.

Global Health Plans Under my: Optima Secure

While choosing a global health insurance plan you should look for the coverages and benefits it offers. As this plan is a comprehensive plan it gives a wider coverage and gives a sense of security. However, make sure that your global insurance

covers all the aspects that you are looking for. Look for options like cashless hospitalisation, emergency medical services, hospital cash benefits, ambulance services as these are basic needs for anyone who lands into a medical crisis.

You can also check out HDFC ERGO’s global health insurance plans to make an informed decision regarding your choice. You can choose from our premium offerings:

Comparison of Global Plans under my: Optima Secure

| Coverages | my: Optima Secure Global | my: Optima Secure Global Plus |

|---|---|---|

| Base Sum Insured | ||

| Hosplitalization Expenses | Worldwide including India | Worldwide including India |

| Secure Benefit | Covered (India Only) | Covered (India Only) |

| Plus Benefit | Covered | Covered |

| Automatic Restore Benefit | Covered (India Only) | Covered (India Only) |

| Pre and Post Hospitalization | 60 and 180 days (India only) | 60 and 180 days |

| Geography covered | ||

| Aggregate Deductible Discount | ||

| Global Health Cover (Emergency Treatments Only) | ||

| Global Health Cover (Emergency & Planned Treatments Only) | ||

| Overseas Travel Secure (Optional Cover) | ||

| GLOBAL BROCHURE | GLOBAL PLUS BROCHURE |

Note: 1:Our maximum liability in a policy year for overseas claim shall be restricted to base Sum Inured and Plus benefit (if available) 2: A per Claim Deductible of Rs. 10,000 will apply separately for each and every claim incurred and made overseas (except E-Opinion for Critical Illness ).

How to Choose a Global Health Insurance Plan?

When choosing a global health insurance plan here are a few things to keep in mind:

Coverage

Look for a global health insurance plan that gives you cashless coverage as that will save you a lot of hassles with money management. Make sure to check if your insurance company has a tie-up with an overseas TPA to take care of your cashless claims and offer hassle-free settlements.

Places covered

Read between the thin lines and make sure you are aware of all the places that your global health insurance covers. Some plans might exclude treatments taken in the USA & Canada, so check on that. Also check the for coverage in cities and suburbs abroad where you may seek medical treatments.

Coverage Amount

Choose a coverage amount that is sufficient to cover your overseas medical treatment costs. If you choose a lower sum insured, your out-of-pocket expenses might increase. However, a very high sum insured amount, will also have an expensive premium. So, take an apt decision.

Procedures covered

When overseas your medical bills mostly comprise of in-patient hospitalization costs and day care expenses. So ensure your medical insurance abroad covers in-patient treatment and day care procedures up to the sum insured limit so you can get maximum coverage benefit.

Renewal Benefits

Pick a global healthcare plan that offers renewal benefits, such as the cumulative bonus and annual health check-ups, on every renewal. This will ensure a comprehensive cover on your overseas medical insurance and value for money too.

Restore Benefits

A restoration benefit means your sum insured gets restored after making a claim. When abroad, this benefit might be of great help if you need frequent hospitalisation for a planned treatment.

Advantages of Global health Insurance

Having Global health Insurance is a blessing in disguise. While travelling abroad where everything can cost you dearly, a medical emergency can literally burn a hole in your pocket. If you are still thinking whether you need to invest in overseas medical insurance, here are a few advantages of the same:

• Cashless hospitalisation: Overseas medical insurance offers cashless facility which means the incurred medical expenses are directly settled with the network hospital by the insurance company as per the terms and conditions of the policy.

• Day-care procedure cover: An international health insurance covers medical expenses incurred during the process of treatment as per listed daycare procedures or any surgery as an inpatient, Which can otherwise be a huge financial blow.

• Hospitalisation expenses: The international medical insurance provides coverage in case of hospitalisation for a minimum of 24 hours for procedures or treatments in case of an emergency or planned surgery. The reason for hospitalization could be an illness, injury, or accidental during the policy term.

• Wider coverage: Global Health Care plans ensure a wider coverage by helping you avail medical services or treatment either in India or abroad. This keeps your mind worry-free and ensures you get quality treatment when needed.

• Ambulance services: Availing ambulance services during a medical emergency is a necessity. However, sometimes the cost of ambulance services could be a way too high. Such expenses are also covered in your international health insurance plan to make the treatment process smooth for you.

• Preventive health check-up: Most Global Overseas Insurance Plans offer an annual preventive health check-up this is an added advantage as you can be well informed about your health status and take preventive measures in case there is an underlying issue.

Buying my:Optima Secure global health cover plans are now easier with our No cost installment*^ option!

Global Health Care Plan: How Does It Work

A global health insurance coverage offers a wider and comprehensive cover for medical treatments and hospitalisations one undergoes whether in India or overseas. If you are sufficiently covered, you need not worry about medical

expenses in case of a sickness, injury or accident when abroad.

The best global medical health insurance offers a cover no matter where you are across the globe and includes a wide array of services such as - out-patient

treatment expenses, air ambulance, medical evaluation, and more as per the services mentioned in your Global Health Care policy.

The key benefit of having global health insurance is to have access to quality medical

care and attention across the globe. With the right plan in place, you can

avail the best treatment either in India or internationally.

Documents Required for Health Insurance Claim Reimbursement

Below are the documents that you need to keep handy when claiming for reimbursement. However, do read the policy terms and conditions carefully, in order to avoid missing out any important document.

- The claim form with your signature and valid identity proof.

- Prescription of the doctor stating hospitalization, diagnostic tests and medicines.

- Original Hospital , diagnostic , doctors and medicine bills along with receipts.

- Discharge summary, case papers , investigation reports.

- Police FIR/medico legal case report (MLC) or post-mortem report if applicable .

- Proof of named Bank Account like Cheque copy/Passbook/Bank statement

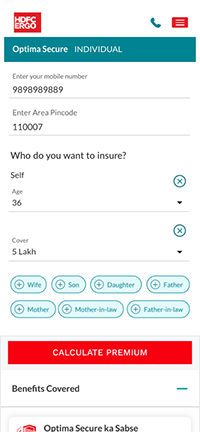

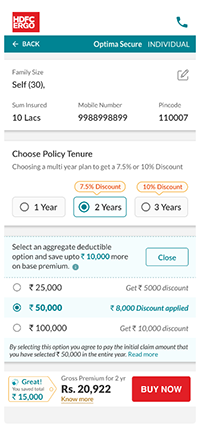

Calculating Premium Is So Easy

How to Make a Claim for your HDFC ERGO Health Insurance

The sole purpose of buying a health insurance plan is to get financial support at the time of medical emergency. Hence, it is important to read the below steps to know how Health Insurance claims process works differently for cashless claims and reimbursement claim requests.

1 claim processed every minute^^

Intimation

Fill up the pre-auth form at the network hospital for cashless approval

Approval/Rejection

Once hospital intimates us, we send you the status update

Hospitalisation

Hospitalisation can be done on the basis of pre-auth approval

Claim settlement

At the time of discharge, we settle the claim directly with hospital

1 claim processed every minute^^

Hospitalisation

You need to pay the bills initially and preserve the original invoices

Register a claim

Post hospital discharge send us all your invoices and treatment documents

Verification

We verify your claim related invoices and treatment documents

Claim Settlement

We send the approved claim amount to your bank account.

12,000+

Cashless Network

Across India

Jaslok Medical Centre

Address

C-1/15A Yamuna Vihar, Pincode-110053

Roopali Medical

Centre Private Limited

Address

C-1/15A Yamuna Vihar, Pincode-110053

Jaslok Medical Centre

Address

C-1/15A Yamuna Vihar, Pincode-110053

Hear From Our Happy Customers

Read Latest Health Insurance Blogs

Frequently Asked Questions

1. Is global health insurance expensive?

Yes, global health insurance is expensive compared to domestic healthcare plans because of its worldwide coverage. As medical expenses in many countries abroad are significantly high, the premiums of global health policies are naturally higher. However, the advantage of having a global health insurance is no matter where you are across the globe, if there's a medical emergency or a planned treatment, your insurer will cover the expenses on your behalf.

2. Are pre-existing diseases covered by global health insurance?

Yes, pre-existing diseases are covered by global health insurance, but after a waiting period of 2-4 years. Remember, pre-existing diseases can increase the cost of your policy. While buying a health insurance foreign plan, you should honestly disclose all health information to avoid any hassles during the time of claim settlement.

3. Is it possible to buy global health insurance in a foreign country?

Yes, you can buy health insurance global coverage in a foreign country, but it can be quite expensive because you have to pay the premium in that country's currency. So, buying global health insurance before you leave India is always recommended.

4. Does global health insurance cover medical expenses incurred in India?

Yes. Medical expenses will be covered if you undergo any treatments in India. Global health insurance policies cover domestic as well as international treatments for both planned and unplanned hospitalisation.

5. How much does international health insurance cost?

The cost of global health insurance depends on many factors, such as the country you are visiting, the age of the insured, medical history, type of plan and sum insured, the number of family members included in the plan, deductible, etc. The cost can range between $500 to $8,000 per year. The average cost will be $5,500 per year.

6. Are there certain countries where international medical insurance costs more?

Healthcare in the United States is the most expensive in the world. So, international health insurance in the US will obviously cost more than in other countries. Several insurance companies offer the option of choosing global cover, including the USA, as well as excluding the country. Also, in Europe, medical insurance is costliest in Switzerland, followed by the Netherlands and Germany. Coming to Asia, international medical insurance costs more in China, Japan, Singapore, Korea, and Hong Kong. So, the cost of your premium will depend on the countries included in your global health insurance plan.

7. Is there an underwriting process when applying for expatriate healthcare?

Yes, when you apply for expatriate healthcare, you must provide your medical history, which the insurer will review. If it's an international family insurance plan, the medical history of all members has to be provided. The underwriting process of global health insurance involves reviewing your medical history, which will take 3 to 5 business days. The process can take longer in some special cases.

8. How do pre-existing conditions affect global health insurance application?

Pre-existing conditions can affect your global health insurance application in the following ways. Firstly, your application can be denied. Secondly, if approved, the pre-existing conditions may be excluded from coverage. Thirdly, the pre-existing condition may be covered if it is a minor one, such as allergies. Some insurance providers will cover pre-existing conditions but with additional premiums and certain other conditions. If you port your policy, the waiting period for the pre-existing condition will continue from there and not start from the beginning. For instance, if you have completed 1 year of the 3-year waiting period for an ailment, the waiting period will be reduced by one year after porting.

9. How does international health insurance work?

When you are abroad and need emergency hospitalisation due to an illness or accident, international health insurance will cover your medical expenses up to the sum insured. In addition to hospitalisation expenses, a global health insurance policy will also cover the cost of emergency evacuation to a better hospital, transfer of mortal remains to home country, dental treatments, etc. When buying the plan, just ensure the policy promises comprehensive coverage.

10. What are the eligibility requirements for international medical plans?

The eligibility criteria for global health insurance policy are:

• The applicant has to provide medical history and any other additional information related to his/her in the application.

• The applicant should live in a foreign country for at least 3 months a year.

• Some providers have an age limit, i.e., you can apply for international medical plans up to the age of 74, and the coverage will terminate when you turn 75.

11. Do I need international health insurance?

Yes, if you are travelling overseas, you should have international health insurance for financial protection against unexpected medical expenses. In a foreign country, healthcare expenses are exorbitant, and if you don't have international health insurance, all your savings can go for a toss. Another reason is that most of the domestic health plans do not cover you for medical expenses when you go abroad.

12. What is the best international health insurance?

This depends on your specific medical needs and budget. There are several international health insurance companies offering different plans. You have to research and compare the plans online on the basis of coverage, benefits, cost, etc., and pick the one that suits you. Look for maximum coverage at an affordable cost.

Car Insurance

Car Insurance  Bike/Two Wheeler Insurance

Bike/Two Wheeler Insurance  Health Insurance

Health Insurance  Pet Insurance

Pet Insurance  Travel Insurance

Travel Insurance  Home Insurance

Home Insurance  Cyber Insurance

Cyber Insurance  Third Party Vehicle Ins.

Third Party Vehicle Ins.  Tractor Insurance

Tractor Insurance  Goods Carrying Vehicle Ins.

Goods Carrying Vehicle Ins.  Passenger Carrying Vehicle Ins.

Passenger Carrying Vehicle Ins.  Compulsory Personal Accident Insurance

Compulsory Personal Accident Insurance  Travel Insurance

Travel Insurance  Rural

Rural  Critical illness Insurance

Critical illness Insurance